FXPIG Exposed: Traders Report Withdrawal Denials, Fund Scams & Regulatory Flags

Abstract:Do you face massive losses due to astonishing spreads at FXPIG? Have you witnessed multiple trade executions by the Georgia-based forex broker even though you wanted to execute a single order? Has this piled on losses for you? Is the FXPIG withdrawal too slow? Maybe your trading issues resonate with some of your fellow traders. In this FXPIG review article, we have shared these issues so that you can introspect them thoroughly before deciding on the best forex trader.

Do you face massive losses due to astonishing spreads at FXPIG? Have you witnessed multiple trade executions by the Georgia-based forex broker even though you wanted to execute a single order? Has this piled on losses for you? Is the FXPIG withdrawal too slow? Maybe your trading issues resonate with some of your fellow traders. In this FXPIG review article, we have shared these issues so that you can introspect them thoroughly before deciding on the best forex trader.

Top Trading Complaints Against FXPIG

The Fund Scam Allegation via High Spreads

It all boils down to the spread when executing a forex order, especially when closing positions. The high spreads, as alleged by the trader, caused losses to the trader, who commented that every trade made at FXPIG is a losing proposition because of this. The disappointing trade figures on the FXPIG login made the trader share this review.

FXPIG No Longer Available on the MT5 Platform Claim

A trader admitted that FXPIG is no longer available on the MT5 platform. He further conceded difficulty in adding accounts. The difficulty experienced due to this made the trader share the FXPIG review this way.

The Goof-up in Trade Order Execution

This is a strange complaint where a trader tried to execute a trade order on XAUUSD. However, the FXPIG trading platform executed it multiple times. This happened twice for the trader and severely impacted his forex trading account. The trader urged the broker to remove this error from the account to help him continue with the trading challenge. The FXPIG support teams response to this situation was also not good, according to the trader. Here is how the trader summed up the situation through this critical FXPIG review.

The Heinous Approach to Forex Investment Scam Claim

According to the trader, FXPIG created a Hypertrade.ai company to defraud investors. Recounting his miserable story, the trader generated profits via Hypertrade. However, the trader witnessed a trading account suspension soon after, scamming all his funds. As the trader raised it, the FXPIG support official backed off by saying that Hypertrade is a different entity. Here is the FXPIG review shared by the trader.

The Usual Fund Withdrawal Delays

Traders blame FXPIG for intentionally delaying their fund withdrawals despite meeting the requirements. One trader, upon failing to receive funds after two weeks of a withdrawal request, shared this FXPIG review online.

Regulatory Flags Raised by the Trader

A trader, who despite not having any deposit or withdrawal issues, tried to dig deep by researching the FXPIGs regulatory framework. Upon research, the trader found that the company was registered in Vanuatu, where many companies can easily obtain a license by paying less and offering no protection to clients. The region is also considered one of the weakest jurisdictions globally, according to the trader. Here is a long and informed review of FXPIG.

WikiFX Shares the FXPIG Review: Score & Regulation Status

The complaints against FXPIG point to a serious breach of trading norms and caused losses for traders. Alarmed by the incident, the WikiFX team conducted a detailed evaluation of the brokers operational status. The regulatory concerns were raised further, as the broker was found to be an unregulated entity. Consequently, the team gave the broker a score of 2.45 out of 10.

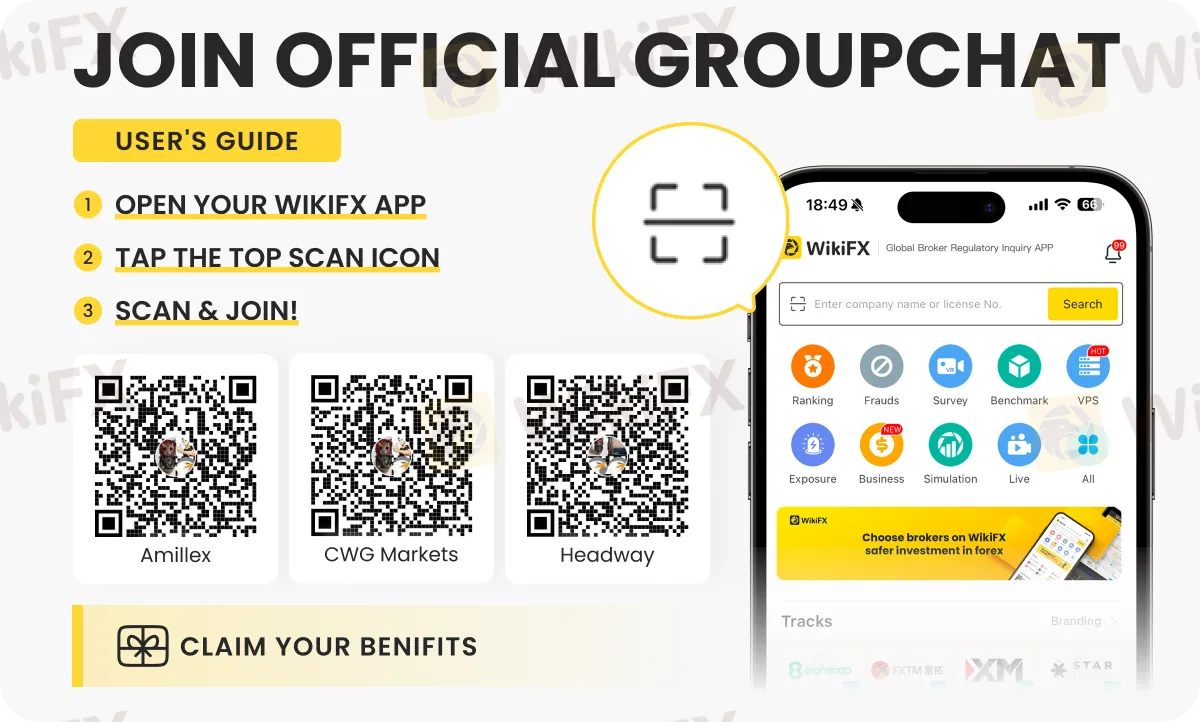

Never miss a single forex event, news or update by joining any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Just follow the simple instructions shown below, and you will be part of an empowered forex community.

Read more

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Is PRCBroker Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking at PRCBroker because you’ve seen their ads or heard about their platform, but you have doubts about whether your funds will be safe. You are right to be cautious.

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking for a broker that can handle serious liquidity without compromising safety. You might be asking: is Finalto just another generic platform, or is it a secure place for your capital?

WikiFX Broker

Latest News

Why Your Entries Are Always Late (And How to Fix It)

Biggest 2025 FX surprise: USD/JPY

NFA Charges Japan’s Forex Wizard and Mitsuaki Kataoka With Delaying Withdrawal Requests

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

【WikiEXPO Global Expert Interviews】Robert Hahm: From Asset Management to AI Innovation

Treasury vs. Fed: Bessent leads Trump's Campaign to Reshape US Monetary Policy

Ceasefire on the Brink: 14 Nations Condemn Israel as Geopolitical Risk Premiums Rise

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Ringgit hits five-year high against US dollar in holiday trade

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Rate Calc