USD 3,000,000 Lost? Over 1270 Investors Report TenX Prime Scams.

Abstract:For a period of time, WikiFX has received a growing number of complaints from traders around the world, reporting that TenX Prime has defrauded more than USD 3,000,000. The latest report came from a trader, who shared his experience and concerns through an email to WikiFX.

For a period of time, WikiFX has received a growing number of complaints from traders around the world, reporting that TenX Prime has defrauded more than USD 3,000,000. The latest report came from a trader, who shared his experience and concerns through an email to WikiFX.

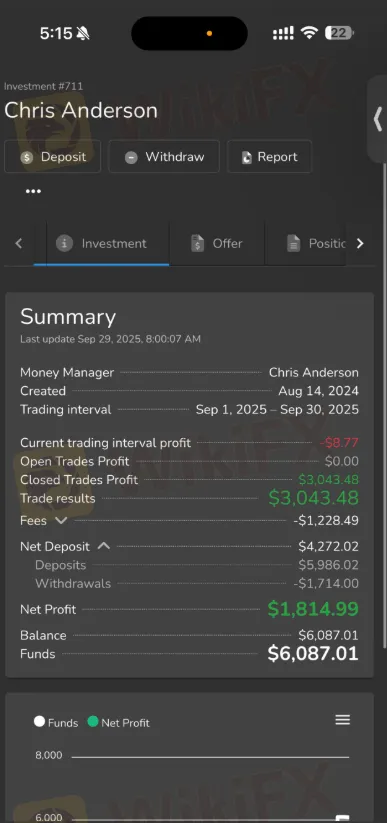

According to this investor, TenX Prime Ltd operated a PAMM (Percent Allocation Management Module) investment system where traders could invest under selected fund managers. One fund manager of this broker, Chris Anderson, reportedly managed a Telegram group named “Chris the Gold Father,” which had over 700 investors at the time.

TenX Prime Breaks the Promises of High Returns

The trader stated that he first invested USD 100 in August 2024, impressed by the trading results shared by a TenX Prime staff named Chris Anderson. Later, he increased his investment to USD 6,095 in September 2025, believing that larger deposits would bring higher profits.

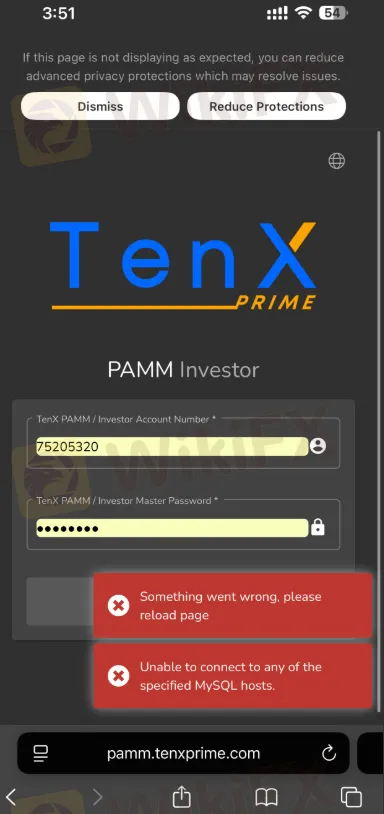

However, beginning October 1, 2025, the TenX Prime PAMM system stopped responding entirely. Investors are unable to access their accounts, check balances, or make withdrawals.

