Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Abstract:Attracted to Advanced Markets for the expert-led copy trading experience? Did you earn profits from the copy trade executed by the expert hired by the forex broker? But did the broker question some trades even though you paid the performance fee to the expert? Is the trade order execution time too slow at Advanced Markets? Do you witness high slippage issues? You are not alone! Many traders have shared these concerns online. In this Advanced Markets review article, we have described some complaints. Take a look!

Attracted to Advanced Markets for the expert-led copy trading experience? Did you earn profits from the copy trade executed by the expert hired by the forex broker? But did the broker question some trades even though you paid the performance fee to the expert? Is the trade order execution time too slow at Advanced Markets? Do you witness high slippage issues? You are not alone! Many traders have shared these concerns online. In this Advanced Markets review article, we have described some complaints. Take a look!

Advanced Markets Overview

Advanced Markets, established in 2006, has been offering DMA liquidity and trading solutions to its clients worldwide. Its client list includes banks, hedge funds, institutions, and retail traders. The company drives its forex and other trading operations from the United Kingdom.

Elaborating on the Top Forex Trading Complaints Against Advanced Markets

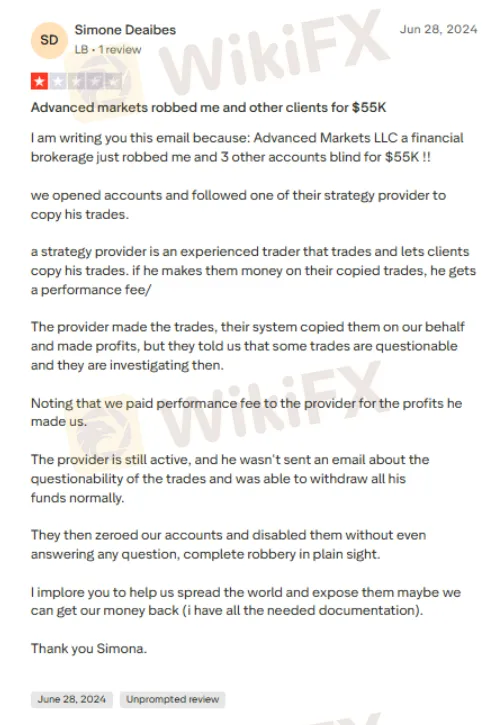

Poor Copy Trading Experience at Advanced Markets, Claims the Trader

A trader recounted a poor copy trading experience wherein an expert hired by Advanced Markets copied a successful trading strategy and implemented it on his trades. The strategy worked as the trader earned profits. However, the broker questioned some trades and informed the trader that an investigation will be made to check their legality. The trader had already paid a performance fee to the expert. Besides, there was no email sent to the expert about the questionable trades. Baffled by the poor trading experience, the trader shared a negative Advanced Markets review as shown below.

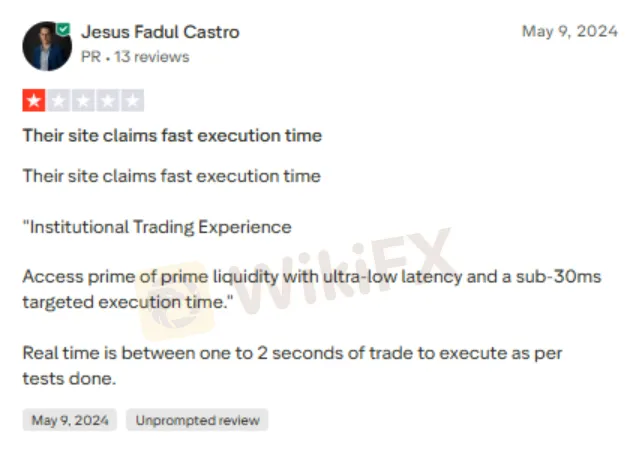

The False Claim of Superfast Trade Order Execution Time

Advanced Markets claim that it offers ultra-low latency on its Prime of Prime Liquidity and a trade order execution time of sub-30ms. However, as per the trader, the order execution time is around one to two seconds. Check out this screenshot supporting this complaint.

