Why Caution Is Needed with SuperFin! Know the Risks

Abstract:SuperFin Scam Alert! Financial fraud is on the rise; shady brokers are ready to drain your money and disappear without a trace. SuperFin has come under the radar for all the wrong reasons, and if you're not informed, you could be their next target. Don’t fall for the trap- stay alert and read on to protect yourself from being looted.

SuperFin Scam Alert! Financial fraud is on the rise; shady brokers are ready to drain your money and disappear without a trace. SuperFin has come under the radar for all the wrong reasons, and if you're not informed, you could be their next target. Dont fall for the trap- stay alert and read on to protect yourself from being looted.

1. Lack of Strong Regulatory Supervision

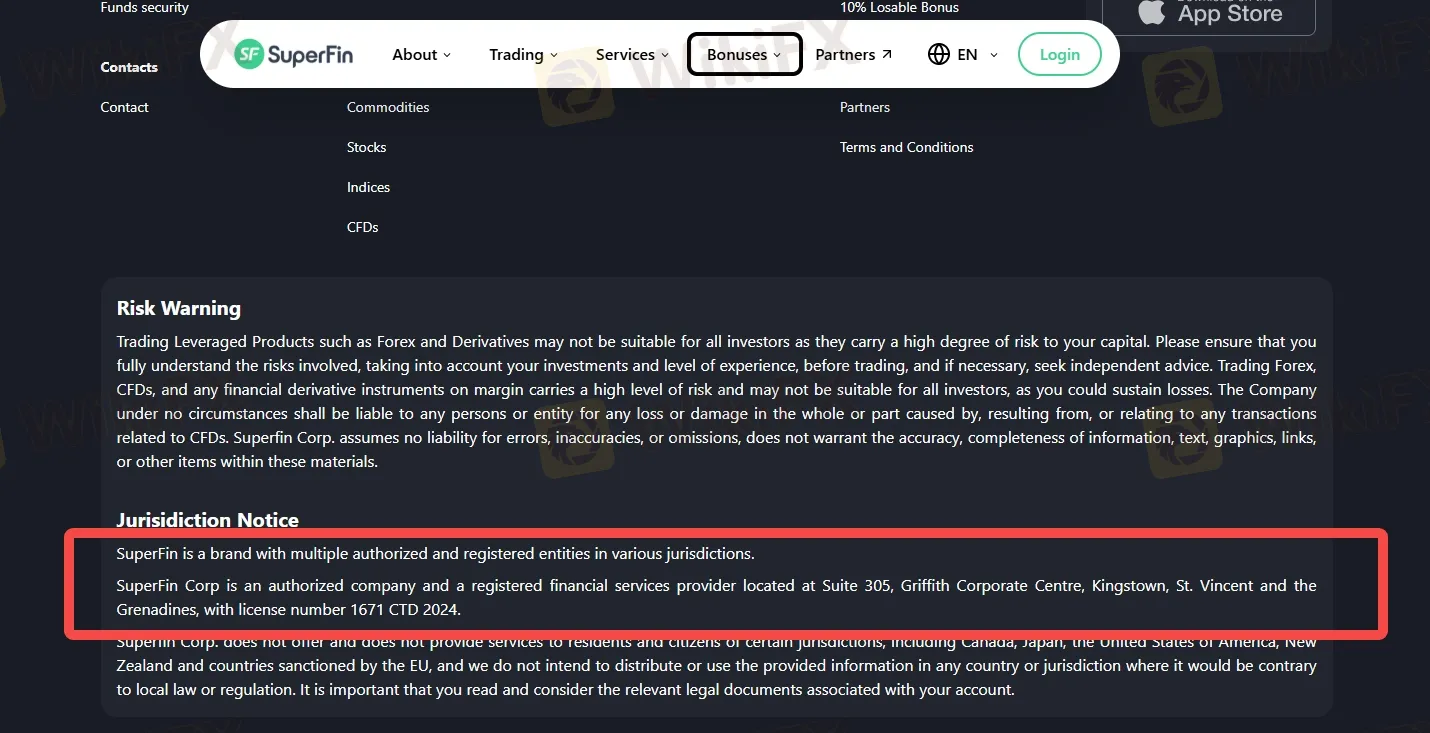

SuperFin Corp is registered in St. Vincent and the Grenadines and operates under license number 1671 CTD 2024. While this registration gives the company a legal business identity, it's important to note that this offshore jurisdiction is known for its limited investor protection. Unlike brokers regulated by tier-one authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), entities licensed in St. Vincent and the Grenadines are not held to the same rigorous standards of transparency, capital adequacy, or client fund segregation.

