Is Seaprimecapitals Regulated? A Complete Look at Its Safety and How It Works

Abstract:The straightforward answer to this important question is no. Seaprimecapitals works as a broker without proper regulation. This fact is the most important thing any trader needs to know, because it creates serious risks for your capital and how safely the company operates. While this broker offers some good features, like the popular MetaTrader 5 platform and a low starting deposit, these benefits cannot make up for the major risks that come from having no real financial supervision. This article will give you a detailed, fact-based look at Seaprimecapitals regulation, what the company claims to do, the services it provides, and the clear differences between official information and user reviews. Our purpose is to give you the information you need to make a smart decision about the risks and benefits of working with this company.

The Simple Answer

The straightforward answer to this important question is no. Seaprimecapitals works as a broker without proper regulation. This fact is the most important thing any trader needs to know, because it creates serious risks for your capital and how safely the company operates. While this broker offers some good features, like the popular MetaTrader 5 platform and a low starting deposit, these benefits cannot make up for the major risks that come from having no real financial supervision. This article will give you a detailed, fact-based look at Seaprimecapitals regulation, what the company claims to do, the services it provides, and the clear differences between official information and user reviews. Our purpose is to give you the information you need to make a smart decision about the risks and benefits of working with this company.

Main Points

· Regulation Status: Seaprimecapitals is a broker without regulation and has no valid financial license.

· Main Risk: There is a high risk for traders because there is no financial oversight or protection for investors.

· Registration: The company, Seaprimecapitals LLC, is registered in Saint Vincent and the Grenadines, a place known for not regulating forex brokers.

· Article Purpose: This review provides a detailed examination of Seaprimecapitals regulation, its trading conditions, and the important difference between official risk warnings and unconfirmed user reviews.

Understanding Regulation Warning Signs

Learning why Seaprimecapitals is considered unregulated is important for judging the safety of your capital. The problem is not just a missing paper; it is a basic lack of oversight that puts traders at serious, unpreventable risks. This section explains the specific regulation warning signs connected to this broker.

SVG Registration Explained

Seaprimecapitals LLC is a registered business in Saint Vincent and the Grenadines (SVG). However, it is important to understand the difference between business registration and financial regulation. Registering a company in SVG is a simple administrative process. It does not mean the company is watched, checked, or held to any specific standard of financial behavior by a government authority. The Financial Services Authority (FSA) of SVG has publicly stated that it does not give licenses for forex brokerage or binary options trading. Therefore, any claim of being “registered” in SVG is not the same as being regulated.

A key finding from independent analysis confirms this: *“It has been verified that this broker currently has no valid forex regulation. Please be aware of the risk!”* This statement shows the reality of how this broker operates.

What No Regulation Means

For a trader, the results of dealing with an unregulated broker are direct and serious. The protections that are normal with regulated companies are completely missing.

· No Fund Protection: Regulated brokers are usually required to keep client capital separate from company operating money. Many are also members of investor compensation programs (like the ICF in Cyprus or the FSCS in the UK) that protect client capital up to a certain amount if the broker goes out of business. With Seaprimecapitals, no such protection exists.

· No Dispute Help: If you have a problem with a trade execution, a withdrawal request, or any other platform issue, there is no official regulatory body to help solve the problem or make a binding decision. You are left to solve the issue directly with the broker, who holds all the power.

· Higher Risk of Bad Behavior: Regulation exists to prevent fraudulent activities, price manipulation, and unfair practices. Unregulated companies such as Seaprimecapitals, which was founded in 2022 and has been operating for 2-5 years, operate without this important layer of supervision, increasing the chance for such bad behavior to happen without consequences.

Official Warnings and Reviews

The broker's profile comes with clear and serious warnings based on its lack of regulation. These include labels such as “High potential risk” and a direct warning: “Warning: Low score, please stay away!” These reviews are not personal opinions but are based on the objective fact of its non-regulated status. The “Suspicious Regulatory License” tag further shows that any claims or hints of oversight should be treated with extreme caution. For a complete, up-to-date overview of the broker's licensing status and any updated warnings, traders are encouraged to check the Seaprimecapitals profile directly on WikiFX.

---

Looking at the Contradiction

A strange aspect of Seaprimecapitals is the huge gap between its high-risk official information and a stream of positive, yet unconfirmed, user reviews. This contradiction can be confusing for potential traders. Understanding how to interpret this conflicting information is essential for a good risk assessment.

Official Information vs User Reviews

The difference between facts you can verify and anonymous claims is huge. One side presents data-driven warnings, while the other offers only positive personal experiences. A side-by-side comparison makes this conflict clear.

| Official Data & Warnings | Highlights from User Reviews |

| Score: Extremely Low | “Trustable broker” |

| Regulation: None / Suspicious | “All withdrawal are available on time” |

| Risk Assessment: High Potential Risk | “Fast trade executions, Fast withdrawals” |

| Warning: “Please stay away!” | “I am making profit every day” |

A Critical View

The “Unverified” status attached to these positive reviews is an important piece of information. It means there is no confirmation that the reviewers are real clients who have deposited and traded real capital with the broker. While we cannot definitely state where these reviews come from, several possibilities should be considered by a careful trader:

· Paid or Fake Reviews: It is a known practice in some parts of the industry for companies to create or pay for positive reviews to build a false image of credibility and attract unsuspecting clients.

