Phyntex Markets Forex Scam: $58K Blocked After $50K

Abstract:Phyntex Markets forex scam: $50K withdrawal approved, $58K blocked on “toxic trading.” Unregulated Comoros broker scams Malaysian traders. Read exposure & protect funds!

Phyntex Markets Exposure Case

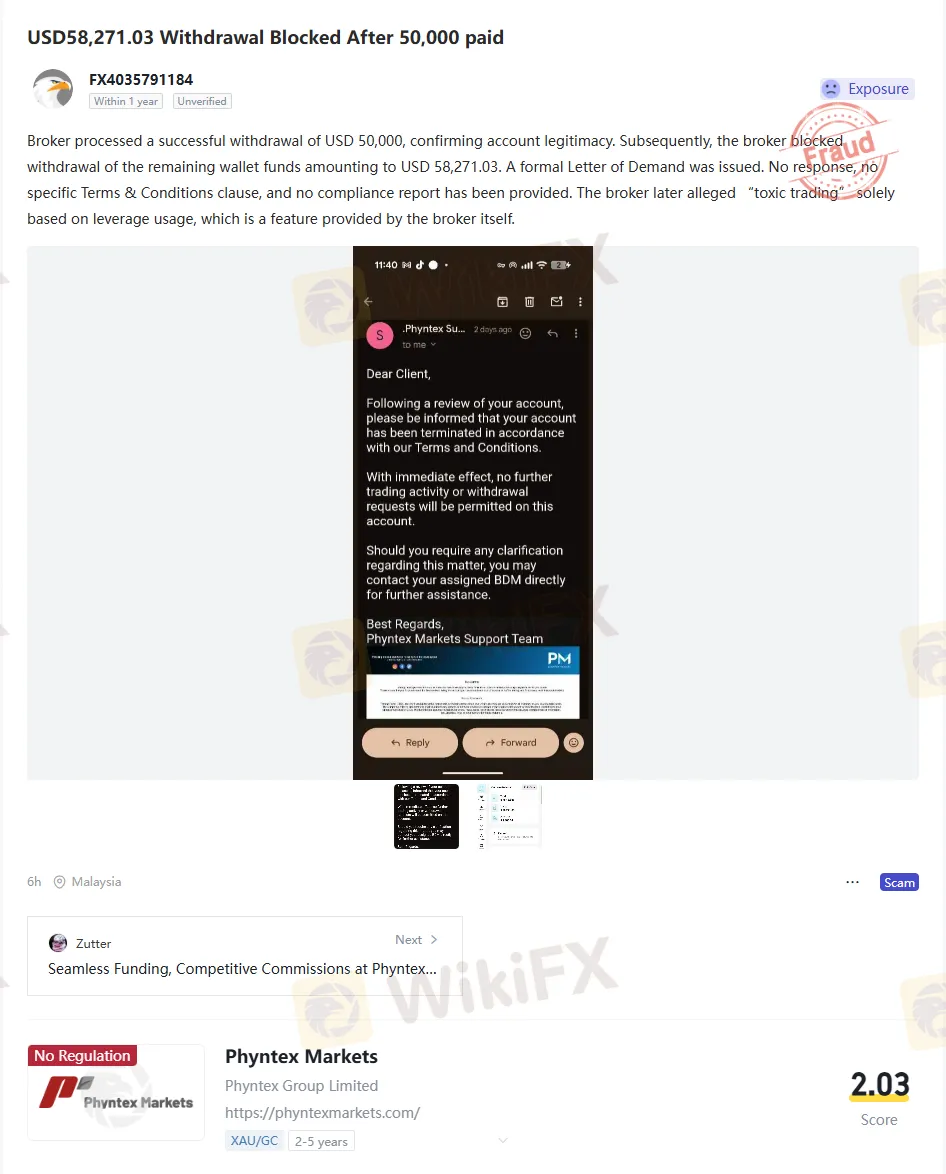

Phyntex Markets has been exposed as a forex scam broker after multiple traders reported blocked withdrawals and manipulative practices. While the broker initially processed a withdrawal of USD 50,000, it later refused to release an additional USD 58,271.03, sparking outrage and exposing its fraudulent behavior.

This incident, reported in Malaysia on February 19, 2026, highlights the dangers of trading with unregulated brokers. Phyntex Markets operates without proper oversight, leaving investors vulnerable to forex, online trading, and investment scams.

Broker Overview

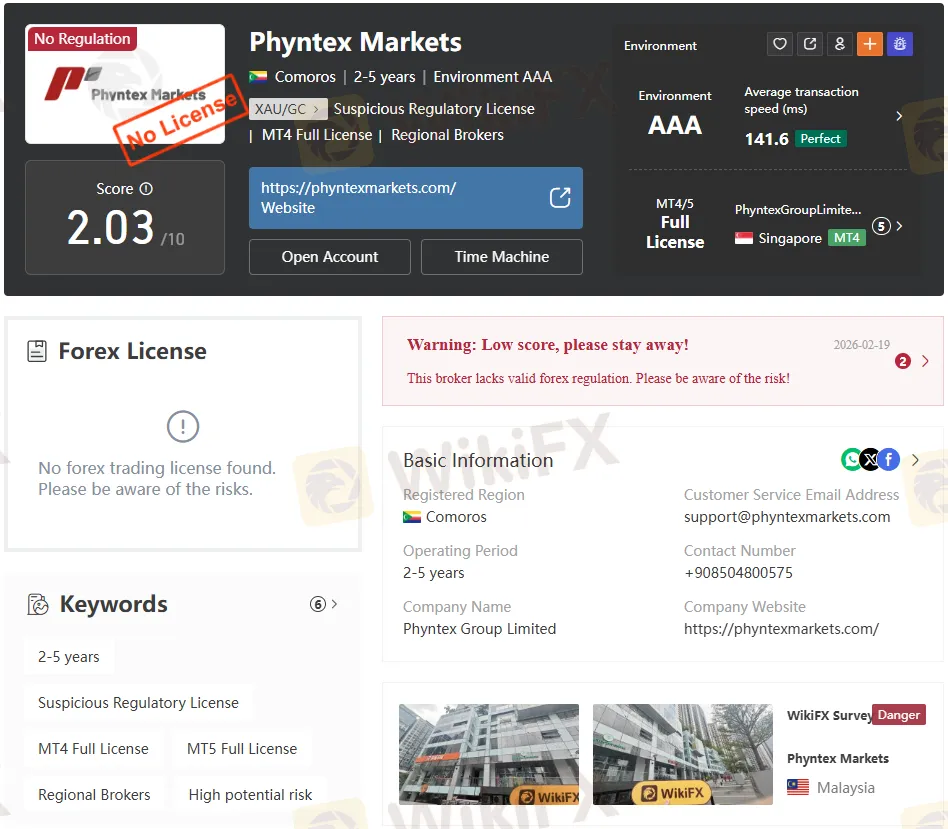

- Broker Name: Phyntex Markets

- Regulatory Status: Unregulated (Comoros)

- Business Type: Forex broker

- Risk Level: High – flagged for forex broker scams and exposure alerts

Phyntex Markets presents itself as a legitimate forex trading provider, but its lack of regulation and refusal to comply with basic transparency standards make it a high-risk forex trading scam. Traders should be cautious when dealing with brokers that cannot provide valid licenses or compliance reports.

Case Details: Blocked Withdrawals

The exposure case centers on a trader who successfully withdrew USD 50,000, confirming that the account was legitimate. However, when attempting to withdraw the remaining USD 58,271.03, Phyntex Markets blocked the transaction.

Key issues include:

- No Terms & Conditions clause provided

- No compliance report issued.

- No response to a formal Letter of Demand

Instead of honoring the withdrawal, the broker alleged “toxic trading” based solely on leverage usage—a feature offered by Phyntex Markets itself. This excuse is widely considered illegitimate and manipulative, designed to deny traders access to their rightful funds.

Regulatory Concerns

Phyntex Markets is unregulated, meaning it does not hold any valid licenses from recognized authorities. This lack of oversight allows the broker to operate without accountability, making it a prime example of forex fraud and online investment scams.

Unregulated brokers often:

- Block withdrawals without justification

- Ignore compliance demands

- Use fabricated excuses like “toxic trading.”

- Operate without transparent Terms & Conditions.

Phyntex Markets fits this pattern perfectly, reinforcing its classification as a forex broker scam.

User Exposure & Scam Alert

This case demonstrates how Phyntex Markets engages in forex broker scams and investment fraud. By processing one withdrawal and then blocking another, the broker creates a false sense of legitimacy before trapping traders funds.

Such practices are consistent with online trading scams, where brokers exploit leverage, hidden clauses, or fabricated accusations to deny payouts.

Why Traders Must Stay Alert

Phyntex Markets is a clear red flag for anyone considering forex trading with unregulated brokers. The blocked withdrawal of USD 58,271.03 is not an isolated incident but part of a broader pattern of forex investment scams.

Traders should:

- Avoid depositing funds with unregulated brokers.

- Verify licenses before trading.

- Use trusted platforms with transparent compliance records.

- Report suspicious activity to regulatory bodies.

Broker Review: Phyntex Markets

A closer look at Phyntex Markets reveals troubling signs:

- Unregulated status in Comoros

- No valid license detected

- High-leverage offerings are used as excuses against traders.

- No transparency in terms of compliance or reporting

While the broker promotes itself as a forex trading provider, its practices align with forex fraud and online investment scams. Traders reviewing Phyntex Markets should consider these red flags before engaging.

