Traders Flag DUHANI as a Scam Forex Broker: Withdrawal Denials, Account Termination & False Promises

Abstract:Lured into the DUHANI trading platform courtesy of the bonus offer that never existed? Did the forex broker prevent you from accessing your account and take away all your profits? Being promised a swap-free account but ended up paying a charge on closing a position? These experiences have become synonymous with DUHANI traders. Frustrated by these incidents, traders have opposed the broker online, with some of them even claiming to have recovered their stuck funds using legal means. Let’s check their negative reviews to find out the pain they have had trading via DUHANI.

Lured into the DUHANI trading platform courtesy of the bonus offer that never existed? Did the forex broker prevent you from accessing your account and take away all your profits? Being promised a swap-free account but ended up paying a charge on closing a position? These experiences have become synonymous with DUHANI traders. Frustrated by these incidents, traders have opposed the broker online, with some of them even claiming to have recovered their stuck funds using legal means. Lets check their negative reviews to find out the pain they have had trading via DUHANI.

Top Complaints Against DUHANI

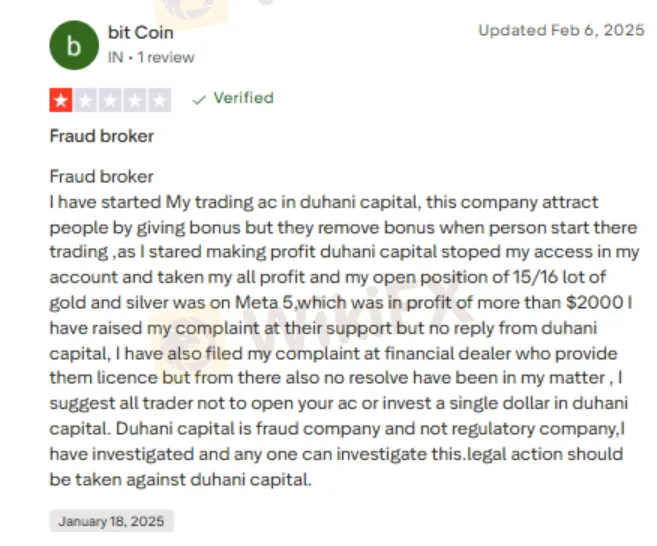

The Bonus Offer & Its Denial

DUHANI taps into traders by inviting them to their trading platform using a fake bonus offer. However, as the trading begins, the bonus is removed from the account, leaving traders stunned. Here is one trader sharing this concern through a screenshot attached below.

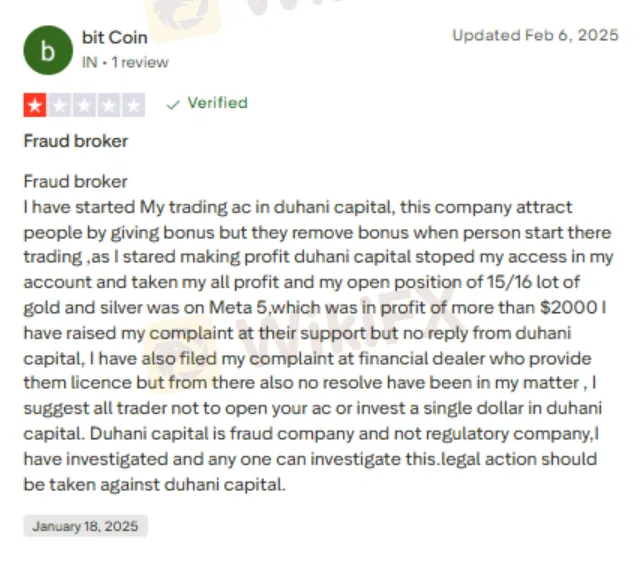

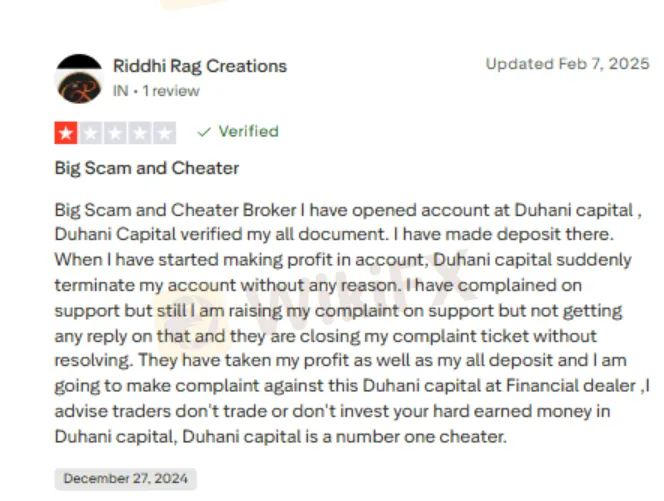

Account Termination & Profit Siphoning Complaints

The trader mentioned above faced account termination as well as profit blocks. However, this case is too rampant at DUHANI. Whats more, there is no effective response from the customer support team on this matter. This makes us share two screenshots (including the one above) below. Take a look at them.

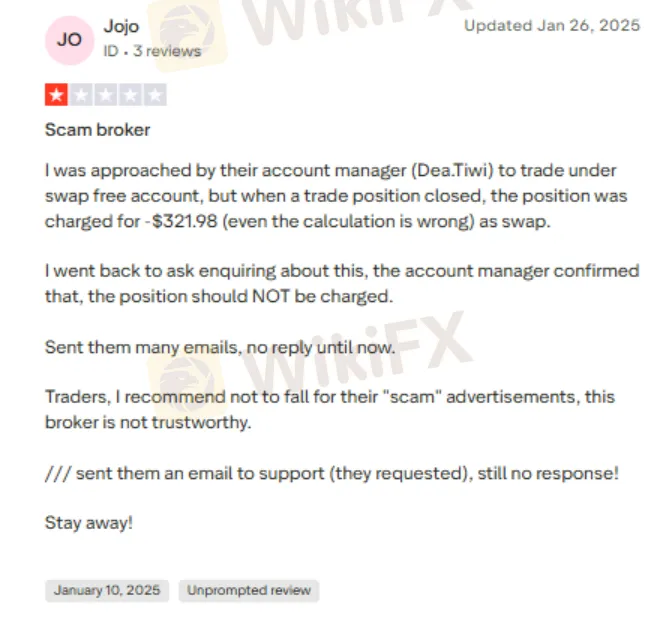

Fake Swap-free Account Promise

Adding to the list of fake promises, DUHANI even approaches traders with a swap-free forex promise. However, as traders close forex positions, they are charged. Even the charge calculation seems erroneous in many cases. One trader shared a review, specifically pointing out this concern. Have a look at the screenshot below to know more.

Legal Support Sought for Fund Recoveries

The issue of frozen withdrawal remains so intense at DUHANI that some traders had to take legal assistance to get their funds back. Here are some screenshots we found in support of this claim.

The Review of DUHANI - Score & Regulation Status

DUHANI seems like a scam forex broker as per the growing trader complaints regarding its operations. The accusation grows only stronger when we reveal to you this - DUHANI does not have a valid license from a competent financial authority. In view of all these, the WikiFX team assigned the Albania-based forex broker a poor score of 1.96 out of 10.

Stay updated about the latest on DUHANI and other scam forex brokers on WikiFX Masterminds (ID:EODL15W5IH)

Follow these steps to get started -

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the group.

Read more

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

FBS Forex Scam Alert: High Complaint Ratio

FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc