The ‘Godfather of Japanese Stocks’ Scam Exposed Within Japan’s Chinese Community

Abstract:A new wave of investment scams has hit Japan’s Chinese community, with reported losses of over ¥100 million (approximately RM2.8 million). At the center is Chen Mansato (real name: Chen Sheng), a Japanese citizen of Chinese descent, who introduced himself as an investment expert and directed people to the broker ACY Securities.

A new wave of investment scams has hit Japans Chinese community, with reported losses of over ¥100 million (approximately RM2.8 million). At the center is Chen Mansato (real name: Chen Sheng), a Japanese citizen of Chinese descent, who introduced himself as an investment expert and directed people to the broker ACY Securities.

It often started with late-night messages on LINE:

“Are you alright? Are you sleeping well?”

“Dont push yourself too hard; you can always talk to me.”

These seemingly caring messages quickly shifted tone:

“The Nikkei 225 is surging from 32,000 to 42,000 points. Now is the time to buy!”

“Even if Buffett sells US stocks, dont worry, just keep buying more!”

Many victims were reassured by the shared nationality of the fraudsters as“someone from home must be trustworthy.” In reality, this misplaced trust became the perfect weapon for exploitation.

Chen Mansato built his reputation across Chinese social media platforms with accounts such as “Golden 30 Years” and “Japan Stocks 30 Years”. He painted himself as a celebrated investment guru, boasting an impressive but largely fabricated résumé:

- Vice President and Chief Analyst at a major FX broker

- Compliance officer at the Financial Futures Association of Japan (FFAJ)

- Host of a programme on Nikkei Radio

- Member of the Society of Technical Analysts

- Best-selling author

These unverified claims amounted to little more than fraud. Nevertheless, they helped him win the confidence of inexperienced Chinese investors in Japan, who saw him as an authority figure.

“Golden 30 Years”:

Through his self-styled academy, BLUEWAVE GAKUIN, Chen offered trading lessons, real-time investment advice, and so-called “copy-trading” services.

In 2024, as the yen weakened and Japanese equities climbed, he proclaimed that the Nikkei would rise continuously for the next 30 years. He launched the slogan “Golden 30 Years”, claiming that forex and gold promised quicker profits than equities. On social media, he posted screenshots of trades that appeared consistently profitable, creating the illusion of success.

But the reality was far from golden. Members paid fees of around ¥50,000 per month, only to be funnelled towards one destination: ACY Securities.

Despite golds historic rally in 2024, Chen repeatedly insisted, “Gold will fall, short it now!” Investors who followed his advice suffered devastating losses.

One victim recalled:

“I entrusted ¥9 million to him. But he kept making trades in the opposite direction from mine. Within just a few gold trades, most of it was gone.”

When losses mounted, the once-sympathetic advisers turned cold, dismissing victims with, “Investment is your own responsibility.” Some were even accused of breaking “trading rules” to shift the blame.

To make matters worse, many community members were later revealed to be Chens associates or paid decoys, planted to create the illusion of widespread success. When anger spread among genuine investors, the fraudulent group was abruptly disbanded.

The Truth About ACY Securities

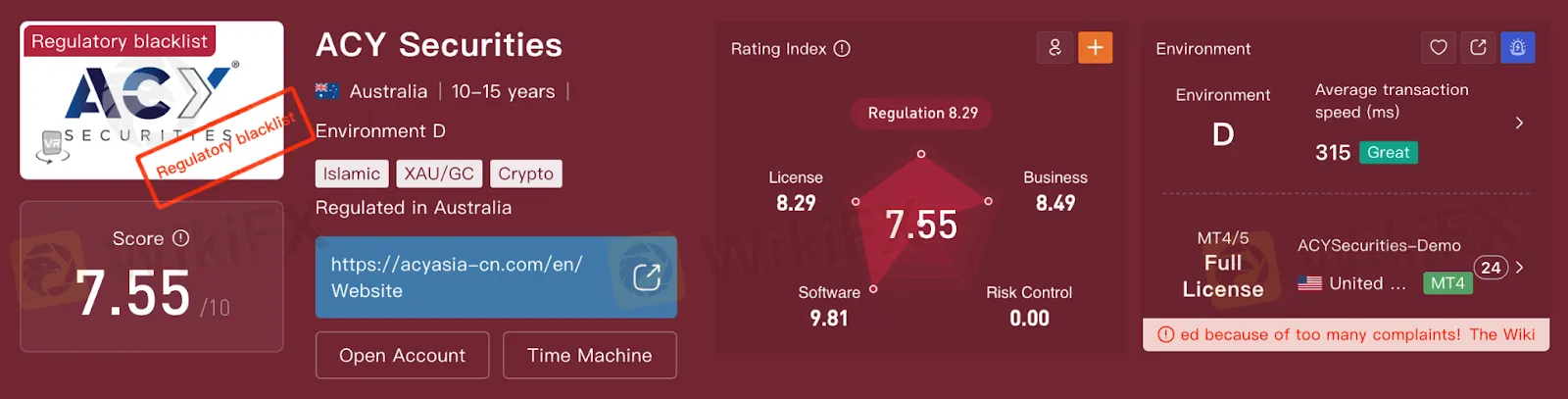

On the surface, ACY Securities presents itself as a long-established Australian broker with official licences and a professional appearance. Yet WikiFXs independent review of 286 user reports revealed serious shortcomings:

- Poor execution speeds well below industry standards

- A low overall rating of “C”, far inferior to top-tier brokers with “AAA” ratings

Victim Reports Include:

- 12% Withdrawal Fees: Some investors were charged exorbitant fees simply for attempting to withdraw funds, even without trading.

- Manipulated Market Data: Repeated irregular price fluctuations, including unexplained halts in Nikkei index trading, suggested backend tampering, with prices not aligned to real markets.

- Frequent Slippage and Delays: Users reported persistent execution problems, leading to heavy losses.

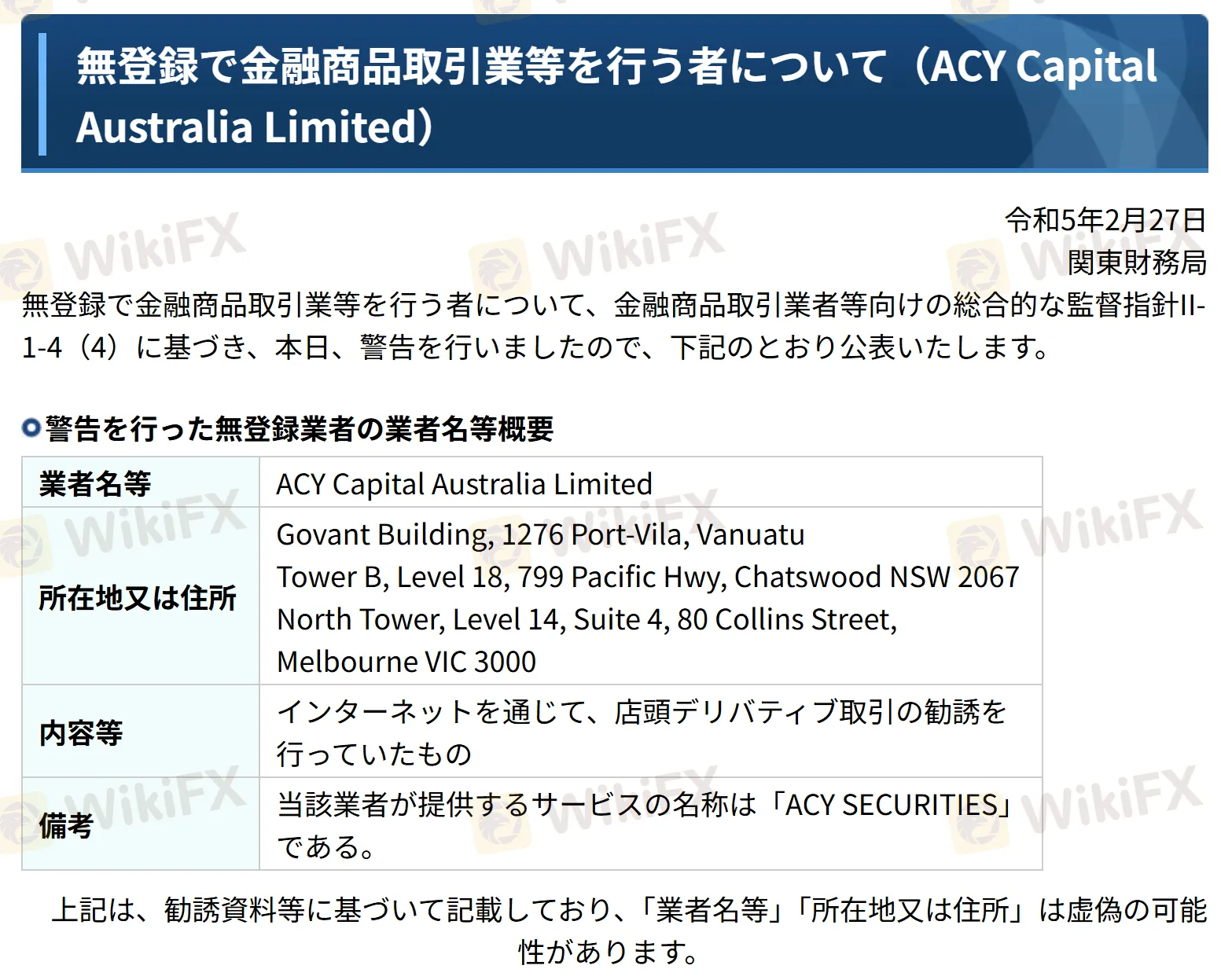

Further compounding concerns, in February 2023 Japans Financial Services Agency (FSA) issued a formal warning against ACY Capital Australia Limited for operating without registration. This makes it illegal for ACY to solicit Japanese residents.

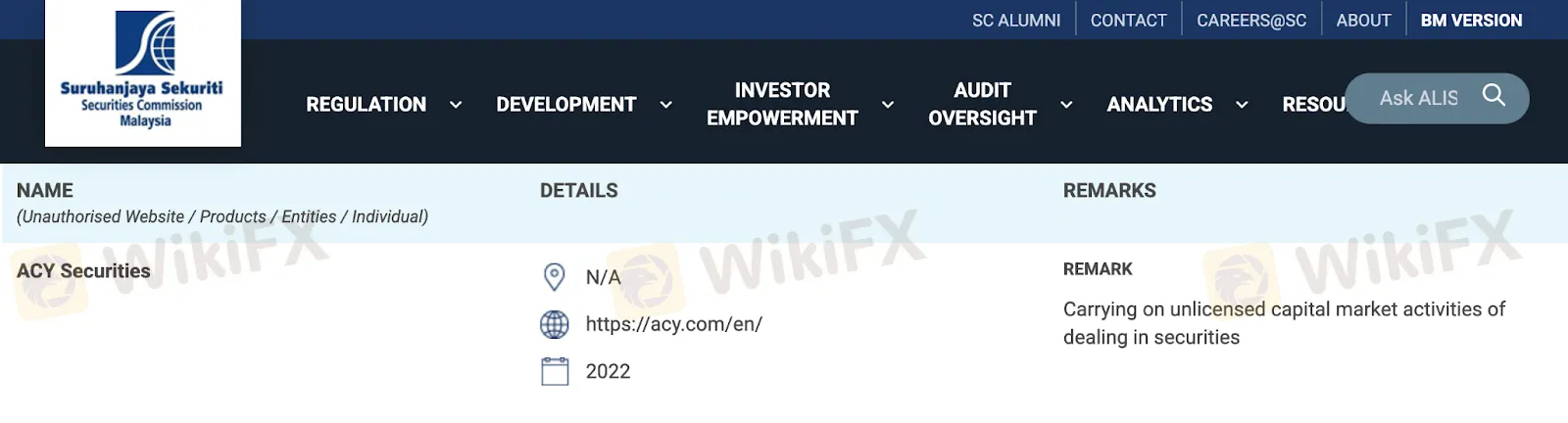

Another important thing to note is that Malaysias Securities Commission (SC) has also flagged this broker in its Investor Alert List.

A Wider Concern

Though this case centers on Japan, the methods are common across Asia. Scammers use social media, messaging apps, and shared cultural ties to gain trust. Authorities warn these tactics may also spread to places like Malaysia, where there are large overseas Chinese communities.

The case of Chen Mansato shows how dangerous it can be to trust personalities instead of verified institutions. With scams growing more advanced, especially within migrant communities, investors must rely on regulatory checks, due diligence, and caution before acting on unsolicited financial offers.

At WikiFX, our mission is to empower investors with the knowledge and tools required to make safe, informed decisions. When selecting an overseas broker, we strongly advise exercising due diligence and, wherever possible, choosing one regulated by a reputable authority such as Australia‘s ASIC, the United Kingdom’s FCA, or other recognised regulators.

Should you fall victim to fraudulent activity, it is essential that you act without delay. We recommend reporting the matter to the police or consulting a qualified solicitor, as well as contacting your local consumer affairs office.

To further support investors, the WikiFX app delivers daily push notifications highlighting brokers identified as posing withdrawal risks. For timely updates and reliable protection, we encourage you to download the app.

Read more

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

31 Malaysians rescued from Myawaddy scam center returned home after joint cross-border operation

Italy’s CONSOB Blocks Five Illegal Investment Sites

CONSOB orders the blocking of five unauthorized investment websites in Italy as part of its ongoing effort to curb financial fraud and protect investors.

Police Smash Forex Scam Network Operating from Pahang

A police raid on an unassuming home in Pahang has exposed a covert app-based fraud operation targeting foreign investors.

FSMA Warns of Fraudulent WhatsApp Investment Groups

FSMA alerts the public to growing WhatsApp scams using fake investment tips, identity theft, and fraudulent trading apps targeting investors on social media.

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

Biggest 2025 FX surprise: USD/JPY

NFA Charges Japan’s Forex Wizard and Mitsuaki Kataoka With Delaying Withdrawal Requests

Why Your Entries Are Always Late (And How to Fix It)

【WikiEXPO Global Expert Interviews】Robert Hahm: From Asset Management to AI Innovation

Treasury vs. Fed: Bessent leads Trump's Campaign to Reshape US Monetary Policy

Ceasefire on the Brink: 14 Nations Condemn Israel as Geopolitical Risk Premiums Rise

Ringgit hits five-year high against US dollar in holiday trade

Rate Calc