Point

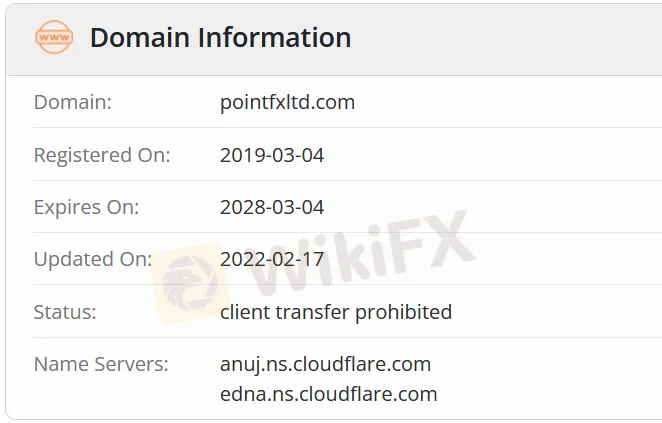

Abstract:Point trader group was registered in 2019 in Mauritius. It offers diverse trading instruments including Forex, Indices, Energies, Precious Metals, Commodities, CFDs, Cryptocurrencies, US Equities and Agriculture. However, this company is currently unregulated.

| Point trader group Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Mauritius |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Energies, Precious Metals, Commodities, CFDs, Cryptocurrencies, US Equities, Agriculture |

| Demo Account | ✅ |

| Leverage | Up to 1:100 |

| Spread | 1 pip (Standard account) |

| Trading Platform | MT5 |

| Minimum Deposit | $500 |

| Customer Support | Phone: +230 5942 2303 |

| Email: support@pointfxltd.com, info@pointfxltd.com | |

| Address: The Catalyst, Suite 201, 2nd Floor, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius | |

Point trader group Information

Point trader group was registered in 2019 in Mauritius. It offers diverse trading instruments including Forex, Indices, Energies, Precious Metals, Commodities, CFDs, Cryptocurrencies, US Equities and Agriculture. However, this company is currently unregulated.

Pros and Cons

| Pros | Cons |

| Diverse trading instruments | Unregulated status |

| Various account types | High minimum deposit |

| No commissions | |

| MT5 available |

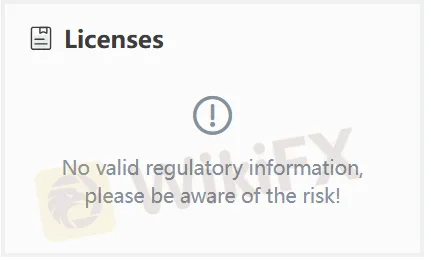

Is Point trader group Legit?

No. Point trader group has no regulations currently. Please be aware of the risk!

What Can I Trade on Point trader group?

Point trader group provides a range of choices like Forex, Indices, Energies, Precious Metals, Commodities, CFDs, Cryptocurrencies, US Equities and Agriculture.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Energies | ✔ |

| Precious Metals | ✔ |

| Commodities | ✔ |

| CFDs | ✔ |

| Cryptocurrencies | ✔ |

| US Equities | ✔ |

| Agriculture | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

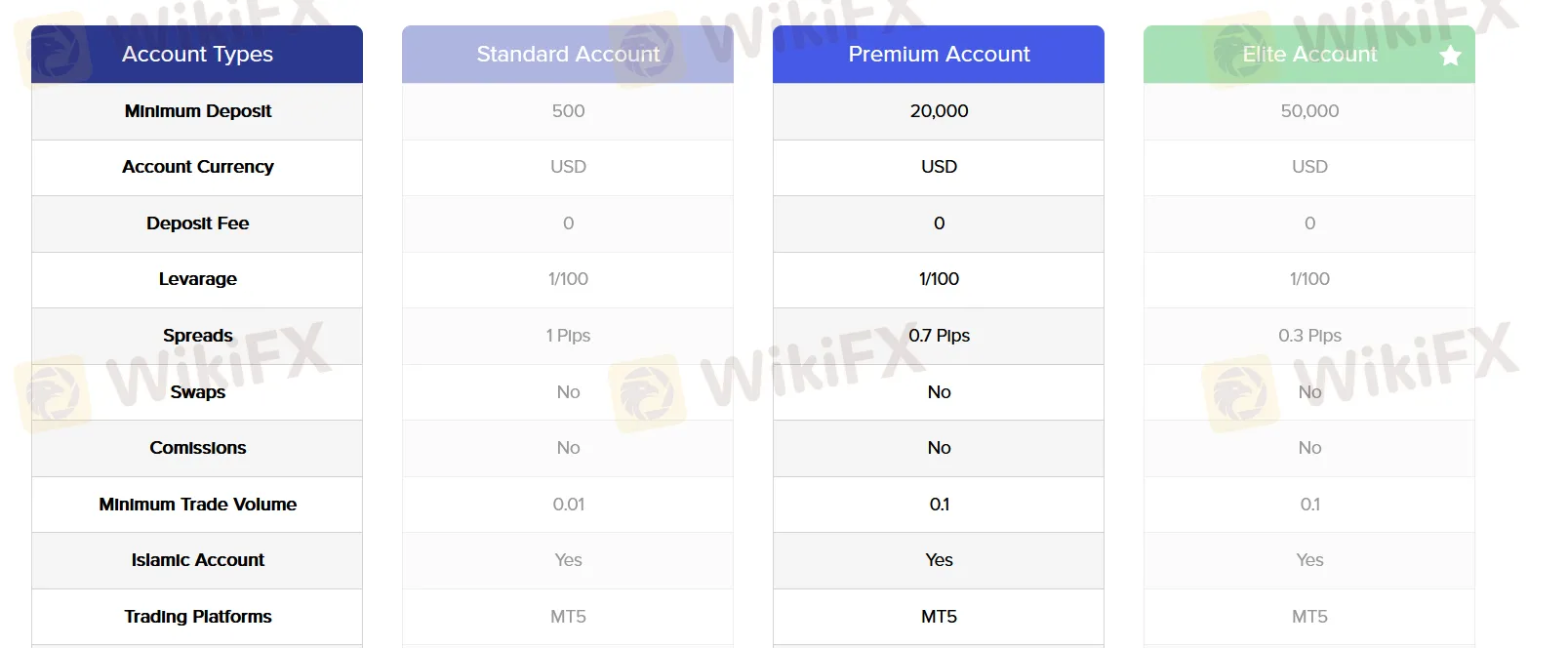

Account Type

| Account Type | Minimum deposit |

| Standard | $500 |

| Premium | $20,000 |

| Elite | $50,000 |

Leverage

Point trader group offers leverage up to 1:100 for all account types. Please note that high leverage can amplify not only profits but also losses.

Fees

| Account Type | Spread | Commission |

| Standard | 1 pip | No |

| Premium | 0.7 pips | No |

| Elite | 0.3 pips | No |

Trading Platform

When it comes to trading platforms available, Point trader group gives traders Meta Trader 5.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Android, iOS | Experienced traders |

| MT4 | ❌ | / | Beginners |

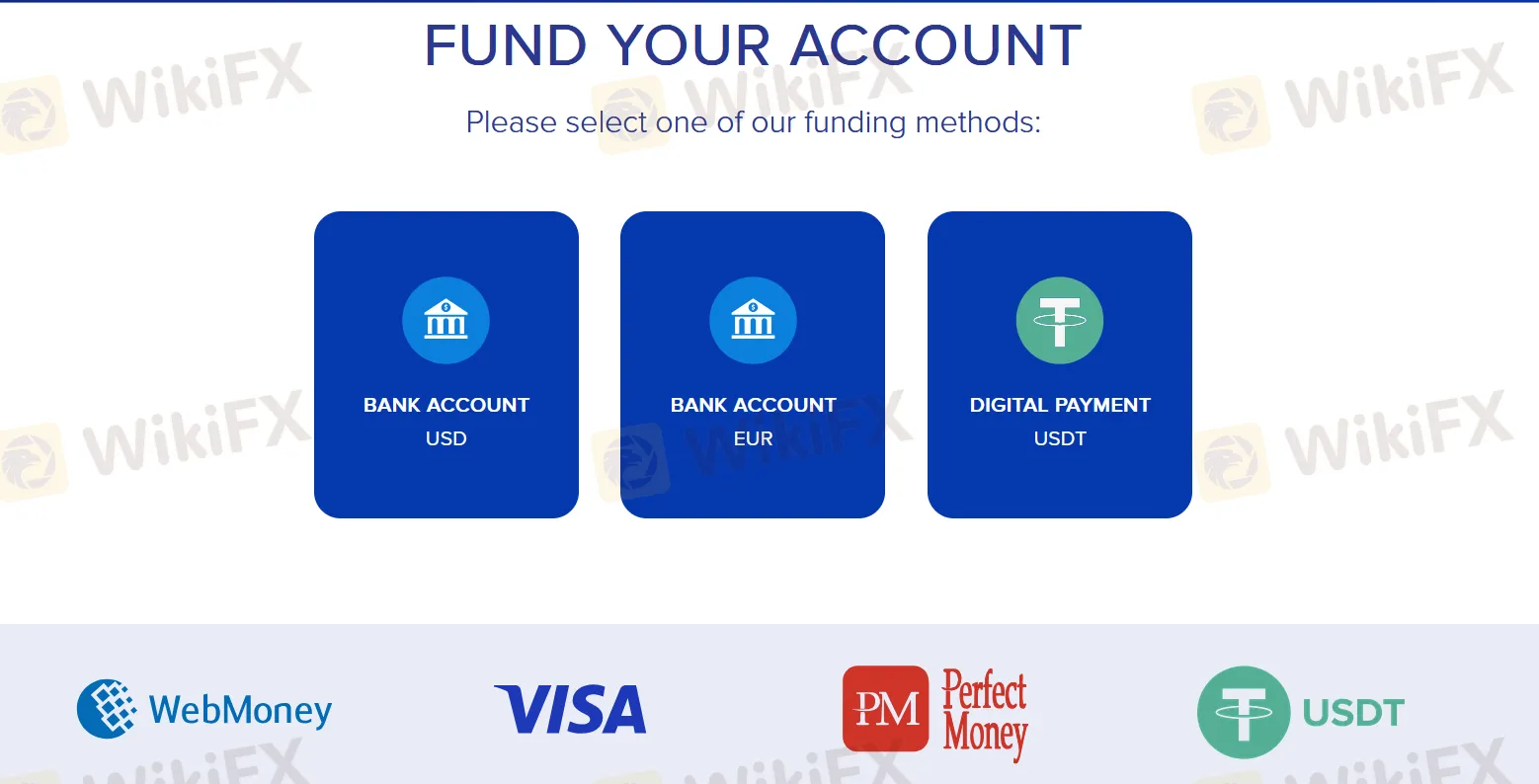

Deposit and Withdrawal

Traders can fund by several methods, including bank transfer, WebMoney, Visa, Perfect Money, and USDT.

Read more

Seacrest Markets Exposed: Are You Facing Payout Denials and Spread Issues with This Prop Firm?

Seacrest Markets has garnered wrath from traders owing to a variety of reasons, including payout denials for traders winning trading challenges, high slippage causing losses, the lack of response from the customer support official to address withdrawal issues, and more. Irritated by these trading inefficiencies, a lot of traders have given a negative review of Seacrest Markets prop firm. In this article, we have shared some of them. Take a look!

GKFX Review: Are Traders Facing Slippage and Account Freeze Issues?

Witnessing capital losses despite tall investment return assurances by GKFX officials? Do these officials sound too difficult for you to judge, whether they offer real or fake advice? Do you encounter slippage issues causing a profit reduction on the GKFX login? Is account freezing usual at GKFX? Does the United Kingdom-based forex broker prevent you from accessing withdrawals? You are not alone! In this GKFX review guide, we have shared the complaints. Take a look!

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

The straightforward answer to this important question is no. Seaprimecapitals works as a broker without proper regulation. This fact is the most important thing any trader needs to know, because it creates serious risks for your capital and how safely the company operates. While this broker offers some good features, like the popular MetaTrader 5 platform and a low starting deposit, these benefits cannot make up for the major risks that come from having no real financial supervision. This article will give you a detailed, fact-based look at Seaprimecapitals regulation, what the company claims to do, the services it provides, and the clear differences between official information and user reviews. Our purpose is to give you the information you need to make a smart decision about the risks and benefits of working with this company.

Seaprimecapitals Review 2025: A Complete Look at an Unregulated Broker

Seaprimecapitals presents a common problem for today's traders: it offers easy-to-use features and low starting costs, but it lacks important financial regulation. When traders research this broker, it looks good at first glance with features such as a $10 minimum deposit and the popular MT5 trading platform. However, these features come without the investor protections that regulated brokers provide. This review gives you a complete and fair analysis based on available information to help you make a smart decision.

WikiFX Broker

Latest News

Simulated Trading Competition Experience Sharing

WinproFx Regulation: A Complete Guide to Its Licensing and Safety for Traders

Interactive Brokers Expands Access to Taipei Exchange

Axi Review: A Data-Driven Analysis for Experienced Traders

INZO Regulation and Risk Assessment: A Data-Driven Analysis for Traders

Cleveland Fed's Hammack supports keeping rates around current 'barely restrictive' level

Delayed September report shows U.S. added 119,000 jobs, more than expected; unemployment rate at 4.4%

The CMIA Capital Partners Scam That Cost a Remisier Almost Half a Million

eToro Cash ISA Launch Shakes UK Savings Market

Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

Rate Calc