VITTAVERSE Review: Safety, Regulation & Forex Trading Details

Abstract:VITTAVERSE currently operates under offshore Seychelles regulation but faces a surge in complaints regarding profit cancellations and withdrawal denials. With a low WikiFX safety score of 3.27, traders should exercise extreme caution due to reports of account restrictions and deducted funds.

VITTAVERSE is a Forex broker established in 2022 that caters to a global audience, with notable influence in regions like Pakistan and the UAE. While the platform offers modern trading interfaces like MT5 and CTrader, its recent operational history has raised significant safety concerns. This review analyzes the broker's regulatory status and the growing volume of user complaints to help investors make informed decisions.

Key Takeaways

- WikiFX Score:3.27 / 10 (High Risk)

- Regulation:Seychelles FSA (Offshore/Tier 2)

- Platform:MT5 and CTrader supported

- Primary Risk: Multiple reports of profit deductions and withdrawal delays

VITTAVERSE Broker Summary

According to WikiFX records, VITTAVERSE ranks as a “C” level broker with a high-risk safety score of 3.27. Although the broker has only been operating since 2022, it has already accumulated 9 serious complaints within the last three months alone.

The broker provides high leverage options up to 1:500 and low entry costs (Standard accounts from $15), features often used to attract retail traders. However, the “HighLight” data suggests that while entry is easy, the safety of funds—specifically regarding withdrawals and profit retention—remains a critical issue. The Forex community often views such a low score paired with a high complaint volume as a major warning sign.

VITTAVERSE Regulation: Is the License Real?

A crucial part of any VITTAVERSE review is verifying the regulatory claims. The broker is regulated, but it operates under an offshore jurisdiction.

| Regulator | License Type | Status | Entity Name |

|---|---|---|---|

| Seychelles FSA | Retail Forex License | Regulated (Offshore) | Opal Markets Ltd |

VITTAVERSE operates under the entity Opal Markets Ltd, authorized by the Seychelles Financial Services Authority (FSA) with license number SD200.

What this means for you:

While the license is valid, Seychelles is considered an offshore jurisdiction. Unlike top-tier regulators like the FCA (UK) or ASIC (Australia), offshore regulators generally have looser requirements regarding capital reserves and dispute resolution. In the event of a dispute, international clients may find it difficult to recover funds compared to brokers regulated in stricter jurisdictions.

User Reviews: VITTAVERSE Login & Withdrawal Complaints

Recent data from WikiFX highlights a disturbing pattern in user experiences. The most frequent complaints do not revolve around market volatility, but rather administrative actions taken by the broker against profitable traders.

1. The “Profit Correction” Issue

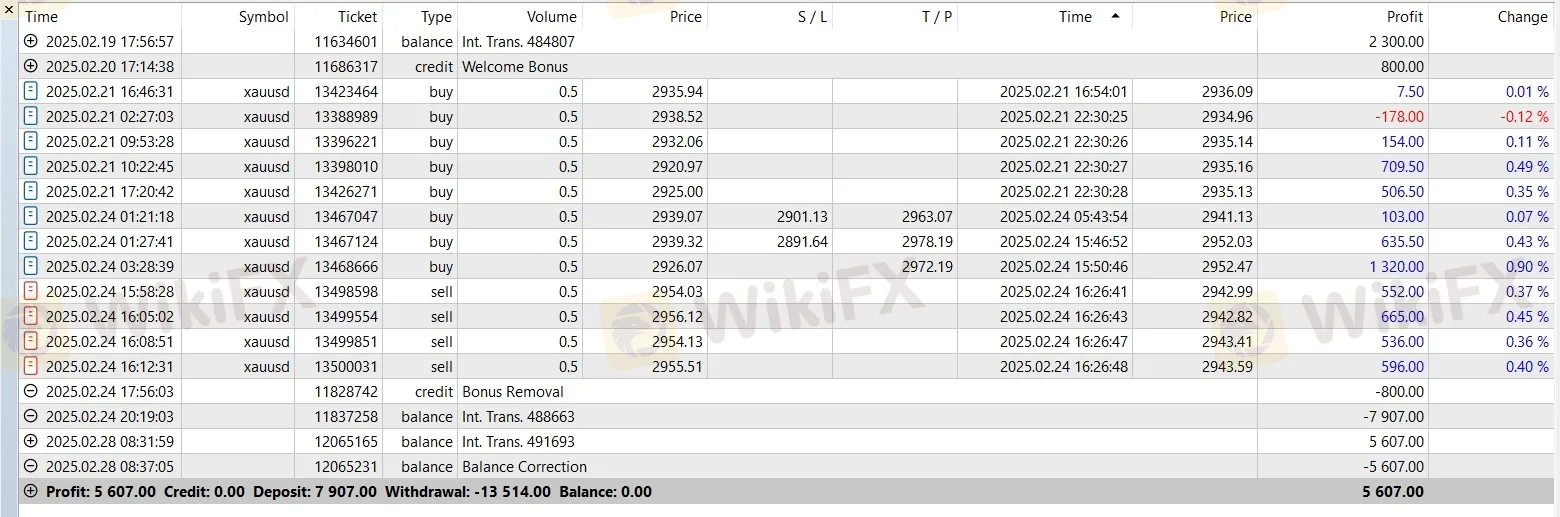

A recurring theme in the review data is the deletion of profits under the guise of “balance correction.”

- In a case filed on November 27, 2024, a user reported that VITTAVERSE removed $12,534 from their wallet without a clear explanation.

- Another report detailed a scenario where a trader turned a deposit and bonus into a $5,609 profit, only to have the profit deducted and the bonus removed, leaving only the initial deposit.

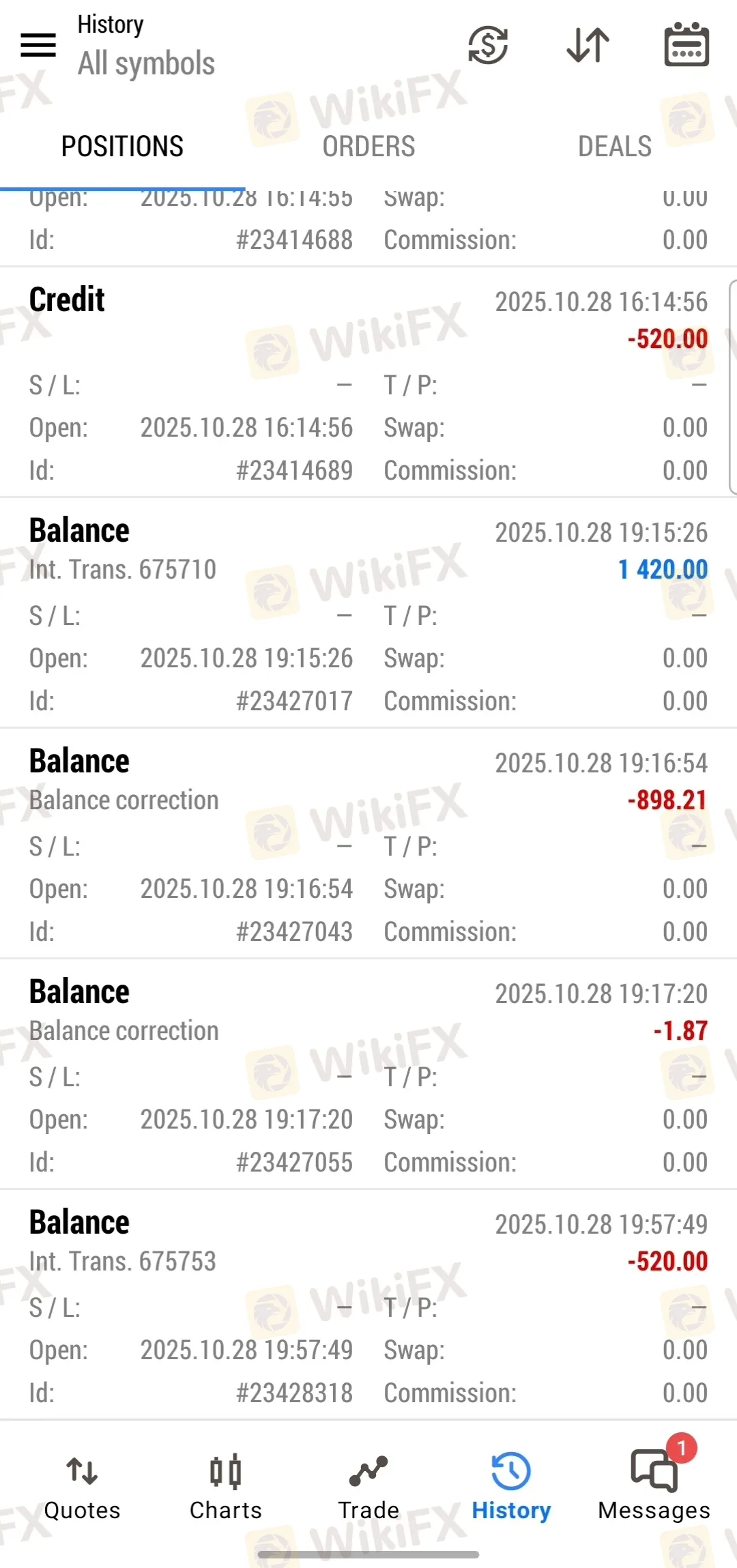

2. VITTAVERSE Login and Account Access

Several users have reported difficulties maintaining access to their accounts after requesting withdrawals.

- Evidence from November 2025 indicates that after a user requested proof for a zeroed account, the broker allegedly deleted the trading account and suspended access to the client panel.

- This suggests that VITTAVERSE login issues may be symptomatic of deeper account disputes rather than technical maintenance.

3. Withdrawal Denials

Multiple cases describe a cycle where withdrawals are declined without valid reasons. One user noted a decline reason consisting merely of two dots (“..”), followed by a complete removal of funds from their wallet. The lack of transparent communication from customer support (email and live chat) exacerbates these risks.

Conclusion: Final VITTAVERSE Review Recommendation

Based on the available market data and regulatory analysis, VITTAVERSE presents a high-risk profile for potential investors. While the broker holds a valid Seychelles FSA license and offers robust software like MT5, the operational conduct reported by users outweighs these technical benefits.

The repeated allegations of profit invalidation, withdrawal denials, and account restrictions suggest improper handling of client funds. With a WikiFX score of 3.27, traders are strongly advised to consider strictly regulated alternatives that prioritize fund safety and transparent withdrawal policies.

Risk Warning:Forex trading involves significant financial risk. Always verify a broker's current standing on the WikiFX app before depositing funds.

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc