MIFX Review: When Regulatory Badges Cannot Shield 'High Risk' Anomalies and Execution Failures

Abstract:Despite holding legitimate regulatory statuses in Indonesia, the broker MIFX (PT. Monex Investindo Futures) has become the subject of intense scrutiny following a surge in trader complaints. Over the past three months alone, WikiFX has logged 15 formal complaints, painting a picture of a trading environment plagued by technical irregularities, unexplained order executions, and a deposit system that allegedly traps funds in a bureaucratic loop. This investigation delves into the disparity between MIFX’s regulatory paperwork and the jarring reality reported by its active users.

Abstract

Despite holding legitimate regulatory statuses in Indonesia, the broker MIFX (PT. Monex Investindo Futures) has become the subject of intense scrutiny following a surge in trader complaints. Over the past three months alone, WikiFX has logged 15 formal complaints, painting a picture of a trading environment plagued by technical irregularities, unexplained order executions, and a deposit system that allegedly traps funds in a bureaucratic loop. This investigation delves into the disparity between MIFXs regulatory paperwork and the jarring reality reported by its active users.

Disclaimer: All cases detailed in this article are based on real user records submitted to the WikiFX exposure center. To protect the privacy of the individuals involved, specific identities have been anonymized.

The “Auto-Cut” Phenomenon: Phantom Prices and Forced Liquidations

One of the most alarming patterns emerging from recent reports involves the discrepancy between market prices and execution prices. For a trader, the chart is the map; when that map is ignored by the broker's platform, trading becomes a game of chance.

