WikiFX Broker Review | CMC Markets: Is It Trustworthy?

Abstract:CMC Markets advertises itself as a long-established, globally regulated broker offering a wide range of instruments and strong regulatory backing, though user complaints (especially over spreads, slippage, and fees) reduce its overall score. This review aims to present an impartial evaluation of CMC Markets, highlighting both its offerings and its shortcomings, so traders can make a well-informed decision before engaging with the platform.

CMC Markets advertises itself as a long-established, globally regulated broker offering a wide range of instruments and strong regulatory backing, though user complaints (especially over spreads, slippage, and fees) reduce its overall score. This review aims to present an impartial evaluation of CMC Markets, highlighting both its offerings and its shortcomings, so traders can make a well-informed decision before engaging with the platform.

Background:

CMC Markets Limited operates globally, offering CFDs, share trading, indices, commodities, forex, cryptocurrencies, and ETFs through various platforms. It is registered in multiple jurisdictions, including Singapore (CMC Markets Singapore Pte. Ltd., UEN 200605050E; Registered Office: 2 Central Boulevard, IOI Central Boulevard Towers, #25-03, Singapore).

CMC Markets distinguishes client funds via segregated bank accounts in jurisdictions like Singapore and Australia, and claims to comply with applicable laws (such as Singapore‘s Securities & Futures Act, Australia’s ASIC client money rules).

While the broker advertises “no minimum deposit” in some jurisdictions and offers competitive pricing, certain aspects of the fee structure (especially for stock CFDs) are considered high by some users.

Types of Accounts:

Standard / Retail CFD / Share Trading Accounts

- Minimum deposit: Varies by region; some jurisdictions claim no minimum deposit.

- Trade size: Depends on product type; varying lots for forex, CFDs; share investing uses standard share units.

- Spreads/commission: Generally competitive; spreads may widen under volatile conditions; stock CFDs tend to carry higher fees.

In 2022, CMC Markets introduced FX Active, a commission-based pricing model available in Southeast Asia, Australia, New Zealand, Canada, and the U.K. on both MT4 and the Next Generation platform. FX Active charges $2.50 per side with minimum spreads starting at 0 pips, giving an effective EUR/USD trading cost of about 1.15 pips based on June 2025 data (average spread 0.65 pips). For comparison, the standard MetaTrader account spread for EUR/USD averaged 1.3 pips during the same period.

CMC Markets also runs an Alpha rebate program (U.K., NZ, Canada, Australia), which provides premium reports, market data, and spread discounts of up to 20% for higher-volume traders. Alpha has three tiers: Classic (minimum 11 trades per month), Active Investor (11–30 trades or 5 trades with at least $500 in commissions), and Premium Trader (over 30 trades per month). Each tier applies a base fee of AUD 9.90 per trade, with discounts ranging from 0.1 bps to 0.075 bps for larger trade sizes.

Additionally, the broker claims to offer Guaranteed Stop-Loss Orders (GSLOs), which ensure stop orders are executed at the specified price. A premium applies, shown in the trade ticket, and is refunded if the GSLO is not triggered.

- Maximum leverage: Up to 1:200 in certain regions.

Deposits and Withdrawals:

