Can You Trust Tauro Markets? A Complete Guide for New Traders

Abstract:When picking a broker, the first question is always: Can you trust Tauro Markets? Is Tauro Markets reliable? For any trader, keeping your money safe is the most important thing, even more important than talking about fees, trading platforms, or what you can trade. A broker's trustworthiness isn't demonstrated by their advertisements, but by their actual licenses and their transparency about their business. The most important factor in determining whether you can trust a broker is whether they are properly regulated. This one thing decides whether your money is protected, whether you can get legal help if there's a problem, and whether the broker follows international rules for fairness and financial safety. This review will look closely at Tauro Markets' regulation, company history, trading conditions, and how they operate. We will study the facts to give you a clear, evidence-based answer about whether they're reliable for traders in 2025.

When picking a broker, the first question is always: Can you trust Tauro Markets? Is Tauro Markets reliable? For any trader, keeping your money safe is the most important thing, even more important than talking about fees, trading platforms, or what you can trade. A broker's trustworthiness isn't demonstrated by their advertisements, but by their actual licenses and their transparency about their business.

The most important factor in determining whether you can trust a broker is whether they are properly regulated. This one thing decides whether your money is protected, whether you can get legal help if there's a problem, and whether the broker follows international rules for fairness and financial safety. This review will look closely at Tauro Markets' regulation, company history, trading conditions, and how they operate. We will study the facts to give you a clear, evidence-based answer about whether they're reliable for traders in 2025.

Looking at Its Regulation

The foundation of trust in financial services is regulation. A good regulatory body makes rules that protect clients, ensure fair market practices, and provide a way to solve disputes. Without this oversight, traders are left unprotected. In our study of Tauro Markets, this is where we found the biggest problems.

No Valid Regulation

Our research confirms an important fact: Tauro Markets currently has no valid regulatory license from any recognized financial authority. The company, JM Financial LLC, is registered in Saint Vincent and the Grenadines. It's important for traders to understand that this country's Financial Services Authority (FSA) does not regulate, monitor, supervise, or license international forex brokerage activities. Getting registered in this location is fairly simple and cheap, but it offers no real protection to traders.

This lack of oversight is a major warning sign. Official reviews have marked the broker with warnings like “Suspicious Regulatory License,” “High potential risk,” and a clear warning: “Low score, please stay away!” These warnings are serious; they come from the broker operating outside the established global system of financial supervision.

The Risks of Unregulated Brokers

To be clear, choosing an unregulated broker isn't just a small risk; it's a major gamble with your capital. The real risks are many and serious:

· No Fund Protection: Regulated brokers usually must keep clients‘ capital in separate accounts, away from the company's operating capital. This ensures that if the broker goes bankrupt, clients’ capital stays protected. Unregulated brokers, such as Tauro Markets, have no such legal requirement, meaning client funds could be used for the companys expenses and may be impossible to get back if the entity has financial problems.

· No Dispute Resolution: If you have a problem with an unregulated broker—whether it's a withdrawal refusal, a pricing problem, or a platform issue—there is no official regulatory body to appeal to. You're left to solve the problem directly with the company, which holds all the power. There is no independent third party to judge your case.

· Potential for Unfair Practices: Regulation enforces transparency in pricing, execution, and terms of service. Unregulated brokers don't have to follow these standards. They can operate with very little transparency, potentially leading to unfair trading conditions, hidden fees, and manipulative practices without fear of regulatory penalties.

Related Company Problems

Further investigation into the corporate structure adds another layer of concern. A related company, J M FINANCIAL LLC, registered in Michigan (US), was listed with an “Abnormal” status as of September 2023. It suggests a pattern of operational or compliance issues that should not be ignored.

Tauro Markets Trading Options

Despite the major regulatory risks, it's important for a complete review to objectively detail the trading products and account types that Tauro Markets advertises. This information allows traders to see the full picture, though it must be viewed considering the previously discussed risks.

Available Trading Instruments

Tauro Markets offers a reasonably broad selection of tradable asset classes, which on the surface may seem appealing to traders looking for portfolio diversification. However, it doesn't cover all major investment categories.

| Supported Instruments | Not Supported |

| Forex | Stocks |

| Indices | ETFs |

| Commodities | Bonds |

| Cryptocurrencies | Mutual Funds |

| Metals |

The availability of cryptocurrencies, forex and indices might attract some traders, but the absence of direct stock, ETF, or bond trading limits its usefulness for long-term investors.

Account Types and Conditions

The broker offers a tiered account structure, seemingly designed to cater to traders with varying capital and trading preferences. There are three main account types: Classic, VIP, and Raw. The key differences are in the minimum deposit requirements, spreads, and commission structures.

| Account Type | Minimum Deposit | Spreads From | Commission |

| Classic | $100 | 1.3 pips | $0 |

| VIP | $5000 | 0.5 pips | $0 |

| Raw | $100 | 0.0 pips | $3.5 (per lot) |

The entry-level Classic account, with its more accessible $100 minimum deposit, features much wider spreads starting from 1.3 pips, which is not particularly competitive.

Trading Platforms

Tauro Markets provides access to the widely recognized MetaTrader 4 (MT4) platform, along with its own WebTrader. These platforms are available on multiple devices, including Windows, iOS, and Android, as well as directly through a web browser.

While having MT4 is good for many new traders who are familiar with its interface and extensive library of expert advisors (EAs), we note that the newer and more advanced MetaTrader 5 (MT5) platform is not available. This may be a significant drawback for traders seeking enhanced features, additional timeframes, and broader market access that MT5 provides.

A more serious problem is the lack of a demo account. This is a major disadvantage. Demo accounts are an essential tool for traders to test a broker's platform, execution speeds, and spread stability under real market conditions without risking capital. The inability to do so with Tauro Markets forces traders to commit real capital just to evaluate the service, which is risky, especially given the broker's unregulated status.

Deposits, Withdrawals and Support

How well and transparently funding and support work are important aspects of a broker's service. For traders, the ability to deposit and, more importantly, withdraw funds in a timely and cost-effective manner is essential.

Funding Methods

Tauro Markets lists several common methods for both deposits and withdrawals. The accepted channels include:

· Visa

· MasterCard

· Wire Transfer

While these are standard options, the limited selection may be inconvenient for traders in regions where alternative payment methods and e-wallets are more common.

Transparency on Fees and Times

A major concern is the complete lack of specific information on the broker's website about transaction processing times and associated fees. Details about how long a withdrawal takes to process or what fees might be charged for deposits or withdrawals are not specified. This lack of clarity is a major operational red flag.

*The following information is for reference only. Due to a lack of official, verifiable details, traders should be extremely careful as unexpected fees or long withdrawal delays are common risks with unregulated brokers.*

This lack of transparency is concerning, as traders rightfully expect to know the full cost and duration of their transactions before committing funds. Before depositing funds with any broker, it's a good practice to check for user reviews and the latest operational details on a comprehensive platform, such as WikiFX, to gauge the experiences of others.

Customer Support Channels

For client assistance, Tauro Markets provides two main points of contact:

· Email: support@tauromarkets.com

· 24/5 Live Chat

The availability of 24/5 live chat during the trading week is a standard feature. However, the true test of customer support is not its availability but its effectiveness in resolving serious issues, particularly those related to funding and withdrawals. With an unregulated broker, the support team has no obligation to follow any external standards of fairness or efficiency.

A Balanced Pros vs Cons

When evaluating a broker, it's easy to be drawn in by a list of attractive features. However, these features must be weighed against the fundamental risks involved. Here, we put the supposed advantages of Tauro Markets against its significant and overarching disadvantages.

· Pro: Wide range of tradable instruments.

· Con in Context: The theoretical ability to trade a diverse range of assets is meaningless if the broker is not trustworthy. The main goal is to secure and grow capital; if you cannot reliably withdraw your profits, the variety of instruments doesn't matter.

· Pro: The MT4 platform is available.

· Con in Context: While MT4 is a solid platform, the lack of an MT5 option limits choices for more advanced traders. More critically, the absence of a demo account prevents any risk-free testing of the platform's execution, spreads, and stability, forcing a blind commitment of real funds.

· Pro: Spreads are advertised from 0.0 pips.

· Con in Context: This attractive spread is locked behind the most expensive Raw account, which carries a commission. The entry-level account, which most new traders would use, has much wider and less competitive spreads starting from 1.3 pips.

· Pro: 24/5 customer support.

· Con in Context: The availability of a support channel doesn't guarantee its quality, fairness, or effectiveness. When dealing with serious disputes, especially concerning withdrawals, the support team of an unregulated broker is not accountable to any higher authority, leaving the trader with little to no leverage. You can explore user-submitted reviews and comments, which often provide real-world insights into these pros and cons, by visiting the Tauro Markets profile page on WikiFX.

Conclusion: The Final Verdict

So, after a detailed analysis, can you trust Tauro Markets and is it reliable?

The evidence points to a clear and decisive answer. The complete and verifiable lack of a valid regulatory license from any reputable financial authority is an undeniable and primary risk factor. This single issue overshadows any potential benefits the broker might appear to offer. An unregulated status means there is no client fund protection, no formal dispute resolution mechanism, and no mandatory adherence to fair and transparent practices.

This primary red flag is made worse by other serious concerns, including its registration in an offshore jurisdiction that doesn't oversee forex activities, the “Abnormal” status of an associated company, and a concerning lack of transparency on crucial operational details like withdrawal fees and processing times.

Based on our analysis, the sentiment expressed by cautious traders is well-founded. Working with unregulated brokers introduces a level of risk that is unacceptable for most investors who prioritize their capitals safety. While features, such as MT4 support and a variety of instruments, may look appealing, they cannot make up for the fundamental absence of trust and security.

Due to these significant and unavoidable risks, Tauro Markets cannot be considered a trustworthy broker for your investment. We strongly advise traders to prioritize brokers with top-tier regulation from established authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). To discover and compare reputable, well-regulated brokers, you can use the search and ranking tools available on WikiFX to check the full profile of any broker before opening an account.

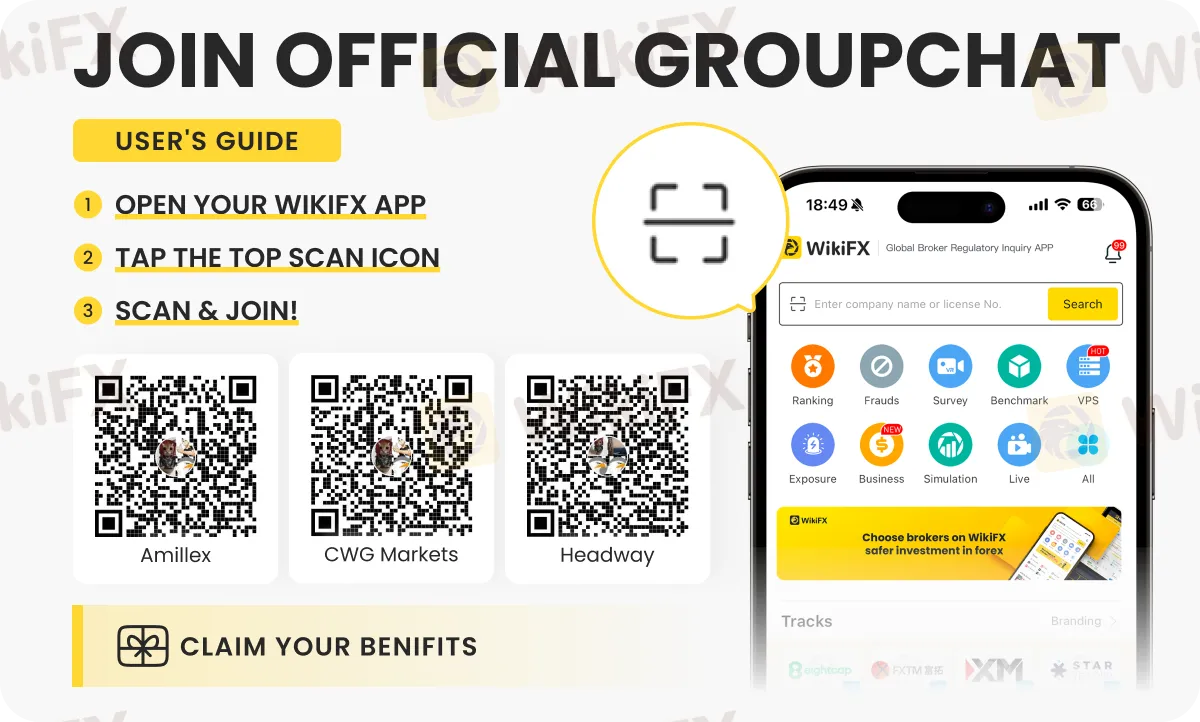

Want forex updates on your fingertips? Join these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) today.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc