Resona Bank

Abstract:Resona Bank is a financial institution based in Japan, offering a wide range of banking services to individuals and businesses. Resona Bank provides traditional banking products and services such as savings and checking accounts, loans, and credit cards. They also offer investment and wealth management solutions, including investment trusts, fund management plans, and retirement courses to help individuals plan for their financial future. The bank provides convenient access to their services through various channels, including internet banking, smartphone apps, and telephone banking. Resona Bank's extensive banking experience and established presence in Japan position them as a trusted institution for customers seeking reliable and comprehensive banking solutions.

| Information | Details |

| Company Name | Resona Bank |

| Year Established | 2-5 Years |

| Headquarters | Japan |

| Licensing/Regulation | Unregulated as a brokerage |

| Services Offered | Savings accounts, loans, credit cards, investment trusts, fund management plans, retirement courses |

| Deposit/Withdraw Methods | Internet banking, smartphone apps, telephone banking |

| Market Platform | Resona Group App |

| Customer Support Options | Phone support, Fax support, AI Chat on the website |

Overview of Resona Bank

Resona Bank is a financial institution based in Japan, offering a wide range of banking services to individuals and businesses. Resona Bank provides traditional banking products and services such as savings and checking accounts, loans, and credit cards. They also offer investment and wealth management solutions, including investment trusts, fund management plans, and retirement courses to help individuals plan for their financial future.

The bank provides convenient access to their services through various channels, including internet banking, smartphone apps, and telephone banking. Resona Bank's extensive banking experience and established presence in Japan position them as a trusted institution for customers seeking reliable and comprehensive banking solutions.

Regulation

Resona Bank operates with no brokerage licensing or regulatory information as a brokerage. In the absence of brokerage licensing, it is important to note that the bank may not have the authorization to engage in certain activities, such as offering investment advice, executing trades, or managing securities on behalf of clients. This can limit the range of investment options and services available through Resona Bank. Additionally, the absence of specific licensing information may indicate that the bank's operations are primarily focused on traditional banking services rather than specialized brokerage activities. It is crucial for individuals seeking brokerage services or investment-related products to consider alternative financial institutions that possess the necessary licenses and regulatory oversight to provide comprehensive investment solutions and ensure investor protection.

Pros and Cons

Resona Bank offers a range of advantages to its customers, including a comprehensive suite of banking services, including savings accounts, loans, credit cards, and investment options like investment trusts and retirement courses. Moreover, Resona Bank prioritizes customer convenience, offering multiple access channels such as internet banking, smartphone apps, and telephone banking, ensuring that customers can easily manage their finances on their preferred platforms. Additionally, Resona Bank's emphasis on personalized service and tailored solutions, such as their fund management plans, enables customers to meet their unique financial goals effectively.

However, it is important to note a potential drawback of Resona Bank. The absence of specific licensing and regulatory information raises questions about the extent of their authorization to engage in certain activities, such as offering specialized investment advice or executing securities trades. This limitation might restrict the range of investment options and services available to customers who require more comprehensive investment solutions. It is essential for individuals seeking brokerage services or specialized investment advice to carefully consider alternative financial institutions that possess the necessary licenses and regulatory oversight. Additionally, the lack of detailed information on specific products, interest rates, or fees in this chat might require potential customers to gather more information directly from Resona Bank to make informed decisions.

| Pros | Cons |

| Established Reputation and Presence | Lack of specific licensing and regulatory information |

| Comprehensive Banking Services | Potential limitations on investment options and specialized services |

| Multiple Access Channels | Lack of detailed information on specific products, rates, or fees in this chat |

| Emphasis on Customer Convenience | |

| Tailored Solutions for Financial Goals |

How to open an Account?

To create a Resona Bank Account, several Japanese Domestic documents are required, in that, being a resident in Japan is high recommended as there is no other way to get most of to required documentation.

To get to the how-to process part of the website, find the “Click here to open an account” button and click it.

This will take you to the menu which uses the computer's location in order to find the nearest Resona Bank in order to care out the application process.

