OctaFX Update: Crypto Deposit Restrictions Raise Regulatory Concerns

Abstract:Malaysian traders using OctaFX Malaysia should take note of a significant update affecting their accounts. As of 18 August 2025, the broker has disabled deposits via Ethereum (ETH) and Bitcoin (BTC) for clients in Malaysia.

Malaysian traders using OctaFX Malaysia should take note of a significant update affecting their accounts. As of 18 August 2025, the broker has disabled deposits via Ethereum (ETH) and Bitcoin (BTC) for clients in Malaysia. This restriction applies only to deposits, while withdrawals in these cryptocurrencies will continue as usual.

At first glance, OctaFX presents itself as a long-established, professional broker with a strong international presence. Its sleek website, diverse range of trading instruments, and claims of regulatory oversight often reassure traders. However, a closer OctaFX review conducted by WikiFX reveals a different story.

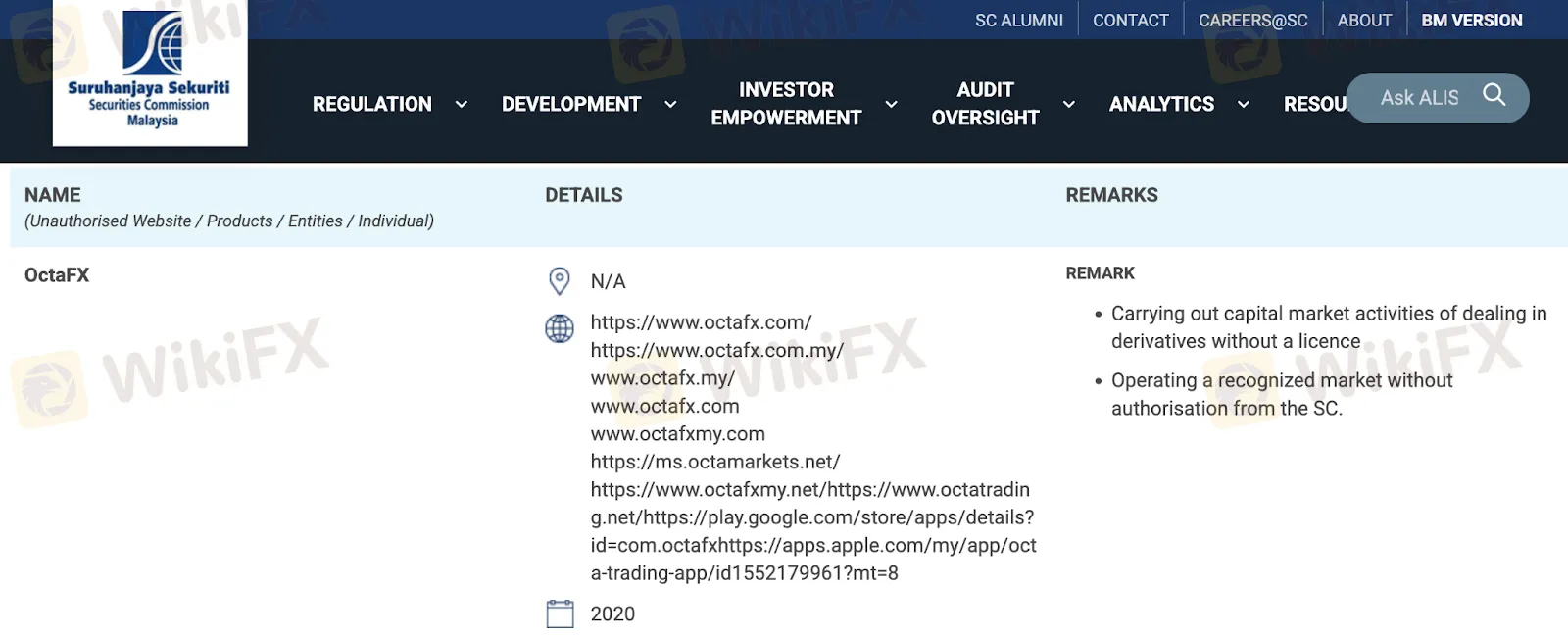

The Securities Commission of Malaysia (SC) has officially placed OctaFX on its Investor Alert List. The regulators notice states that OctaFX has been conducting derivative trading activities without a valid licence and operating a recognised market without authorisation. This means that, despite its global reputation, OctaFX is currently operating in Malaysia without proper approval from the SC.

Globally, OctaFX does hold a licence with the Cyprus Securities and Exchange Commission (CySEC) under licence number 372/18, registered as a market maker. While this offers a degree of legitimacy in Europe, it does not cover operations in Malaysia. This is where many investors misunderstand the concept of regulation. Being licensed in one jurisdiction does not automatically mean a broker is authorised everywhere.

For Malaysian traders, this distinction is crucial. A brokers regulation is only effective in the regions where it is recognised. In the case of OctaFX Malaysia, clients lack the local protections that come with dealing through an SC-approved broker. This exposes traders to risks such as limited recourse in cases of disputes, delayed fund recovery, or potential malpractice.

In every circumstance, investors should not only verify whether a broker is regulated, but also ensure that it is authorised specifically within Malaysias legal framework.

Read more

How to Verify if a Forex Broker is Legit or not?

Starting your trading journey with a reliable and licensed broker is crucial. In the fast-paced world of forex trading, partnering with an unregulated broker can expose you to significant financial risks. Therefore, in this article we’ll let you know the steps to verify if a broker is legit or not ?

Zerodha Regulation Check: Risks for Traders

Zerodha operates without valid regulation, posing high risks for traders. Learn the implications, risks, and compliance gaps in this in-depth analysis.

FCA Warning List – October 2025

The Financial Conduct Authority (FCA) in the UK has published the FCA Warning List- October 2025, alerting forex traders and investors about unauthorized brokers. These firms are operating without the necessary FCA approval. To safeguard your funds and avoid scams, be sure to check the full warning list below.

Malaysia Investor Alert List is Out! Check the list to Avoid Scam

SC (Securities Commission Malaysia) recently issued Investor Alert List to warn investors about companies or firms who are not authorized to carry out capital market activities in the country. Checkout the full list below.

WikiFX Broker

Latest News

Trading While Traveling – Is It Possible? Digital Nomad Traders Are Making It Reality

The Offshore vs. Onshore Broker Dilemma: Who Can You Really Trust?

FBS Added AI tool for Rapid Forex Insights

Axiory Review Alert: What Traders Must Know

Do Content Creators Need a “License”? A Plain-English Guide to the Finfluencer Idea

XM Revamps Trading Platform with AI

Malaysia Investor Alert List is Out! Check the list to Avoid Scam

BotBro Chief Lavish Chaudhary to be Behind Bars Soon? Here’s the Inside Story!

Top Forex Regulatory Bodies You Need to Know

Think Your Broker is Safe? 5 Secrets Only WikiFX Can Uncover

Rate Calc