Consumer Credit Smashes All Estimates As Monthly Credit Card Debt Unexpectedly Surges By Most In 2 Years

Abstract:2025 closed with a surprising surge in consumer spending and retail sales, one which was unexpected

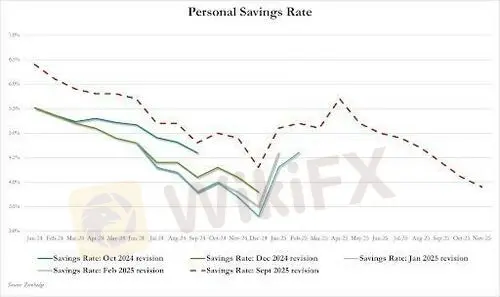

2025 closed with a surprising surge in consumer spending and retail sales, one which was unexpected since personal savings at the end of the year had just ground to a 3 year low...

... which when coupled with stagnant earnings prompted the question just where did consumers get the money for December's spending spree.

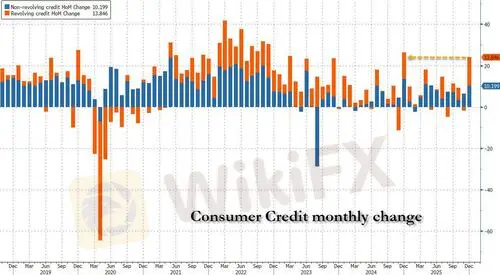

We now have the answer: at 3pm today, the Fed published the latest consumer credit data, and boy was it a doozy. After November's tepid $4.2 billion increase in total consumer credit (which came in below estimates even after today's revision to $4.7 billion), consensus was looking for a modest bounce to $8 billion, or well below the post-covid average. Instead, what the Fed reported was a stunner: consumer credit soared by a whopping $24.045 billion, the biggest monthly increase of 2025 by a wide margin (only Dec. 2024 was bigger going back all the way to 2023),..

... and not only was the number 3x higher than the median forecast, it came in above the highest economist forecast, in this case from RBC's Michael Reid at $22.7 billion.

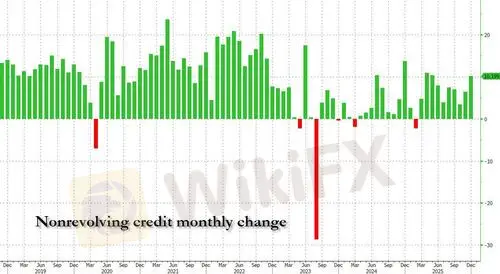

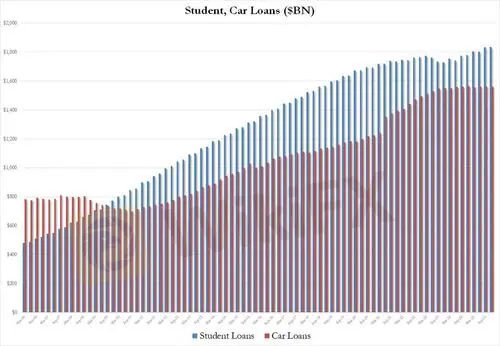

The breakdown shows that while the increase in non-revolving credit, or auto and student loans, was a bit more than recent monthly prints at $10.2 or the highest since May '25...

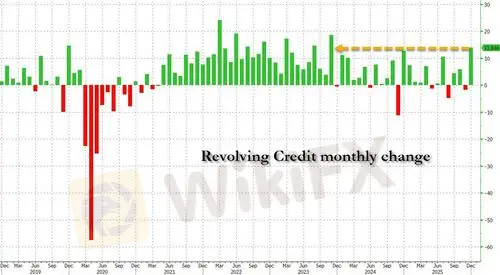

... it was the surge in credit card debt (i.e. revolving credit) that was the big delta in the December numbers: at $13.8 billion, a huge jump from the $1.7 billion drop in November, this was the biggest monthly increase since 2023!

In other words, the unexpectedly strong close to the end of the year was funded by the same old source: credit cards, and as in all previous credit card fueled surges, this one too will have to be repaid, pulling from future spending at some point, although it very well may not if credit card companies just tacitly approve some more dry powder and instead just bury the average American under even more debt.

As for student and auto loans, it was a surprisingly tame quarter because even though nonrevolving credit closed 2026 at a new record high of $3.780 trillion (with the two largest components student and car loans at $1.856 trillion and $1.562 trillion, respectively), the increase in the quarter was modest at best, up just $2.6 billion for student loans, and $0.8 billion for auto loans. What is remarkable is that auto loans actually declined in 2025 which may explain why the car industry has been so bad in 2025.

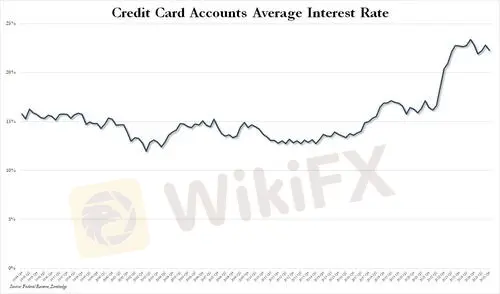

Finally, and this will come as a surprise to nobody, despite 1.75% in rate cuts by the Fed since last September, we can now confirm that rates on credit cards have gone... nowhere as banks continue to bleed US consumers dry: at the middle of 2023 the average rate on credit card accounts was 22.16%... and on Dec 31, 2025 - and a half years years later, the number was higher at 22.30%, just barely below the all time high of 23.37% set one year ago. And all thise despite 6 rate cuts by the Fed.

One almost wonders: if it's not the Fed setting rates on consumer credit, what's the point of having a central banks?

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Rate Calc