Maven Trading Review: Traders Flag Funding Rule Issues, Stop-Loss Glitches & Wide Spreads

Abstract:Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from what’s available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

Are you facing funding issues with Maven Trading, a UK-based prop trading firm? Do you find Mavin trading rules concerning stop-loss and other aspects strange and loss-making? Does the funding program access come with higher spreads? Does the trading data offered on the Maven Trading login differ from whats available on the popular TradingView platform? These are some specific issues concerning traders at Maven Trading. Upset by these untoward financial incidents, some traders shared complaints while sharing the Maven Trading Review. We have shared some of their complaints in this article. Take a look.

Check Out the Top Maven Trading Complaints

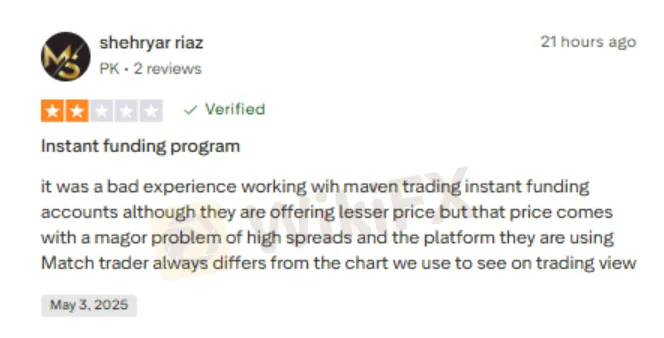

Highlighting Funding Program Issues

Its like a double whammy for traders when looking for a funded account at Maven Trading. A trader reported that the instant funding program comes at a lower price. Yet, there are higher spreads involved in the transaction. Additionally, the Maven Trading App platform shows data different from the globally recognized platform, i.e., TradingView.

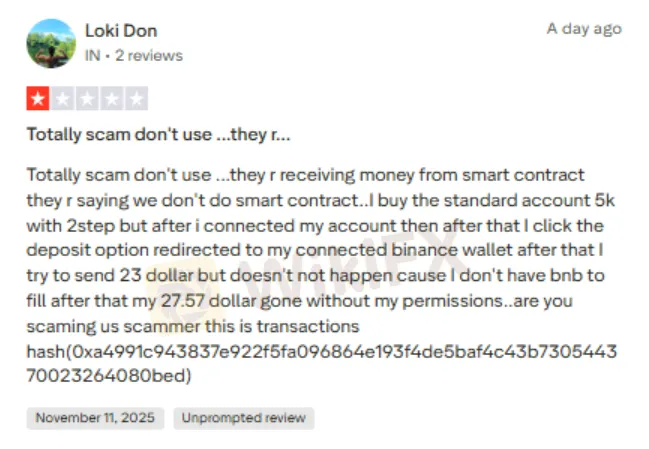

Traders Raise Fund Scam Allegations Against Maven Trading

A trader recently reported that Maven Trading receives money through smart contracts but denies doing so. The trader subscribed to the standard account with two steps, connected his account, and clicked on the deposit option. It redirected the trader to the Binance wallet. Subsequently, the trader attempted to send $23. However, the transaction did not go through because the trader did not have BNB to fill. Strangely, the traders account saw an unfair debit of 27.57 without his permission. Frustrated by this, the trader shared this Maven Trading review.

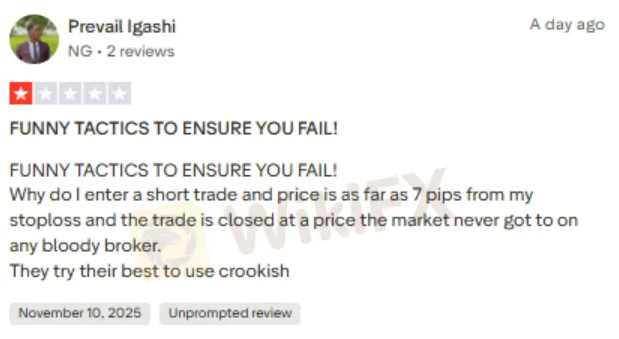

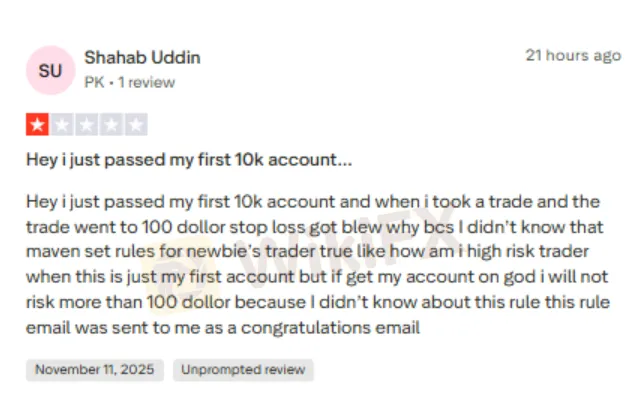

Traders Report Illegitimate Stop-loss Order Execution by Maven Trading

Traders also report increasing incidents of foul play by the broker when executing stop-loss, a trading order, when applied effectively, can help curb losses for the trader. However, as per traders accusations, Maven Trading closes the order even if the price is far away from reaching the stop-loss point. This prevents traders from leveraging the forex market potential. Some traders even point out that, as soon as passing the challenge and getting funded, the broker blows away the account if it reaches the stop-loss point. They get surprised by this. As they delve deeper, they find that new Maven Trading rules label them in the high-risk segment. Traders question how they can be classified as high-risk, given that it is their first shot at trading. To know more, check two explosive Maven Trading reviews.