2. Attractive Yet Flashy Promotions

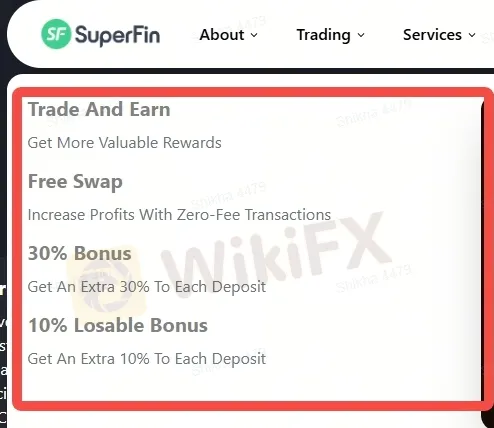

SuperFin aggressively markets itself with bold and flashy promotions designed to attract new traders and retain existing ones. Campaigns like “Trade and Earn” promise valuable rewards, while financial incentives such as a 30% deposit bonus and a 10% losable bonus aim to boost traders capital. SuperFin offers a free swap feature, which allows traders to hold positions overnight without paying swap fees, potentially increasing profitability. However, while these offers may look appealing on the surface, traders should be cautious.

3. Limited Platform Availability

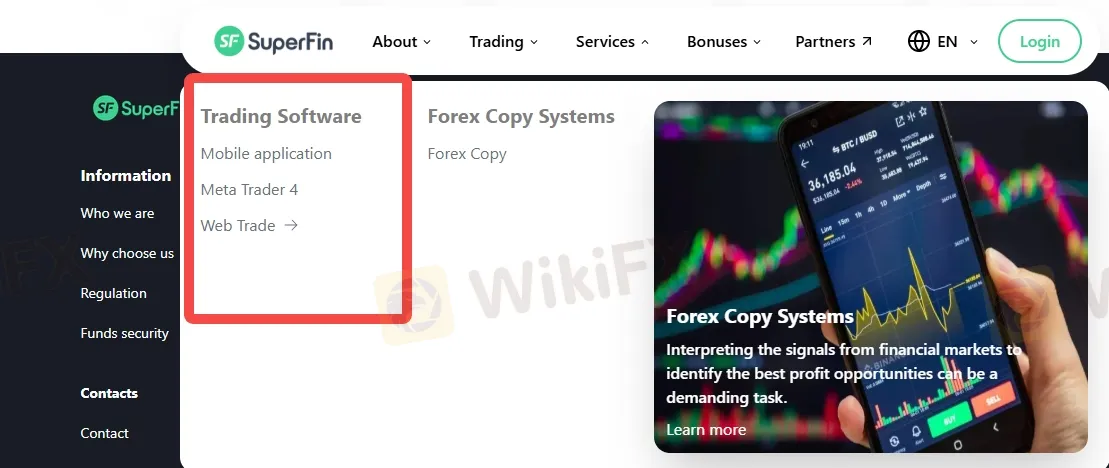

SuperFin currently offers trading exclusively through the MetaTrader 4 (MT4) platform. While MT4 is one of the most widely used platforms in the forex industry, known for its user-friendly interface, advanced charting tools, and automated trading capabilities via Expert Advisors (EAs), it is also somewhat outdated compared to newer platforms like MetaTrader 5 (MT5) or cTrader.

The absence of platform diversity could be a disadvantage for professional or multi-asset traders who expect broader functionality and integration across different devices and asset classes.

What WikiFX Reveals about SuperFin?