To summarize the documents required for the account application process:

Account Creation App Process:

Japanese Driver's license

Smartphone

If you don't have a driver's license, you can provide:

Japanese “My Number card” or

Japanese “Residence card” (may require additional identification documents such as employee ID card, health insurance card, or student ID card)

In-store Process (select one from each category):

Official document with face photo (mandatory) which includes:

Driver's license

Driving record certificate (issued after April 1, 2012)

Passport

Crew notebook

Individual number card

Nursing notebook

Residence card (please provide if available, along with proof of employment if applicable)

Special permanent resident certificate

Handicapped person's notebook

Mental Disability Health and Welfare Handbook

War Injured Handbook

Documents issued by a government office (with face photo)

Official document without face photo (mandatory - choose one document in red) which includes:

Various health insurance cards

Various pension handbooks

Latter-stage elderly medical insurance card

Maternal and Child Health Handbook (for children under 15 years old)

Membership card/participant card of various mutual aid associations

Various Child Rearing Allowance Certificates

Seal registration certificate (when using the registered seal for transactions)

Copy of resident card

Certificate of registered items in resident card

Copy of the family register appendix

Seal registration certificate

Financial Products

Resona Bank offers a range of financial products to cater to diverse customer needs. The investment trust provides an avenue for individuals to invest in professionally managed portfolios diversified across various assets. Fund wrap is another investment option that allows customers to invest in a diversified portfolio of funds managed by experts. The NISA (Small Investment Tax Exemption System) is a tax-efficient investment account for long-term savings and investments. Time deposit offers a secure way to grow savings with fixed interest rates over a specified period. Money trust provides a flexible and convenient way to invest in various money market instruments.

Resona Bank also offers foreign currency deposits for those interested in holding deposits in currencies other than the domestic currency. The fund management plan assists customers in creating personalized investment strategies and achieving their financial goals. The retirement course focuses on helping individuals plan and manage their finances for a secure retirement. JGBs for Individuals/Government Bonds are available for customers interested in investing in Japanese government bonds, while foreign bonds intermediation allows customers to invest in bonds from other countries.

| Financial Products | Descriptions |

| Investment Trust | Professionally managed portfolios, diversified investments, potential for capital appreciation, risk exposure, various asset classes. |

| Fund Wrap | Diversified fund portfolios, professional management, convenience, risk exposure, investment in multiple funds, potential for capital appreciation. |

| NISA | Tax-efficient investment account, long-term savings, tax exemption benefits, various investment options, potential for capital growth, retirement planning. |

| Time Deposit | Fixed interest rates, secure savings, specified period, capital protection, limited liquidity, guaranteed returns. |

| Money Trust | Flexible investment options, convenience, liquidity, investment in money market instruments, potential for short-term gains, risk exposure. |

| Foreign Currency Deposits | Holding deposits in foreign currencies, currency diversification, potential for currency gains/losses, risk exposure, international transactions. |

| Fund Management Plan | Personalized investment strategies, tailored approach, professional advice, goal-oriented investment, risk exposure, potential for capital appreciation. |

| Retirement Course | Retirement-focused planning, financial security, customized solutions, risk management, long-term savings, post-retirement income. |

| JGBs for Individuals/Government Bonds | Investment in Japanese government bonds, fixed income, capital protection, low-risk investment, stable returns, risk exposure to interest rate changes. |

| Foreign Bonds (Financial Instruments Intermediation) | Investment in bonds from other countries, global diversification, potential for higher returns, risk exposure to foreign markets, international investment opportunities. |

Loans

Resona Bank provides a range of loan options to meet different financing needs. The housing loan is designed for individuals looking to purchase a new home, offering competitive interest rates and flexible repayment terms. Mortgage loans are specifically tailored for new home purchases, providing financial support for property acquisition. Housing loan refinancing enables individuals to transfer their existing housing loan to Resona Bank for better terms and conditions. Renovation loans cater to those seeking funds for home improvements or remodeling projects. Apartments and condominium loans are available for individuals interested in purchasing or refinancing residential properties in multi-unit buildings.

