FIBOGROUP Investigation: When Revoked Licenses Meet Malicious Liquidation

Abstract:In the high-stakes world of forex trading, regulatory status and execution quality are the bedrock of trust. However, our latest investigation into FIBOGROUP reveals a troubling disconnect between their marketing claims and the reality faced by traders. With key licenses from the UK’s FCA and Cyprus’s CySEC currently listed as Revoked, and a surge in complaints regarding malicious liquidations and vanishing withdrawal options, the safety of client funds is in question. This report dissects the evidence to determine if FIBOGROUP remains a viable option for investors.

Abstract

In the high-stakes world of forex trading, regulatory status and execution quality are the bedrock of trust. However, our latest investigation into FIBOGROUP reveals a troubling disconnect between their marketing claims and the reality faced by traders. With key licenses from the UK‘s FCA and Cyprus’s CySEC currently listed as Revoked, and a surge in complaints regarding malicious liquidations and vanishing withdrawal options, the safety of client funds is in question. This report dissects the evidence to determine if FIBOGROUP remains a viable option for investors.

Privacy Disclaimer

All cases cited in this report are based on authentic records submitted to the WikiFX Exposure Center. To protect the privacy and safety of the victims, specific personal identities have been anonymized, though transaction details remain unaltered.

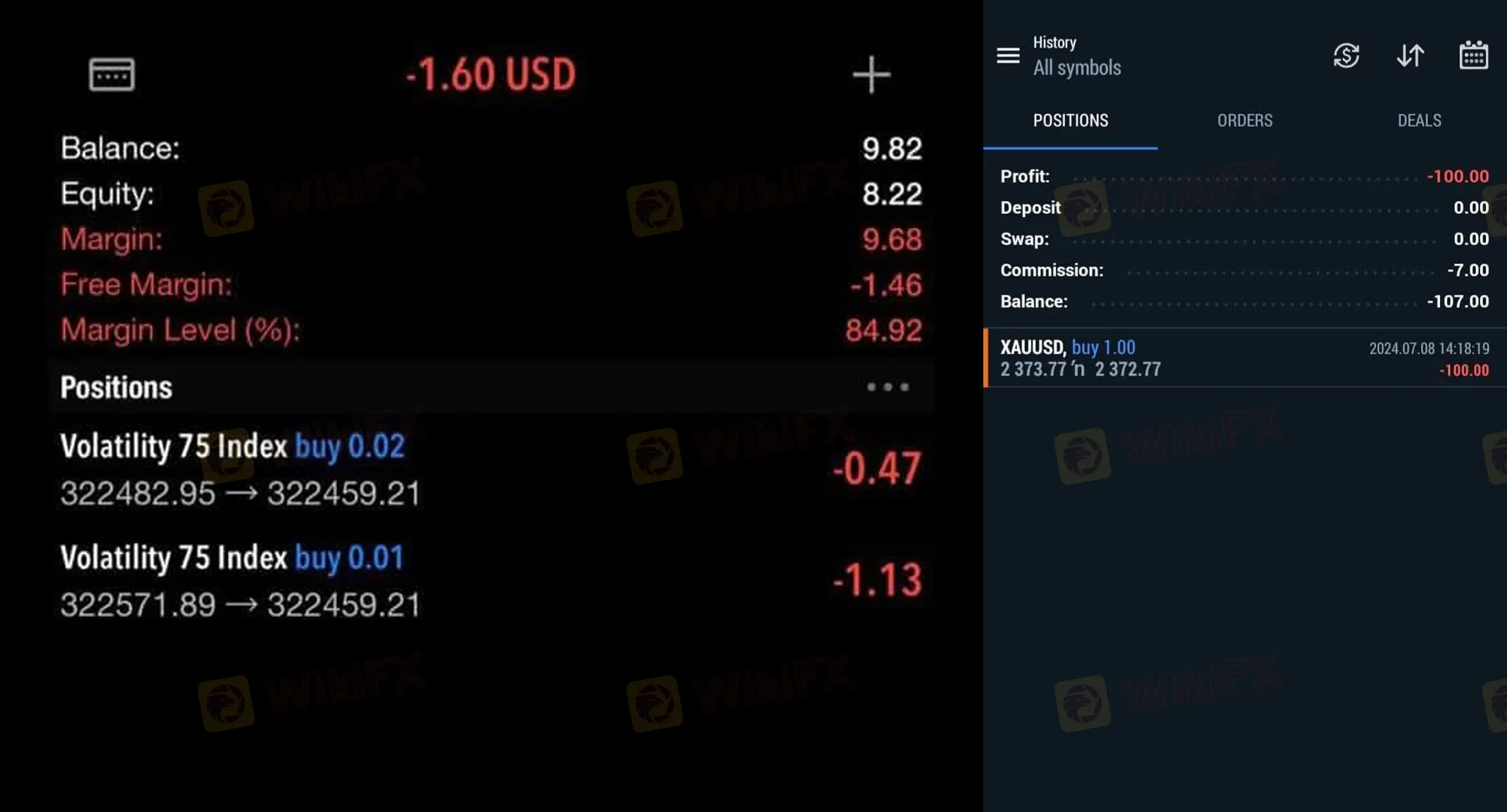

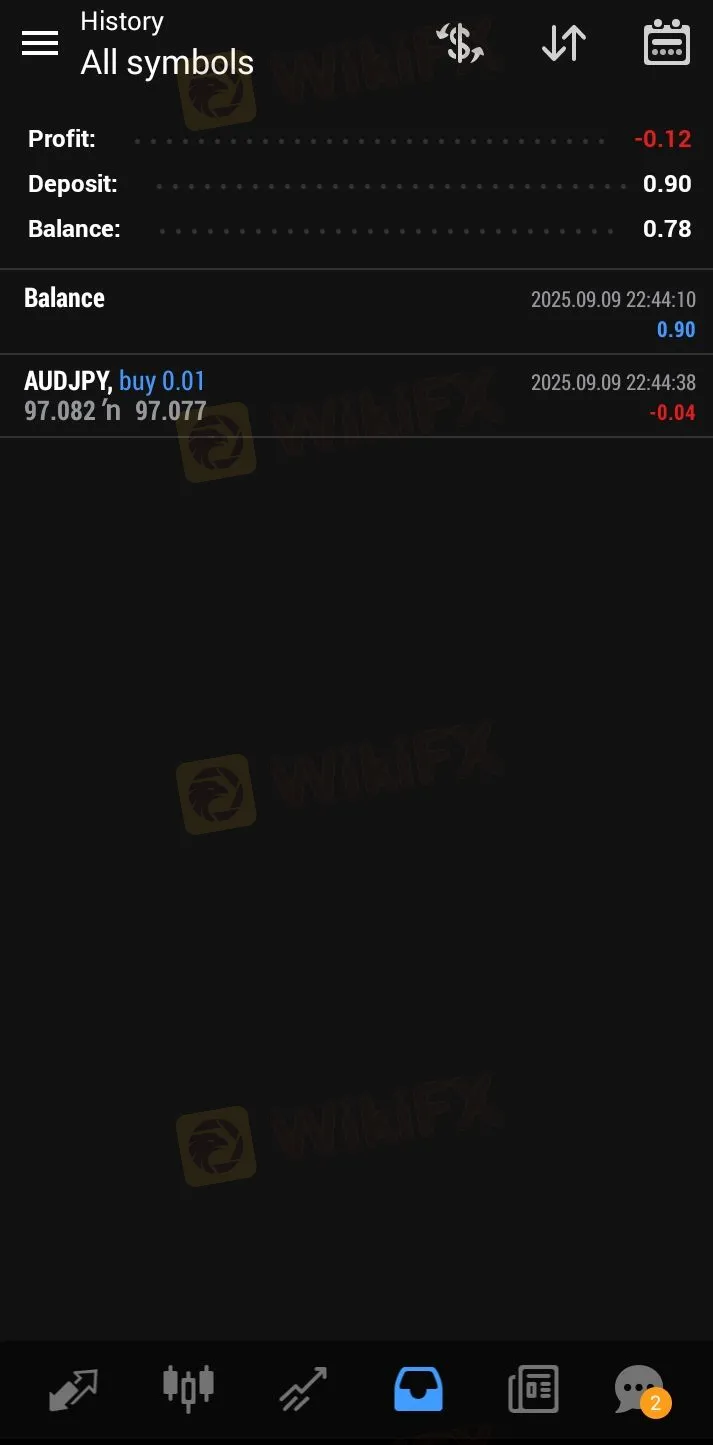

The “Algorithm” of Losses: Slippage and Price Manipulation

For a broker that advertises NDD (No Dealing Desk) execution and competitive spreads, the user feedback paints a contradictory picture of aggressive interference. A “No Dealing Desk” model should theoretically offer direct market access with minimal manipulation, yet reports from active traders suggest that FIBOGROUPs execution engine may be working against its clients.

A trader from Belgium provided us with a detailed trading log that serves as a smoking gun for execution quality issues. According to the user, their log shows 32 separate instances where the platform executed orders at a price significantly worse than requested—a phenomenon known as negative slippage. While occasional slippage is a part of normal market volatility, the consistency described here implies a systemic issue. The user noted that sometimes the price deviated by over 10 pips, resulting in over $400 in losses that were unrelated to the traders strategy performance.

This was not an isolated incident. An Italian trader echoed these sentiments, stating that despite high expectations driven by marketing claims, their account suffered severe capital erosion over two months. They reported that trades were “consistently executed at worse prices,” suggesting that what FIBOGROUP labels as market volatility might actually be an internal mechanism designed to widen spreads artificially.

Furthermore, another report from Belgium highlighted an “excessive difference between buy and sell prices” that made profitability nearly impossible. When the spread—the cost of doing business—is manipulated to be abnormally wide, the trader enters every position at a deeper loss, requiring significant market movement just to break even.

