AMarkets Safety Review: Is Your Money Protected?

Abstract:The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

Introduction: The Main Question

The question “Is AMarkets safe?” is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance.

To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

The Three Main Areas We Checked

· Rules and Oversight: Looking at who watches over AMarkets and what that means for you.

· Money Protection: Checking the specific ways they protect your funds.

· Company Background: Looking at their 18-year history and reputation in the industry.

Rules and Oversight: Understanding The Licenses

A trading company's safety depends heavily on who regulates them. Regulators create rules to protect investors, make sure markets are fair, and help solve problems when they happen. Top-level regulators, like the UK's Financial Conduct Authority (FCA) or Australia's Securities and Investments Commission (ASIC), have strict rules for trading companies, including keeping lots of capital in reserve, separating client funds from company funds, and joining national protection programs.

AMarkets, however, works under offshore regulation. This is an important difference that directly affects how much protection a trader gets. Our review confirmed the following official registrations.

AMarkets' Official Registrations

| Regulatory Body | Jurisdiction | Company Name | License/Registration No. | Regulatory Tier |

| Mwali International Services Authority (MISA) | Comoros | AMarkets LTD | T2023284 | Offshore |

| Financial Supervisory Commission (FSC) | Cook Islands | AMarkets LLC | LLC14486/2023 | Offshore |

| Financial Services Authority (FSA) | St. Vincent & the Grenadines | AMarkets LTD | 22567 BC 2015 | Offshore (Registration Only) |

What Offshore Regulation Really Means

Offshore regulators like those in Comoros, the Cook Islands, and St. Vincent & the Grenadines generally offer much weaker investor protection compared to top-tier ones. The requirements for getting and keeping these licenses are less strict. Key differences often include:

· Lower minimum capital requirements for the trading company.

· Less strict reporting and checking standards.

· Limited power to enforce rules and weak legal systems for solving client problems.

· No mandatory government-backed protection programs if the company goes bankrupt.

While working under offshore regulation isn't illegal, it puts more responsibility on the trader to check if the company is trustworthy and financially stable, since regulatory protection is minimal.

Warning Signs: Official Alerts

An important part of any safety review involves checking for warnings from global financial authorities. Our investigation found that AMarkets has been flagged by several regulators for operating in their areas without the necessary local permission. These include:

· Securities Commission Malaysia (SC Malaysia)

· Italian Companies and Exchange Commission (CONSOB)

· National Securities and Stock Market Commission (NSSMC) of Ukraine

These warnings don't automatically prove a company is fraudulent. However, they are serious signs of not following regulations in major markets. They show that the company is advertising its services in areas where it hasn't met local regulatory standards, which is a significant warning sign for safety-focused traders.

Looking Closely at Money Security

Beyond formal regulation, we must examine the specific ways a company protects client capital. These are the practical safety measures that help during disputes or financial problems. AMarkets has several such measures, but our review also found a significant unclear area.

The Financial Commission (FinaCom)

AMarkets is a verified member of The Financial Commission (FinaCom), an independent organization that helps resolve disputes in the financial services industry. This membership provides a notable layer of protection.

Key aspects of FinaCom membership include:

· Problem Resolution: It offers a neutral third-party platform for traders to resolve complaints against the company if they can't be settled directly.

· Protection Fund: FinaCom maintains a protection fund that acts as insurance for traders. If FinaCom rules in favor of a client in a dispute, and the company fails to follow the ruling, the client can be paid up to €20,000 from this fund.

It's important to understand that FinaCom is a self-regulatory body, not a government authority. Its protection fund is a valuable feature, but it should not be confused with the larger, government-backed investor protection programs required by top-tier regulators, which can offer protection up to £85,000 (UK) or more.

Fund Separation: An Unanswered Question

Fund separation is a cornerstone of client protection. It's the practice of keeping client funds in bank accounts that are completely separate from the company's business funds. This ensures that if the company goes bankrupt, client capital can't be used to pay the company's debts. All top-tier regulators require this practice without exception.

During our review, we could not find clear and verifiable confirmation from AMarkets or its regulators that client capital is held in separated accounts. While many offshore companies claim to follow this practice, the lack of a regulatory requirement and independent verification makes it a point of significant concern. For any trader evaluating AMarkets fund security, this unclear area represents a real risk. The absence of guaranteed separation means that in a worst-case scenario, client deposits could be at risk.

Other Protection Measures

AMarkets does offer one standard risk management feature that provides some protection at the account level: Negative Balance Protection (NBP).

NBP ensures that a trader's account cannot go below zero. This means a client can never lose more than the total amount of money put into their account, even during extreme market changes. This is a positive feature that prevents traders from owing capital to the company. This feature is standard across all of AMarkets' account types.

Business History and Reputation

When regulatory oversight is weak, a company's long-term business history and reputation become critical indicators of trustworthiness. A trading company that has survived for nearly two decades in a highly competitive market has shown some business strength. AMarkets was founded in 2007, giving it an 18-year track record as of 2025.

Third-Party Trade Quality Check

AMarkets has sought third-party validation for its trading environment through the Verify My Trade (VMT) certification. VMT is an independent service that conducts monthly checks of a sample of a company's completed trades to assess the quality of order execution.

This certification provides transparency, suggesting that the company's execution quality meets industry standards. However, it's important to note that VMT checks trade execution fairness, not the safety of client capital. It doesn't offer any protection if the company goes bankrupt.

A Closer Look: Staff History

A complete safety review must also consider the background of the company's key staff. Research from public sources, including forums like Forex Peace Army, has highlighted concerns for risk-conscious traders. A current key employee at AMarkets was previously a high-level marketing executive at MFX Broker. MFX Broker was a firm that collapsed and was widely associated with being a Ponzi scheme, resulting in significant client losses.

This information is not a direct accusation against AMarkets or its current operations. However, for a careful background check, the connection of key staff with a past failed company known for fraudulent behavior is a relevant piece of historical context. It raises questions about the company's hiring practices and overall risk culture that a careful investor should consider.

Customer Reviews and Client Opinions

On platforms like Trustpilot, AMarkets holds a very high rating of 4.8 out of 5 from over 3,300 reviews. This shows a high level of customer satisfaction among its users, with many praising its customer service and withdrawal speeds. However, reviews on other platforms are more mixed, with some users reporting problems. While a high Trustpilot score is a positive sign, it should be weighed against the more concrete safety concerns raised by the regulatory framework and business history.

The Final Answer: A Balanced Conclusion

After a thorough review of AMarkets' regulatory status, fund security measures and business history, it is clear that the company presents a mixed safety profile. It is not an outright scam, as shown by its long history and FinaCom membership, but it operates with significant weaknesses not visible in top-tier regulated firms.

We have put together our findings into a clear summary to help you weigh the evidence.

AMarkets Safety Profile: Good vs. Bad Points

| Safety Strengths (Good Points) | Safety Weaknesses (Bad Points) |

| ✅ 18+ years of business history | ❌ No top-tier regulation (FCA, ASIC, etc.) |

| ✅ Member of The Financial Commission (up to €20k protection) | ❌ Only offshore regulation (weak investor protection) |

| ✅ Third-party execution check by VMT | ❌ Official warnings from multiple regulators |

| ✅ Negative Balance Protection is in place | ❌ Unclear information about client money separation |

| ✅ High positive rating on Trustpilot | ❌ Questionable staff history noted in public forums |

Your Final Check: Independent Verification

Our review provides a deep, fact-based analysis of the question, “Is AMarkets safe?” The final decision, however, rests with the individual trader and their personal comfort with risk. The evidence clearly shows that trading with AMarkets involves accepting risks associated with an offshore regulatory environment, which lacks strong protections available under top-tier jurisdictions.

Before opening an account with any trading company, especially one with an offshore profile, we strongly recommend doing your own research. A crucial step in this process is to use independent third-party verification platforms.

