Government Officer Lost RM12,000 to Non-Existent Forex Scheme

Abstract:A government officer has become the latest victim of an online investment scam, losing more than RM12,000 after being drawn into a fake foreign exchange trading scheme promoted on social media.

A government officer has become the latest victim of an online investment scam, losing more than RM12,000 after being drawn into a fake foreign exchange trading scheme promoted on social media.

The victim, a 58-year-old civil servant, encountered the scheme earlier this month through an advertisement on Facebook. The promotion presented itself as a foreign currency investment opportunity, a sector that has gained popularity as more retail investors look for alternative ways to grow their savings. According to police, the advertisement caught the officers attention and prompted him to make contact with the individual behind the offer.

After initial contact, the suspect provided what appeared to be structured investment details, creating the impression of a legitimate forex operation. The victim was encouraged to make a small first payment to begin trading. He transferred RM300, having been assured that this amount would generate a return of RM11,000 within just two hours. The promise of such a swift and sizeable gain played a key role in building confidence in the scheme.

Following this initial transfer, the situation escalated. The victim was told that additional payments were required to release the supposed profits. These requests were framed as processing fees and administrative charges, a common tactic used in investment fraud to keep victims engaged. Between 11 and 15 December, the officer made several further transfers, bringing the total amount paid to RM11,771.

Despite repeated assurances, no profits were ever credited to the victim. Communication with the suspect eventually failed to produce any proof of trading activity or a clear explanation for the delay. It was only after the promised returns failed to materialise that the officer realised he had likely been deceived. He subsequently filed a police report.

Kuala Terengganu police have confirmed that the case is being investigated as a cheating offence under Section 420 of the Penal Code. This provision covers fraud involving dishonest inducement and financial loss, and it is frequently applied in cases involving online investment scams.

The incident reflects a wider challenge faced by regulators and law enforcement as fraudulent schemes become more polished and harder to detect. Social media platforms remain a favoured channel for scammers due to their wide reach and low cost. By combining professional-looking advertisements with direct messaging, fraudsters are able to create a sense of urgency and credibility, even when no real investment exists.

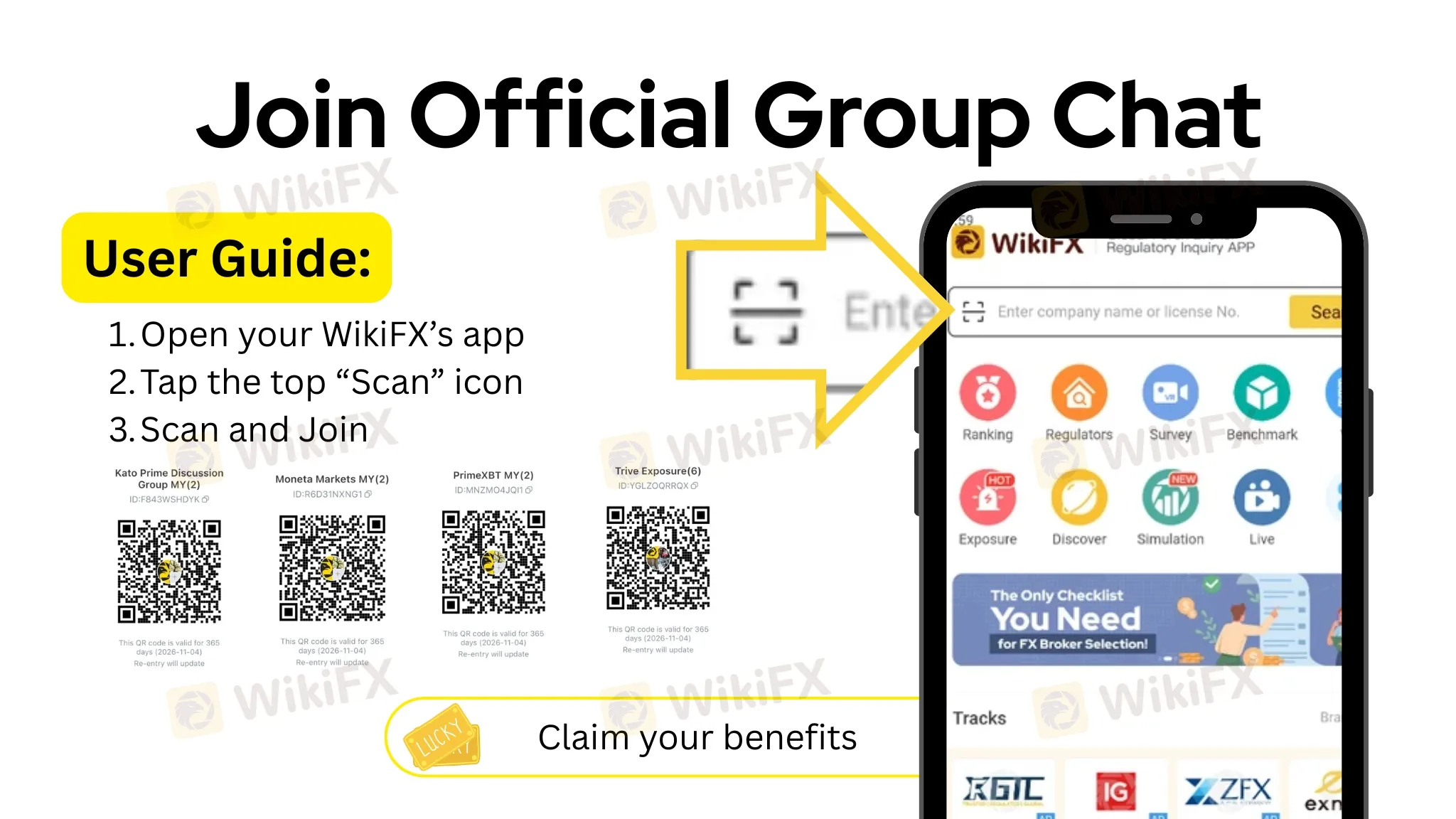

Conducting due diligence before investing is crucial, and independent verification tools such as WikiFX can be instrumental in assessing the legitimacy of brokers and investment firms. The WikiFX mobile application, available on Google Play and the App Store, provides comprehensive insights into brokers regulatory status, customer reviews, and safety ratings. By leveraging such resources, investors can make informed decisions and avoid the financial devastation caused by fraudulent schemes.

WikiFX Broker

Latest News

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

Why You’re a Millionaire on Demo but Broke in Real Life

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

JPMorgan Chase Eyes Crypto Trading for Institutional Clients

Voices of the Golden Insight Award Jury | Dennis Yeh, Head of Asia Pacific Region at Taurex

Fake Government Aid Scams Are Wiping Out Elderly Savings

The "Paper Money" Lie: Why Your Demo Win Streak Means Nothing

QuoMarkets Review 2025: Safety, Features, and Reliability

The Richest Traders in History and the Strategies Behind Their Success

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Rate Calc