Maven Trading Review by WikiFX: Score & Regulatory Status

Maven Trading review by WikiFX is not good either, much in line with the above complaint screenshots. The team investigated the broker by screening numerous complaints and its regulatory status. While it is found to be regulated, it is marked as ‘Exceeded’, which raises alarms and may lead to penalties by the regulator. Looking at the overall scenario, the team could only give a score of 1.56 out of 10 to Maven Trading.

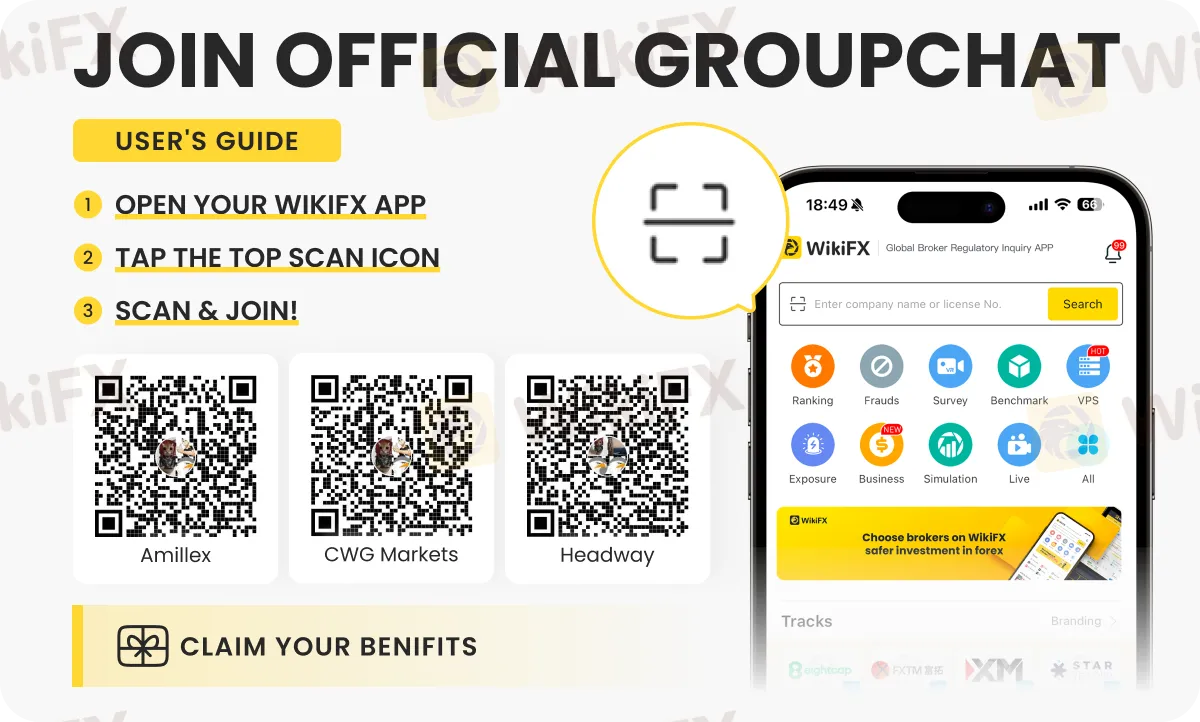

To know whats keeping the forex market alive and kicking, join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.

Read more

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Is PRCBroker Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking at PRCBroker because you’ve seen their ads or heard about their platform, but you have doubts about whether your funds will be safe. You are right to be cautious.

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking for a broker that can handle serious liquidity without compromising safety. You might be asking: is Finalto just another generic platform, or is it a secure place for your capital?

WikiFX Broker

Latest News

Why Your Entries Are Always Late (And How to Fix It)

Biggest 2025 FX surprise: USD/JPY

NFA Charges Japan’s Forex Wizard and Mitsuaki Kataoka With Delaying Withdrawal Requests

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

【WikiEXPO Global Expert Interviews】Robert Hahm: From Asset Management to AI Innovation

Treasury vs. Fed: Bessent leads Trump's Campaign to Reshape US Monetary Policy

Ceasefire on the Brink: 14 Nations Condemn Israel as Geopolitical Risk Premiums Rise

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Ringgit hits five-year high against US dollar in holiday trade

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Rate Calc