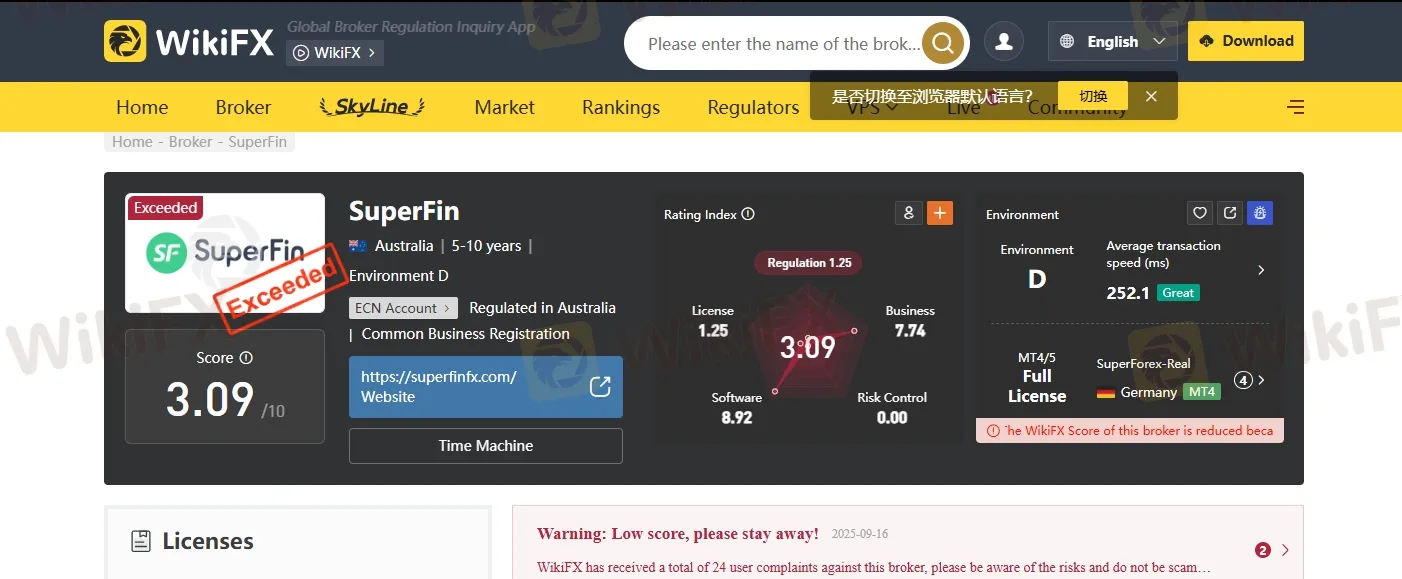

According to WikiFX, SuperFin has received a poor trust score of just 3.09 out of 10, indicating serious concerns about the brokers credibility and overall reliability. WikiFX has also issued an explicit warning against using the platform, stating: “Warning: Low score, please stay away!”

This low rating reflects multiple risk factors, including weak regulatory oversight, questionable transparency, and potentially unsafe trading conditions. For traders seeking a secure and trustworthy trading environment, such a low score should serve as a major red flag and a strong reason to reconsider opening an account with SuperFin.

Join WikiFX Community

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

AssetsFX Review – What Traders Are Saying & Red Flags to Watch

Has AssetsFX stolen your deposits when seeking withdrawals from the trading platform? Did the broker fail to give any reason for initiating this? Did you notice fake trades in your forex trading account? Does the Mauritius-based forex broker deny you withdrawals by claiming trading abuse on your part? Did you also receive assistance from the AssetsFX customer support team? Firstly, these are not unusual here. Many traders have shared negative AssetsFX reviews online. In this article, we have highlighted such reviews so that you can make the right investment call. Take a look!

ROCK-WEST Complete Review: A Simple Guide to Its Trading Platforms, Costs, and Dangers

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.

LTI Review 2026: Safe Broker or a High-Risk Scam? User Complaints Analyzed

When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

LTI Regulatory Status: Understanding Its Licenses and Company Registration Details

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Rate Calc