SogoTrade Fined $75K Amid Compliance Failures

Abstract:FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

SogoTrade Faces $75K FINRA Fine as Synthetic Indices Trading Grows

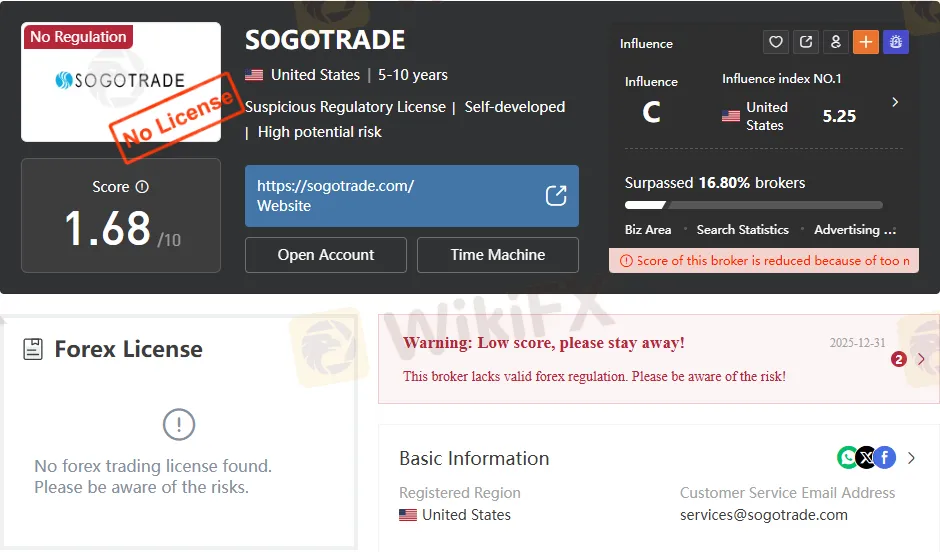

Financial Industry Regulatory Authority (FINRA) has fined SogoTrade, Inc. $75,000 for failing to maintain adequate risk management controls and supervisory procedures over its market access business. The action underscores growing regulatory scrutiny even as traders worldwide explore modern tools like synthetic indices trading on the cTrader platform, offered by innovative brokers such as TopFX.

According to FINRA, from January 2018 onward, SogoTrade failed to establish and document systems designed to prevent the entry of erroneous orders, violating several sections of the Securities Exchange Act and FINRA rules. Furthermore, the firm did not complete annual reviews and CEO certifications required under federal market access regulations. In addition to the fine, SogoTrade accepted a censure and agreed to remediate its compliance issues.

While legacy brokers like SogoTrade address internal control failures, new technology-driven firms are setting higher operational standards. TopFX, for instance, continues to expand its multi-asset trading solutions and features, attracting traders seeking stability and flexibility. The companys synthetic indices trading on the cTrader platform enables investors to trade non-correlated assets that mirror global market movements, providing continuous trading access 24/7 — a key advantage of trading synthetic indices.

But how do synthetic indices work in trading? Unlike traditional assets tied to real-world markets, synthetic indices simulate price behavior through algorithms, offering consistent volatility and reduced exposure to geopolitical risks. TopFX synthetic indices features and benefits include real-time execution speeds, transparent pricing, and seamless integration across asset classes.

As regulatory bodies tighten oversight on risk controls, the rise of algorithmic and synthetic instruments highlights a shift toward more resilient, technology-enabled market participation — where compliance, speed, and innovation increasingly define competitive advantage.

Read more

AssetsFX Review – What Traders Are Saying & Red Flags to Watch

Has AssetsFX stolen your deposits when seeking withdrawals from the trading platform? Did the broker fail to give any reason for initiating this? Did you notice fake trades in your forex trading account? Does the Mauritius-based forex broker deny you withdrawals by claiming trading abuse on your part? Did you also receive assistance from the AssetsFX customer support team? Firstly, these are not unusual here. Many traders have shared negative AssetsFX reviews online. In this article, we have highlighted such reviews so that you can make the right investment call. Take a look!

ROCK-WEST Complete Review: A Simple Guide to Its Trading Platforms, Costs, and Dangers

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.

LTI Review 2026: Safe Broker or a High-Risk Scam? User Complaints Analyzed

When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

LTI Regulatory Status: Understanding Its Licenses and Company Registration Details

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Trade Nation Rebrands TD365 in Global Integration Move

NaFa Markets Review: An Important Warning & Analysis of Fraud Claims

TenTrade Review: Safety, Regulation & Forex Trading Details

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

HERO Review: Massive Withdrawal Crisis and Platform Blackouts Exposed

PRCBroker Review: Where Profitable Accounts Go to Die

Rate Calc