Sucden Review 2026 — Is the Sucden Broker Worth Your Trust?

Abstract:If you are researching Sucden review or looking into Sucden Forex trading, this in-depth article will help you understand the strengths and weaknesses of Sucden Financial, its regulatory standing, trading services, and whether it’s the right choice for you.

If you are researching Sucden review or looking into Sucden Forex trading, this in-depth article will help you understand the strengths and weaknesses of Sucden Financial, its regulatory standing, trading services, and whether its the right choice for you.

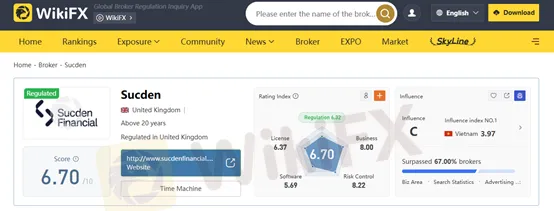

According to WikiFX, Sucden has a score of 6.70/10, reflecting a mix of regulatory compliance, trading options, and user feedback. WikiFX also conducted an on-site survey and verified its physical address in the United Kingdom.

What Is Sucden? — Broker Overview

Sucden Financial (often referred to simply as Sucden) is a financial services provider with a long history in the global markets. It primarily targets institutional clients and corporations, offering trading access to:

- Forex currency markets

- Metals and commodities

- Energy and soft agricultural markets

- Fixed income instruments

Sucden Financial is headquartered in London, United Kingdom with multiple international offices listed on its official contact page.

Regulation Sucden — Is It Regulated?

One of the most critical aspects in any Sucden broker evaluation is the regulatory status:

Sucden Regulation Snapshot

| Authority | Status |

| UK Financial Conduct Authority (FCA) | ✔️ Regulated (License No. 114239) |

| US National Futures Association (NFA) | ⚠️ Previously licensed, now unauthorised |

| Other Regulators (e.g., Hong Kong) | ⚠️ Mixed reports on status |

Sucden Financial currently holds regulation with the FCA, one of the most respected regulatory bodies in the world, adding credibility to its operations. However, it previously lost its authorization from the NFA in the USA, which makes regulation Sucden a nuanced topic when evaluating risks.

Trading Instruments & Platforms — Forex Sucden and Beyond

Sucden provides access to a broad spectrum of tradable assets, including but not limited to:

- Forex (currency pairs)

- Precious & base metals

- Energies (oil, gas, etc.)

- Agricultural commodities

- Fixed income products

Note that details about account types, spreads, and fee structures are not always clearly published, which is a drawback for retail traders seeking transparency.

Sucden Broker — Pros and Cons

Pros

- ✔️ FCA regulated in the UK

- ✔️ Wide range of trading markets including Forex, commodities, and fixed income

- ✔️ Tailored solutions for institutions and corporate clients

- ✔️ Long-standing presence in global financial services

Cons

- ❌ Limited transparency on account types and fees

- ❌ Some past regulatory changes (e.g., NFA de-authorization)

- ❌ Mixed user feedback on customer service and withdrawals

- ❌ Not primarily focused on retail traders

User Feedback — Mixed Reviews

According to WikiFX user surveys, Sucdens reputation among individual traders is divided:

- Several users reported issues with withdrawals or account handling

- Some positive comments exist, but transparency concerns persist

This mixed feedback is typical in institutional broker reviews but highlights areas future clients should research deeply before investing.

Sucden vs. Other Brokers — Quick Comparison

| Feature | Sucden | Typical Retail Forex Broker |

| FCA Regulation | Yes | Yes |

| NFA Regulation | Previously held (now unauthorised) | Often Yes |

| Retail Account Focus | Limited | Strong |

| Asset Range | Forex, Metals, Energy, Commodities | Forex + CFDs + Crypto |

| Transparency (Fees/Spreads) | Limited info | Usually clear |

| Target Market | Institutional & Corporates | Retail & Institutional |

FAQ Section

Is Sucden a regulated broker?

Yes. Sucden is regulated by the UK Financial Conduct Authority (FCA), one of the worlds most reputable financial regulators.

Is Sucden safe for Forex trading?

Sucden is considered relatively safe due to FCA regulation and verified office presence, but it mainly serves institutional clients rather than retail traders.

What is Sucdens WikiFX score?

Sucden has a WikiFX score of 6.70/10, supported by regulatory status and on-site verification.

Does Sucden support retail traders?

Sucden primarily focuses on institutional and corporate clients, making it less suitable for beginner retail Forex traders.

Final Verdict — Review Sucden

In this Sucden review, the broker stands out for its regulatory backing by the FCA, diversified market access, and institutional trading focus. However, if your priority is a transparent and retail-friendly trading environment, Sucden might not offer the clarity or support you expect. Its WikiFX score of 6.70/10 reflects this balanced picture — a legitimate broker with specific strengths but also limitations.

Read more

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

The forex market is a happening place with currency pairs getting traded almost non-stop for five days a week. Some currencies become stronger, some become weaker, and some remain neutral or rangebound. If you talk about the Indian National Rupee (INR), it has dipped sharply against major currencies globally over the past year. The USD/INR was valued at around 85-86 in Feb 2025. As we stand in Feb 2026, the value has dipped to over 90. The dip or rise, whatever the case may be, impacts our daily lives. It determines the price of an overseas holiday and imported goods, while influencing foreign investors’ perception of a country. The foreign exchange rates change constantly, sometimes multiple times a day, amid breaking news in the economic and political spheres globally. In this article, we have uncovered details on exchange rate fluctuations and key facts that every trader should know regarding these. Read on!

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc