Vittaverse Review 2025: Is This Forex Broker Safe?

Abstract:This 2025 review of Vittaverse analyzes its Seychelles FSA regulation, MT5/CTrader platforms, and high leverage offers. Despite legal status, a low WikiFX score of 3.27 and a surge of complaints regarding withdrawal denials and profit deletions raise significant safety concerns for traders.

Vittaverse is a Seychelles-based online trading provider established in 2022. Operating as a Vittaverse broker, it offers access to global markets through popular trading platforms. While the company holds an offshore regulatory license, its reputation has been heavily impacted by recent user feedback. With a WikiFX Score of 3.27 and a significant number of unresolved complaints, traders are advised to approach this entity with extreme caution.

Pros and Cons of Vittaverse

Based on the latest data and user reports, here are the key advantages and disadvantages:

- ✅ Regulated:Seychelles FSA license (Offshore).

- ✅ Platforms: Supports industry-standard MT5 and CTrader.

- ✅ Leverage: Offers high leverage up to 1:500.

- ✅ Accounts: Diverse options including VIP and ECN PRO.

- ❌ Low Score: Rated only 3.27/10 by WikiFX due to risk factors.

- ❌ Withdrawal Issues: Multiple reports of denied withdrawals and deleted profits.

- ❌ Account Safety: Reports of account suspension without clear reasoning.

- ❌ Security: Review data indicates a lack of 2-step login or biometric authentication.

Vittaverse Regulation and License Safety

Vittaverse operates under the corporate name Opal Markets Ltd and is regulated by the Seychelles Financial Services Authority (FSA).

License Details

- Regulator: Seychelles Financial Services Authority (FSA)

- License Number: SD200

- Status: Regulated (Offshore)

- Entity: Opal Markets Ltd

While Vittaverse holds a valid license, it is important to understand that the Seychelles FSA is an offshore regulator. Offshore jurisdictions generally have less accumulation of capital requirements and looser compliance standards compared to top-tier authorities like the FCA (UK) or ASIC (Australia). This means client fund protection schemes may be limited.

Risk Warning

Despite the valid license, the WikiFX system has flagged this broker with a “Low Score” and “Poor Influence” warning. The high volume of complaints in the last three months suggests that holding an offshore license has not prevented severe operational issues for clients.

Real User Feedback and Complaints

The recent influx of complaints paints a worrying picture. WikiFX has received 9 specific complaints in recent months, with accusations ranging from profit deduction to account suspension.

Significant User Issues:

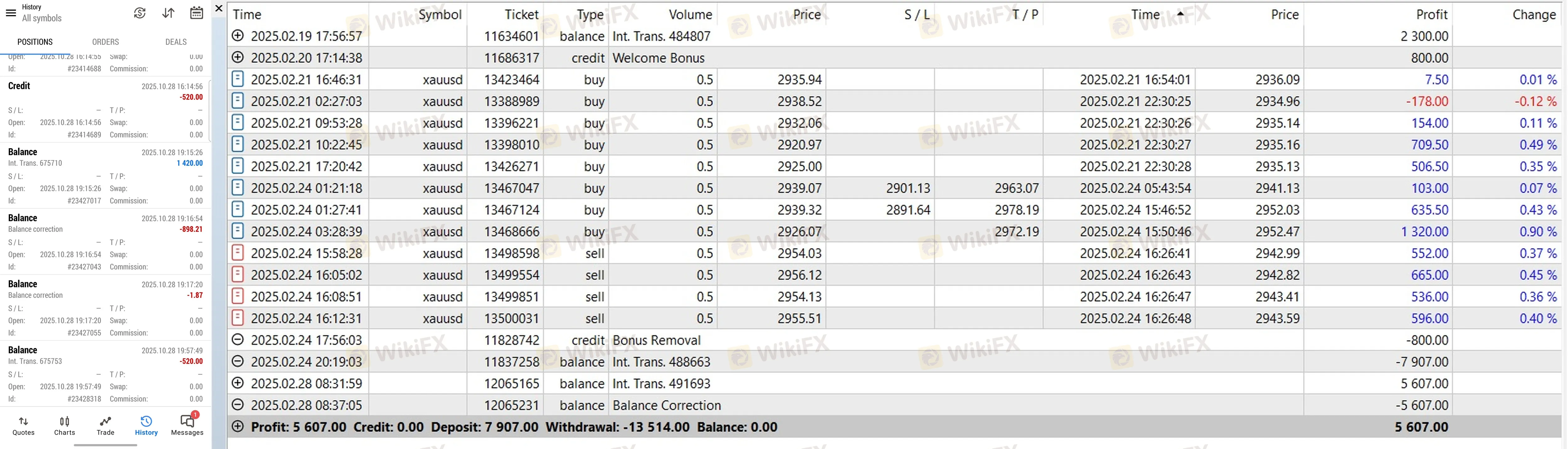

- Profit Deletion: Multiple traders (Cases 1, 4, 6) reported that their profits were zeroed out under the label of “correction” without valid evidence provided by the broker.