How Scam Brokers Operate

Phyntex Markets is not unique in its tactics. Many scam brokers follow similar patterns:

- Initial Legitimacy: Allowing small withdrawals to build trust.

- Blocked Funds: Refusing larger withdrawals with fabricated excuses.

- No Accountability: Operating without regulation or compliance.

- Blame Shifting: Accusing traders of “toxic trading” or other violations.

These steps are designed to trap traders funds while maintaining the appearance of legitimacy.

The Role of Regulation in Forex Trading

Regulation is the cornerstone of trust in forex trading. Licensed brokers must comply with strict standards, including transparent reporting, fair trading practices, and protection of client funds.

Phyntex Markets, by operating without regulation, avoids these responsibilities. This exposes traders to forex broker scams and online trading fraud, with no recourse for recovery.

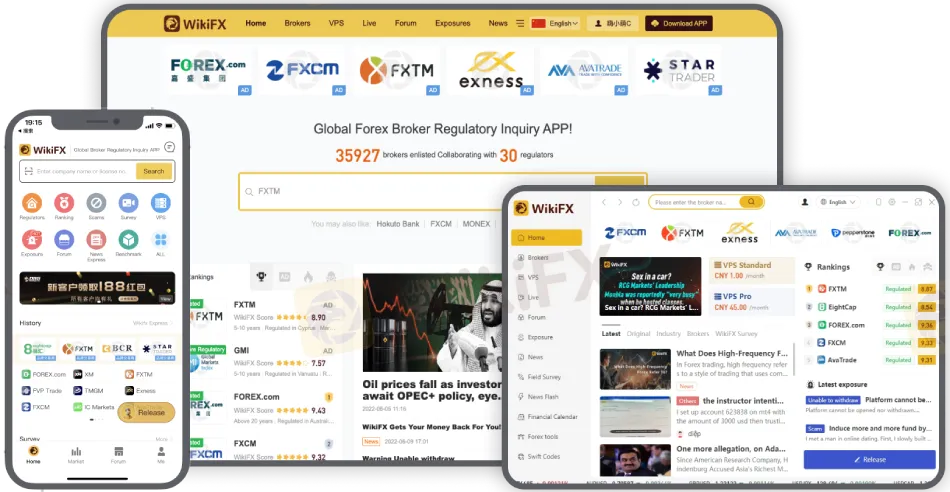

WikiFX App: Protect Yourself from Scams

The WikiFX App is a valuable tool for traders seeking to avoid scams like Phyntex Markets. By checking broker profiles, regulatory status, and exposure cases, traders can make informed decisions and protect their investments.

The WikiFX App provides:

- Broker reviews and ratings

- Regulatory license verification

- Exposure alerts and scam reports

- User feedback and complaint records

Using the WikiFX App ensures traders are aware of risks before committing funds, helping them avoid forex broker scams and online investment fraud.

Conclusion: Phyntex Markets Scam Exposure

Phyntex Markets has proven itself to be a forex scam broker, blocking legitimate withdrawals and hiding behind fabricated excuses. With no regulation, compliance, or accountability, it poses a serious risk to traders worldwide.

This exposure case serves as a forex fraud alert: avoid Phyntex Markets and protect your funds by relying on regulated brokers and tools like the WikiFX App.

Read more

ICE FX Review: Are Traders Raising Red Flags Over Withdrawal Fees & Regulation Status?

Does ICE FX ask you to pay taxes for fund withdrawal access? Were you made to pay a hefty fee on a verification failure? Does the broker deliberately cancel your profitable trades? Have you failed to receive assistance from the ICE FX customer support team on your fund deposit and withdrawal queries? These issues have become common for its traders. Many of them have highlighted these issues online. In this ICE FX review article, we have investigated some of their complaints. Read on as we dive deep.

Exfor Forex Scam Cases: Withdrawal Issues Exposed

Exfor clients face blocked withdrawals and no support response. Scam cases exposed—protect your funds and avoid this unregulated forex broker.

NEWTON GLOBAL Regulatory Status: A Complete Guide to Its Licenses and Company Registration

When choosing a financial services company, the most important question is about its regulatory status. For traders looking at NEWTON GLOBAL, this question is extremely important. A basic investigation using third-party verification platforms shows a worrying picture: The broker is marked for having no valid regulation. This article provides a detailed, fact-based analysis of NEWTON GLOBAL's regulatory claims, company registration, and the major risks with how it operates. We will examine the data provided by global broker inquiry apps and public records to present a clear and objective report. For any trader, an important first step before investing in any broker is to do a basic check on such a platform. This simple action can be the most important part of your research process.

Valutrades Review: Reliable Choice or Risky Move?

Valutrades is FCA & FSA regulated, offers MT4/5 and leverage up to 1:500. Read pros, cons & full awareness review to decide if it’s right for you.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Swissquote Scam Alert: 53/64 Negative Cases Exposed

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

Rate Calc