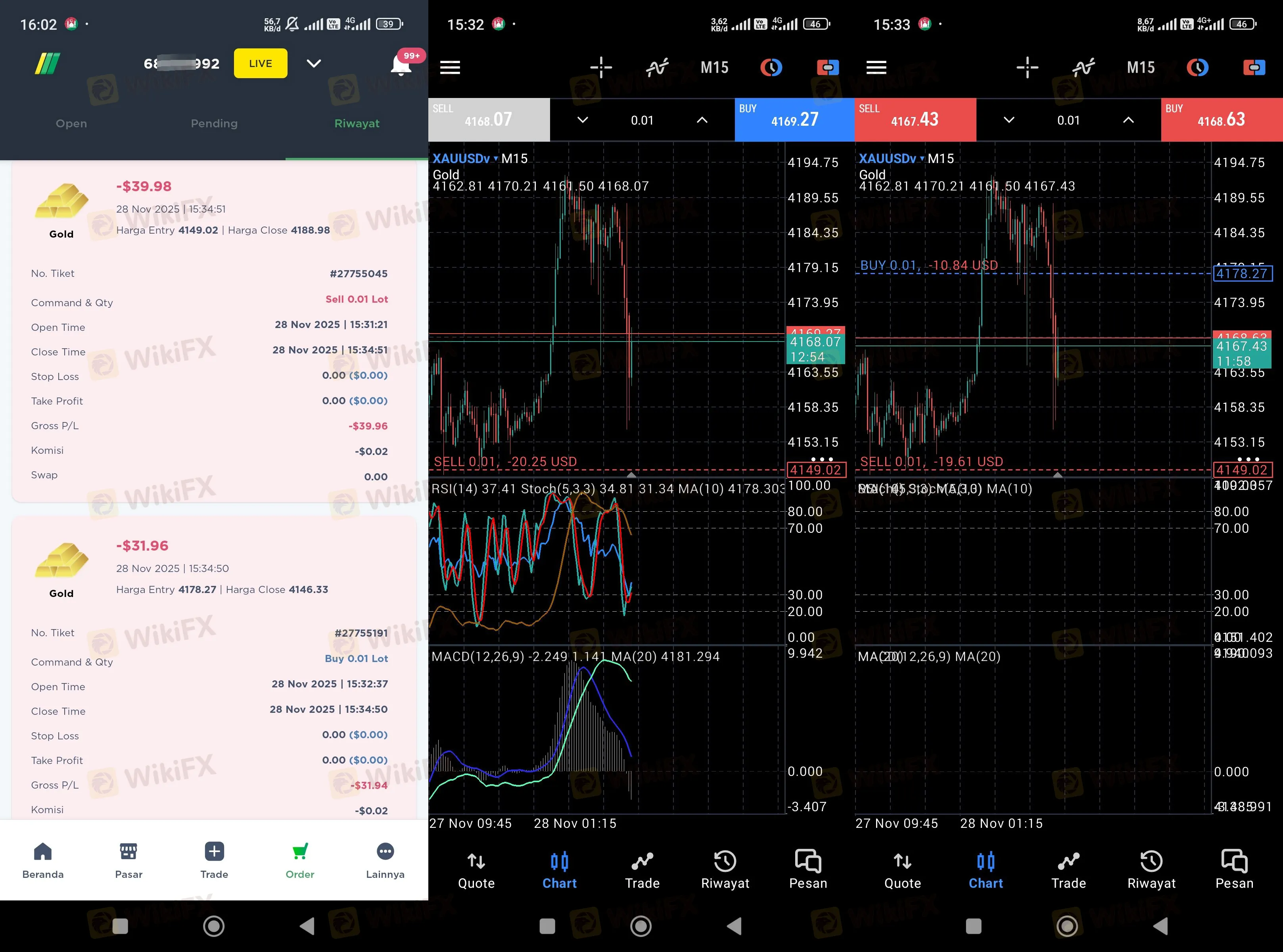

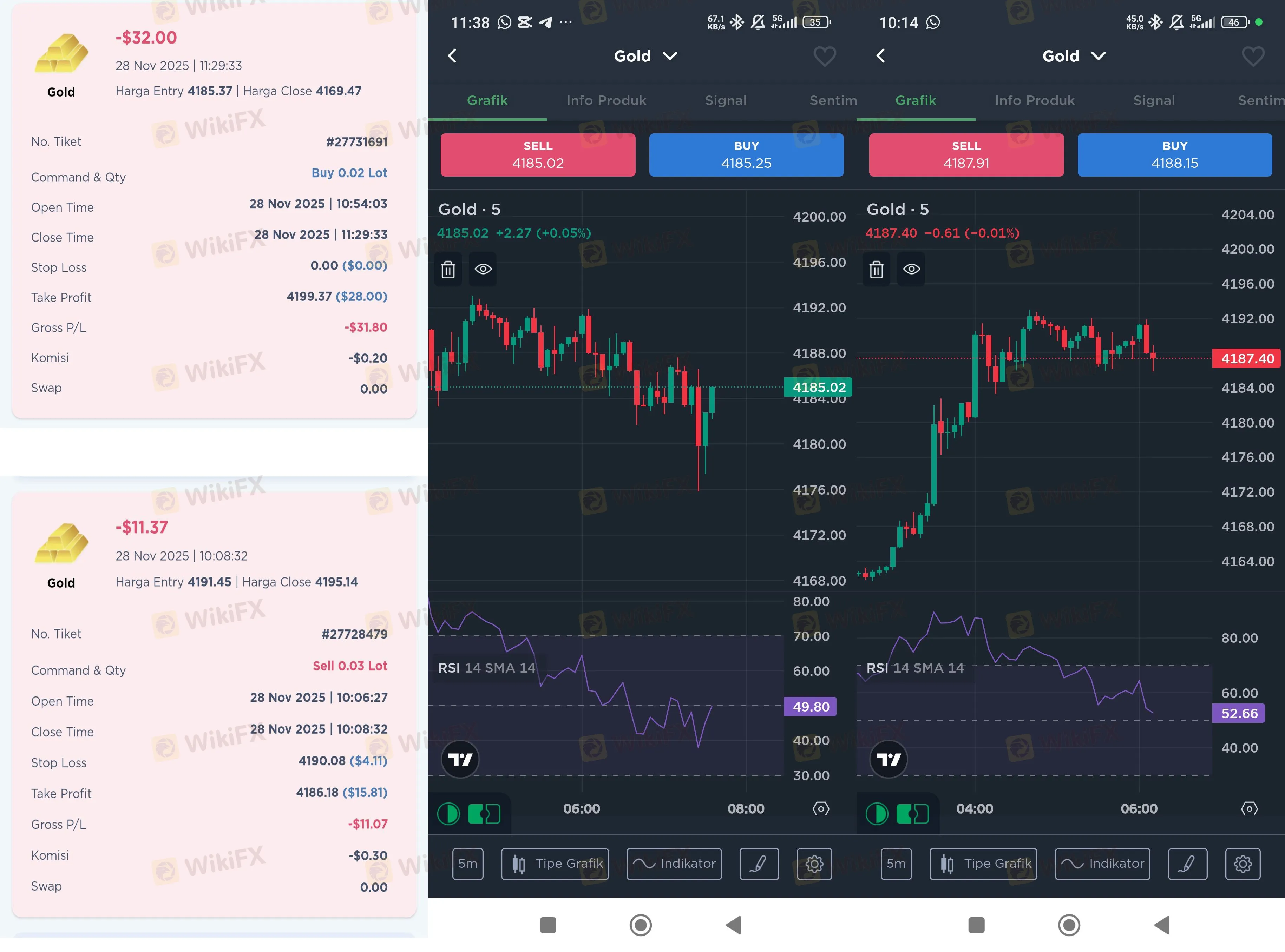

We received a detailed report dated November 28, 2025, from an Indonesian trader who expressed deep frustration with MIFX's spread and execution logic. The trader reported that their entry positions were liquidated via “auto-cut” (stop-out) mechanisms that did not match the agreed-upon entry spreads. The user noted a significant gap between the entry price and the realized transaction, sarcastically advising others to “think again” before using this broker.

This was not an isolated incident. On the very same day, another trader filed a complaint regarding what they described as a huge anomaly. They reported that their entry was closed at a price point that the market had not even touched—a price they described as being “so far” from the actual market action. While the platform claims to offer MT4 and MT5 services, these reports suggest a disconnection between the visible market feed and the backend execution engine.

Further reinforcing this pattern of irregular liquidations, a report from June 2024 detailed a scenario where a user's account was reportedly “locked” (likely referring to a hedging strategy or account freeze), yet the system still processed an auto-cut on the positions.

