Headway Broker Regulation and User Reviews

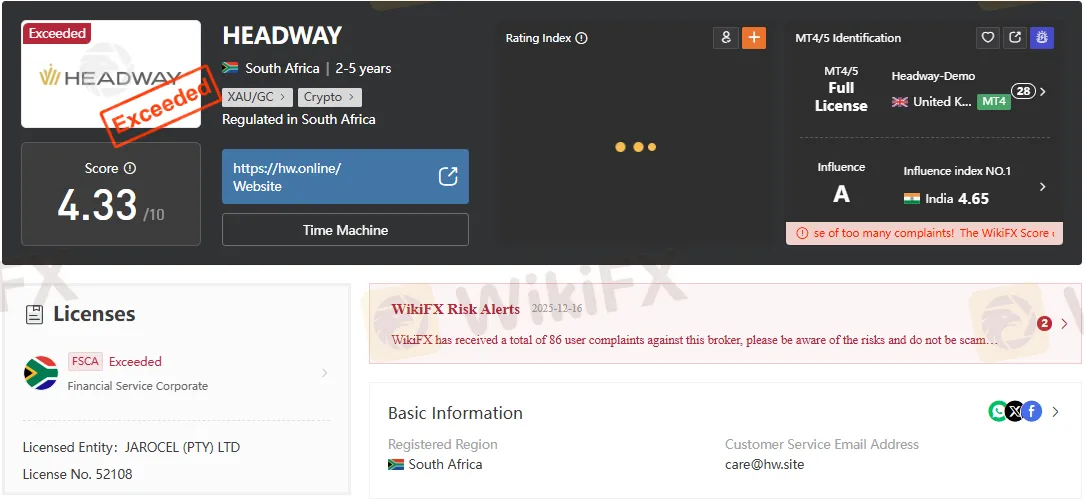

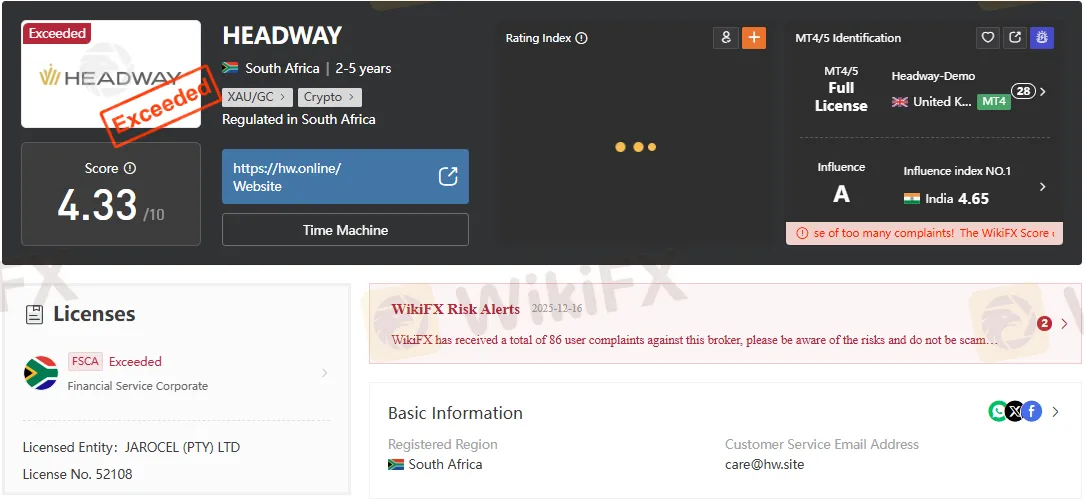

Abstract:Headway Broker review: FSCA license exceeded, unregulated claims, and 86+ user complaints.

Headway Broker Regulation: FSCA License Exceeded

Headway presents itself as a South Africa–based trading firm operating under JAROCEL (PTY) LTD, with license number 52108 issued by the Financial Sector Conduct Authority (FSCA). However, the attached regulatory record shows the license status marked as “Exceeded”, raising immediate concerns about compliance. In practical terms, this means the brokers authorization has lapsed or is no longer valid, yet Headway continues to market itself as regulated.

The company‘s own summary contradicts its licensing claims, stating “No regulation” under its corporate profile. This inconsistency between the FSCA license record and the broker’s public-facing statements is a red flag for traders evaluating Headways legitimacy.

Headway Broker Profile and Market Position

Founded in 2022, Headway Broker operates primarily in South Africa but promotes itself globally. Its website domains include headwaybrokers.com and hw.site, with servers registered in the United Kingdom and the United States. The broker advertises participation in expos and awards such as Best Broker Africa 2025 and Best Global Forex Broker 2025. While these accolades appear prominently in marketing material, they are not substantiated by independent verification.

The brokers WikiFX score of 4.33/10 is notably low, compounded by 86+ user complaints logged as of December 2025. These complaints range from withdrawal refusals to alleged manipulation of spreads and leverage.

Trading Instruments and Platforms

Headway Broker offers a wide range of instruments:

- Forex

- Indices

- Stocks

- Energies

- Metals

- Cryptocurrencies

- Bonds, Options, ETFs, Mutual Funds

Clients can trade via the proprietary Headway Trading App or industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The broker operates multiple servers, with average execution speeds around 210 ms, suggesting infrastructure maturity.

Leverage is advertised as 1:1 to unlimited, available after trading five standard lots. While flexible leverage is attractive, unlimited ratios are considered high-risk and are rarely permitted by reputable regulators.

Account Types and Fees

Headway Broker provides three account tiers:

| Account Type | Minimum Deposit | Currency Options | Instruments | Spread | Commission |

| Cent | $1 | USD | Stocks, indices | Floating from 0.3 pips | None |

| Standard | $10 | USD, EUR, IDR, JPY, THB, NGN, ZAR, BRL, MYR | Forex, cryptos, metals, energies, stocks, indices | Floating from 0.3 pips | None |

| Pro | $100 | Same as Standard | Forex, cryptos, metals, energies, stocks, indices | Floating from 0.0 pips | Up to $1.5 per side per lot |

All accounts are swap-free optional, catering to traders seeking Islamic-compliant accounts.

Deposit and Withdrawal Transparency

Payments are accepted via Visa, Mastercard, and cryptocurrencies. However, the broker does not disclose processing times or fees. Numerous user reviews highlight withdrawal refusals and unexplained delays, undermining trust in Headways financial operations.

User Reviews: Complaints and Exposure

The attached document reveals a consistent pattern of negative exposure:

- Withdrawal Declines: Multiple verified users report repeated refusals without explanation.

- Bonus Manipulation: Traders claim deposit bonuses vanish mid-trade, leading to forced account losses.

- Spread and Slippage Issues: Reports of spreads widening from 1.8 to 15 points during major events, draining accounts.

- Profit Seizures: Cases where profits were removed under claims of “negative balance misuse” or “multiple accounts.”

- Server Failures: Allegations of technical outages leading to forced position closures.

These complaints span Nigeria, Iraq, Saudi Arabia, Malaysia, India, and Indonesia, indicating systemic issues across regions.

Pros and Cons of Headway Broker

Pros:

- Wide range of tradable instruments (forex, stocks, cryptos, metals, indices).

- Low minimum deposit ($1 for Cent accounts).

- Supports MT4 and MT5 alongside proprietary app.

- Swap-free accounts available.

- 24/7 multilingual support is advertised.

Cons:

- FSCA license exceeded; effectively unregulated.

- 86+ user complaints citing withdrawal and manipulation issues.

- Limited transparency on payment processing.

- Marketing awards are not independently verified.

- Risk of unlimited leverage amplifying losses.

Competitor Comparison

Compared to regulated brokers such as IG Markets or Pepperstone, Headway Broker falls short in transparency and compliance. Competitors provide clear regulatory oversight, detailed fee structures, and established reputations. Headways reliance on promotional bonuses and unverified awards contrasts sharply with the compliance-first approach of established firms.

Bottom Line: Headway Broker Regulation and Risks

Headway Brokers regulatory standing is its most critical weakness. Despite claiming FSCA oversight, its license status is “Exceeded”, leaving traders exposed to unregulated practices. The volume of user complaints—withdrawal refusals, spread manipulation, and profit seizures—further undermines credibility.

While Headway offers attractive features such as low deposits, flexible leverage, and multiple trading platforms, these benefits are overshadowed by regulatory inconsistencies and operational risks. Traders seeking security and transparency should weigh these factors carefully before engaging with Headway Broker.

Verdict: Headway operates as an unregulated broker with significant user complaints, making it unsuitable for traders prioritizing safety and compliance.

Read more

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

WikiFX Broker

Latest News

Consumer Credit Smashes All Estimates As Monthly Credit Card Debt Unexpectedly Surges By Most In 2 Years

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Metals Massacre: Silver Plunges 40% on Margin Hikes; Gold Rejects $5,000

TradeEU Review: Safety, Regulation & Forex Trading Details

Resource Sentiment Dampened as Rio Tinto-Glencore Merger Talks Implode

GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

Jetafx Review 2026: A Trader's Warning on Regulation and High-Risk Signals

Emerging Markets: NGO Capital Injection Highlights NGN Liquidity Flows

Italian Regulator Moves to Block Seven Unauthorised Investment Websites

NNPC and Edo State agree on New 10,000 bpd Refinery Project

Rate Calc