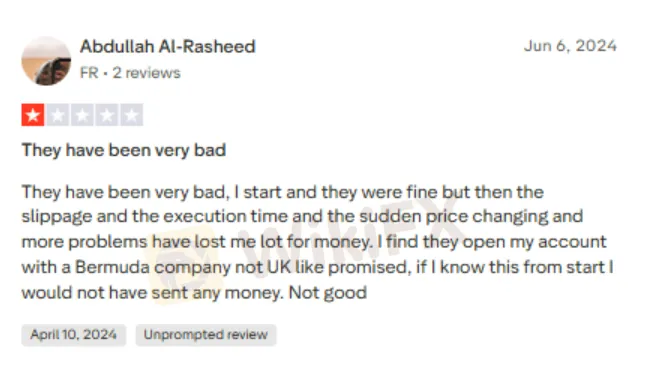

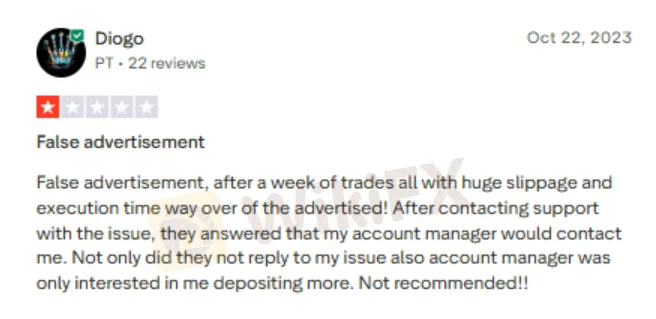

High Slippage & Sudden Price Changes Pile Losses for Traders

Recounting a bad forex trading experience with Advanced Markets, traders mention that things have become worse here as high slippage, slow trade order execution and sudden price changes took effect. Amid losses due to these poor trading circumstances, they shared these bad Advanced Markets reviews.

Advanced Markets Review by WikiFX: Check the Score & Regulatory Status

After reading the complaints, the common point that emerged was the false promise on every trading aspect, including copy trading and trade order execution. A thorough analysis of the complaints was followed by a crucial investigation of Advanced Markets regulatory frameworks. The investigation revealed no license for the broker, further raising suspicion over the capital's safety. Consequently, the team gave Advanced Markets a score of just 2.19 out of 10.

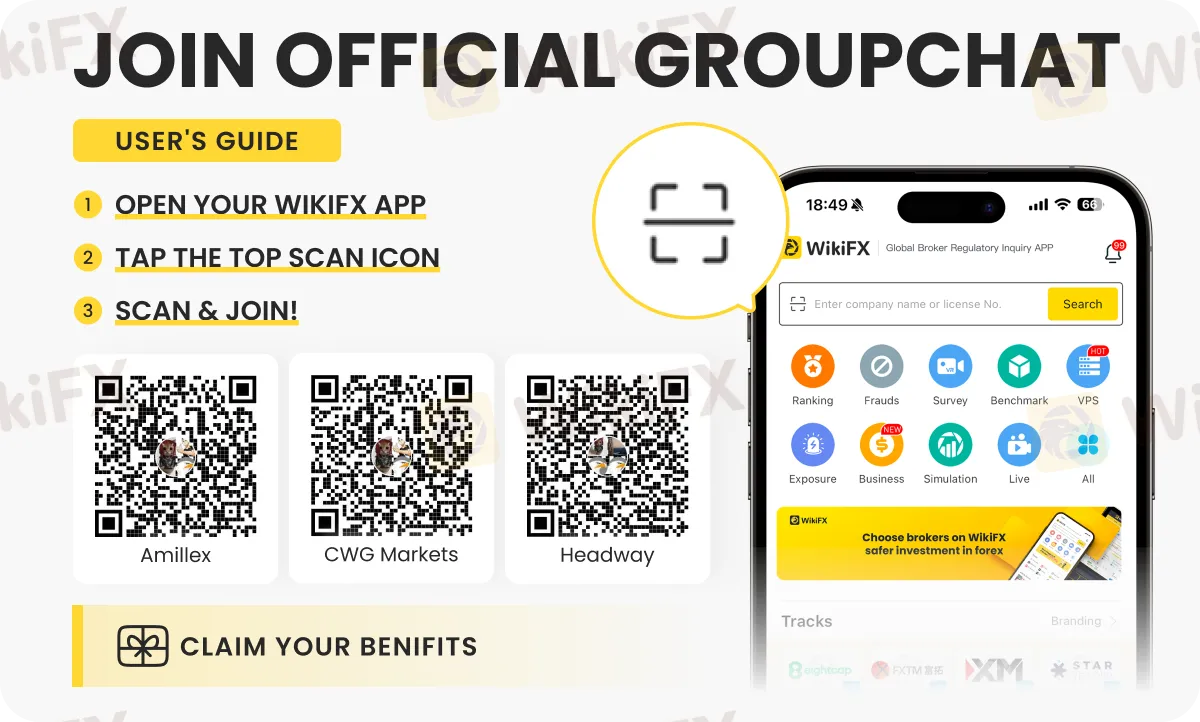

Want to know about the latest strategies that can help you navigate an ever-evolving forex market? Join these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G).

Read more

Is WisunoFX Safe? An Unbiased 2025 Assessment of Platform Risks and Red Flags

Is WisunoFX a safe broker for your money? The answer is not simple. After looking at everything carefully, the platform gets a score of 7.21 out of 10. This means it has both good points and serious risks. For traders who want to research before investing, WisunoFX has two sides: it offers good trading conditions, but it also has some structural and regulatory issues that need careful thought. The broker has been operating for 5-10 years and has built up a presence in the market. However, it's officially labeled as a "Medium potential risk" platform, which cannot be ignored. Before investing, it's important to compare its good points with its bad ones.

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

When evaluating any trading company, it is essential to conduct a thorough WisunoFX regulation check first. This broker operates under two distinct sets of rules, which you must understand carefully. First, it has a license from the Cyprus Securities and Exchange Commission (CySEC), which is a trusted European regulator. Second, it has another license from the Financial Services Authority (FSA) in Seychelles, which is located offshore. These two licenses don't give traders the same level of protection. The CySEC license means the broker must follow strict European Union financial rules, while the FSA license has much less supervision. This guide will explain what each license means to traders, look at the company structure behind the brand, and examine the safety factors every potential client should think about.

Is TradeEU Global Safe? Reports of Extra Deposit Requests, High Spreads & Trader Losses

Does TradeEU Global demand an extra deposit every time you raise fund withdrawal requests? Does the constant deposit and trading pressure make you bear capital losses? Are the high spreads lowering your trading gains? Many traders have criticized the Mauritius-based forex broker for allegedly carrying out these fraudulent trading activities. In this TradeEU review article, we have disclosed some complaints. Take a look.

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

Despite claiming legitimate regulation, Zenstox has become the subject of an alarming surge in complaints regarding blocked withdrawals and aggressive account mismanagement. WikiFX investigates the pattern where "personal account managers" allegedly guide traders into debt, only to lock the doors when it’s time to cash out.

WikiFX Broker

Latest News

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

BLITZ finance Review 2025: Is It a Scam? License and Safety Evaluation

Inside Darwinex Broker Review: Regulation Explained & Authentic User Complaints

B2CORE Update Enhances Forex Broker Operations and CRM Systems

MIFX Regulation, Is This Indonesian Broker Safe?

The "Invalid Profit" Trap & The Withdrawal Maze: A Deep Dive into MultiBank Group

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

9X Markets Review: Is It Reliable?

Rate Calc