User Reports Issues with TMI Markets! Be Worried About Your Investment

Abstract:When it comes to investing your hard-earned money, choosing a reliable and trustworthy broker is crucial. Many new brokers enter the market each year, offering attractive deals to grab your attention. However, not all of them are safe. One such broker that has recently raised several concerns is TMI Markets. In this article, we’ll walk you through five major red flags you need to know.

When it comes to investing your hard-earned money, choosing a reliable and trustworthy broker is crucial. Many new brokers enter the market each year, offering attractive deals to grab your attention. However, not all of them are safe. One such broker that has recently raised several concerns is TMI Markets. In this article, well walk you through five major red flags you need to know.

1. Brand New Broker (Since 2022)

TMI Markets is a relatively new name in the forex trading world, launched in 2022. It means that the broker has a very short track record. They havent yet proven their stability or long-term trustworthiness. New brokers are also more likely to close operations suddenly or face regulatory challenges, which could put your funds at risk.

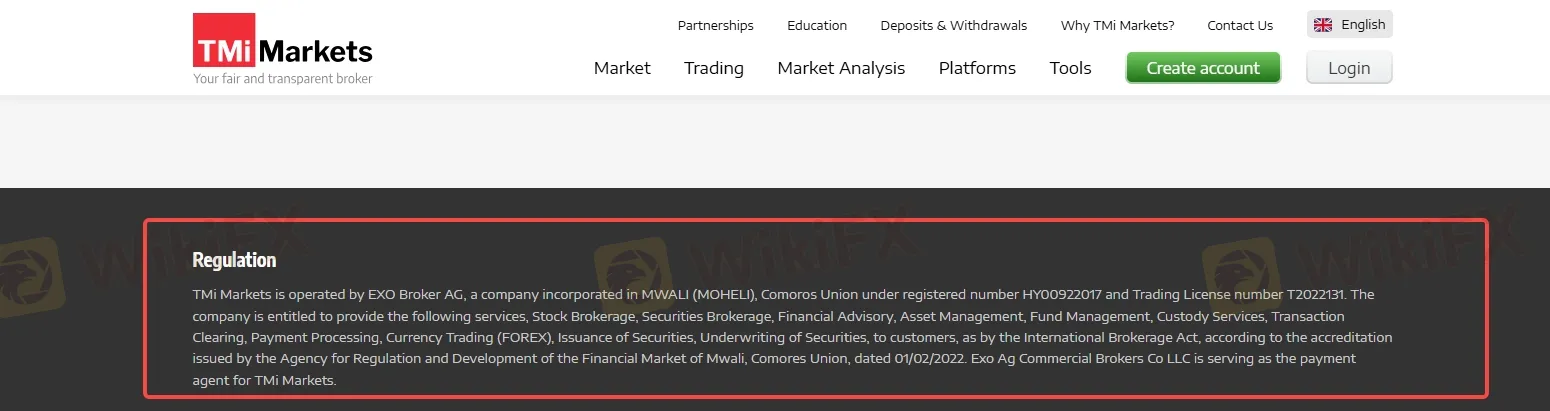

2. Low-Tier Regulation

TMI Markets claims to be licensed by Mwali (Moheli), Comoros Union, under registration number HY00922017 and trading license T2022131. However, this is not a top-tier regulatory body. Trusted brokers are usually regulated by authorities like the FCA (UK), ASIC (Australia), or CySEC (Europe). Being licensed by a weak regulator often means there is little to no investor protection and the broker may not be held accountable for unethical practices.

