ThinkMarkets Hit By Chaos Ransomware In Major Data Breach

Abstract:Australian broker ThinkMarkets suffers a Chaos ransomware attack; 512GB of sensitive company and client data leaked online.

ThinkMarkets Suffers Ransomware Breach

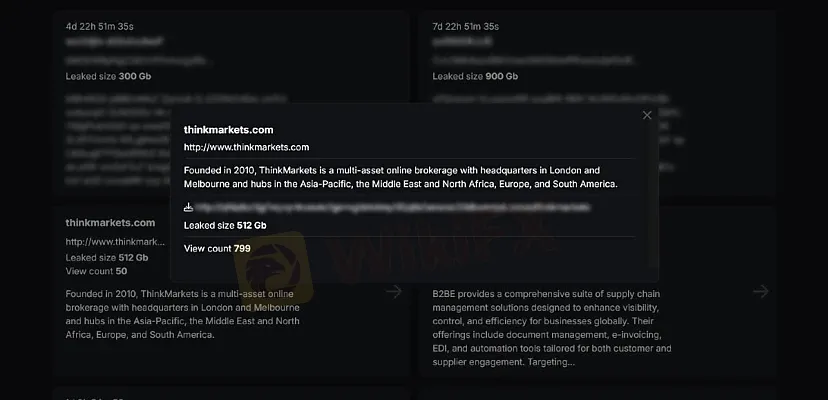

Australian online brokerage ThinkMarkets has been listed as a victim of a ransomware attack by a group calling itself Chaos, which claims to have stolen and leaked 512 gigabytes of sensitive data.

The group posted ThinkMarkets on its dark web extortion site on 8 December, alongside another unnamed victim. The leaked files appear to include human resources records, client disputes, legal advice, company policies, and trading information. Cyber Daily reporters also observed passport scans of employees and know-your-customer (KYC) documents belonging to clients.

ThinkMarkets has not issued a public statement or responded to requests for comment.

Who is Chaos?

Chaos is a relatively new ransomware group, first detected in February 2025, and has claimed 28 victims to date. Analysts at Talos Intelligence describe the group as active on Russian-language hacking forums, where it promotes its ransomware and recruits affiliates.

The malware is advertised as compatible with Windows, ESXi, Linux, and NAS systems, offering features such as individual file encryption keys, rapid encryption speeds, and network resource scanning. Chaos also provides an automated management panel for affiliates, requiring a paid entry fee that is refunded after the first ransom payment.

The group has stated it avoids targeting BRICS/CIS countries, hospitals, and government entities, focusing instead on corporate victims.

About ThinkMarkets

Headquartered in Melbourne, ThinkMarkets operates globally with offices in the Middle East, South Africa, Europe, and the United States. Originally launched as ThinkForex in 2012 under regulation by the Australian Securities and Investments Commission (ASIC), the firm rebranded as ThinkMarkets in 2016.

The company markets itself as a provider of innovative online trading services, offering clients advanced tools, educational resources, and customer support.

Read more

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

FBS Forex Scam Alert: High Complaint Ratio

FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Swissquote Scam Alert: 53/64 Negative Cases Exposed

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

Rate Calc