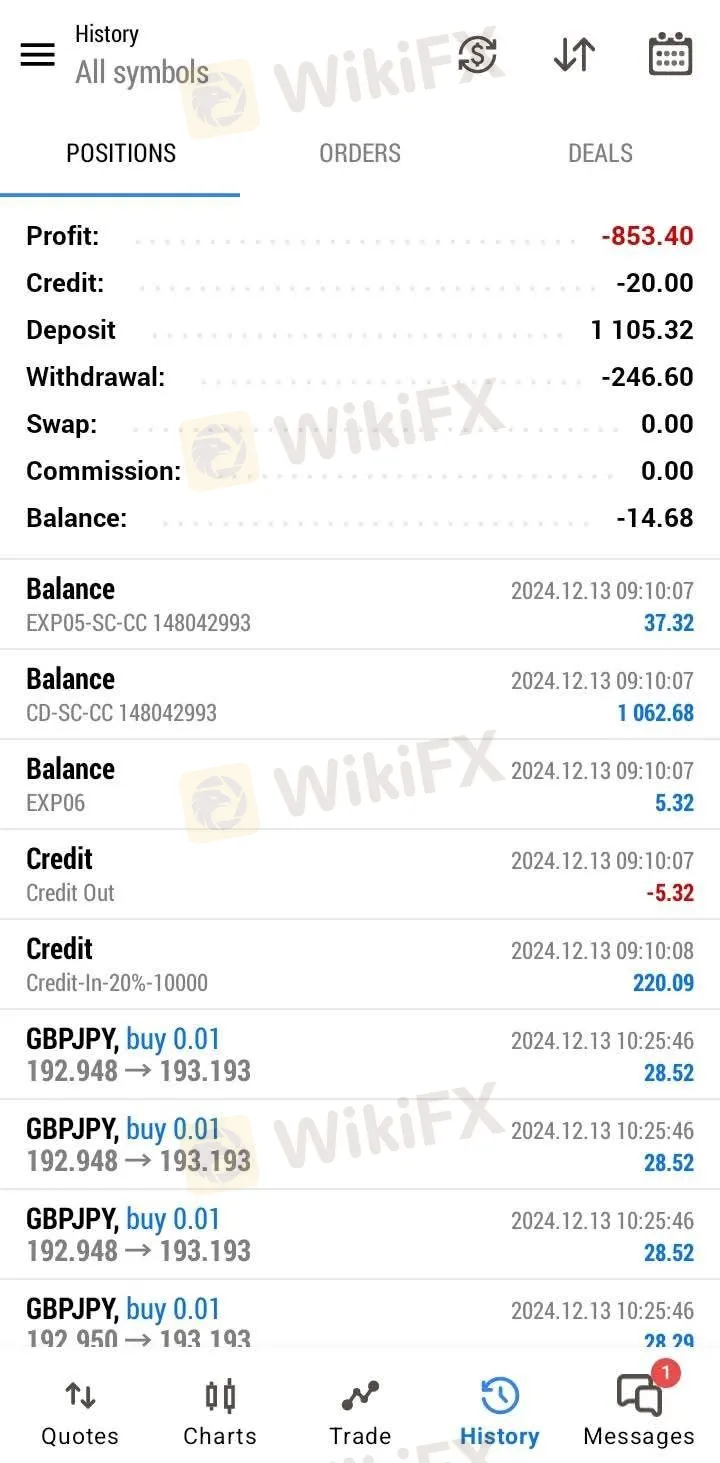

The “Phantom” Liquidation: Erasing Positions in the Dark

Perhaps the most alarming evidence comes from a trader in India regarding the treatment of a US stock position (MSFT). In a standard trading environment, forced liquidation usually occurs when margin requirements receive a “margin call” during active market hours, allowing the market to absorb the order.

However, the complainant (Account ID: 3048898) reported a highly irregular event. They opened a position in Microsoft (MSFT) on a Tuesday evening during the US trading session. According to the trader, FIBOGROUP did not adjust the margin requirements while the market was open. Instead, the position was liquidated the following afternoon during non-trading hours.

The trader asserts, “There was no such tactic as weekend and holiday liquidation... you deleted the order during the non-trading time.” If accurate, this is a severe violation of trading norms. Closing a position when the underlying market is closed allows the broker to essentially fictionalize the exit price, as there is no live ticker to verify the execution value. The trader claims this action was “deliberately caused” and resulted in heavy losses, with the platform refusing to provide a valid explanation.

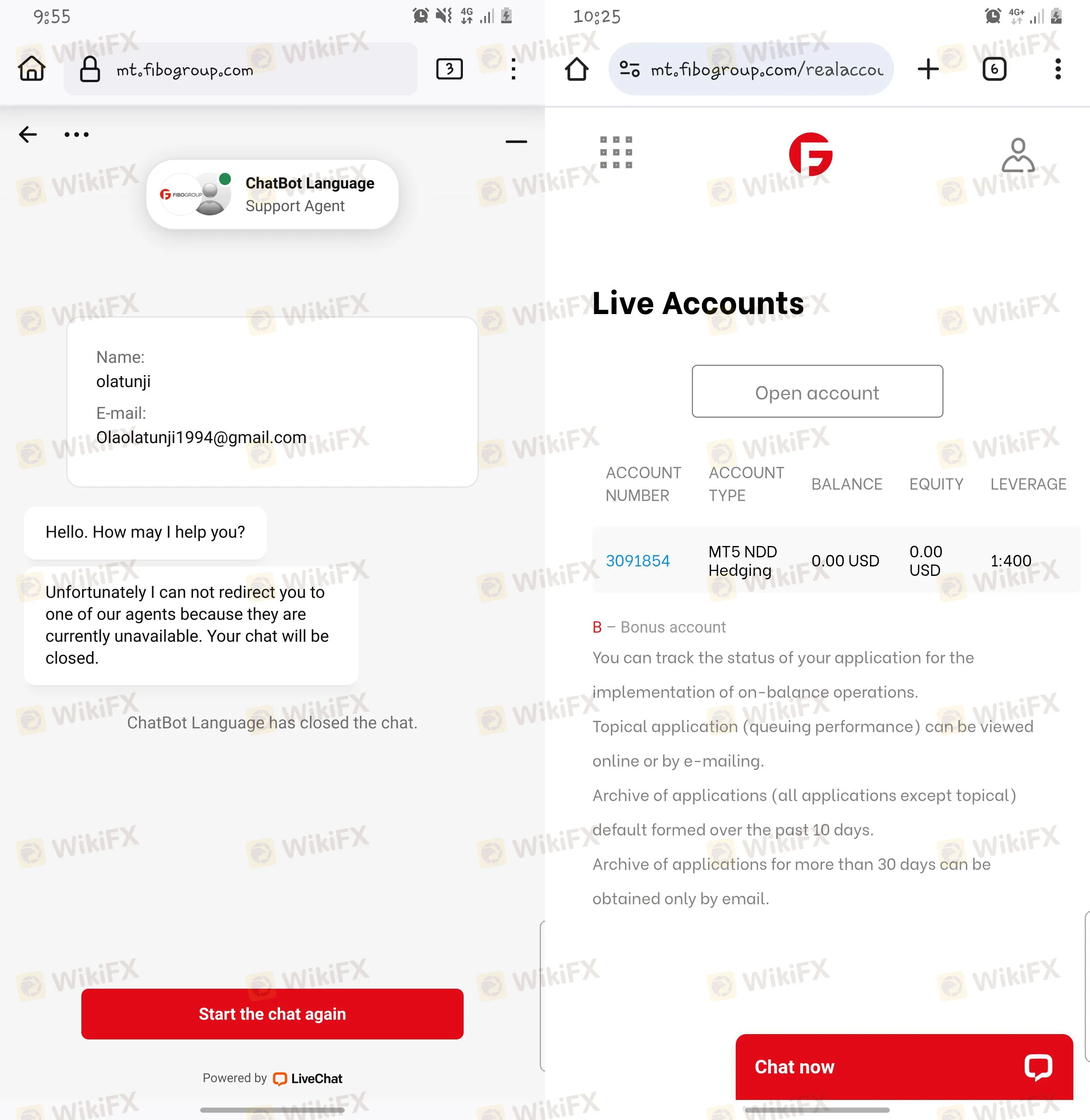

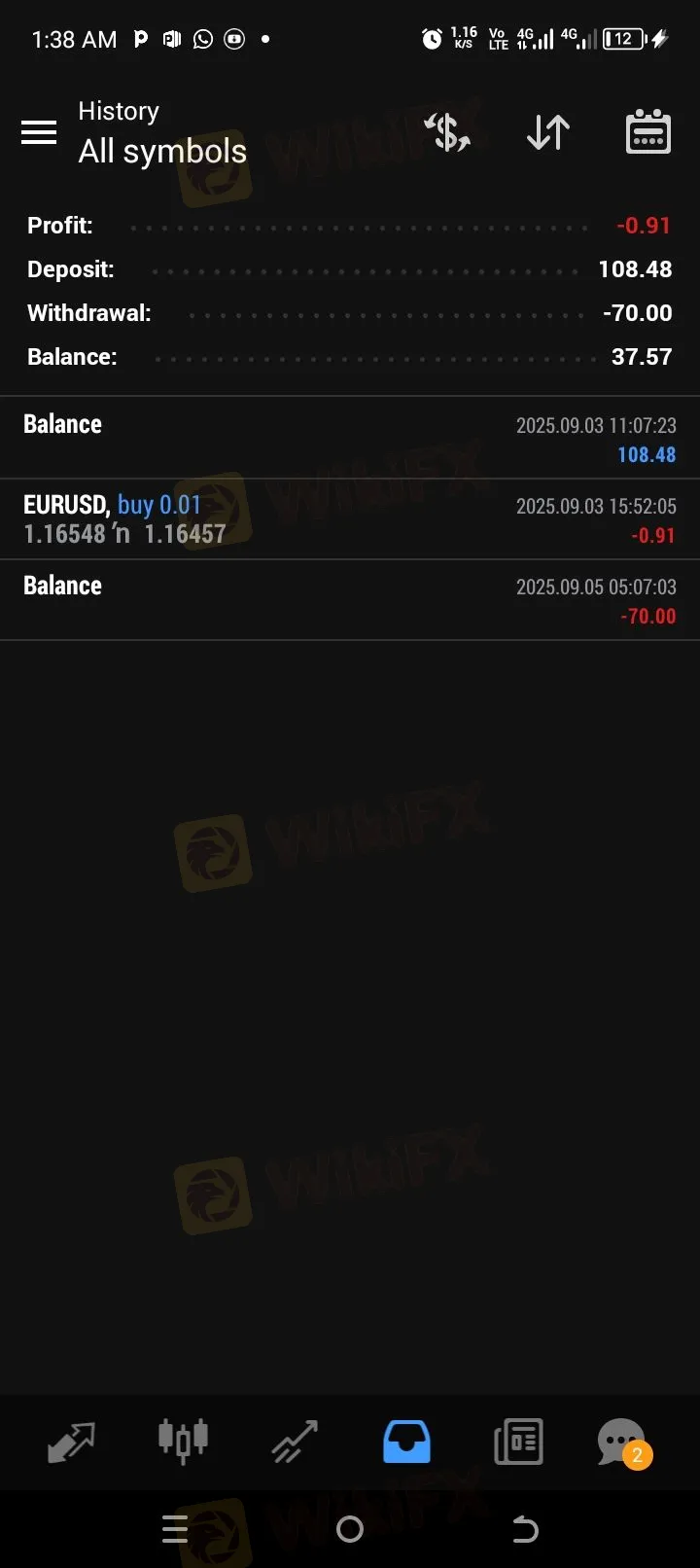

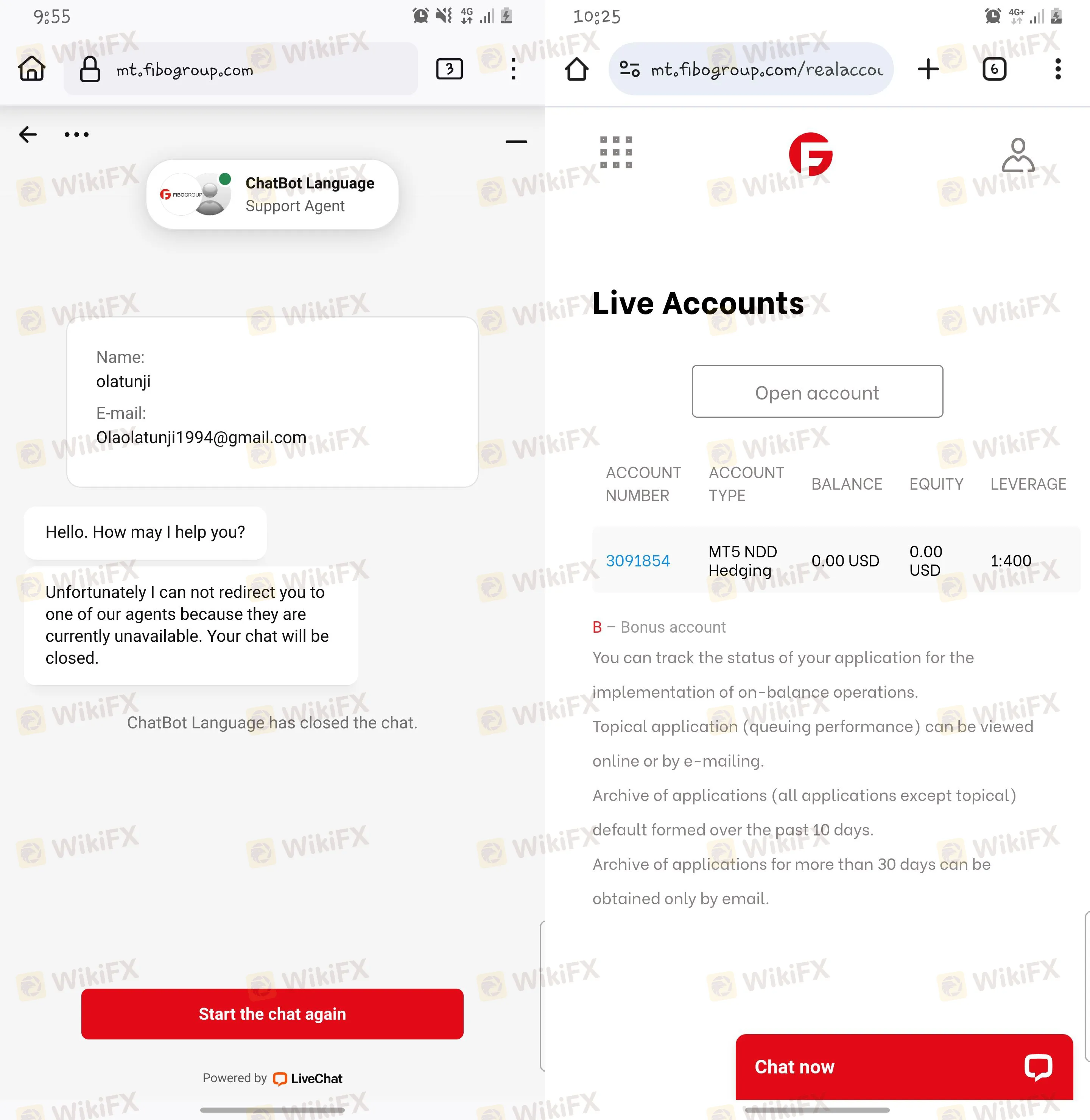

The Disappearing Button: Introduction to Deposit Traps

While execution issues deplete accounts slowly, deposit and withdrawal anomalies block access to funds entirely. Our investigation uncovered a disturbing pattern where the entry barriers are non-existent, but the exit doors are welded shut.

A user from the Netherlands reported a “black hole” scenario regarding deposits. After being persuaded to fund their account, the deposit failed to reflect in their trading balance. In a desperate attempt to resolve it, they opened a second account, only to have the same issue occur again. The funds left the user's bank but never arrived in the tradable balance, effectively holding the money in limbo.

For those who do manage to trade, getting money out appears equally difficult. A detailed complaint from a UK trader described the withdrawal process as intentionally time-consuming, filled with irrelevant advertisements and demands for “unnecessary information” not previously required.

Most critical, however, is the report from August 2025 by a Belgian user who provided screenshots showing that the withdrawal button was completely missing from the website interface. A trading dashboard without a withdrawal function is a hallmark of high-risk platforms attempting to prevent capital flight. When the user attempted to contact customer service regarding this missing feature, they received no response.

The sentiment was summarized bluntly by a Ukrainian trader who stated simply: “I have traded so many trades and all to no avail... they have taken my money.”

