FDC

Abstract:FDC Tech is a fintech-driven acquisition company specializing in acquiring and integrating small to medium-sized traditional financial services enterprises (such as brokers and wealth management firms). It replaces obsolete systems with its self-developed Condor trading technology infrastructure. In 2023, it acquired Alchemy Markets, a European brokerage, Alchemy Prime, a UK institutional brokerage; and AD Advisory Services, an Australian wealth management company. Its business covers multi-asset trading fields including foreign exchange, stocks, ETFs, and cryptocurrencies.

| FDC Review Summary | |

| Registered | 2017 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Forex, Commodities, Stocks, Cryptocurrencies, Futures, ETFs |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

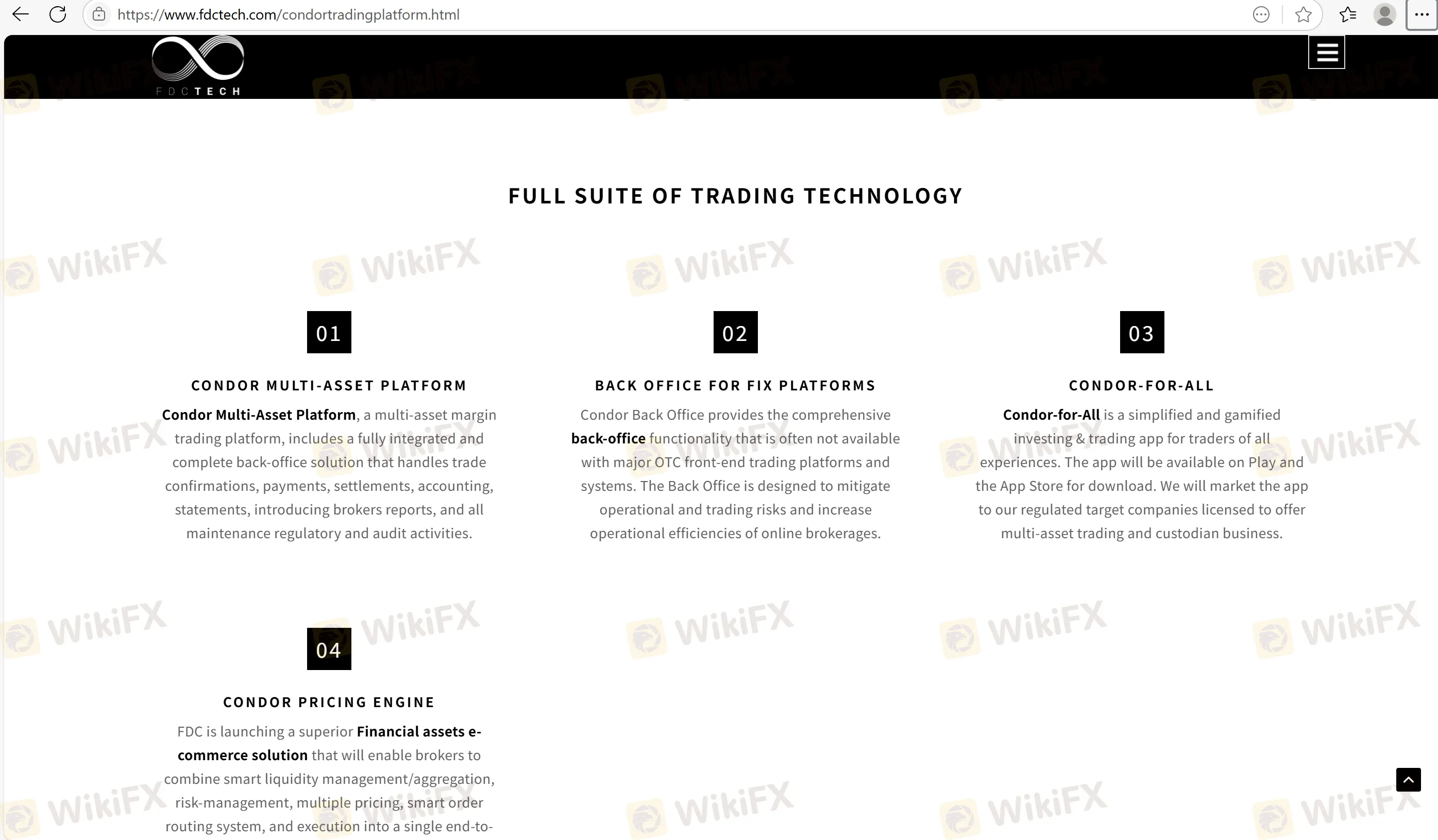

| Trading Platform | Condor Multi-Asset Platform, Condor-for-All, Condor Pricing Engine, FIX |

| Minimum Deposit | / |

| Customer Support | +1 877-445-6047 |

| info@fdctech.com | |

| LinkedIn, Twitter, YouTube | |

FDC Information

FDC Tech is a fintech-driven acquisition company specializing in acquiring and integrating small to medium-sized traditional financial services enterprises (such as brokers and wealth management firms). It replaces obsolete systems with its self-developed Condor trading technology infrastructure. In 2023, it acquired Alchemy Markets, a European brokerage, Alchemy Prime, a UK institutional brokerage; and AD Advisory Services, an Australian wealth management company. Its business covers multi-asset trading fields including foreign exchange, stocks, ETFs, and cryptocurrencies.

Pros and Cons

| Pros | Cons |

| Demo account available | Not regulated |

| Diversified trading instruments | Acquisition and integration risks |

| Four trading platforms | Unclear fee information |

Is FDC Legit?

FDC Tech is not regulated. It is recommended that traders prioritize choosing regulated brokers.

What Can I Trade on FDC?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Futures | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Condor Multi-Asset Platform | ✔ | / | / |

| Condor-for-All | ✔ | iOS/Android | / |

| Condor Pricing Engine | ✔ | / | / |

| FIX | ✔ | / | / |

Read more

OspreyFX Review: Do Traders Face High Slippage and Wide Spreads?

Are your funds stuck with OspreyFX, a Saint Vincent and the Grenadines-based forex broker? Does your trade execution price always remain far away from the requested price due to heavy slippage? Does the broker, contrary to its claims of low-cost trading experience, widen spreads to inflate your costs? Like others, do you always witness constant fund withdrawal denials by the broker? In this OspreyFX review article, we have investigated complaints against the forex broker. Read on!

Xlibre Deposit and Withdrawal Methods: A Complete 2026 Review

When choosing a broker, how you move capital in and out of your account is extremely important. Investing funds and withdrawing them out are not just simple tasks - they show whether a broker is trustworthy and works properly. It doesn't matter if putting money in is easy if you can't get your money back out. This guide explains Xlibre deposit and withdrawal methods, but we also talk about managing risks and being careful. Sometimes it's easy to deposit funds in an account, but very hard to take out your profits and original capital. Our main goal is to keep your funds safe by giving you a clear analysis of how these processes work and, more importantly, what risks they involve.

Xlibre User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

When traders want to know if a broker is safe or a scam, they want a clear answer based on facts. After carefully studying regulation data and reports from users, Xlibre appears to be a high-risk brokerage. The direct answer to "Is Xlibre Safe or Scam?" is clearly no - it's not safe. The platform works without any proper financial regulation from a trusted authority, which is absolutely necessary to keep traders’ finances safe. This lack of oversight gets worse when you add the serious user complaints saying they cannot withdraw large amounts. These two problems - no regulation and believable claims about blocked withdrawals - are major warning signs. While "scam" is a legal term, Xlibre shows a pattern that puts it clearly in the unsafe and untrustworthy category. This article will break down the evidence step by step, giving you the information you need to make a smart decision and protect your capital.

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

Is HeroFx safe? Uncover withdrawal problems, payout issues, and scam risks before depositing. Download the WikiFX App now for regulation checks and trader complaints.

WikiFX Broker

Latest News

Canadian Regulators Say More Than 7,500 Fraudulent Investment and Crypto Websites Were Taken Down

Oil prices jump above $100 for first time in four years

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

US NFP Preview: Markets Brace for Volatility as Employment Data Tests Fed's Patience

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

JRJR Review: Safety, Regulation & Forex Trading Details

Middle East Conflict Esculates: Cloud Infrastructure Targeted as US & Israel Strike Tehran

9X markets Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc