The "Profit Deletion" Anomaly: Why ActivTrades Users Are Seeing Balances Vanish

Abstract:While holding a reputation rooted in longevity, ActivTrades has recently become the subject of alarming reports regarding the sudden removal of trader profits. Our analysis of data ranging from late 2024 through 2025 reveals a specific pattern: traders generate returns, attempt to withdraw, and subsequently find their profits—and occasionally principal deposits—deducted without clear recourse.

Abstract: While holding a reputation rooted in longevity, ActivTrades has recently become the subject of alarming reports regarding the sudden removal of trader profits. Our analysis of data ranging from late 2024 through 2025 reveals a specific pattern: traders generate returns, attempt to withdraw, and subsequently find their profits—and occasionally principal deposits—deducted without clear recourse.

The 33,000 USD Question

For many African traders, the ultimate fear is not market volatility, but broker intervention. Recent complaints lodged with WikiFX suggest a disturbing trend where successful trades are retroactively nullified.

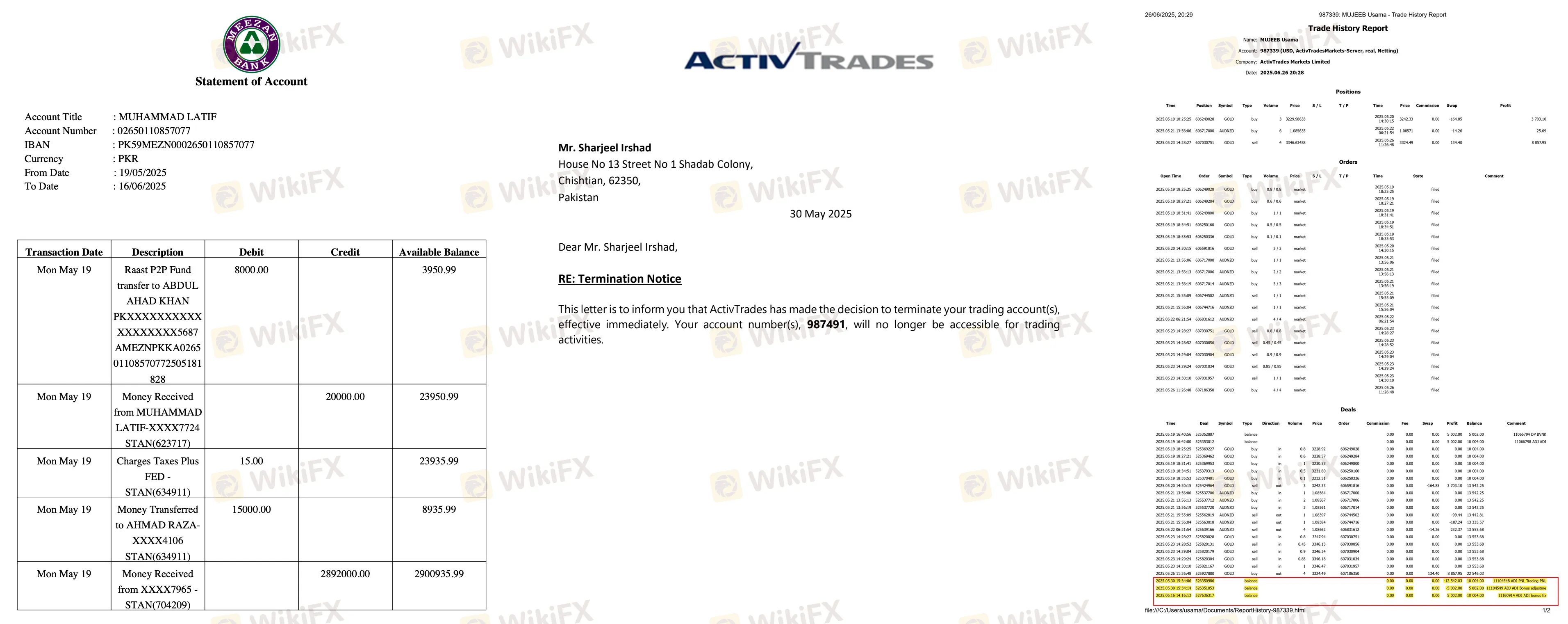

The most striking piece of evidence comes from a trader who reported a harrowing experience in June 2025. After successfully trading on the platform, the user attempted to realize their gains, only to find that $33,253.79 USD in profits were removed from the account. According to the trader's record, this deduction occurred “without any clear explanation.” More concerning is the allegation that the broker also refused to return the user's initial capital (real money), creating a scenario of total loss despite successful market prediction.

This is not an isolated incident. Another report dated August 2025 mirrors this specific mechanism. A trader described depositing funds and generating a profit, but upon initiating a withdrawal request, the broker allegedly “removed the profit” and simultaneously “removed the deposit amount.”

License vs. Reality: A Regulatory Audit

Traders often assume that a broker with a United Kingdom license is automatically safe. However, a deeper audit of the ActivTrades regulatory framework reveals a complex picture. While they maintain high-tier status in London, other jurisdictions show “revoked” statuses and offshore dependencies.

Acting as a neutral database auditor, WikiFX presents the complete regulatory footprint found in our records below. Traders should note the difference between “Valid” and “Revoked” statuses.

| Regulator Name | Country / Jurisdiction | License Type | Current Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | MM (Market Making) | Valid |

| Securities Commission of The Bahamas (SCB) | Bahamas | Offshore Regulatory | Valid |

| Dubai Financial Services Authority (DFSA) | UAE | General License | Revoked |

Additional Regulatory Warnings

Beyond the standard licenses, our records indicate significant regulatory friction in Southeast Asia. The Indonesian Commodity Futures Trading Regulatory Agency (BAPPEBTI) has previously disclosed information regarding the blocking of illegal commodity futures trading websites. ActivTrades appeared in this disclosure effectively blacklisting the domain in that region for operating without local licensure.

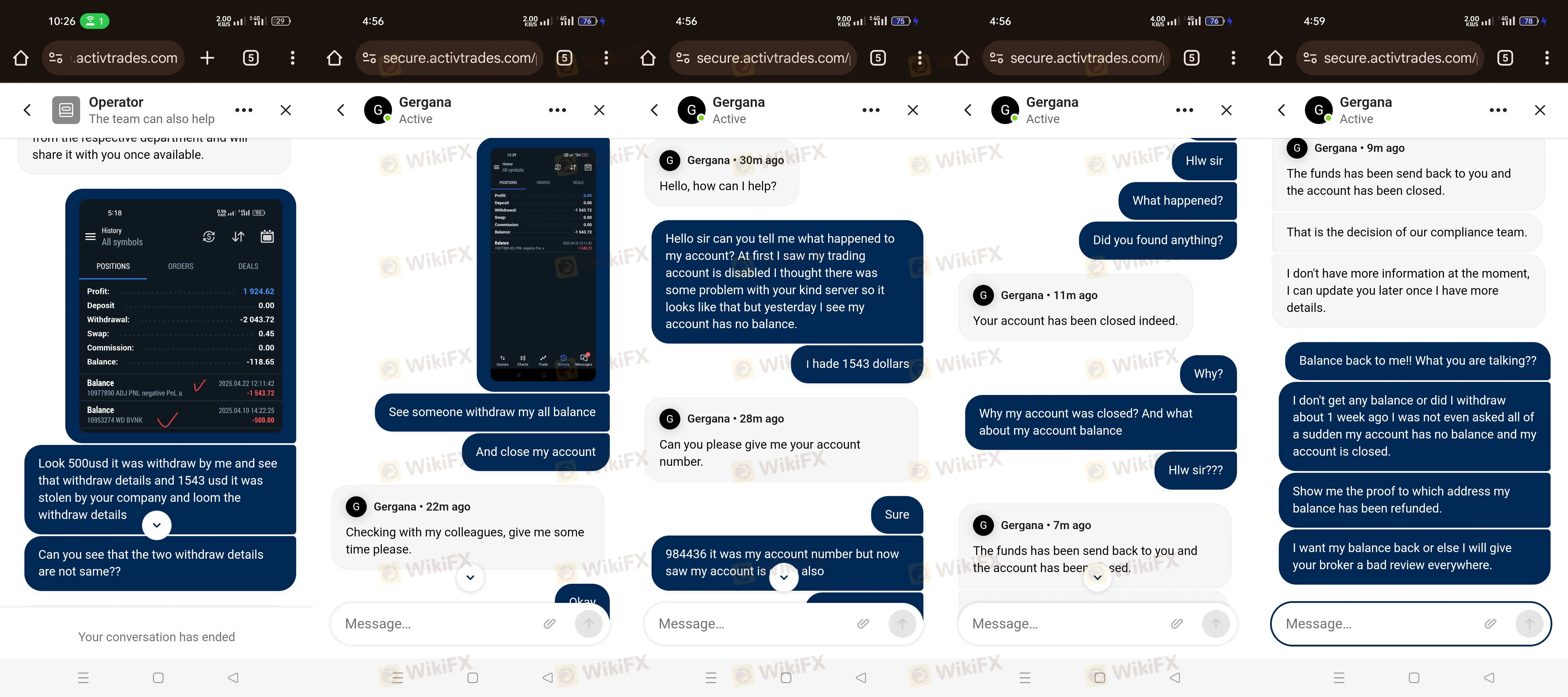

The Exit Trap: Accounts Closing Upon Withdrawal

The narrative emerging from the complaints suggests that the “trigger” for these issues is almost always a withdrawal request.

In April 2025, another trader reported having $1,543 in their account. After waiting two weeks for a partial withdrawal of $500, the request was not granted. Instead, the trading account was closed. The trader alleges that despite customer service claims that funds were returned, nothing was received. The user described the experience as dealing with a “thief broker,” citing a complete lack of email response regarding the missing funds.

This pattern was corroborated by a UK-based trader earlier in 2024. This user had been trading for six months without issue. However, the moment they attempted to withdraw profits, the account was closed. The broker reportedly claimed the termination was due to “trading activities.” The trader challenged this logic, asking, “Why didn't they claim it before if they saw any wrong activities?” implies that the trading style was only a problem once money was leaving the broker, not while it was being deposited.

Mixed Signals: The Divide Between Entry and Exit

To maintain objectivity, it is crucial to note that not all feedback is negative. Records from early 2024 include positive sentiments from traders in Germany and the UK.

- German Trader (March 2024): Praised the reliability, platform variety (TradingView interface), and the quick verification and deposit process.

- UK Trader (February 2024): Expressed general satisfaction with the services, noting that while leverage was low due to regulations, the overall environment was “appropriate.”

This creates a “Jekyll and Hyde” profile for the broker. The entry process (deposits, verification, platform setup) appears smooth and professional, earning praise from newcomers. However, the exit process (withdrawals, profit realization) is where the severe friction—and alleged fund removal—occurs.

Verdict: Caution Advised on “Profit Corrections”

While ActivTrades holds a valid FCA license, the repeated allegations of “profit stripping” and account closures upon withdrawal requests are significant red flags that cannot be ignored. The revocation of their UAE license further suggests volatility in their compliance history.

- Positive: Strong platform options (MT4/MT5/TradingView) and valid UK regulation.

- Negative: Recurring reports of profits being deducted without adequate explanation, revoked UAE license, and “offshore” handling of clients.

Anonymity Disclaimer: All cases cited in this article are based on real records lodged with the WikiFX Support Center. User identities have been hidden for their protection.

Risk Warning: Forex and CFD trading involves significant risk to your invested capital. The information provided here is based on available data and trader feedback. Please conduct your own due diligence before depositing funds.

Read more

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

MIFX Review: When Regulatory Badges Cannot Shield 'High Risk' Anomalies and Execution Failures

Despite holding legitimate regulatory statuses in Indonesia, the broker MIFX (PT. Monex Investindo Futures) has become the subject of intense scrutiny following a surge in trader complaints. Over the past three months alone, WikiFX has logged 15 formal complaints, painting a picture of a trading environment plagued by technical irregularities, unexplained order executions, and a deposit system that allegedly traps funds in a bureaucratic loop. This investigation delves into the disparity between MIFX’s regulatory paperwork and the jarring reality reported by its active users.

AMarkets Safety Review: Is Your Money Protected?

The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

XS Review: The Disconnect Between Global Ambition and Client Reality

In the complex architecture of modern forex brokerage, there exists a specific category of firm that presents a particular challenge to the analytical observer: the "Janus-faced" broker. On one side, there is the facade of institutional solidity—licenses from reputable jurisdictions like Australia and Malaysia, a high "Influence Rank," and a sophisticated digital presence. On the other side lies a darker operational reality characterized by profit reversals, opaque execution policies, and friction-heavy withdrawal processes.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

Coinbase Expands Into Stocks and Tokenized Assets

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

London Capital Group – Regulation & Genuine User Reviews

ZarVista Review 2025: A Complete Look at Its High-Risk Profile

Rate Calc