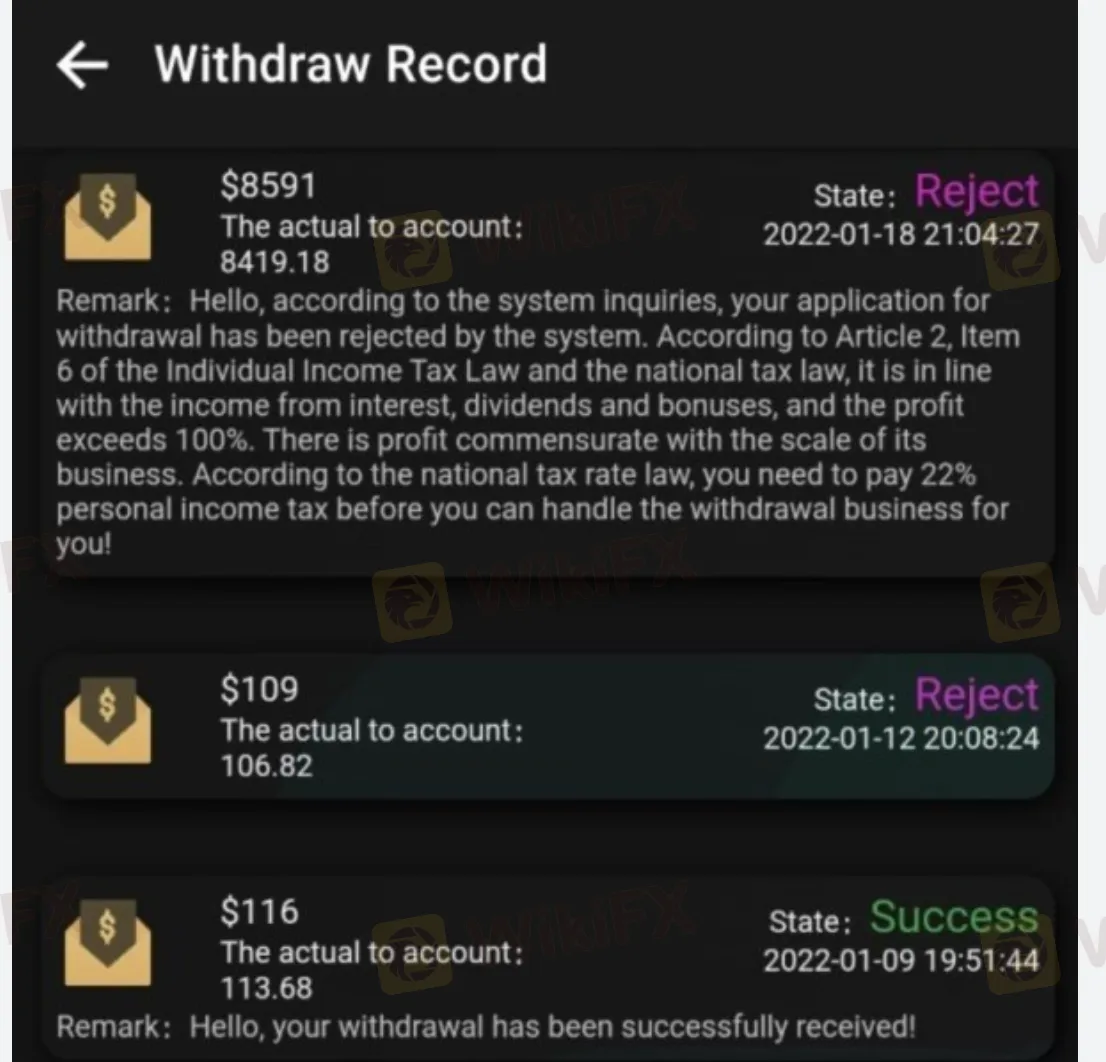

CMC Markets uses standard banking methods, credit/debit cards, bank transfers, etc. Payment methods vary by jurisdiction. (Exact minimum/maximum transaction limits, fees, and processing times depend on country.)

CMC Markets claims that client funds are held in segregated accounts so that, in insolvency, clients money should be protected.

Trading Platforms:

- MetaTrader 4 (MT4) – Available on PC, mobile, and web. MT4 is an industry-standard platform known for technical analysis tools, one-click trading, fast execution, Expert Advisors (EAs), VPS hosting, and chart customization.

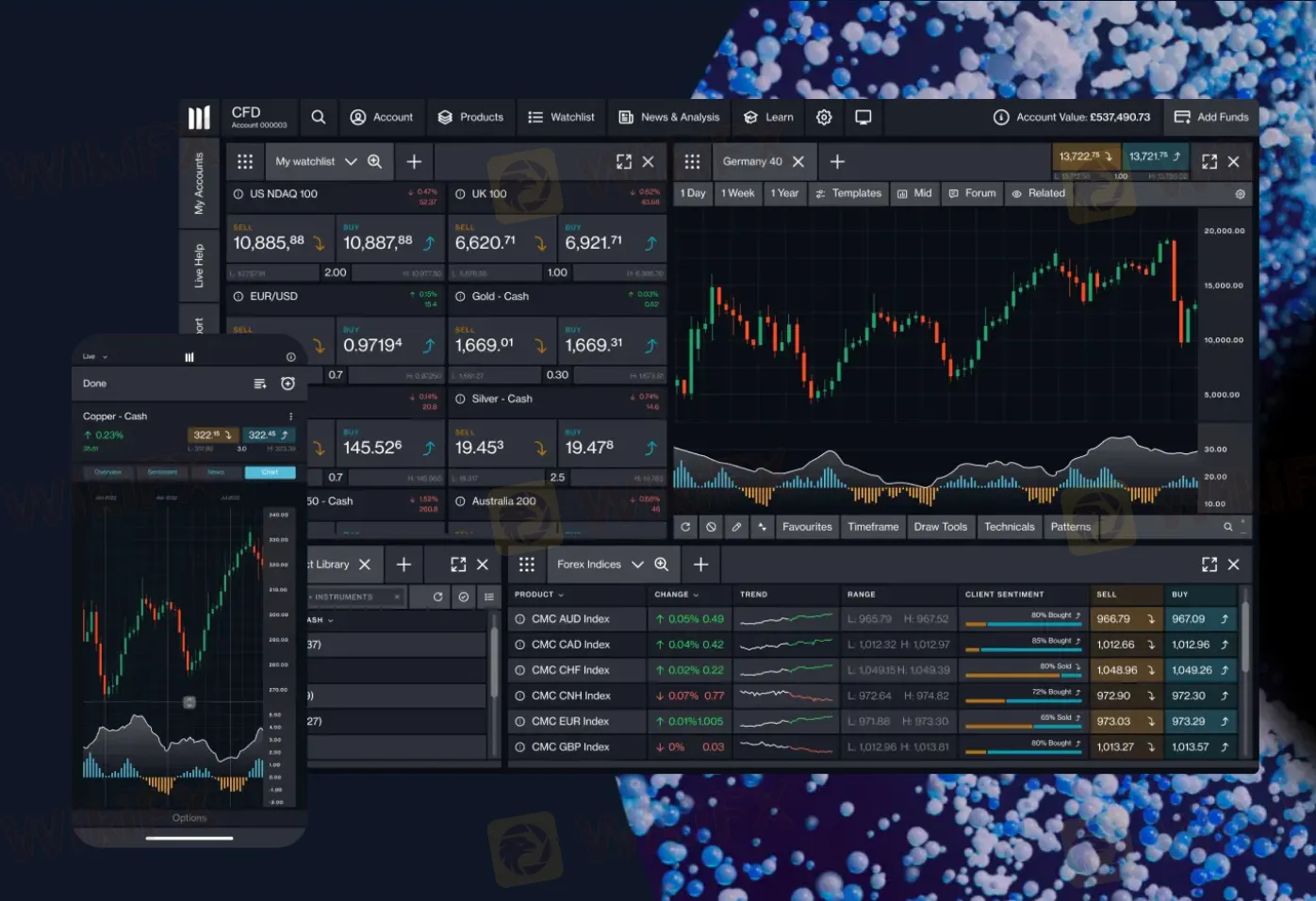

- Next Generation (proprietary platform) - Offers web and mobile access with advanced charting, built-in research, and customizable layouts.

- TradingView integration - Connects to TradingView for advanced charts, community insights, and direct order placement (where supported).

Research and Education:

CMC Markets offers a “Knowledge Hub”, platform guides, tutorials, market news & analysis, including written articles, video updates, podcasts, and live webinars.

Customer Service:

Clients can contact CMC Markets through:

- Email: support@cmcmarkets.com.sg

- Phone: 1800 559 6000

- Live chat

Support is available in English and Chinese.

Conclusion:

WikiFX assigns an overall score of 7.99 / 10 to CMC Markets in many metrics, but notes that this score is reduced due to numerous user complaints.

View WikiFXs full review on CMC Markets here: https://www.wikifx.com/en/dealer/0361475237.html

Take a closer look at CMC Markets licenses here:

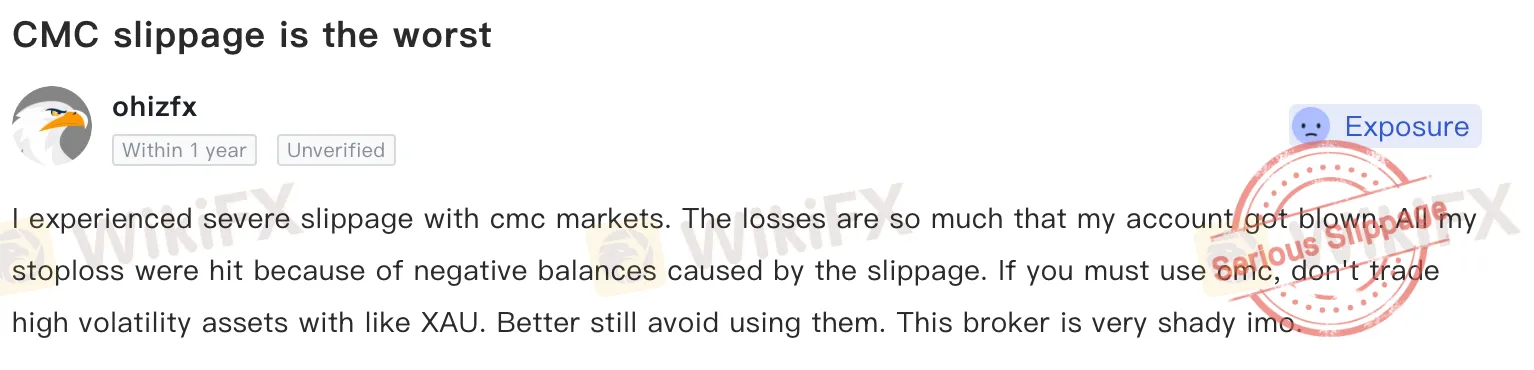

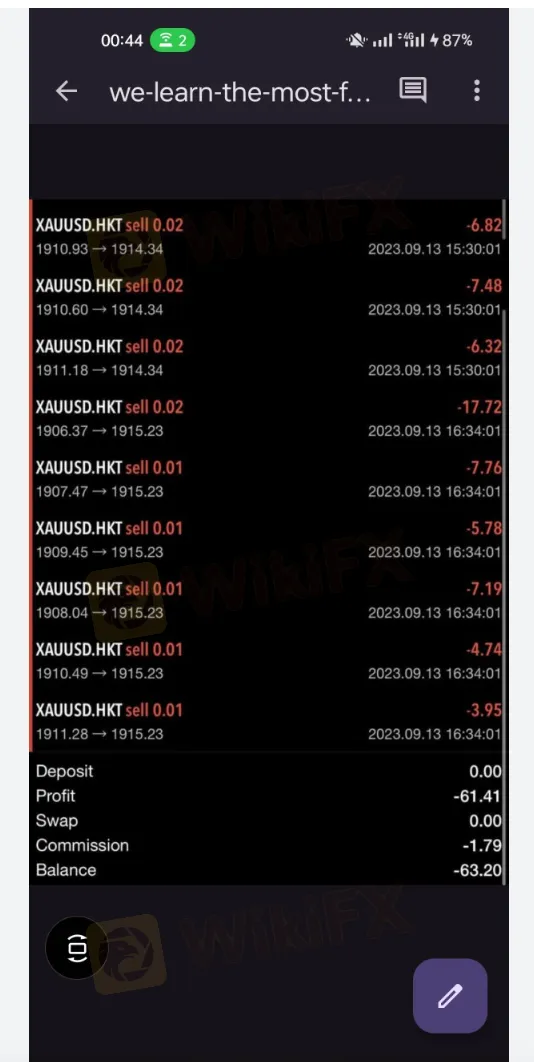

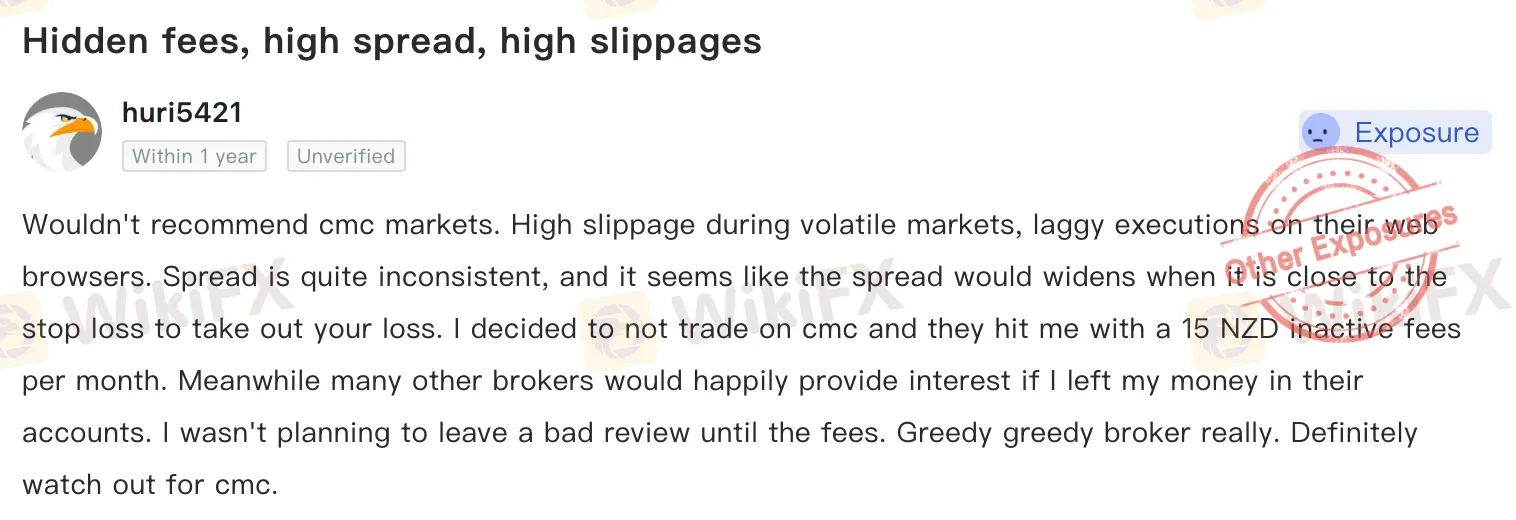

Key concerns related to CMC Markets service include inconsistent spreads / high fees in certain instruments (especially stock CFDs), slippage during volatile market conditions, and occasional customer service issues.

WikiFX Recommendations:

- Be aware that while regulation is strong in many regions, trading costs (spreads, commissions, fees) may erode gains in some products.

- Monitor slippage risks, especially when trading volatile instruments.

Conducting due diligence before investing is crucial, and independent verification tools such as WikiFX can be instrumental in assessing the legitimacy of brokers and investment firms. The WikiFX mobile application, available on Google Play and the App Store, provides comprehensive insights into brokers regulatory status, customer reviews, and safety ratings. By leveraging such resources, investors can make informed decisions and avoid the financial devastation caused by fraudulent schemes.

WikiFX Broker

Latest News

Silver Volatility Explodes: Tariff Reprieve and Demand Destruction Fears

Castle Market Forex Broker Review: Regulation, Risks & Verdict – Is It Safe or Scam?

Oil Rout: Crude Plunges 3% as Geopolitical Risk Premium Evaporates

Geopolitical Risk: Trump Pauses Iran Strike, Markets Weigh "Tactical Delay" vs. De-escalation

USD/CAD Breaches 1.3900 as Loonie Succumbs to Oil Collapse and King Dollar

US Inflation Stickiness and Geopolitical Rift Keep Dollar Firm; Gold Volatile

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Gold Holds Record Highs as Geopolitical Fractures Widen from Arctic to Middle East

Goldman Sachs 2026 Outlook: Dollar Overvalued by 15%, Tech 'Exceptionalism' is Key Risk

Trump tells Hassett he wants to keep him where he is; Warsh Fed Chair odds jump

Rate Calc