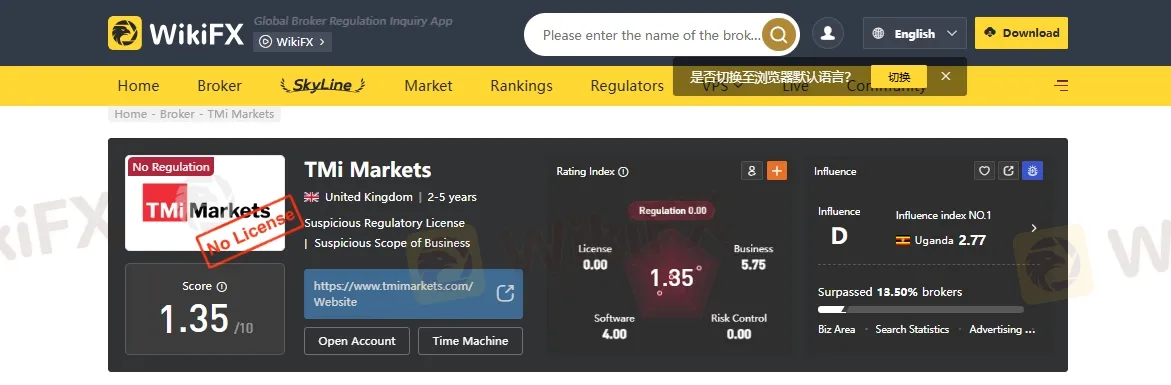

3. Poor Score on WikiFX

Reputation matters a lot in trading. According to WikiFX, a well-known broker review platform, TMI Markets has a very disappointing score of just 1.35 out of 10. Such a low score is a serious warning sign. You should think twice before trusting your money with a broker.

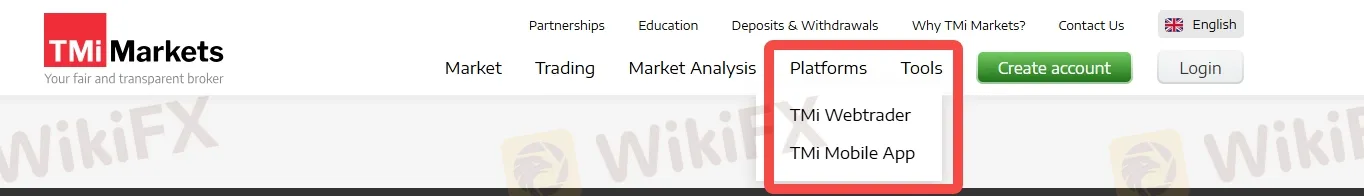

4. Does Not Support Popular Trading Platforms

Many trusted brokers offer MetaTrader 4 (MT4) or MetaTrader 5 (MT5) two of the most popular trading platforms but TMI Markets only offers its own platform. This limits your trading experience, especially if youre used to the tools, features, and expert advisors available on MT4 and MT5. Many traders see this as a major downside.

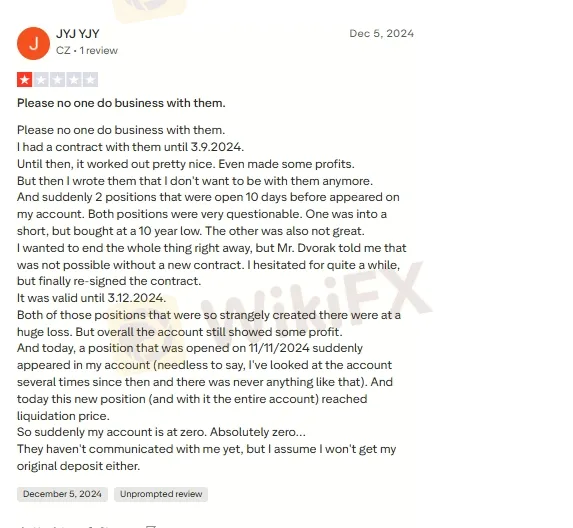

5. Serious User Complaints

Perhaps the biggest red flag is the user complaints. Traders have reported unprofessional behavior from the broker and even called it a scam out of frustration. When users share the same negative experiences, its usually a sign that something is seriously wrong.

Conclusion

From weak regulation to poor reviews and limited trading tools, its better to stay cautious. Always do your own research and choose a broker that is transparent, well-regulated, and trusted by the trading community.

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Is PRCBroker Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking at PRCBroker because you’ve seen their ads or heard about their platform, but you have doubts about whether your funds will be safe. You are right to be cautious.

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking for a broker that can handle serious liquidity without compromising safety. You might be asking: is Finalto just another generic platform, or is it a secure place for your capital?

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

JPY Forecast: Japan Raises Debt Cost Assumption to 30-Year High

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Brokers or Prop Firms, or both...

Trading.com Launches Zero-Commission Investment Account

Quotex Review 2025: Safety, Features, and Reliability

Rate Calc