Card loans provide convenient access to funds through credit card facilities. The free loan offers flexible financing options for various purposes, including personal expenses, travel, or other needs. The secured type of free loan requires collateral for loan approval. Car loans are designed for individuals looking to finance the purchase of a vehicle, while education loans offer financial assistance for educational expenses.

| Loans | Features |

| Housing Loan | Competitive interest rates, flexible repayment terms, financing for new home purchases, capital for property acquisition. |

| Mortgage | Financing for new home purchases, specialized loan for property acquisition, competitive interest rates, tailored terms and conditions. |

| Housing Loan (Refinancing) | Transfer of existing housing loan to Resona Bank, improved terms and conditions, potential for better interest rates, refinancing convenience. |

| Renovation Loan | Funds for home improvements or remodeling projects, flexible loan options, tailored to renovation needs. |

| Apartments and Condominium Loans | Financing for residential properties in multi-unit buildings, competitive interest rates, options for purchasing or refinancing. |

| Card Loan | Convenient access to funds through credit card facilities, flexible repayment options, quick and easy application process. |

| Free Loan | Flexible financing options for various purposes, including personal expenses, travel, or other needs, loan amounts tailored to individual requirements. |

| Free Loan (Secured Type) | Flexible financing options with collateral required for loan approval, potential for higher loan amounts, secured loan terms and conditions. |

| Car Loan | Financing for vehicle purchases, competitive interest rates, flexible repayment terms, support for purchasing new or used cars. |

| Education Loan | Financial assistance for educational expenses, tuition fees, study materials, etc., flexible repayment options, potential for specialized loan terms for education-related needs. |

Future Investment Products

Resona Bank provides various future investment products to help individuals and businesses plan for their financial goals.

Inheritance/succession services: Offer tailored solutions for estate planning and wealth transfer, ensuring a smooth transition of assets to the next generation.

Property management business: Assists individuals in managing their real estate assets efficiently, offering services such as property valuation, leasing, and maintenance.

Private banking business: Provides personalized financial services and investment strategies for high-net-worth individuals, focusing on wealth management and asset growth.

iDeCo (individual-type defined contribution pension): A pension product that allows individuals to accumulate retirement savings through voluntary contributions, providing tax advantages and investment opportunities.

Corporate Defined Contribution Pension: Designed for businesses to offer retirement benefits to their employees, enabling them to build retirement savings through employer and employee contributions.

| Future Investment Products | Features |

| Inheritance/Succession Services | Tailored estate planning solutions, smooth wealth transfer, asset protection, wealth preservation, inheritance tax optimization. |

| Property Management Business | Efficient management of real estate assets, property valuation, leasing services, property maintenance and upkeep. |

| Private Banking Business | Personalized financial services, tailored investment strategies, wealth management, asset growth, exclusive benefits for high-net-worth individuals. |

| iDeCo (Individual-Type Defined Contribution Pension) | Retirement savings through voluntary contributions, tax advantages, investment opportunities, long-term wealth accumulation, pension income upon retirement. |

| Corporate Defined Contribution Pension | Retirement benefits for employees, employer and employee contributions, retirement savings accumulation, long-term financial security for employees, potential tax advantages for the employer. |

Deposit/Withdrawal Methods

Resona Bank offers various convenient deposit and withdrawal methods to cater to the diverse needs of their customers.

my gate: Internet transfer service that allows easy and convenient banking transactions through phone or computer.

Smartphone app: App for performing banking activities conveniently.

Telephone banking (Communication Dial): Allows inquiries about deposit balance, deposit/withdrawal details, fund management, loans, and access to product information.

Currency exchange: Offers foreign currency exchange services at specialized stores, home delivery, and mail purchase.

Overseas remittance: Conveniently apply for overseas remittance through the app, available 24/7.

Visa debit card: Enables easy payment for shopping and transactions.

Debit card service (J-Debit): Allows payment with a cash card at shops and other establishments.

Credit card: Offers credit cards that earn club points for shopping.

Pay-easy: Allows easy payment of various fees, such as taxes and public utility charges, through the app.

Kora tax and public money, Kora remittance: Use the smartphone app to pay taxes and send money up to 100,000 yen.

Bank Pay: QR code payment service that allows direct payment from a bank account, such as Resona Bank, at merchants displaying the Bank Pay mark.

Trading Platforms

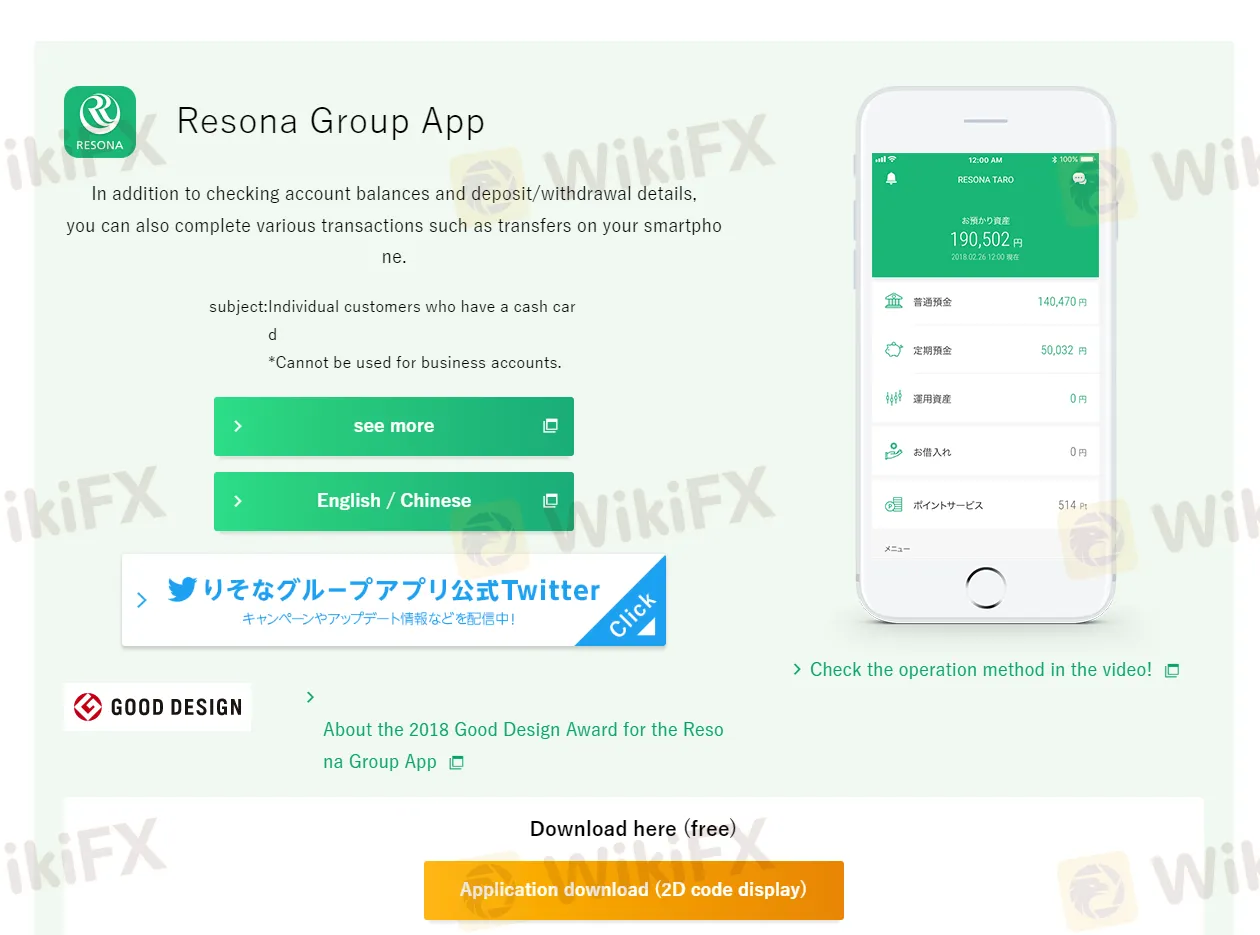

Resona Group App serves as the market platform for Resona Bank, offering a comprehensive range of features and functionalities. Users of the app can conveniently check their account balances and view deposit/withdrawal details in real-time. The platform goes beyond basic banking functions for completing various transactions directly on smartphones. Customers can easily initiate transfers, enabling quick and secure money transfers between accounts. The Resona Group App offers a robust market platform that caters to customers' needs for efficient and accessible banking services, ensuring a smooth and convenient banking experience.

Customer Support Options

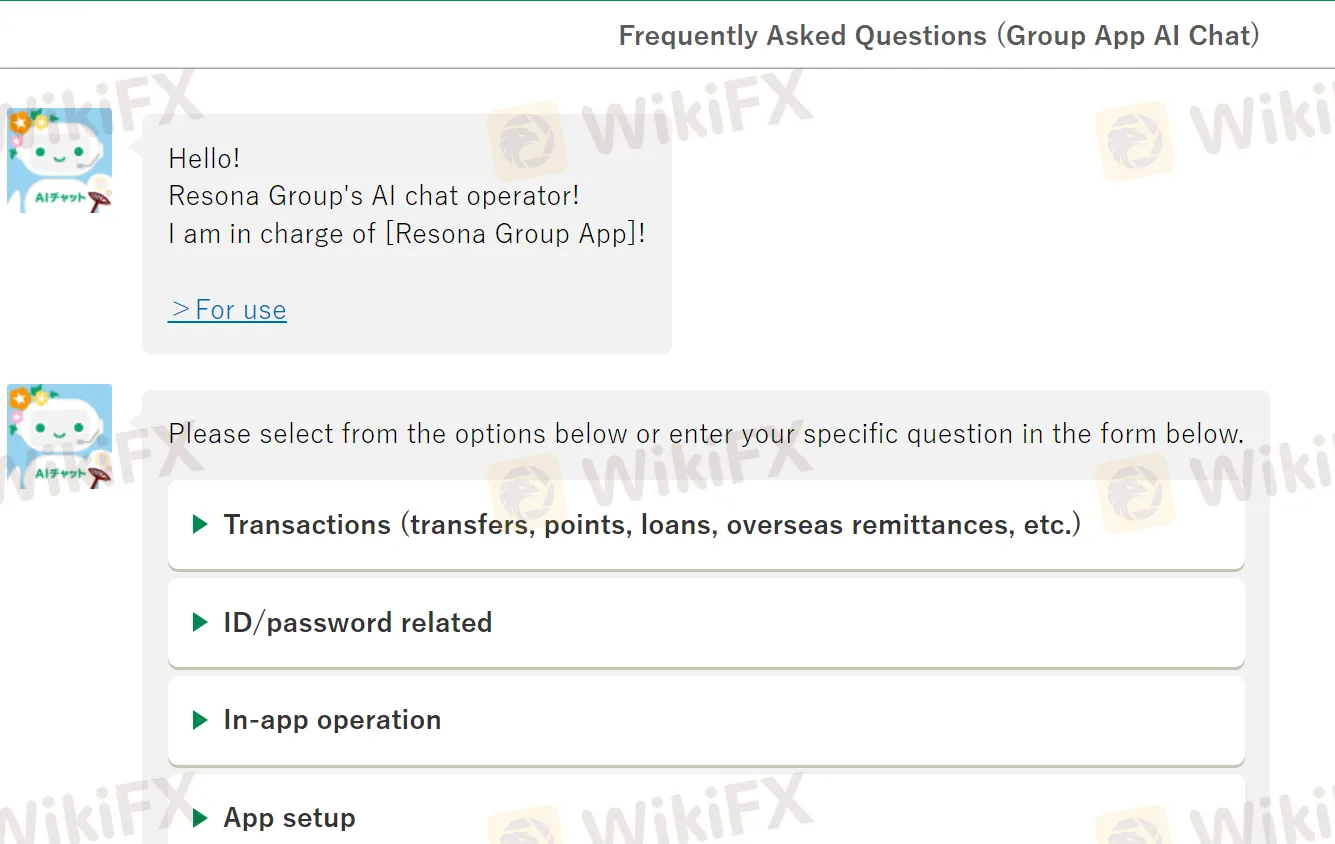

Resona Bank offers customer support through phone, fax, and anAI chat feature on their website, providing convenient and accessible means of communication for inquiries and assistance.

Phone Support: Customers can reach out to Resona Bank's customer support team by phone, utilizing the phone number closest to their location in Japan. This provides a direct and immediate means of communication for inquiries, assistance, and support related to banking services. These store numbers will be based on the location, therefore the specific number can be searched per location.

