Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

Abstract:If you are currently staring at red numbers on your screen, don't panic. It’s not just you. The statistics are brutal: roughly 90% of retail traders lose money. But have you ever stopped to ask why? It’s rarely because they are stupid. It’s because they fall into specific traps.

Listen to me closely. The Forex market is not your friend. It doesn't care if you need money for rent, and it certainly doesn't care if you “feel” like the Euro is going up today.

I've been in this game a long time, and I see the same story play out every single week. A new trader enters the market with high hopes, a small deposit, and dreams of quitting their 9-to-5 job next month.

Three weeks later? Account blown. Zero balance.

If you are currently staring at red numbers on your screen, don't panic. It‘s not just you. The statistics are brutal: roughly 90% of retail traders lose money. But have you ever stopped to ask why? It’s rarely because they are stupid. Its because they fall into specific traps.

Lets break them down so you can stop being part of the 90% and start joining the 10% who actually survive.

The “Get Rich Quick” Bacteria

This is the biggest killer. New traders don't treat Forex like a business; they treat it like a casino.

You see someone on social media making $5,000 in a morning, and you think you can do the same with a $500 account. This leads to over-leveraging.

Leverage is a tool, but for beginners, its like giving a Ferrari to a 16-year-old who just got their permit. If you use 1:500 leverage on every trade, one small move against you wipes out your entire margin. You aren't trading; you're gambling. Real traders care about preservation of capital first, profit second.

Why Does the Market Always Move Against Me?

I hear this question constantly. “Coach, as soon as I pressed buy, the candle dropped!”

It feels personal, but it‘s not. It’s usually because you are chasing the price.

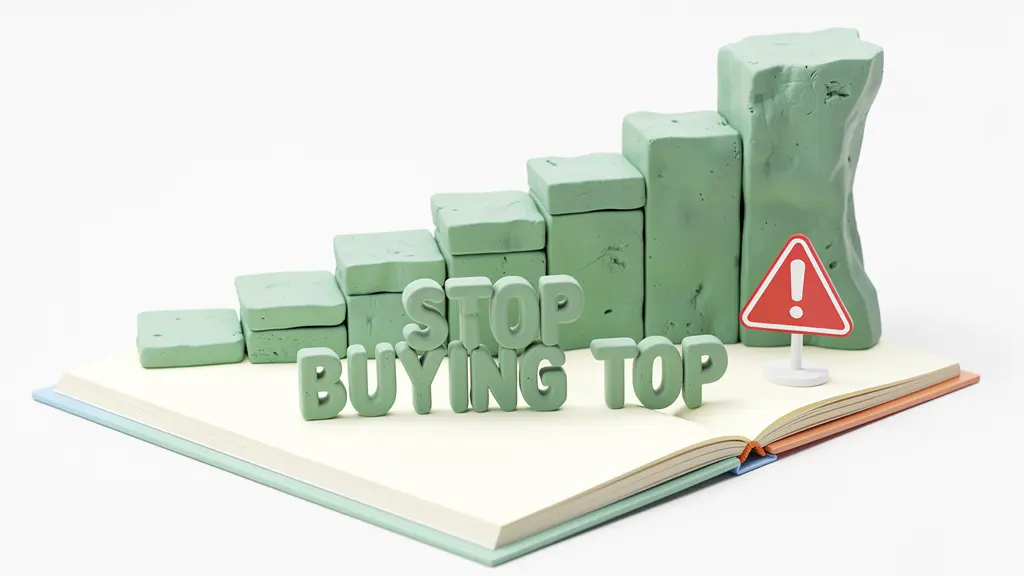

Beginners love to jump in when they see a massive green candle. They experience FOMO (Fear Of Missing Out). But by the time you see that big move, the smart money (big banks and institutions) is already taking profit. You are buying at the top, right when the market is ready to reverse.

You need patience. You need to wait for the setup to come to you, rather than chasing a running bus.

The Silent Account Killer: Bad Brothers & Scams

Here is a hard reality check. Sometimes you lose money because your strategy sucks. But sometimes, you lose because the game is rigged against you.

The internet is flooded with unregulated, shady brokers who promise “zero spreads” and “guaranteed bonuses.” If you deposit your hard-earned cash with a broker that has no regulation, you might as well light that money on fire. They can manipulate the charts, widen spreads to hit your stop loss, or simply refuse your withdrawal request.

You have to protect your digital back. Before you even think about placing a trade, check who you are dealing with. I always tell my students to run the broker's name through WikiFX.

It takes ten seconds. You type in the broker, and WikiFX shows you their regulatory status, their license, and—most importantly—complaints from other traders. If the score is low, run away. Don't let a scammer eat your profit before you even make a trade.

Revenge Trading

This is purely psychological, but it destroys accounts faster than anything else.

Here is the scenario: You take a loss. You lose $50. You get angry. You want that $50 back right now. So you immediately open a new trade, usually with a bigger lot size, just to “make it back.”

This is Revenge Trading. When you trade with anger, you are blind to the charts. You are reacting to pain, not logic. The market will punish this behavior every single time.

If you take a loss, step away. Close the laptop. put the phone down. The market will be there tomorrow.

Can You Actually Win?

Yes, but you have to change your brain.

Profitable trading is boring. It‘s repetitive. It’s about risk management, not hitting home runs.

- Risk Management: Never risk more than 1-2% of your account on a single trade. If you have $1,000, do not lose more than $20 on a trade. This ensures you can survive a losing streak.

- Stop Losses: A trade without a stop loss is a ticking time bomb. Always know your exit point before you enter.

- Verify Everything: Don't trust signals blindly, and don't trust brokers blindly. Use tools like WikiFX to ensure your trading environment is safe.

Stop trying to be a millionaire by Friday. Focus on being a good trader today. The money will follow the discipline.

Stay sharp.

Coach K

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Forex trading involves high risk and may not be suitable for all investors. Always do your own research.

Read more

Stop Buying the Top: Why You Always Enter at the Worst Time

Trading isn't about predicting the future; it's about waiting for the right odds.

5 Mental Traps That Are Burning Your Trading Account Today

Trading is 10% skill and 90% psychology. You can learn technical analysis in a month, but mastering your own head takes a lifetime.

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

The market is designed to transfer money from the impatient to the patient, and from the arrogant to the humble.

High Inflation: Will It Crush Your Currency or Send It Soaring?

The market rewards patience and logic, not emotional reactions to headlines. Understand the rate hike game, and you turn a crisis into an opportunity.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

November's inflation report is the first to be released after the shutdown. Here's what to expect

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Rate Calc