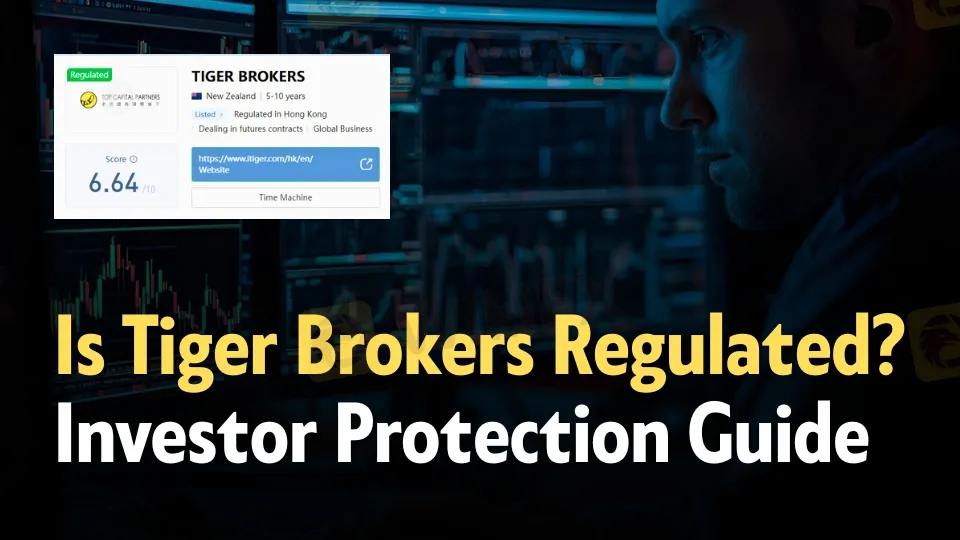

Is Tiger Brokers Regulated? Investor Protection Guide

Abstract:Tiger Brokers offers regulated trading in US, HK, SG stocks & futures. SFC-approved in HK (BMU940), FMA in NZ. No min deposit, competitive fees.

Tiger Brokers delivers regulated access to global stocks, futures, and more across key markets like the US, Hong Kong, and Singapore. Backed by licenses from bodies such as Hong Kong's SFC (license BMU940) and New Zealand's FMA, the broker stands out with no minimum deposits and low fees.

Tiger Brokers Regulation Overview

Tiger Brokers operates under multiple regulatory umbrellas, including a confirmed license from the Securities and Futures Commission (SFC) in Hong Kong. License BMU940, issued to Tiger Brokers HK Global Limited in 2018, covers dealing in futures contracts, with the entity based at a verified Hong Kong address. Additional oversight appears in New Zealand via the Financial Markets Authority for TIGER BROKERS NZ LIMITED (license 473106), though some international registrations like the US NFA (0328552 for US TIGER SECURITIES INC) remain unverified in public records.

This setup provides investor safeguards, such as segregated client funds and dispute resolution channels, but traders should confirm entity-specific protections based on their residency. Unlike unregulated offshore firms, Tiger Brokers Regulation ties directly to established jurisdictions, reducing risks of fund mismanagement.

Key Tiger Brokers Regulatory Licenses

- Hong Kong SFC (BMU940): Active since July 11, 2018; authorizes futures trading; contact via hk-compliance@tigerbrokers.com.hk.

- New Zealand FMA (473106): Covers financial services; entity at Level 27, 151 Queen Street, Auckland; phones include 0800 884 437.

- US NFA (0328552): Linked to US TIGER SECURITIES INC at 437 Madison Ave, New York; requires further verification for full compliance status.

Domain details trace to tigerbrokers.com.sg and itiger.com, registered under entities like Top Capital Partners Limited in New Zealand, operational for over five years. These licenses signal legitimacy, contrasting with brokers lacking tier-1 oversight.

Trading Instruments at Tiger Brokers

Access spans US stocks/ETFs/options/futures, Hong Kong equities/warrants/CBBCs, Singapore REITs/DLCs/futures, Australian stocks, and China A-shares via HKEX Northbound. Futures include equity, treasury, forex (micro pairs commission-free), index (e.g., China A50 from $0.99), energy (e-mini crude), agriculture (corn/wheat), and metals (micro gold).

Compared to peers like Interactive Brokers, Tiger Brokers emphasizes Asia-Pacific assets with competitive breadth, though forex depth lags majors like IG Group.

| Market | Key Instruments | Example Availability |

| US | Stocks, ETFs, Options, Futures | GME stock, OTC trades |

| Hong Kong | Stocks, Warrants, CBBCs, Futures | Stock options from 0.2x value |

| Singapore | Stocks, ETFs, REITs, Futures | DLCs, rights issues |

Tiger Brokers Account Types Explained

Two main options suit varied traders: cash accounts for basic buying/holding (1 lot minimum, no shorting or margin) and margin accounts unlocking full products with up to 14x intraday leverage or 12x overnight. Upgrades from cash to margin incur no fees, and neither requires minimum deposits—ideal versus brokers like Saxo Bank demanding $2,000+. 2,000+.

Both support unlimited orders, but margin opens futures/options are absent in cash setups.

Fees and Commissions Breakdown

Commissions beat industry averages: US stocks from $0.005/share, HK/Australia/China A-shares at 0.03x value, Singapore assets 0.04x. Options start at $0.65 US contract or 0.2x HK value; futures from $0.99 (micros free on some forex).

Extra charges like stamp duty apply, but no platform fees stand out. Versus eToro's spreads, Tiger Brokers' model favors active stock/futures traders.

| Asset Class | Commission Example |

| US Stocks/ETFs | $0.005/share min |

| Futures (Index/Energy) | $0.99–$8/contract |

| HK Warrants/CBBCs | 0.03x value |

Deposits, Withdrawals, and Platforms

No minimum deposits across USD/EUR/SGD/HKD/AUD; Singapore users enjoy instant DBS/POSB transfers (SGD), others 1-3 days via bank wire (USD $25 fee possible). Withdrawals mirror this—no Tiger fees, but third-party costs apply; processing hits 1-3 business days.

Tiger Trade platform powers all trades, with demo accounts for practice and 24/5 hours (asset-specific). Support runs weekdays via email (service@tigerbrokers.com.sg), phones (e.g., Singapore +65 6331 2277), and live chat.

Pros and Cons of Tiger Brokers

Pros:

- Zero minimum deposit lowers entry barriers.

- Competitive commissions on global stocks/futures.

- Regulated in HK/NZ with multi-market access.

- Free margin upgrades and demo trading.

Cons:

- Some licenses (e.g., US NFA) unverified, raising due diligence needs.

- Withdrawal fees from banks, not broker.

- Limited forex versus dedicated CFD brokers.

Bottom Line

Tiger Brokers Regulation anchors a solid choice for cost-conscious traders eyeing US/Asia stocks and futures, with SFC/BMU940 offering real protections absent in offshore alternatives. Its no-minimum, low-fee structure delivers value for beginners to pros, provided users verify regional entity compliance—outshining less transparent competitors in legitimacy and accessibility.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

MultiBank Group Analysis Report

Pepperstone Analysis Report

TradingPro: Regulation, Licences and WikiScore Analysis

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

Weltrade Review: Safety, Regulation & Forex Trading Details

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Rate Calc