Fax Support: Resona Bank also offers fax support as an additional communication channel. Customers can use the provided fax number to send documents, forms, or other relevant information to the bank, ensuring a secure and reliable mode of transmission. This method can be found by contacting the nearest Resona Bank via the Phone Support method above.

AI Chat: Resona Bank provides an AI-powered chat feature on their website, offering customers the convenience of accessing customer support and information in real-time. The AI chat serves as a virtual assistant, addressing common queries, providing guidance, and offering assistance for various banking-related matters.

Conclusion

Resona Bank, a financial institution in Japan, offers a wide array of banking services catering to the diverse needs of individuals and businesses. Resona Bank provides multiple channels for customers to access their services, including internet banking, smartphone apps, and telephone banking.

Their offerings encompass traditional banking products such as savings and checking accounts, loans, and credit cards, as well as investment and wealth management solutions such as investment trusts, fund management plans, and retirement courses.

FAQs

Q: What types of banking services does Resona Bank provide?

A: Resona Bank offers a comprehensive range of financial services, including savings accounts, loans, credit cards, and investment solutions.

Q: How can customers access Resona Bank's services?

A: Customers can conveniently access Resona Bank's services through internet banking, smartphone apps, and telephone banking.

Q: Does Resona Bank offer investment options?

A: Yes, Resona Bank provides investment solutions such as investment trusts, fund management plans, and retirement courses.

Q: Are there specific regulations and licenses associated with Resona Bank?

A: There is no specific licensing information as a brokerage.

Q: What is the focus of Resona Bank's operations?

A: Resona Bank primarily focuses on providing traditional banking services to individuals and businesses.

Q: How does Resona Bank prioritize customer convenience?

A: Resona Bank emphasizes customer convenience by offering multiple channels for banking transactions, including internet banking, smartphone apps, and telephone banking.

Read more

Zacks Trade Review: Is Zacks trade Legit or Scam?

Zacks Trade is a forex broker operating in Forex market, but its customer support has received negative feedback. Many users have reported that the support team is totally unprofessional & Slow. If you are considering using Zacks Trade, it's important to be aware of these concerns.

Dhan Review: Broker Risks and Regulation Exposed

Dhan operates under parent Raise Securities’ SEBI license; learn the real regulatory setup, risks, protections, and what that means for traders today.

FXONET Exposed: Traders Report Scam Allegations & Major Capital Losses

Has your forex trading experience with FXONET been marred by investment scams, capital losses, and withdrawal issues? You’re not alone! Many traders have reported these experiences online, with some of them taking legal recourse to recover their stuck funds. While reading FXONET reviews online, we found a lot of negative comments for the broker. And a large chunk of them resorted to legal means for fund recoveries. In this article, we have shared some negative reviews of FXONET. Read on!

ScoreCM Faces Traders’ Wrath: Unprofessional Behavior & Withdrawal Delays Spoil Investment Mood

Do you frequently encounter unprofessional trading behavior from ScoreCM officials? Do you have to face repeated fund withdrawal denials or delays? It’s time to wake up to the growing investment scam within this forex broker. Investors frequently complain about the unethical trading practices while sharing ScoreCM reviews online. We have shared those reviews in this article. Take a look.

WikiFX Broker

Latest News

RM8.7 Million Lost to Scam Promising US$3 Million Returns Abstract: 57 Malaysians have collectively

Top Forex Regulatory Bodies You Need to Know

Fidelity Global Innovators to High Risk in Jan 2026

BotBro Chief Lavish Chaudhary to be Behind Bars Soon? Here’s the Inside Story!

Malaysia Investor Alert List is Out! Check the list to Avoid Scam

Think Your Broker is Safe? 5 Secrets Only WikiFX Can Uncover

Why Forex Trading? Top 10 Reasons to Start Now

WTO hikes global trade forecast for 2025 — but next year doesn't look so good

Kazakhstan Cracks Down Unlicensed Crypto Exchanges

Spot Forex Trading Explained: Definition, How It Works and Key Factors to Know

Rate Calc