RSL

Abstract:RSL is an unregulated service provider of premier brokerage and financial services, which was founded in Pakistan in 2004. It offers trading on commodities, stocks, indices, forex, options, and futures on Vtrade, PMEX Software, and MT5 platforms. The minimum deposit is PKR 25,000.

| RSL Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Pakistan |

| Regulation | No regulation |

| Market Instruments | Commodities, stocks, indices, forex, options, futures |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | Vtrade, PMEX Software, MT5 |

| Minimum Deposit | PKR 25,000 |

| Customer Support | 24/5 support, contact form |

| Tel: 021-111-159-111 | |

| Whatsapp: 0337-3159159 | |

| Email: Info@rafionline.com | |

| Facebook, X, Instagram, Linkedin | |

| Address: 1004, 10th Floor, Al-Rahim Towers I.I Chundrigar Road, Karachi | |

RSL Information

RSL is an unregulated service provider of premier brokerage and financial services, which was founded in Pakistan in 2004. It offers trading on commodities, stocks, indices, forex, options, and futures on Vtrade, PMEX Software, and MT5 platforms. The minimum deposit is PKR 25,000.

Pros and Cons

| Pros | Cons |

| Long operation time | Lack of regulation |

| Various trading products | Commission fees charged |

| Demo accounts | Limited info on deposit and withdrawal |

| MT5 platform | |

| Various contact channels |

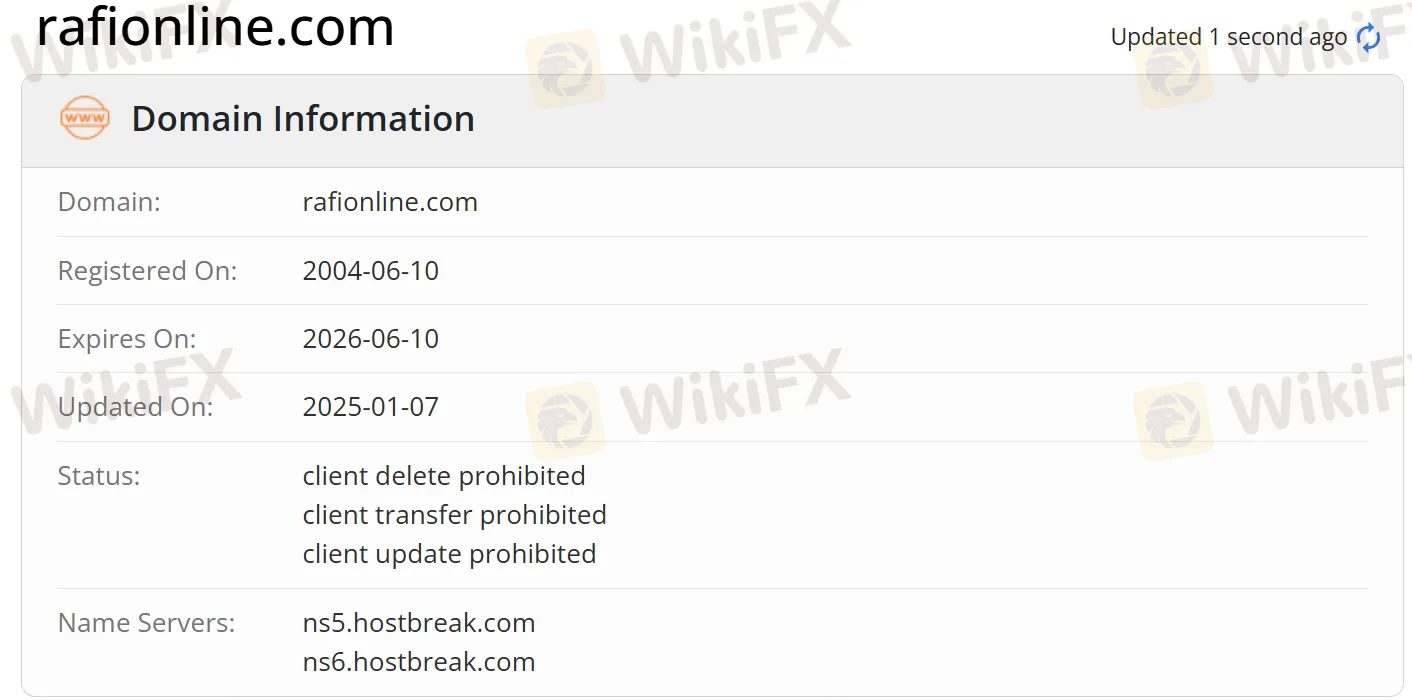

Is RSL Legit?

No. RSL currently has no valid regulations. Please be aware of the risk!

Besides, its domain status shows that client transferring, deleting and updating are prohibited.

What Can I Trade on RSL?

| Trading Instruments | Supported |

| Commodities | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Forex | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Cryptos | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

RSL Fees

RSL offers flexible commission options, varying by trading instruments type.

| Category | Service/Instrument | Commission/Fee | Additional Notes |

| Equity Trading | Local Stocks | 0.25% of trade value (min ₹20 per order) | Lower rates for high-volume traders |

| IPO Applications | ₹50 per application | Refundable if allotment fails | |

| Derivatives Trading | Futures | 0.03% of trade value (min ₹20 per order) | Intraday discounts available |

| Options | ₹50 per lot | Flat fee regardless of contract size | |

| Currency & Commodities | Currency Derivatives | 0.02% of trade value (min ₹15 per order) | |

| MCX Commodities | 0.04% of trade value (min ₹25 per order) | ||

| Account Fees | Demat Account Annual Fee | ₹300/year | Waived for first year |

| Trading Account Maintenance | ₹0 | ||

| Other Charges | Brokerage Plans | Flat Fee Plan: ₹999/month (unlimited trades) | Contact for negotiated corporate rates |

| Volume Discounts: Custom rates | |||

| Call & Trade | ₹20 per executed order | 0 for online trading | |

| Pledge Creation | 0.02% of loan value (min ₹100) |

More details can be found via https://rafionline.com/Comission-charges

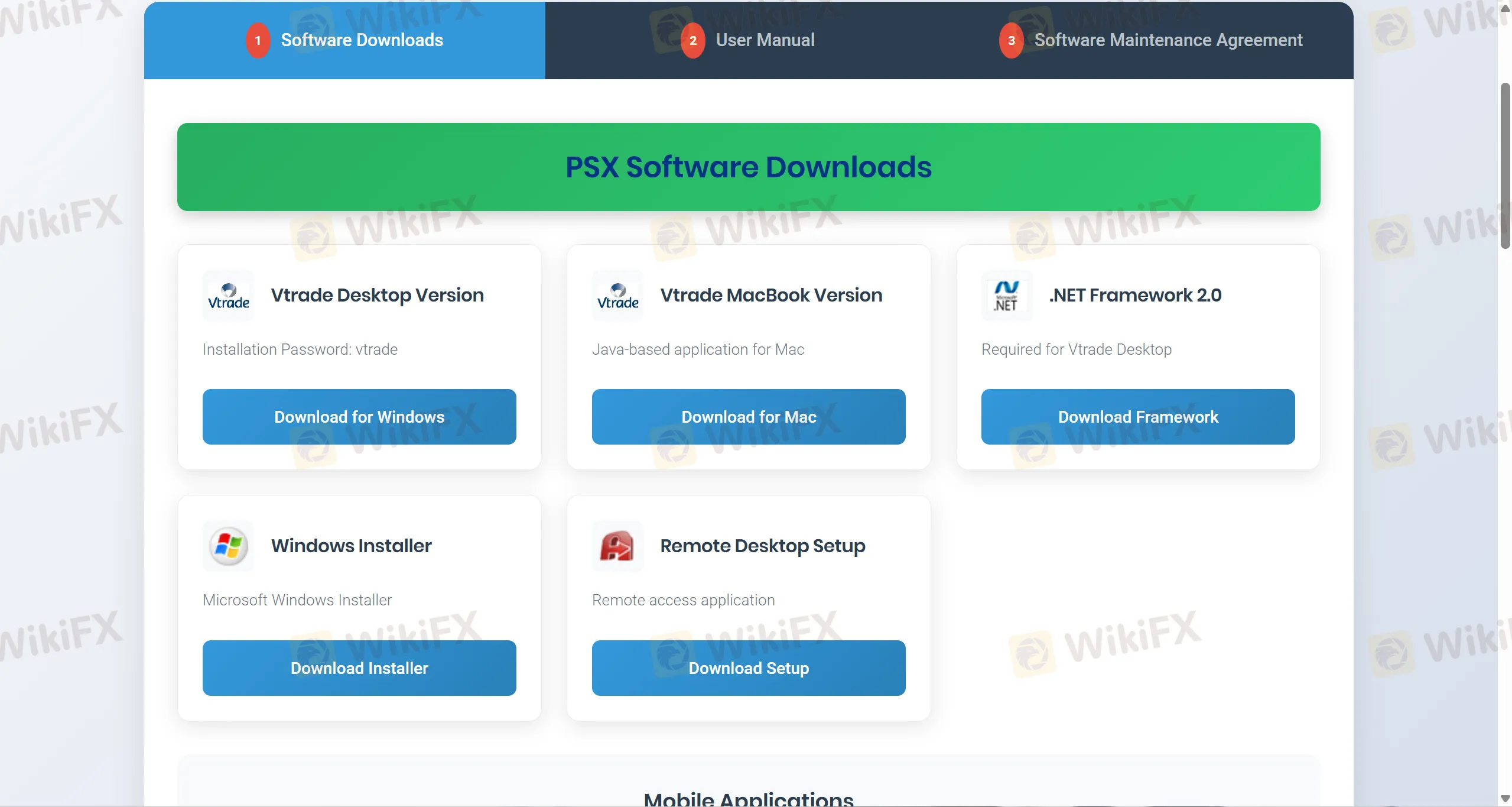

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Vtrade | ✔ | PC, web, mobile | / |

| PMEX Software | ✔ | PC, web, mobile | / |

| MT5 | ✔ | PC | Experienced traders |

| MT4 | ❌ | / | Beginners |

WikiFX Broker

Latest News

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

Why You’re a Millionaire on Demo but Broke in Real Life

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

JPMorgan Chase Eyes Crypto Trading for Institutional Clients

Voices of the Golden Insight Award Jury | Dennis Yeh, Head of Asia Pacific Region at Taurex

Fake Government Aid Scams Are Wiping Out Elderly Savings

The "Paper Money" Lie: Why Your Demo Win Streak Means Nothing

QuoMarkets Review 2025: Safety, Features, and Reliability

The Richest Traders in History and the Strategies Behind Their Success

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Rate Calc