Icahn Enterprises

Abstract:Icahn Enterprises FX, a subsidiary of Icahn Enterprises LP, offers trading services in the financial markets. Operating under the leadership of Mr. Carl Icahn, the company is headquartered in Milton Towers, Sunny Isles Beach, Florida. Founded on February 17, 1987, Icahn Enterprises FX provides access to a 1000+ currencies. With competitive spreads and a user-friendly mobile trading platform, it attracts traders seeking convenience and cost-effective trading options. However, the platform's lack of regulatory oversight may pose challenges for some traders, necessitating careful consideration before engaging with the platform.

| Aspect | Information |

| Company Name | Icahn Enterprises FX |

| Registered Country/Area | United States |

| Founded Year | 1987 |

| Regulation | Unregulated |

| Market Instruments | Forex |

| Account Types | N/A |

| Minimum Deposit | 4,000 yen |

| Maximum Leverage | N/A |

| Spreads | Competitive (e.g., USD/JPY: 0.2 pips) |

| Trading Platforms | Icahn Enterprises FX Trading Platform |

| Customer Support | +1 781 575 4223 |

Overview of Icahn Enterprises FX

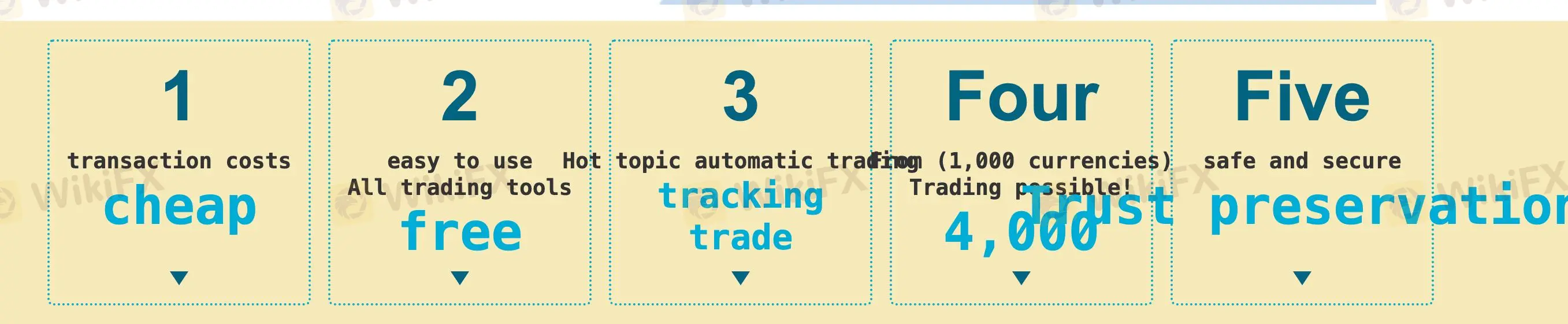

Icahn Enterprises FX, a subsidiary of Icahn Enterprises LP, offers trading services in the financial markets. Operating under the leadership of Mr. Carl Icahn, the company is headquartered in Milton Towers, Sunny Isles Beach, Florida. Founded on February 17, 1987, Icahn Enterprises FX provides access to a 1000+ currencies.

With competitive spreads and a user-friendly mobile trading platform, it attracts traders seeking convenience and cost-effective trading options. However, the platform's lack of regulatory oversight may pose challenges for some traders.

Regulatory Status

Icahn Enterprises FX operates without regulation, rendering it unauthorized for trading activities.

Pros and Cons

| Pros | Cons |

| Competitive spreads (e.g., USD/JPY: 0.2 pips, JPY/GBP: 1.0 pips) | Limited range of trading assets |

| Mobile phone trading platform available | Lack of regulatory oversight |

| 1000 currencies available | User exposure about unresponsive to complaints |

Market Instruments

Icahn Enterprises FX provides a comprehensive selection of forex trading assets, empowering users with precise control over position management.

By offering trading in currency increments rather than the standard, traders can optimize their strategies. For instance, trading USD/JPY typically requires a margin at a ratio. However, with currency increments, the margin reduces, facilitating smaller transactions.

Spreads & Commissions

At Icahn Enterprises FX, transaction costs are notably low, with spreads ranking among the narrowest in the industry. For instance, the spread for USD/JPY stands at 0.2 pips, while for JPY/GBP, it is 1.0 pip.

Trading Platform

Icahn Enterprises FX offers a proprietary trading platform known as the Icahn Enterprises FX Trading Platform.

This platform is compatible with iOS, Android, and Mac operating systems, providing flexibility for users across different devices.

The Android version of the platform is highlighted for its trading speed and competitive advantage, featuring one-touch trading, customizable screen layouts, access to trading history data, advanced drawing tools, and over 30 indicators for market analysis and account management.

An offline mode is available, allowing users to access price and graph data even without an internet connection. The platform is available for free download from the respective app stores.

Deposit & Withdrawal

Enterprises FX Transactions offer a flexible minimum deposit requirement, starting from 4,000 yen.

This allows traders to initiate transactions with a relatively small amount, facilitating entry into the market for beginners or those seeking to minimize risk. With the option to trade in 1,000 currency increments rather than the conventional 10,000, traders gain enhanced control over position management. For instance, trading 10,000 USD/JPY with a 1 dollar = 100 yen ratio typically requires a 40,000 yen margin. However, with the ability to trade in 1,000 currencies, the margin reduces to 4,000 yen, enabling traders to engage in transactions with smaller amounts.

Moreover, the platform permits up to 10 positions with varying rates for each 1,000 currencies.

Customer Support

Icahn Enterprises FX offers a single customer support channel via phone to assist users with inquiries and risks. Their dedicated support team can be reached via phone at +1 781 575 4223, providing prompt assistance and guidance.

Exposure

User reviews of Icahn Enterprises FX reveal a significant level of dissatisfaction and distrust among some users.

One reviewer alleges the company's failure to deliver promised profits and accuses them of being unresponsive to complaints.

Such negative experiences can erode trust in the platform and discourage potential traders from engaging with it. The exposure of such reviews can also tarnish the platform's reputation, potentially leading to decreased user activity and participation.

Conclusion

Icahn Enterprises FX, a subsidiary of Icahn Enterprises LP, offers trading services primarily in forex markets with over 1000 currency options. The platform attracts traders with its competitive spreads and user-friendly mobile trading platform. However, the absence of regulatory oversight poses risks for traders, necessitating caution.

FAQs

What is the minimum deposit required to start trading with Icahn Enterprises FX?

The minimum deposit is 4,000 yen, allowing traders to begin trading with a relatively small investment.

How can I contact customer support at Icahn Enterprises FX?

You can reach customer support via phone at +1 781 575 4223, email, or live chat for prompt assistance.

What trading instruments are available on Icahn Enterprises FX?

Icahn Enterprises FX offers forex trading with over 1000 currency options, providing diversified trading opportunities.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

BitPania Review 2026: Is this Broker Safe?

Rate Calc