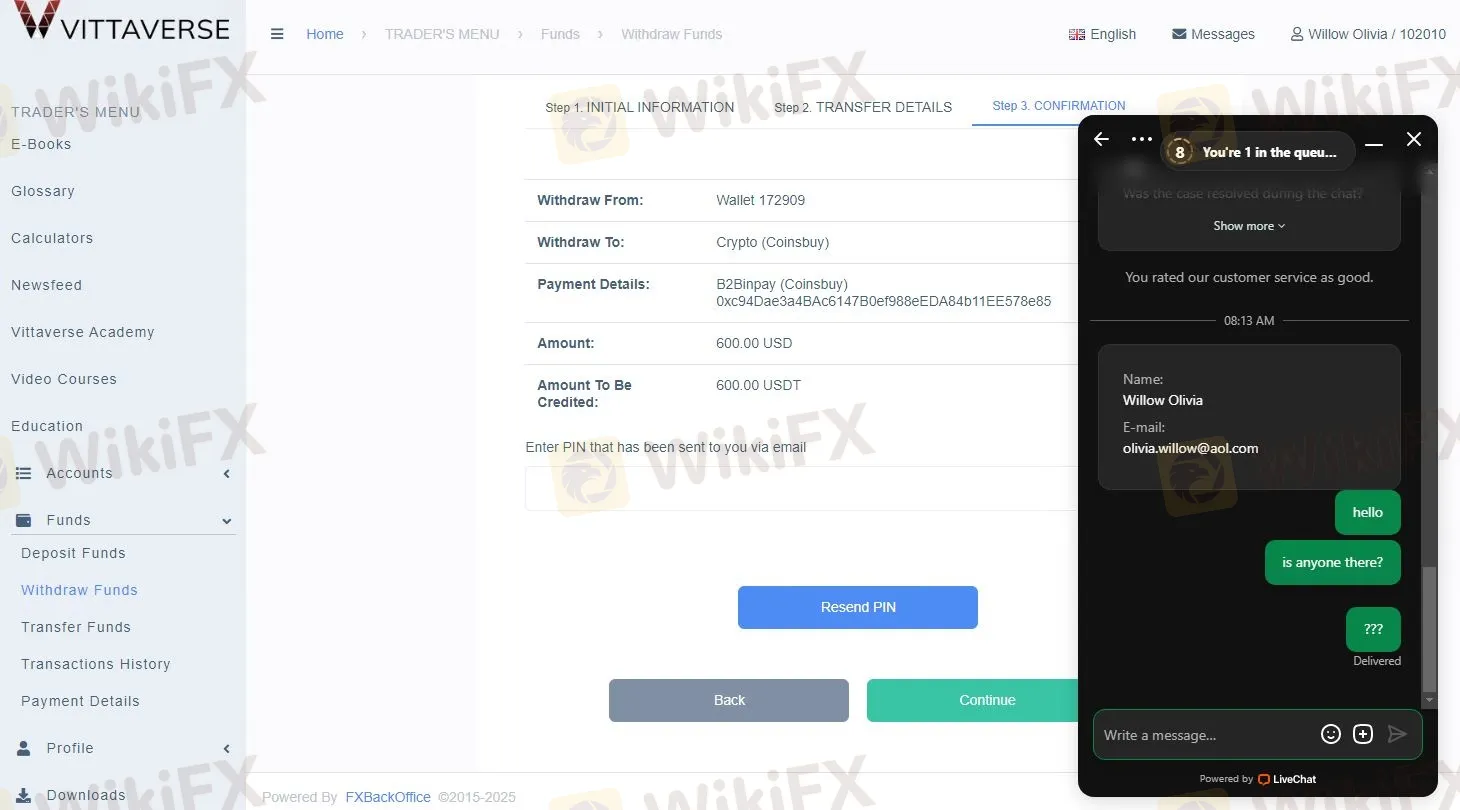

- Access Denial: Users have reported difficulties with the login process, with some stating their access to the client panel was suspended entirely after requesting withdrawals.

- Withdrawal Failures: Case 2 highlights an inability to receive withdrawal PIN codes, effectively locking funds. Case 5 reports a loss of over $12,000 removed from the wallet without explanation.

One specific case underscores the severity: a user mentioned that upon accessing their account, they found their balance wiped.

Vittaverse Forex Trading Conditions and Fees

For those still considering this broker, here is a breakdown of the trading environment provided by official data.

Platforms

Traders can access markets via MT5 and CTrader. These platforms are industry standards known for robust charting and automated trading capabilities. However, the software review notes a lack of advanced security features like two-factor authentication.

Leverage

Vittaverse offers substantial leverage up to 1:500. While this allows for maximizing small deposits, it significantly increases the risk of rapid capital loss.

Spreads and Accounts

The broker offers three main account types:

- VIP: Minimum deposit $12,000, spreads from 0.0.

- Standard: Minimum deposit $15, accessible for beginners.

- ECN PRO: Minimum deposit $100.

Final Verdict

Vittaverse presents a conflicting profile: it uses reliable software like MT5 and holds an FSA license, but its operational conduct raises major red flags. The prevalence of complaints regarding zeroed profits and suspended accounts suggests a high-risk environment. The low WikiFX score reflects these dangers.

Traders are strongly urged to prioritize brokers with higher safety scores and cleaner track records.

To stay safe and view the latest regulatory certificates, check Vittaverse on the WikiFX App.

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc