MH Markets Overview: Fees, Platforms, and Regulation

Abstract:Choosing a forex broker is an important step for any trader. With so many options available, the main question is always: is this broker a safe and effective partner for my trading goals? This review is designed to answer that question about MH Markets. We will examine the key parts of their service—regulation status, trading costs, platform features, and overall user experience—to give you a clear, complete picture. Our goal is to give you the information you need to decide if MH Markets fits your strategy and risk comfort level.

MH Markets Overview: Fees, Platforms, and Regulation

Choosing a forex broker is an important step for any trader. With so many options available, the main question is always: is this broker a safe and effective partner for my trading goals? This review is designed to answer that question about MH Markets. We will examine the key parts of their service—regulation status, trading costs, platform features, and overall user experience—to give you a clear, complete picture. Our goal is to give you the information you need to decide if MH Markets fits your strategy and risk comfort level.

To start, here is a quick summary of what MH Markets offers.

| Feature | Details |

| Regulation | ASIC (Australia), VFSC (Vanuatu) |

| Minimum Deposit | Standard Account - 50 USD, ECN Account - 1000 USD, Prime Account - 100 USD |

| Average Spread (EUR/USD) | From 0.0 pips on ECN accounts + commission |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Maximum Leverage | Up to 1:2000 |

| Primary Asset Classes | Forex, Indices, Commodities, Cryptocurrencies |

Is MH Markets Safe?

The most important thing to consider when choosing a broker is your capital safety. We will now look at the regulation rules and security measures MH Markets has in place to determine how trustworthy it is.

Regulatory Compliance

A broker's safety is mainly based on its regulatory licenses. MH Markets operates under the watch of multiple authorities, which provides different levels of protection depending on where the client is located.

· Australian Securities and Investments Commission (ASIC): MH Markets Pty Ltd is authorized and regulated by ASIC, one of the world's top financial regulators. Its Australian Financial Services Licence number is 001291883. Regulation under ASIC requires strict operating standards, including keeping client funds separate from company funds. This means the broker must hold client money in separate trust accounts with reputable banks, ensuring it cannot be used for business operations.

· Vanuatu Financial Services Commission (VFSC): For its international operations, MH Markets is regulated by the VFSC under license number 40358. While considered an offshore regulator, the VFSC requires brokers to follow anti-money laundering (AML) and know-your-customer (KYC) policies. This dual-regulation approach allows MH Markets to offer different trading conditions, such as higher leverage, to clients outside of Australia.

Security and Reputation

Beyond formal regulation, MH Markets uses several standard security measures to protect client data and account access. Our review confirmed the presence of:

· SSL Encryption: The client portal and website are secured with SSL (Secure Socket Layer) encryption, protecting data sent between the user and the server.

· Two-Factor Authentication (2FA): Traders can enable 2FA for their client portal, adding an essential layer of security against unauthorized access.

· Segregated Funds: As required by their regulators, client deposits are kept in segregated accounts, separate from the company's operating capital.

In terms of reputation, MH Markets has been operating for several years and has generally maintained a positive impression among traders. Feedback trends point towards appreciation for their competitive ECN pricing and stable MetaTrader environment, though some users note the limitations of operating under different regulatory jurisdictions.

Understanding the Costs

Understanding a broker's complete fee structure is essential for managing profitability. We will break down both the trading and non-trading costs you can expect when using MH Markets.

Trading Fees

Trading costs at MH Markets are mainly made up of spreads and commissions, which vary significantly depending on the chosen account type.

· Spreads: This is the difference between the bid and ask price of an asset. MH Markets offers variable spreads that change with market liquidity.

· Commissions: This is a fixed fee charged per trade, typically applicable to ECN-style accounts that offer tighter, raw spreads.

To provide clarity, we have compared the fee structures across the primary MH Markets account types. The spreads shown are typical averages for the EUR/USD pair during active trading sessions but can change.

| Account Type | Average Spread (EUR/USD) | Commission per Lot |

| Standard Account | 1.2 pips | $0 |

| ECN Account | 0.1 pips | $7 per round turn |

| Prime Account | 0.6 pips | $0 |

The Standard and Prime accounts bundle the trading cost into the spread, making them commission-free and simpler for many traders to calculate. The ECN account, however, appeals to scalpers and algorithmic traders by providing access to near-zero raw spreads in exchange for a fixed commission.

Non-Trading Fees

These are costs incurred outside of active trading. MH Markets maintains a transparent and competitive structure for these fees.

· Deposits: We found that MH Markets does not charge any fees for depositing funds. However, your payment provider (e.g., your bank) may impose its own charges.

· Withdrawals: Withdrawal fees depend on the method used. For example, bank wire transfers may incur a fee of around $20, while withdrawals to e-wallets like Skrill and Neteller are often free, at least for the first transaction each month.

· Inactivity Fee: An inactivity fee may be charged to accounts that show no trading activity for an extended period. Typically, this is around $10 per month after 90 days of dormancy, which is in line with industry standards.

Choosing Your Path

MH Markets offers several distinct account types and leverage options to cater to different trading styles and capital levels. Selecting the right combination is crucial for an optimal trading experience.

Account Types Comparison

Each of the MH Markets account types is designed with a specific trader in mind. Here's a breakdown to help you choose.

The Standard Account

Perfect for beginners and casual traders, the Standard account offers a straightforward, commission-free trading experience.

· Minimum Deposit: $50

· Fee Structure: Spreads from 1.0 pips, no commissions.

· Best For: New traders who prefer simplicity and predictable costs.

The ECN Account

This account is built for scalpers, high-volume traders, and those using automated strategies (EAs) who require the tightest possible spreads.

· Minimum Deposit: $1000

· Fee Structure: Raw spreads from 0.0 pips + a $7 round-turn commission per lot.

· Best For: Experienced traders who prioritize low spreads and fast execution.

The Prime Account

The Prime account strikes a balance, offering lower spreads than the Standard account without the separate commission structure of the ECN account.

· Minimum Deposit: $100

· Fee Structure: Spreads from 0.6 pips, no commissions.

· Best For: Intermediate to advanced traders seeking competitive spreads in a commission-free environment.

Understanding Leverage

Leverage is a tool that allows traders to control a larger position with a smaller amount of capital. The maximum MH Markets leverage available is up to 1:2000. However, it is critical to understand that this is not a fixed number. The actual leverage you can access depends on several factors:

· Regulatory Jurisdiction: Clients under ASIC regulation in Australia are subject to leverage caps (e.g., 30:1 for major forex pairs). Clients under the VFSC jurisdiction can access higher leverage up to 1:500.

· Asset Class: Leverage varies by instrument. Forex pairs typically have the highest leverage, while commodities, indices, and especially cryptocurrencies will have lower limits.

· Account Equity: Some brokers reduce available leverage as account size increases to reduce risk.

While high leverage can increase profits, it equally increases losses. It is a double-edged sword that must be used with a strong risk management strategy.

Learn more about MH Markets Forex Trading Account here.

Platforms and Tools

The trading platform is your primary interface with the market. Our hands-on testing focused on the usability, speed, and features of the software offered by MH Markets.

MetaTrader 4 & 5

MH Markets has chosen to focus on the globally recognized MetaTrader suite, offering both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This is a strong choice, as these platforms are known for their reliability, extensive charting capabilities, and support for automated trading.

· MT4 remains the industry standard, beloved for its simplicity and vast library of custom indicators and Expert Advisors (EAs).

· MT5 is the more modern successor, offering more timeframes, additional technical indicators, and a cleaner interface. It also provides a Depth of Market (DOM) view, which is valuable for ECN traders.

*In our testing, the MT5 platform on MH Markets loaded quickly, and order execution was precise with minimal slippage during normal market conditions. We found the one-click trading feature to be particularly responsive, which is critical for active traders. Setting up chart templates with our preferred indicators was an intuitive process that took only a few minutes.*

Proprietary Tools

Our review found that MH Markets does not offer a proprietary trading platform. Instead, it has concentrated its resources on providing a stable and well-supported MetaTrader environment. While some traders may prefer a unique web-based platform, the focus on MT4 and MT5 ensures a familiar and powerful experience for the vast majority of users. They also do not heavily promote third-party tools, such as Autochartist, keeping the offering streamlined and focused on the core trading experience within MetaTrader.

Versus The Competition

To provide practical context, we analyzed how MH Markets stacks up for two distinct trader profiles, comparing its offerings to what you might find at other specialized brokers.

For the Scalper

A scalper's success depends on razor-thin spreads, low latency, and minimal commissions. We evaluated the MH Markets ECN account from this perspective.

· Pros: The raw spreads starting from 0.0 pips are highly competitive. *Our experience with the MT5 platform showed fast execution speeds, which is a key requirement for a scalping strategy.*

· Cons: The $7 round-turn commission is standard but not the absolute lowest in the industry. Some ECN-focused competitors may offer commissions closer to $5 or $6 per lot.

For the Swing Trader

A beginner swing trader holds positions for days or weeks, prioritizing ease of use, reasonable overnight costs (swaps), and good support over micro-pips.

· Pros: The Standard account is simple and commission-free. The MT4 platform is user-friendly for beginners. Overnight swap fees were found to be in line with industry averages.

· Cons: The educational resources are present but not as extensive as those offered by some larger, education-focused brokers. A beginner might need to supplement their learning with outside materials.

This analysis shows that MH Markets can be a strong contender for specific strategies. If you believe it aligns with your trading approach, you can get started and test its environment with a demo or live account.

The Complete User Journey

A broker's quality is also reflected in its administrative processes. We walked through the entire user journey, from initial sign-up to contacting support, to assess its efficiency and user-friendliness.

Opening Your Account

The registration process is a straightforward, digital procedure.

1. Provide your basic personal information (name, email, phone number).

2. Complete a brief questionnaire about your trading experience and financial standing, which is a standard regulatory requirement.

3. Upload verification documents: a government-issued ID (like a passport) and a proof of residence (like a utility bill or bank statement).

*Our account was verified within six hours, which is faster than the industry average of 24 hours. The document upload interface was straightforward and easy to use on both desktop and mobile.*

Funding and Withdrawal

MH Markets offers a solid range of modern and traditional payment methods.

· Deposit Methods: Credit/Debit Cards (Visa, Mastercard), Bank Wire Transfer, and popular e-wallets such as Skrill and Neteller. Deposits are generally processed instantly for e-wallets and cards.

· Withdrawal Methods: The same methods are available for withdrawals. Processing times are typically within 24 hours for e-wallets and 2-5 business days for bank transfers, which is standard.

Contacting Customer Support

Accessible and knowledgeable support is crucial. MH Markets provides support through the main channels: Live Chat, Email, and Phone.

*We tested the Live Chat feature at 3 PM GMT with a query about swap fees on the Prime account. We were connected to an agent in under 30 seconds. The agent was knowledgeable, quickly confirming the fee structure and providing a direct link to the relevant terms on their site. The experience was efficient and professional.*

Final Verdict

After a thorough mh markets review of its regulation, fees, platforms, and user journey, mh markets presents itself as a solid and reliable broker, particularly for a certain type of trader. Its strengths lie in its dual-regulation framework, which offers both high-security and high-leverage options, and its competitive fee structure on the ECN and Prime accounts. The exclusive focus on the MetaTrader suite ensures a powerful and familiar trading environment.

Here is our final summary of the key advantages and disadvantages.

| Pros | Cons |

| Strong ECN account with raw spreads | Educational resources are not as deep as some competitors |

| Regulated by top-tier ASIC | No proprietary platform for those seeking an alternative to MT4/5 |

| Fast account verification and support | Higher spreads on the Standard account compared to the Pro/ECN |

Conclusion

MH Markets stands out as an excellent choice for intermediate to advanced traders who are comfortable with the MetaTrader platform and are looking for a cost-effective environment for active trading or scalping via the ECN or Prime accounts. Beginners can certainly use the Standard account, but they should be mindful of the higher spreads and the significant risks associated with the high MH Markets leverage available in certain jurisdictions.

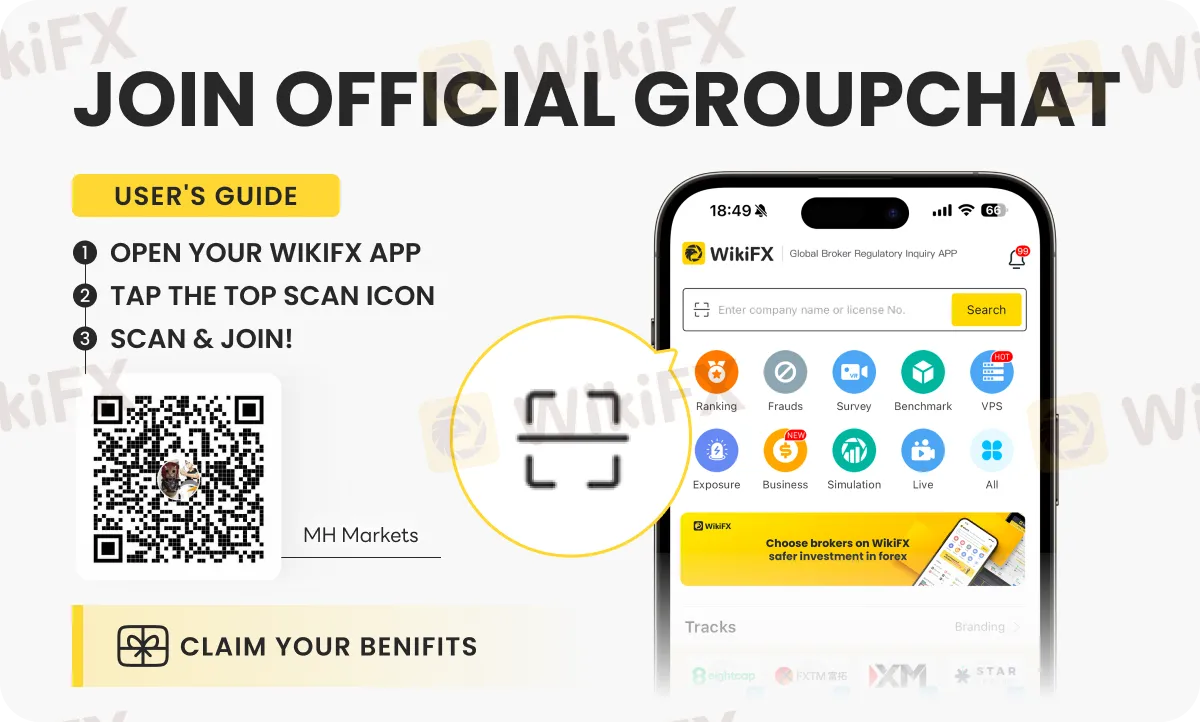

To know more about MH Markets' products and services, join an exclusive chat group (OIFSYYXKC3) by following the process shown on the image below -

Read more

Voices of the Golden Insight Award Jury | Theo, Global Markets Director of WeTrade

WikiFX Golden Insight Award uniting industry forces to build a safe and healthy forex ecosystem, driving industry innovation and sustainable development, launches a new feature series — “Voices of the Golden Insight Awards Jury.” Through in-depth conversations with distinguished judges, this series explores the evolving landscape of the forex industry and the shared mission to promote innovation, ethics, and sustainability.

Ox Securities Review: Complaints About Withdrawal Delays, Technical Issues & Customer Support

Is your Ox Securities trading filled with constant withdrawal denials? Have you faced unfair profit deduction and account closure here? Does the Ox Securities customer support team fail to answer your trading queries or issues? Have you had to face a rampant charge on your withdrawals? These issues have been highlighted by your fellow traders as they share the Ox Securities review online.

MIFX Regulation, Is This Indonesian Broker Safe?

MIFX is a regulated Indonesian broker with STP licenses from BAPPEBTI, JFX, and ICDX. Learn how its oversight protects traders and ensures compliance.

B2CORE Update Enhances Forex Broker Operations and CRM Systems

B2BROKER updates B2CORE CRM with new features and improved UX for forex brokers, offering better mobile access and multilingual support.

WikiFX Broker

Latest News

BLITZ finance Review 2025: Is It a Scam? License and Safety Evaluation

Inside Darwinex Broker Review: Regulation Explained & Authentic User Complaints

B2CORE Update Enhances Forex Broker Operations and CRM Systems

MIFX Regulation, Is This Indonesian Broker Safe?

CommSec Regulation, Login Information & User Review : A Comprehensive Review

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

FCA Waning list of Unauthorised firms

The "Invalid Profit" Trap & The Withdrawal Maze: A Deep Dive into MultiBank Group

Can You Trust Tauro Markets? A Complete Guide for New Traders

FCA’s 2027 Compliance Overhaul: A New Reality for FX and CFD Brokers

Rate Calc