Three Choices, None Good

Abstract:We like to think we're special and this moment in history is special, but alas, we're still running

We like to think we're special and this moment in history is special, but alas, we're still running Wetware 1.0which was coded between 300,000 and 60,000 years ago, when the last “out of Africa” migration finally got traction. Since then, the code has been tweaked a bit here and there (adults can now digest dairy products, etc.), but we're running the old code, and so we make the same mistakes and follow the same emotional pathways as individuals and as groups.

Which leads us to our current predicament, which is not unique: we're living on debt, “money” borrowed from the future, a future we're assuming will be so over-supplied with energy and other goodies that we'll be able to pay all the interest we're piling up with ease.

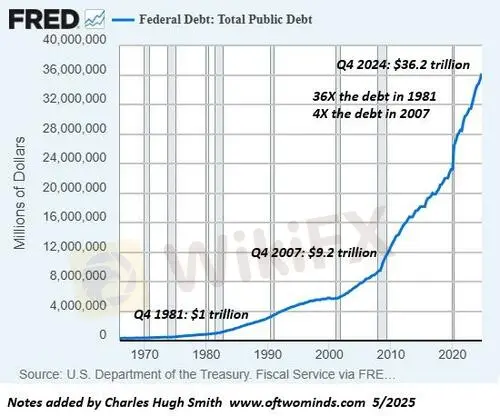

All the charts below are shouting “parabolic,” as in . There's the federal debt, $36 trillion, up 4X from the 2008 spot of bother, there's TCMDO, total public and private debt (McMansions, university degrees and SUVs all paid for with debt), student loans from zero to $1.5 trillion, Medicare and Medicaid, now 1/3 of the federal budget, and so on.

How did we get here? Let's start with what's not taught in Econ 101: Every economy--from households to empires, meaning this is --generates a surplus from its production of goods and services, or it runs a deficit, meaning it has to get more money from somewhere to support its consumption.

The question then becomes, how is the primary surplus being spent?(Or put another way, how is it being distributed across the economy and society?) There are only three options: 1) consume it, 2) invest it and 3) save it / hoard it.

Without making a conscious choice, the US has chosen to “invest” most of its primary surplus in , unproductive frauds, skims, scams, monopolies, cartels, regulatory capture, grift and graft.

This is the problem with giving an irresponsible teenager a no-limit Platinum credit cardwith an easily ignored admonishment to “stick to a tight budget, pay the balance off every month.” Uh, right.

Since the US can borrow unlimited trillions on its credit card, we can “afford” to burn our surplus on grift, graft, inefficiency, cronyism, profiteering, etc.Since our surplus was squandered on , we have to borrow trillions to pay for what the citizenry wants and what politicians must promise to get re-elected.

Wetware 1.0: we like windfalls and free stuff, and so every program becomes a “third rail” politically: touch it and you don't get re-elected. But if you borrow a few “free” trillions a year, you get re-elected.

We love windfalls and free stuff and hate hard choices, but that's all we have now.

We have three choices in how we deal with our dependence on parabolic debt to sustain our profligate lifestyle:

1. Run the debt up to the point that nobody is dumb enough to lend us more, and then default on the debt/ go bankrupt. All our creditors are wiped out.

The problem here is Since the wealthy run the status quo in a manner that serves their interests, they're unlikely to be thrilled with that zero out their assets and income or messy defaults that end up doing the same thing.

So nix that option. The wealthy want to keep their wealth and income streams, and since they own US Treasuries, they're not going to approve defaulting on that debt.

2. Inflate the debt away with sustained high inflation.So we borrowed $1 when $1 bought a lot of stuff, and now we've inflated everything so it takes $10 to buy what $1 bought back then. Now we can pay back the $1 with a fraction of the earnings it took back when we borrowed it.

We've already taken that step--what once cost $1 now costs $10.So the next step is to do another 10X reduction in the debt via inflation.

In previous eras, authorities reduced the silver content of coinage to near-zero, effectively devaluing the money, i.e. inflating away the debt.What cost one mostly-silver denarius in the good old days soon cost 100 devalued denarius.

This looks like some pretty easy hocus-pocus to pull off, but there's a catch:, which is , all of which leaves the economy and society a hollowed-out shell awaiting a stiff breeze to push the whole system off the cliff.

The problem here is inflation is distributed asymmetrically, along with the primary surplus.The wealthy, powerful elites skim off the surplus, and they're equally adept at distributing the “inflation tax” to the middle and working classes, which soon meld into a single class,

A funny thing about Wetware 1.0 is we're hard-wired to take note of rampant unfairness and eventually we respond in a destabilizing fashion,for example, uprisings, revolts, revolutions, etc.

3. The third option is to root out all the that's consuming the economy's surplus and our future, scrap all the programs designed in the bygone eras of 50+ years ago (defense, Social Security, Medicare, Medicaid, higher education, etc.) and start from scratch with new programs whose expenses are limited to what the economy generates as surplus.

In other words, go Cold Turkey on our addiction to living on debt.

Yes, I know: , because the is too deep, it's now to the point that we don't even recognize the reality that there's nothing left but a flimsy facade we paint with gaudy colors to hide the rot.

Everyone assumes the empire is forever and can endlessly fund any amount of grift and graft with borrowed money. But this is a self-serving fantasy, not reality. Every empire of debt implodes.

These charts are merely facts. If we find them depressing, that response says something about our refusal to be accountable and responsible for our choices.Who's going to cut up the unlimited Platinum card?

The federal government's Platinum card balance:

The US economy's Platinum card balance:

Student loans Platinum card balance:

Medicare, which has an unlimited Platinum card:

Medicaid, which also has an unlimited Platinum card, though this is obscured by phony “reforms”:

There are only three options, none easy, and not making a choice is a greased slide to collapse.The of unlimited debt looks “free” but it's unaffordable in the end.

WikiFX Broker

Latest News

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

RM783,000 Gone: Restaurant Owner Fell Victim to an 85%-Return Investment Scheme

Complete Breakdown: MARKET-HUB Regulation & All Negative Reviews Exposed

Exposure: NAGA’s "Phantom Bonus" Trap and the $80,000 Silent Treatment

ATFX Partners with KX to Enhance Real-Time Trading Solutions

ThinkMarkets Hit By Chaos Ransomware In Major Data Breach

Interactive Brokers Opens Access to Brazil’s B3 Exchange

Rate Calc