· Short-Term Experiences: Some reviews may come from real users who have had a positive experience with a few small, successful withdrawals. However, this does not guarantee the safety of larger capital amounts or reflect the broker's long-term reliability. The true test of an unregulated broker often comes when a client tries to withdraw a significant profit.

· Focusing on Facts You Can Verify: Ultimately, a trader's decision should be based on objective, verifiable information. A broker's regulatory status is a hard fact that can be checked against official regulator databases. Anonymous, unverified testimonials are personal claims that cannot be independently confirmed. In any risk assessment, verifiable information must always take priority over unverified praise.

Seaprimecapitals' Trading Profile

Beyond the critical issue of regulation, it is important to understand what Seaprimecapitals actually offers as a trading service. This section provides an objective breakdown of its platform, available instruments, and account structure, allowing for a complete picture of its operational setup.

Trading Platform: MetaTrader 5

The broker provides its clients with a full license for the MetaTrader 5 (MT5) platform. MT5 is a globally recognized and respected trading terminal, known for its advanced charting tools, technical analysis capabilities, and support for automated trading through Expert Advisors (EAs). The platform is available for desktop (Windows, Mac) and mobile (Android, iPhone), helping traders who prefer to manage their accounts from anywhere. Information shows the broker's MT5 server, named “Seaprimecapitals-Live,” is located in the United States. While the platform itself is strong, its quality does not reduce the risks associated with the unregulated broker providing access to it.

Available Trading Instruments

Seaprimecapitals offers trading primarily through Contracts for Difference (CFDs). Its asset selection focuses on a few key classes, while notably leaving out others. This can be a limiting factor for traders seeking a diversified portfolio.

| Instrument Class | Available? | Details |

| Forex | ✔️ | Over 50 currency pairs are available for trading. |

| Commodities | ✔️ | Includes major commodities like gold, silver, and crude oil. |

| Cryptocurrencies | ✔️ | Offers CFDs on a variety of popular crypto pairs. |

| Indices | ✖️ | Trading on stock market indices is not offered. |

| Stocks | ✖️ | Trading on individual company shares is not offered. |

Account Types and Structure

The broker has structured its offerings around three distinct live account levels, in addition to a demo account for practice. There is no mention of a swap-free (Islamic) account, which may be a problem for traders of Islamic faith. The main differences between the accounts lie in the minimum deposit requirements and the associated spreads. Traders interested in the specific differences between these accounts can find a comprehensive comparison on the Seaprimecapitals profile available on WikiFX.

| Account Type | Minimum Deposit | Spread (EUR/USD) | Best Suited For |

| Micro | $100 | 1.0–1.5 pips | Beginners and traders with small capital. |

| Standard | $500 | 2.0–2.5 pips | Regular traders seeking standard conditions. |

| Premium | Not Specified | 2.5–3.5 pips | High-volume traders supposedly seeking premium services. |

Breaking Down the Costs

A trader's profitability is directly affected by the costs of trading. This section analyzes the fees, spreads, and leverage offered by Seaprimecapitals, placing them in the context of industry standards and highlighting the associated risks.

Spreads and Commissions

Seaprimecapitals operates on a zero-commission model for all its account types. This can seem appealing at first glance. However, the broker makes up for this by using spreads that are notably higher than the industry average, particularly on its Standard and Premium accounts. A typical spread for the EUR/USD pair on a competitive regulated broker's standard account is often below 1.5 pips.

A spread of 2.0-2.5 pips on Seaprimecapitals' Standard account can significantly increase trading costs, especially for active strategies like scalping or day trading. Over time, these wider spreads can eat into potential profits and make it more challenging to achieve profitability compared to trading with brokers that offer tighter spreads.

Leverage: Opportunity and Risk

The broker offers a maximum leverage of up to 1:200 across all account types. Leverage is a powerful tool that allows traders to control a large position with a relatively small amount of capital, amplifying potential profits. However, it is a double-edged sword. The same mechanism that amplifies gains also amplifies losses, and a small market movement against your position can lead to a rapid and substantial loss of capital. Using high leverage is particularly dangerous with an unregulated broker, as there is no guarantee of negative balance protection, a feature that prevents a client's account from going into debt.

Deposits and Withdrawals

Seaprimecapitals offers several common payment methods for funding and withdrawing from accounts. There is a slight difference in its stated minimums: while the general minimum deposit is listed as $10, the entry-level Micro account requires a $100 deposit. Traders should assume the $100 figure is the practical minimum to begin trading. The broker does not charge deposit fees, but withdrawal fees apply to certain methods, such as a 2.5% fee for bank transfers.

| Payment Method | Minimum Deposit | Deposit Fee | Withdrawal Fee | Withdrawal Time |

| Bank Transfer | $10 | 0% | 2.5% | 1–7 working days |

| Neteller | $10 | 0% | 0% | Instant |

| Skrill | $10 | 0% | Not specified | 1–7 working days |

| Visa/Mastercard | $10 | 0% | Not specified | 6-12 working hours |

Conclusion: The Final Decision

After a thorough examination of the available information, our conclusion on Seaprimecapitals is clear and definite. The broker's lack of valid financial regulation is the defining characteristic that should guide any trader's decision. While it offers some seemingly attractive features, they are insufficient to make up for the fundamental and serious risks involved.

Final Assessment

· Main Finding: Seaprimecapitals is an unregulated broker registered in a place with no oversight for forex trading. This exposes clients to a high level of risk, including the potential loss of all deposited funds with no way to get help.

· Risk vs. Reward: Features like the MT5 platform, an assortment of CFD instruments, and a low entry deposit of $10 are positive on the surface. However, these benefits do not and cannot outweigh the critical danger posed by the absence of regulatory protection, fund separation, and access to a dispute resolution body.

· Recommendation: A trader's first priority must always be the security of their capital. Working with an unregulated company like Seaprimecapitals introduces unnecessary and significant risks that are entirely avoidable by choosing a broker licensed by a reputable financial authority. The potential for platform manipulation, withdrawal issues, or complete business failure without any safety net is a risk not worth taking.

*Disclaimer: The information presented in this article is based on data available as of its writing in 2025 and is intended for informational and educational purposes only. This information may become outdated. Traders should always conduct their own thorough research and verify all details before making any financial decisions.*

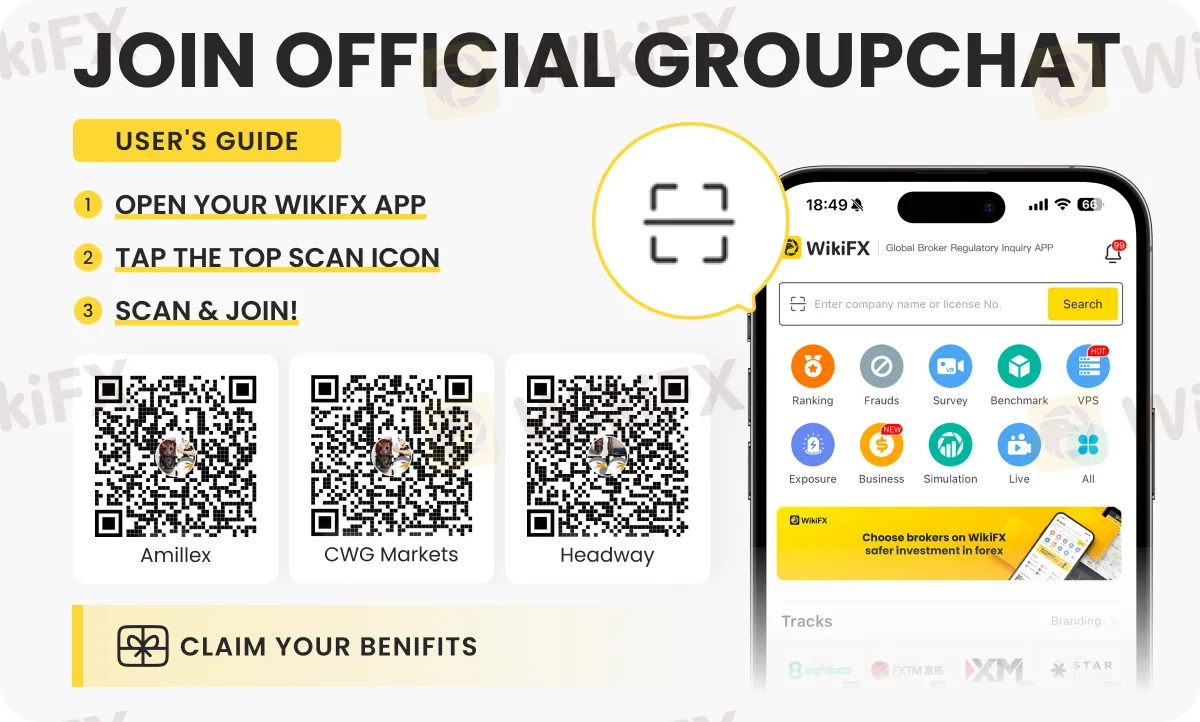

Want to stay updated about forex news, trends and more? Join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.

Read more

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.

GMO-Z.com Review: Do Traders Face Unfair Tax Payment on Withdrawals?

Do you have to pay taxes or margin when seeking fund withdrawals from GMO-Z.com, a Thailand-based forex broker? Do you witness heavy slippage when trading on the broker’s platform? These are some complaints traders have made against the broker. In this GMO-Z.com review article, we have explained these complaints. Take a look!

EO Broker Review: Why You Should Avoid It

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

Pocket Broker Review: Why Traders Should Avoid It

Pocket Broker review highlights user complaints of blocked accounts, rejected withdrawals, and fraudulent practices.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Merin Review (2025): Is it Safe or a Scam?

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Rate Calc