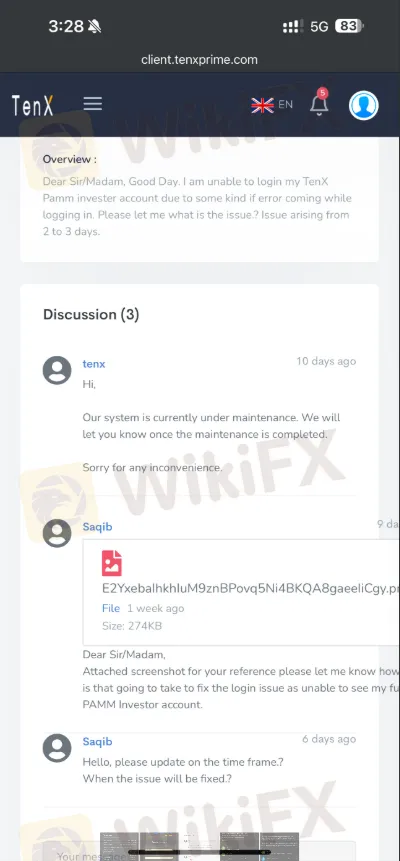

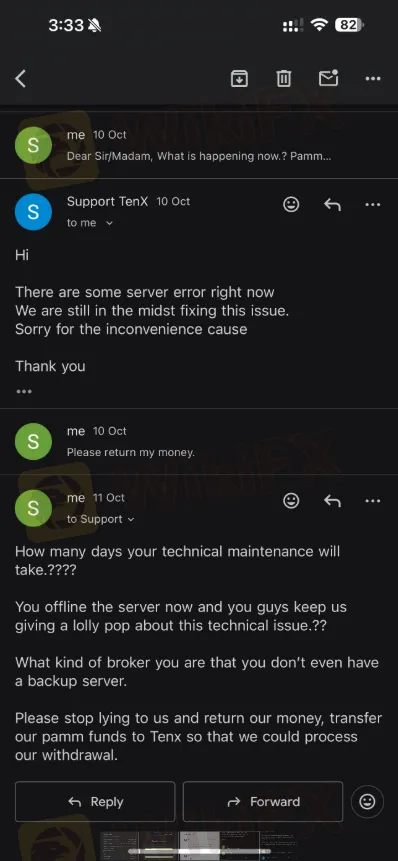

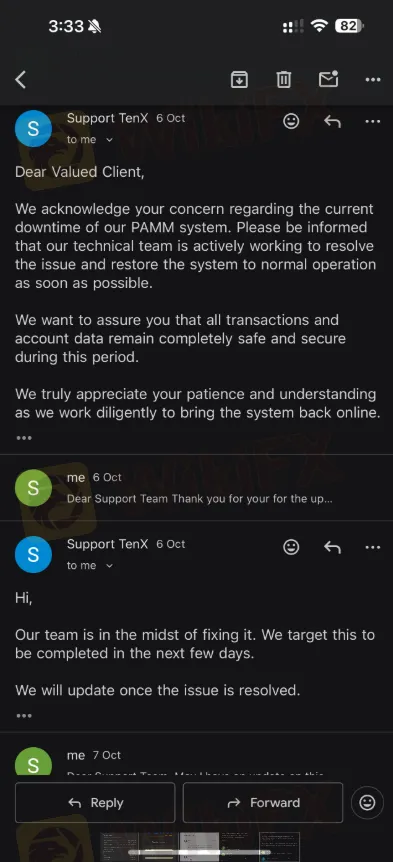

Despite repeated attempts to contact customer support, TenX Prime has only issued automatic or vague replies, claiming the issue is “under maintenance.” No concrete updates or timelines have been provided to affected users.

“The TenX Prime support team only sends automatic or unclear replies, saying the issue is being fixed, but there has been no progress or concrete update. Now over 1200 investors, including myself, are worried this could be a scam,” the victim said.

Growing Number of Complaints Raise Red Flags

Reports indicate that more than 1,200 investors have been affected by the platforms sudden inactivity. The PAMM system outage has persisted for over two weeks with no transparency from the broker.

These developments have raised critical questions among traders:

- Who exactly owns and operates TenX Prime Ltd, and where is the company truly based?

- Is the PAMM database genuinely undergoing maintenance, or has the broker disappeared with investors funds?

- What legal or regulatory steps can affect traders take to recover their investments?

WikiFX Investigation and Findings

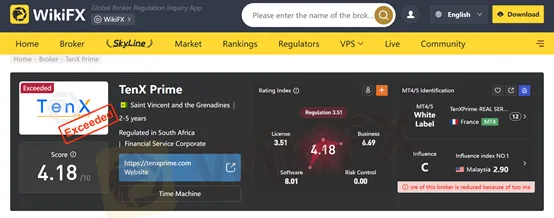

According to the WikiFX, TenX Prime holds a low trust score, showing significant risk to investors. The brokers regulatory status is unclear, and no verified licenses have been identified from recognized financial authorities.

WikiFX is currently reaching out to victims and other affected traders to collect more evidence and better understand the scope of the issue. WikiFX continues to monitor the situation and urges all affected investors to report their experiences through the official WikiFX channels.

Trader Protection Comes First

Protecting the legitimate rights and interests of forex traders is always the primary concern of WikiFX. Cases like TenX Prime highlight the importance of verifying a brokers license and operational transparency before investing.

WikiFX reminds all traders to remain cautious when engaging with brokers that:

- Lack transparent ownership details

- Fail to provide clear regulatory credentials

- Delay or block withdrawal requests

- Use unverified fund managers or Telegram channels to solicit investors

How to Check a Brokers Legitimacy

To safeguard your funds and trading accounts, always verify a broker‘s legitimacy through WikiFX’s official website or app. WikiFX provides detailed reports, regulatory verification, and user feedback to help traders make informed decisions.

Visit https://www.wikifx.com/en

Or https://www.wikifx.com/en/download.html for instant access to broker ratings and real-time scam alerts.

How TenX Prime Performs vs. Typical Risk Benchmarks

- Score & Trust: TenX Prime has been given 4.18/10 by WikiFX due to an accumulation of unresolved complaints and other reasons.

- Regulation Claim vs. Reality: The label “FSCA (Exceeded)” means the broker claims an FSCA license, but that license is no longer valid or “exceeded” — rendering the claim moot or misleading.

- Red Flag signaled: White-label arrangements, offshore registration, hidden real identity of fund managers (e.g., “Chris Anderson”) are classic signs of a high-risk operation.

- Reputation: Compared to more established brokers (which might occasionally have issues), TenX Primes problems are systemic, persistent, and global in scope.

Conclusion: Stay Alert and Report Suspicious Brokers

The TenX Prime case serves as a warning about the dangers of unregulated brokers and high-risk investment schemes. As more investors report losses and the PAMM system remains offline, the evidence increasingly suggests a potential scam operation.

WikiFX will continue to track updates, expose unethical brokers, and provide guidance for traders seeking justice. Stay tuned for further developments.

Read more

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Is PRCBroker Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking at PRCBroker because you’ve seen their ads or heard about their platform, but you have doubts about whether your funds will be safe. You are right to be cautious.

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking for a broker that can handle serious liquidity without compromising safety. You might be asking: is Finalto just another generic platform, or is it a secure place for your capital?

WikiFX Broker

Latest News

Why Your Entries Are Always Late (And How to Fix It)

Biggest 2025 FX surprise: USD/JPY

The Richest Traders in History and the Strategies Behind Their Success

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Brokers or Prop Firms, or both...

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Trading.com Launches Zero-Commission Investment Account

Quotex Review 2025: Safety, Features, and Reliability

Government Officer Lost RM12,000 to Non-Existent Forex Scheme

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Rate Calc