Regulatory Disclosure: The Fall from Grace

To understand why these issues are occurring now, we must look at FIBOGROUP's regulatory history. At one point, this broker held licenses from some of the world's most respected authorities. However, the current landscape is vastly different.

The withdrawal of oversight from the UK's FCA and Cyprus's CySEC is a critical blow to trader protection. The FCA, for instance, mandates segregated accounts and compensation schemes (FSCS) that protect traders up to £85,000. With this license revoked, FIBOGROUP clients are no longer afforded these safety nets.

Currently, the broker operates primarily under the regulation of the British Virgin Islands (BVI FSC). While BVI is a legitimate regulatory jurisdiction, it is classified as an “Offshore Regulation.” Offshore jurisdictions generally have more lenient reporting requirements and fewer mechanisms for dispute resolution compared to the UK or EU. This regulatory downgrade might explain the lack of accountability regarding the execution and withdrawal issues highlighted above.

FIBOGROUP Regulatory Status Table:

| Regulator Name | License Type | Current Status |

|---|---|---|

| United Kingdom Financial Conduct Authority (UK FCA) | Investment Advisory License | Revoked |

| Cyprus Securities and Exchange Commission (CySEC) | Straight Through Processing(STP) | Revoked |

| Virgin Islands Financial Services Commission (BVI FSC) | Retail Forex License | Offshore Regulation |

Conclusion

For traders, particularly those in regions with developing financial protection laws, the risks of trading with a broker that holds revoked major licenses cannot be overstated. We advise all investors to exercise extreme caution and consider the evidence presented here before entrusting capital to this entity.

WikiFX Risk Warning

Risk Warning: Forex and CFD trading involves a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment. Please be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. WikiFX provides this information for reference only and does not constitute investment advice.

Read more

Zenstox Review: Do Traders Face Withdrawal Blocks & Fund Scams?

Does Zenstox give you good trading experience initially and later scam you with seemingly illicit contracts? Were you asked to pay an illegitimate clearance fee to access fund withdrawals? Drowned financially with a plethora of open trades and manipulated execution? Did you have to open trades when requesting Zenstox fund withdrawals? You have allegedly been scammed, like many other traders by the Seychelles-based forex broker. In this Zenstox review article, we have investigated multiple complaints against the broker. Have a look!

Smart Trader Exposure: Login Glitches, Withdrawal Delays & Scam Allegations

Did your Smart Trader forex trading account grow substantially from your initial deposit? But did the forex broker not respond to your withdrawal request? Failed to open the Smart Trader MT4 trading platform due to constant login issues? Does the list of Smart Trader Tools not include the vital ones that help determine whether the reward is worth the risk involved? Have you witnessed illegitimate fee deduction by the broker? These issues have become too common for traders, with many of them criticizing the broker online. In this article, we have highlighted different complaints against the forex broker. Take a look!

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

24option Review: Is it Legit or a Scam? Find Out in This In-depth Investigation

Contemplating 24option as your forex trading companion? Want to explore its trading platforms? We appreciate your interest! But how about knowing the Hong Kong-based forex broker and its different aspects, such as withdrawals and deposits. More specifically, if we have to say, what’s the feedback of traders concerning 24option? Are they happy trading with the broker? From a healthy collection of over 200 reviews, the broker is found to be a SCAM! Many traders have expressed concerns over the illegitimate trading approach adopted by the broker. In the 24option review article, we have explored many complaints against the broker.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

Forex 101: Welcome to the $7.5 Trillion Beast

Oil Surge: WTI Reclaims $60 as Middle East Tensions Override Venezuela Deadlock

ThinkMarkets Regulation: Safe Trading or Risky Broker?

ehamarkets Review 2026: Regulation, Score and Reliability

8xTrade Review 2025: Safety, Features, and Reliability

VEBSON Review 2025: Is This Broker Safe or a Potential Scam?

Rate Calc