Another trader reported a similar experience where an order simply “disappeared” without hitting either the Stop Loss or Take Profit levels during a price reversal.

The Refund Loop: “Talking to a Robot”

While trading losses can sometimes be attributed to market volatility, the inability to manage deposits and withdrawals strikes at the core of a broker's trustworthiness. A particularly distressing characteristic of MIFXs recent complaints is the unresponsiveness of their support channels when funds go missing.

In a case recorded on November 16, 2024, a trader attempted to deposit funds. The transaction failed, and while the broker promised a refund, the money effectively vanished. The trader described the aftermath as an exhausting cycle: despite being told the refund was processed, the funds never arrived in their account. The broker's support team allegedly demanded bank statements repeatedly, forcing the user to resubmit the same proof over and over. The user described the communication style as “repeated,” feeling as though they were “talking to a robot” rather than a human capable of resolving a financial discrepancy.

Concerns regarding financial integrity were further compounded by a report from May 2024 involving a “giveaway” promotion. A user claimed to have been misled regarding a 500k IDR amount in a promotional context, pleading for assistance to recover the funds. While promotional disputes are common, the volume of evidence screenshots provided by this user suggests a complex and frustrating interaction with the broker's promotional terms.

A “Glitchy” Environment: Technical Instability

For a brokerage that prides itself on offering digital ease of use and proprietary software alongside standard platforms, the user feedback regarding technical stability is concerning.

On April 28, 2024, a trader based in Australia criticized the MIFX mobile app for major functional shortfalls. The review highlighted that the app lacked essential functionalities and was “glitchy all the time,” leading to a poor trading experience for international users not accustomed to the specific nuances of this Indonesian brokerage.

Technical incompetence was also the theme of a report from April 15, 2024. A trader dealing in Chinese Yuan (CNY) context noted that a pending order failed to execute despite the price clearly hitting the target. The trader provided specific timestamps: the order was placed at 1:57 local time, and the price hit the target at 2:01, yet the trade was never triggered. This creates a “no-win” situation for traders—if the price moves against them, they lose; if the price moves for them, the system fails to enter the trade.

Regulatory Disclosure

MIFX (PT. Monex Investindo Futures) is a regulated entity in Indonesia. While regulation is a vital component of a safe trading environment, the cases above demonstrate that possession of a license does not automatically equate to perfect technical execution or superior customer service.

Below is the complete list of regulatory licenses currently held by MIFX, derived directly from the WikiFX database:

| Regulator Name | License Type | Current Status |

|---|---|---|

| Indonesia BAPPEBTI (Badan Pengawas Perdagangan Berjangka Komoditi) | Retail Forex License | Regulated |

| Indonesia JFX (Jakarta Futures Exchange) | Retail Forex License | Regulated |

| Indonesia ICDX (Indonesia Commodity and Derivatives Exchange) | Retail Forex License | Regulated |

It is important to note that these regulators are specific to the Indonesian jurisdiction. Traders outside this region should be aware that cross-border dispute resolution may be difficult.

Conclusion

The data surrounding MIFX presents a complex dichotomy. On paper, they are a legitimate, regulated entity under the oversight of Indonesian authorities (BAPPEBTI, JFX, ICDX). However, the operational reality reported by traders suggests significant “growing pains” or deeper systemic issues.

The recurring themes of phantom pricing, valid orders failing to execute, and a customer support system that seemingly traps users in verification loops indicate that MIFX carries a high risk for traders who rely on precision and quick access to their funds. A WikiFX score of 6.51 usually indicates a moderate level of reliability, but the recent spike in 15 complaints within three months serves as a critical warning sign that conditions may be deteriorating.

As always, we advise traders to exercise extreme caution and consider these operational risks before committing capital.

WikiFX Risk Warning: Open claims and recent complaint spikes are significant indicators of a broker's current operational health. Forex and CFD trading involves high risk and the potential for total capital loss. Ensure you are fully aware of the risks and the regulatory limitations of your chosen broker before trading.

Read more

The "Profit Deletion" Anomaly: Why ActivTrades Users Are Seeing Balances Vanish

While holding a reputation rooted in longevity, ActivTrades has recently become the subject of alarming reports regarding the sudden removal of trader profits. Our analysis of data ranging from late 2024 through 2025 reveals a specific pattern: traders generate returns, attempt to withdraw, and subsequently find their profits—and occasionally principal deposits—deducted without clear recourse.

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

AMarkets Safety Review: Is Your Money Protected?

The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

XS Review: The Disconnect Between Global Ambition and Client Reality

In the complex architecture of modern forex brokerage, there exists a specific category of firm that presents a particular challenge to the analytical observer: the "Janus-faced" broker. On one side, there is the facade of institutional solidity—licenses from reputable jurisdictions like Australia and Malaysia, a high "Influence Rank," and a sophisticated digital presence. On the other side lies a darker operational reality characterized by profit reversals, opaque execution policies, and friction-heavy withdrawal processes.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

November's inflation report is the first to be released after the shutdown. Here's what to expect

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Rate Calc