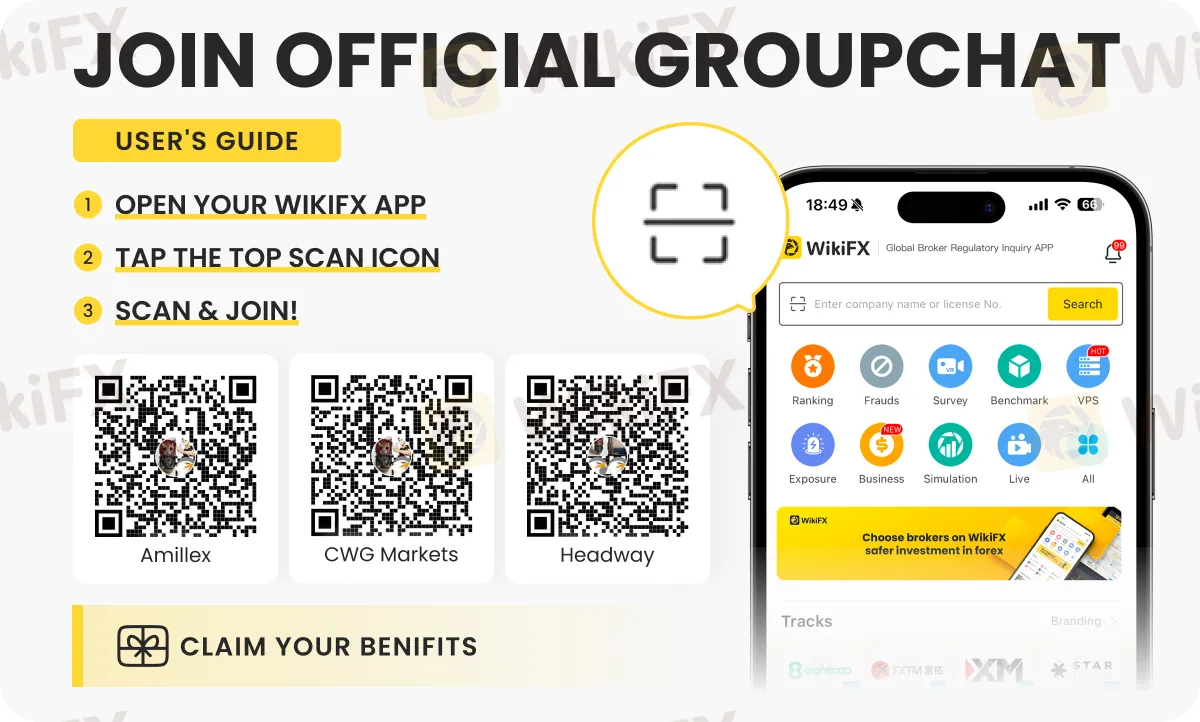

One of the most complete resources for this is WikiFX. You can use it to check the latest regulatory status, review user feedback, and see any new warnings that may have been issued against a company. This simple step can provide an extra layer of security and peace of mind, ensuring you have the most current information before investing.

For the latest forex updates, strategies and tips, be part of these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G.

Read more

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

MIFX Review: When Regulatory Badges Cannot Shield 'High Risk' Anomalies and Execution Failures

Despite holding legitimate regulatory statuses in Indonesia, the broker MIFX (PT. Monex Investindo Futures) has become the subject of intense scrutiny following a surge in trader complaints. Over the past three months alone, WikiFX has logged 15 formal complaints, painting a picture of a trading environment plagued by technical irregularities, unexplained order executions, and a deposit system that allegedly traps funds in a bureaucratic loop. This investigation delves into the disparity between MIFX’s regulatory paperwork and the jarring reality reported by its active users.

Why Do You Always Lose When Trading?

With the year ending and 2026 just around the corner, here comes the golden question: are you profitable this year? If not, this article is a must-read!

NPE Market Review: Why to Stay Away

NPE Market review shows blocked accounts, no regulation, and low trust—best to stay away.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

November's inflation report is the first to be released after the shutdown. Here's what to expect

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Rate Calc