Angel Broking Review 2026: Is Angel Broking a Safe Broker or a High-Risk Platform?

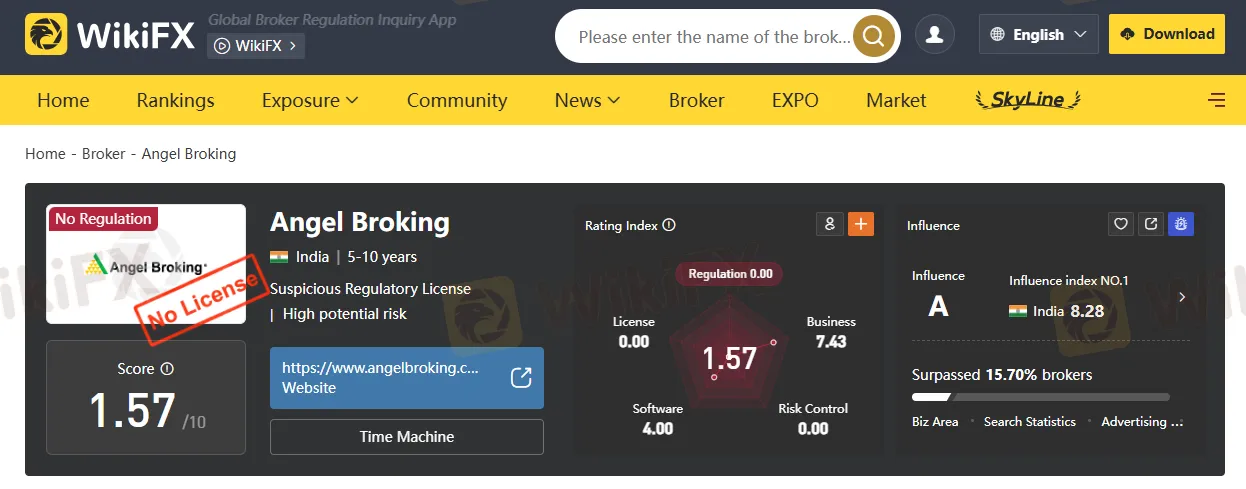

Abstract:When choosing a forex or CFD broker, regulation and transparency are critical factors. In this Angel Broking review, we take a close look at the broker’s background, regulatory status, trading conditions, and potential risks. According to WikiFX, Angel Broking has received a low score of 1.57/10, which raises serious concerns for traders.

When choosing a forex or CFD broker, regulation and transparency are critical factors. In this Angel Broking review, we take a close look at the brokers background, regulatory status, trading conditions, and potential risks. According to WikiFX, Angel Broking has received a low score of 1.57/10, which raises serious concerns for traders.

This article aims to help investors evaluate whether Angel Broking broker is suitable for trading or if it carries significant risks.

What Is Angel Broking?

Angel Broking presents itself as an online trading platform offering access to forex, CFDs, and other financial instruments. The broker claims to provide modern trading tools and competitive trading conditions. However, claims alone are not enough—regulation and investor protection are far more important.

Angel Broking Regulation: A Major Red Flag

One of the most critical aspects of this review Angel Broking is its regulatory status.

Based on available public information and WikiFX data:

- Angel Broking does not hold valid forex regulatory licenses

- There is no evidence of authorization from major regulators such as FCA, ASIC, NFA, or CySEC

- Client fund protection and dispute resolution mechanisms are unclear

The lack of strong regulation significantly increases trading risk.

Unregulated brokers operate without oversight, meaning traders may have little to no legal protection if disputes or withdrawal issues arise.

WikiFX Score Overview

WikiFX has assigned Angel Broking a score of just 1.57/10, reflecting weaknesses in key areas such as regulation, transparency, and operational credibility.

A score this low typically indicates:

- Insufficient regulatory oversight

- Higher probability of complaints or trading disputes

- Increased risk of fund safety issues

Trading Conditions and Platform

Angel Broking claims to offer:

- Multiple tradable instruments

- Online trading platforms

- Retail-focused trading services

However, due to the lack of verified regulatory disclosures, traders cannot independently confirm:

- Actual execution quality

- Fund segregation practices

- Risk management standards

This uncertainty further weakens the brokers credibility.

Angel Broking vs Regulated Brokers (Comparison Table)

| Feature | Angel Broking | Regulated Forex Broker |

|---|---|---|

| Regulatory Status | Unregulated / Unverified | FCA, ASIC, CySEC, NFA |

| WikiFX Score | 1.57/10 | 7.0–9.5/10 |

| Fund Protection | Unclear | Segregated client funds |

| Transparency | Limited | High |

| Dispute Resolution | Not guaranteed | Regulator-backed |

| Overall Risk Level | High Risk | Lower Risk |

Key Risks of Trading With Angel Broking

Before opening an account, traders should carefully consider the following risks:

- No strong regulatory supervision

- Limited transparency on company operations

- Potential withdrawal and fund safety risks

- Low credibility score from WikiFX

These factors make broker Angel Broking a questionable choice for risk-averse traders.

Is Angel Broking Safe or a High-Risk Broker?

Based on regulatory gaps, its low WikiFX score, and limited publicly verifiable information, this Angel Broking review concludes that:

Angel Broking appears to be a high-risk broker rather than a safe trading platform.

Traders—especially beginners—are generally better served by choosing well-regulated brokers with strong oversight, transparent operations, and proven track records.

Final Verdict: Should You Trade With Angel Broking?

Best for: Traders who fully understand the risks of unregulated platforms

Not recommended for: Beginners, long-term investors, or anyone prioritizing fund safety

Regulation Angel Broking remains the biggest concern, and until the broker can demonstrate credible regulatory compliance, caution is strongly advised.

Frequently Asked Questions (FAQ)

Q1: Is Angel Broking regulated?

No clear evidence shows Angel Broking is regulated by top-tier financial authorities.

Q2: What is Angel Brokings WikiFX score?

Angel Broking has a WikiFX score of 1.57/10, indicating high risk.

Q3: Is Angel Broking suitable for beginners?

Due to regulatory uncertainty and high risk, it is not recommended for beginners.

Read more

Fidelity Exposure: Examining the Latest User Reviews on Withdrawal Denials & Trade Manipulation

Fidelity Investments has been grabbing attention of late for negative reasons. These include complaints concerning withdrawals, account closure without notice, technical glitches in trade order processing, and inept customer support service. As the complaints continue to grow, we prepared a Fidelity review article showcasing some of them. Read on as we share details.

ICE FX Review: Are Traders Raising Red Flags Over Withdrawal Fees & Regulation Status?

Does ICE FX ask you to pay taxes for fund withdrawal access? Were you made to pay a hefty fee on a verification failure? Does the broker deliberately cancel your profitable trades? Have you failed to receive assistance from the ICE FX customer support team on your fund deposit and withdrawal queries? These issues have become common for its traders. Many of them have highlighted these issues online. In this ICE FX review article, we have investigated some of their complaints. Read on as we dive deep.

Phyntex Markets Forex Scam: $58K Blocked After $50K

Phyntex Markets forex scam: $50K withdrawal approved, $58K blocked on “toxic trading.” Unregulated Comoros broker scams Malaysian traders. Read exposure & protect funds!

Exfor Forex Scam Cases: Withdrawal Issues Exposed

Exfor clients face blocked withdrawals and no support response. Scam cases exposed—protect your funds and avoid this unregulated forex broker.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc