User Reviews

More

User comment

1

CommentsWrite a review

2023-03-02 16:40

2023-03-02 16:40

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT5 Full License

Global Business

High potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.38

Risk Management Index0.00

Software Index9.02

License Index0.00

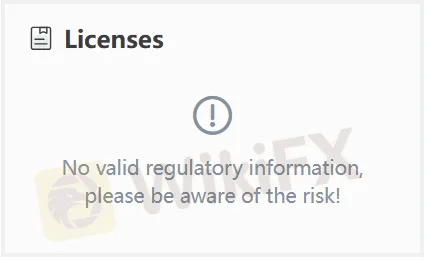

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Point Trader Group (Mauritius) Limited

Company Abbreviation

Point trader group

Platform registered country and region

Mauritius

Company website

X

YouTube

+230 5942 2303

+20 22 8135 691

Company summary

Pyramid scheme complaint

Expose

| Point trader group Review Summary | |

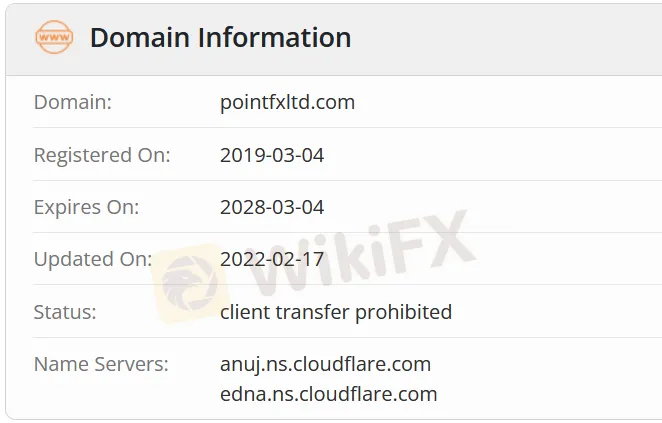

| Founded | 2019 |

| Registered Country/Region | Mauritius |

| Regulation | Unregulated |

| Market Instruments | Forex, Indices, Energies, Precious Metals, Commodities, CFDs, Cryptocurrencies, US Equities, Agriculture |

| Demo Account | ✅ |

| Leverage | Up to 1:100 |

| Spread | 1 pip (Standard account) |

| Trading Platform | MT5 |

| Minimum Deposit | $500 |

| Customer Support | Phone: +230 5942 2303 |

| Email: support@pointfxltd.com, info@pointfxltd.com | |

| Address: The Catalyst, Suite 201, 2nd Floor, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius | |

Point trader group was registered in 2019 in Mauritius. It offers diverse trading instruments including Forex, Indices, Energies, Precious Metals, Commodities, CFDs, Cryptocurrencies, US Equities and Agriculture. However, this company is currently unregulated.

| Pros | Cons |

| Diverse trading instruments | Unregulated status |

| Various account types | High minimum deposit |

| No commissions | |

| MT5 available |

No. Point trader group has no regulations currently. Please be aware of the risk!

Point trader group provides a range of choices like Forex, Indices, Energies, Precious Metals, Commodities, CFDs, Cryptocurrencies, US Equities and Agriculture.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Energies | ✔ |

| Precious Metals | ✔ |

| Commodities | ✔ |

| CFDs | ✔ |

| Cryptocurrencies | ✔ |

| US Equities | ✔ |

| Agriculture | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

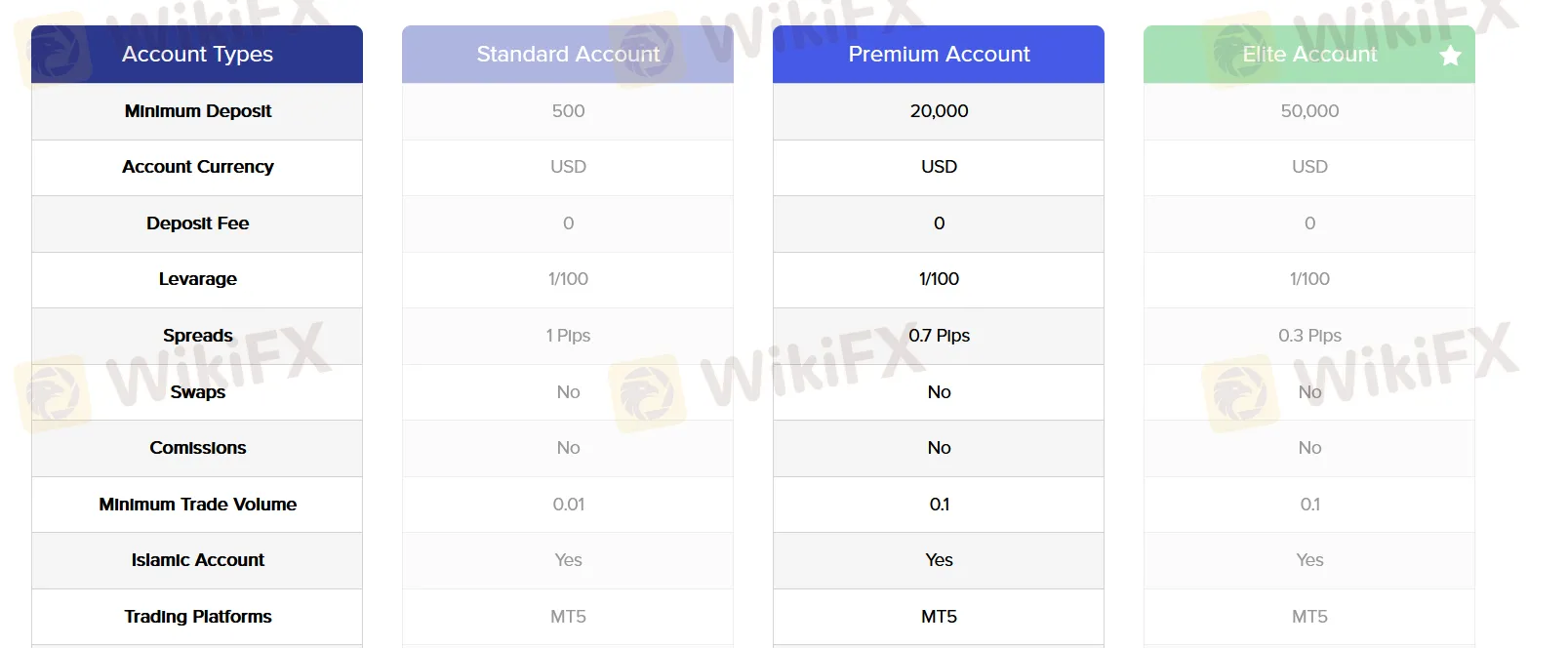

| Account Type | Minimum deposit |

| Standard | $500 |

| Premium | $20,000 |

| Elite | $50,000 |

Point trader group offers leverage up to 1:100 for all account types. Please note that high leverage can amplify not only profits but also losses.

| Account Type | Spread | Commission |

| Standard | 1 pip | No |

| Premium | 0.7 pips | No |

| Elite | 0.3 pips | No |

When it comes to trading platforms available, Point trader group gives traders Meta Trader 5.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Android, iOS | Experienced traders |

| MT4 | ❌ | / | Beginners |

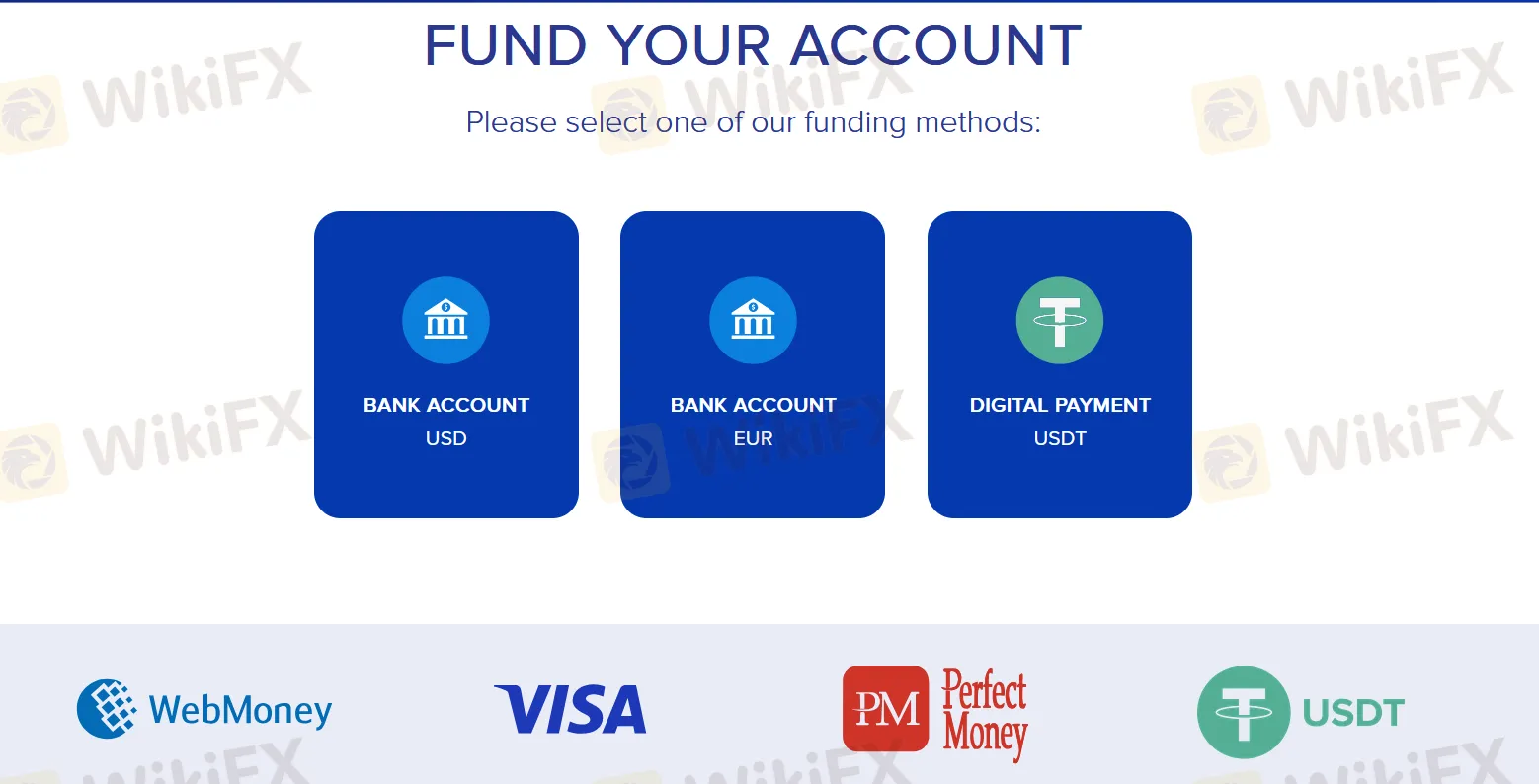

Traders can fund by several methods, including bank transfer, WebMoney, Visa, Perfect Money, and USDT.

More

User comment

1

CommentsWrite a review

2023-03-02 16:40

2023-03-02 16:40