Exfor Forex Scam Cases: Withdrawal Issues Exposed

Abstract:Exfor clients face blocked withdrawals and no support response. Scam cases exposed—protect your funds and avoid this unregulated forex broker.

Broker Overview: Exfor

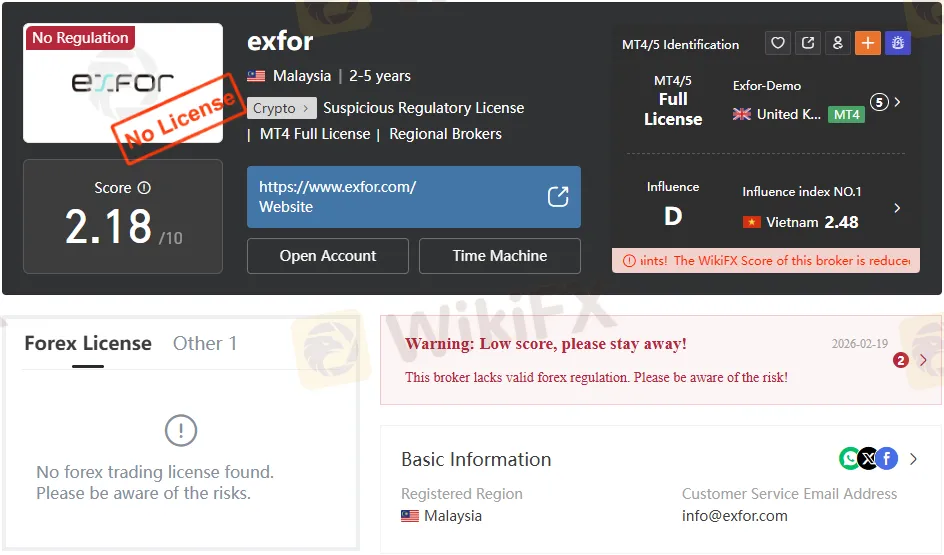

Exfor Limited presents itself as a forex broker offering access to MT4 and MT5 platforms, with trading options in forex, metals, indices, energies, and stocks. The company operates from Malaysia and has been active for 2–5 years. Despite its claims of legitimacy, Exfor is unregulated and holds a suspicious LFSA license reference that is not valid.

The brokers profile on the WikiFX App shows a low trust score, reflecting repeated complaints from traders worldwide. This lack of regulation means Exfor operates without oversight, leaving clients vulnerable to fraud, withdrawal delays, and poor dispute resolution.

Withdrawal Issues: A Pattern of Scam Behavior

One of the most alarming issues reported by Exfor clients involves withdrawal delays. A verified trader explained that their withdrawal request had been pending for more than a week, even after completing all verification steps, including ID and proof of address.

Even after contacting support and speaking directly with representatives, the client received no clear timeline or explanation. This lack of transparency is a hallmark of forex broker scams, where funds are deliberately withheld to frustrate clients and discourage further withdrawal attempts.

Documented Scam Cases Against Exfor

Exfors exposure is not limited to one region. Multiple cases across different countries highlight a consistent pattern of fraud:

- Pakistan (2026): A trader reported that pending withdrawals had been pending for days, with no communication from Exfor.

- Venezuela (2025): A victim accused Exfor of outright theft, vowing to expose the broker until funds are returned.

- Indonesia (2025): Several clients described Exfor as a “bastard broker” that stole their money, and they promised to spread warnings until justice is served.

In total, five negative cases have been documented, all pointing to blocked withdrawals, ignored support requests, and fraudulent practices.

Why Exfor Is Unsafe for Traders

Several factors make Exfor a high-risk broker:

- Unregulated Status: Exfor lacks valid regulation, meaning client funds are not protected.

- Fraudulent Practices: Multiple scam alerts and exposure cases confirm fraudulent activity.

- Blocked Withdrawals: Clients cannot access their own money, a clear sign of a forex trading scam.

- Poor Customer Support: Victims report no clear communication or resolution from the broker.

These issues combine to classify Exfor as a forex fraud and a serious threat to investors.

The Importance of Verification

One of the most effective ways to avoid falling victim to brokers like Exfor is to verify their legitimacy before depositing funds. The WikiFX App provides detailed broker profiles, regulatory checks, and user reviews. By using this tool, traders can quickly identify unregulated brokers and avoid scams.

Exfors profile on the WikiFX App clearly shows its unregulated status and multiple scam complaints. This transparency empowers traders to make safer decisions and avoid fraudulent brokers.

How Exfor Misleads Traders

Exfor builds credibility by offering popular trading platforms such as MT4 and MT5 and by advertising a wide range of trading products. However, these features are meaningless without proper regulation.

Unregulated brokers often use such tactics to lure traders into depositing funds, only to block withdrawals later. Exfors repeated exposure cases confirm that its business model relies on deception and fraud rather than legitimate trading services.

Global Impact of Exfors Scam Practices

The fact that Exfor has scam complaints from Pakistan, Venezuela, and Indonesia shows that its fraudulent practices are not isolated. This global pattern of fraud highlights the brokers deliberate strategy of targeting unsuspecting traders across different regions.

Such widespread exposure cases underscore the need for traders to remain vigilant and rely on trusted verification tools, such as the WikiFX App.

Final Warning: Avoid Exfor

Exfor presents itself as a legitimate forex broker but operates without valid regulation and has a growing list of scam complaints worldwide. With blocked withdrawals, ignored support requests, and repeated instances of fraud, Exfor fits the profile of an online investment scam.

Protect your funds. Avoid Exfor. Use the WikiFX App to verify brokers before investing.

Read more

ICE FX Review: Are Traders Raising Red Flags Over Withdrawal Fees & Regulation Status?

Does ICE FX ask you to pay taxes for fund withdrawal access? Were you made to pay a hefty fee on a verification failure? Does the broker deliberately cancel your profitable trades? Have you failed to receive assistance from the ICE FX customer support team on your fund deposit and withdrawal queries? These issues have become common for its traders. Many of them have highlighted these issues online. In this ICE FX review article, we have investigated some of their complaints. Read on as we dive deep.

Phyntex Markets Forex Scam: $58K Blocked After $50K

Phyntex Markets forex scam: $50K withdrawal approved, $58K blocked on “toxic trading.” Unregulated Comoros broker scams Malaysian traders. Read exposure & protect funds!

NEWTON GLOBAL Regulatory Status: A Complete Guide to Its Licenses and Company Registration

When choosing a financial services company, the most important question is about its regulatory status. For traders looking at NEWTON GLOBAL, this question is extremely important. A basic investigation using third-party verification platforms shows a worrying picture: The broker is marked for having no valid regulation. This article provides a detailed, fact-based analysis of NEWTON GLOBAL's regulatory claims, company registration, and the major risks with how it operates. We will examine the data provided by global broker inquiry apps and public records to present a clear and objective report. For any trader, an important first step before investing in any broker is to do a basic check on such a platform. This simple action can be the most important part of your research process.

Valutrades Review: Reliable Choice or Risky Move?

Valutrades is FCA & FSA regulated, offers MT4/5 and leverage up to 1:500. Read pros, cons & full awareness review to decide if it’s right for you.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Swissquote Scam Alert: 53/64 Negative Cases Exposed

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

Rate Calc