Dhan Review: Broker Risks and Regulation Exposed

Abstract:Dhan operates under parent Raise Securities’ SEBI license; learn the real regulatory setup, risks, protections, and what that means for traders today.

Dhan Review: Broker Risks and Regulation Exposed

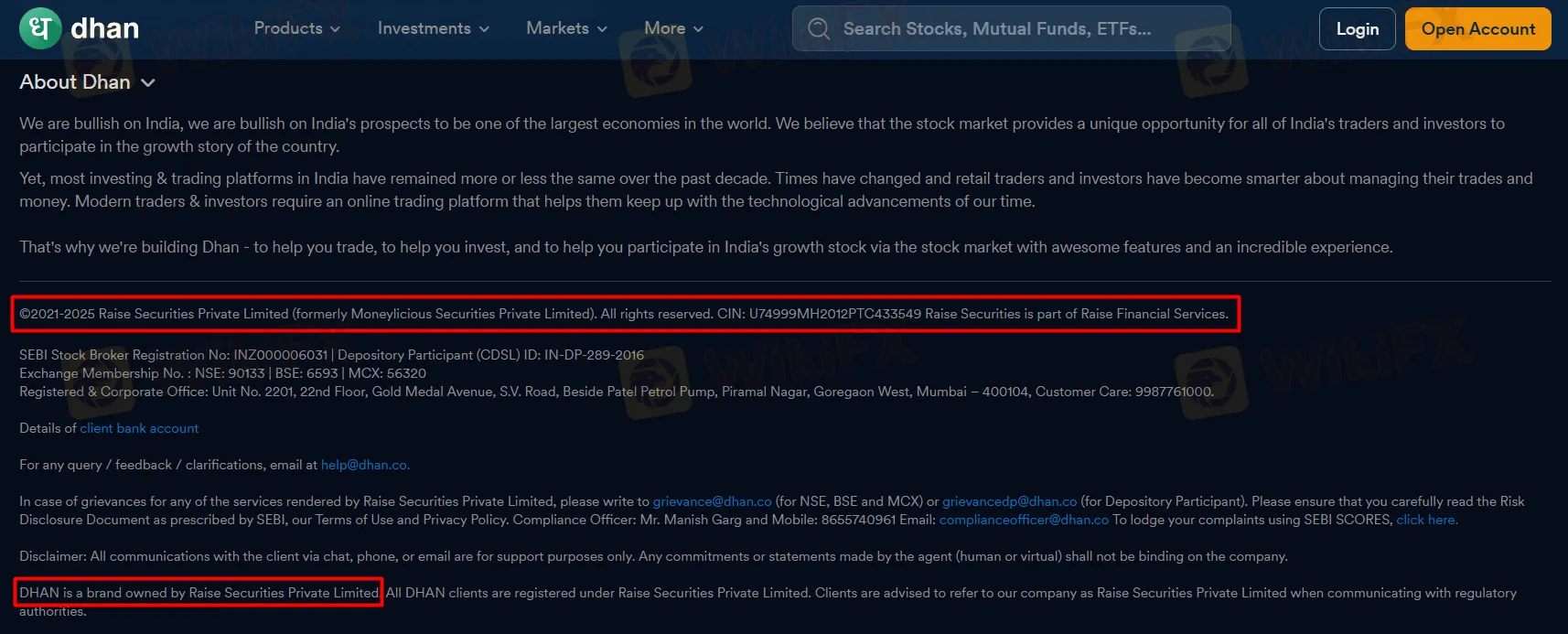

Dhan is the trading brand of Raise Securities Private Limited, an Indian stockbroker that holds a SEBI registration and exchange memberships, while “Dhan” itself is a commercial name rather than a separately licensed brokerage entity. This distinction matters because client contracts, dispute redressal, investor protection, and compliance standards apply to the specific legal entity—Raise Securities—not the marketing brand “Dhan,” and misunderstanding this can affect expectations about remedies, disclosures, and obligations.

The choice of a broker is one of the most critical decisions a trader or investor will make. This decision hinges on trust, security, and, most importantly, regulation. When a broker like Dhan emerges, it presents itself as a modern, technology-driven platform for a new generation of Indian investors. However, a deeper investigation into its corporate and regulatory structure reveals a complex situation that every potential user must understand.

This review unpacks the intricate regulatory status of Dhan, exposing the potential vulnerabilities traders face when dealing with a brand that is legally distinct from the regulated entity. The core issue lies in a practice known as regulatory arbitrage, where the protections and oversight guaranteed by a top-tier regulator like SEBI may not fully extend to clients of the subsidiary brand. Understanding this distinction is not a mere technicality; it is fundamental to safeguarding your investments and ensuring you have adequate protection in a volatile market.

Dhan's Regulatory Status Unpacked

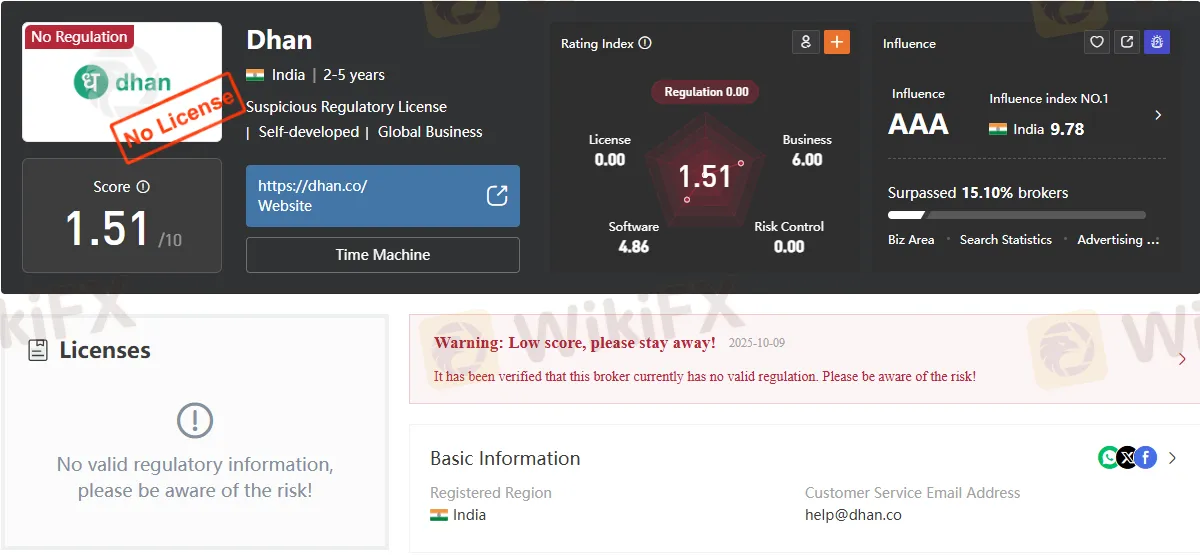

On the surface, Dhan's association with a SEBI-regulated entity appears to offer a seal of approval. The parent company, Raise Securities Private Limited, holds a valid SEBI registration (INZ000006031), which permits it to operate as a stockbroker in the equity segment. Dhan's own disclaimer clarifies that all its clients are technically registered under Raise Securities Private Limited, and advises clients to use the parent company's name when communicating with regulatory authorities.

However, the analysis provided in the source material paints a concerning picture, assigning Dhan a “Suspicious Regulatory License” status and a low score of 1.51 out of 10, accompanied by a warning to “please stay away”. The reason for this stark warning is that the Dhan brand itself—the platform with which users interact daily—has “no valid regulation” under its own name. This creates a crucial separation between the marketing face of the operation (Dhan) and the legally accountable entity (Raise Securities). For the average trader, this division can obscure where the legal and financial responsibility truly lies, creating a false sense of security based on the parent company's credentials.

The Parent vs. Subsidiary Dilemma

To appreciate the risks involved, it's essential to understand the legal distinction between a parent company and its subsidiary. A parent company that is regulated in a stringent jurisdiction like India by an authority like SEBI must adhere to high standards of financial conduct, capital adequacy, and client fund protection. A subsidiary, even one operating under the same brand, is a separate legal entity. It may be registered in the same country or, in many cases, in an offshore jurisdiction with significantly weaker regulations.

While Dhans parent company is based in India, the principle remains a critical point of awareness for traders globally. The reputation of a regulated parent can be used to attract clients to a subsidiary that does not offer the same level of protection. The subsidiary is bound only by the laws and regulations of its own jurisdiction. This means that the investor protection schemes, dispute resolution mechanisms, and operational standards that apply to the parent company may not be accessible to the clients of the subsidiary. This creates a potential minefield for unsuspecting traders who believe they are protected by the parent's regulatory status.

Risk 1: Regulatory Arbitrage

“Regulatory arbitrage” is a key risk highlighted in the analysis. This term describes a strategy where a company establishes a subsidiary in a jurisdiction with more lenient financial laws to bypass the strict rules imposed on the parent company. For a broker, this can be a deliberate business decision to lower operational costs and offer higher leverage, which might be prohibited in more regulated markets.

For the trader, the consequences of regulatory arbitrage are direct and severe. It can translate to weaker client fund segregation rules, meaning the broker might be able to use client funds for its operational purposes, placing capital at risk. It can also mean lower capital adequacy requirements, making the subsidiary more vulnerable to insolvency during periods of market volatility. By operating through such a structure, a firm can effectively offer products or terms that would not be allowed by a major regulator, all while using the brand credibility of its well-regulated parent to attract customers.

Risk 2: Inconsistent Investor Protection

Perhaps the most tangible risk for a trader is the variation in investor protection. The regulations that safeguard your money, such as compensation schemes that protect client funds in the event of a broker's insolvency, are tied to the specific legal entity you trade with. A highly regulated parent in a major financial hub like Mumbai might be covered by a robust investor protection fund. A subsidiary, particularly one in an offshore location, may offer minimal or no such protection.

In Dhan's case, while clients are registered under the SEBI-regulated Raise Securities, the separation of the brand and the licensed entity requires careful scrutiny of the terms of service. Traders must confirm that their agreement is unequivocal with Raise Securities Private Limited and that they are end to all protections afforded by SEBI. Any ambiguity in the legal language could potentially leave them without recourse in a worst-case scenario. The source material's warning about Dhan's lack of direct regulation underscores the importance of this point, as protections are rarely extended by association; they are granted by direct legal and regulatory mandate.

Risk 3: Challenges in Dispute Resolution

When a dispute arises with your broker—be it over a trade execution, a withdrawal request, or a platform malfunction—your ability to seek legal remedies is governed by the laws of the broker's jurisdiction. If your contract is with a subsidiary registered in a foreign country, you may find yourself facing a difficult and expensive legal battle in an unfamiliar court system.

Even in a domestic scenario like Dhan's, the two-entity structure can complicate matters. The disclaimer instructing clients to use the parent company's name when dealing with authorities is a telling sign. It suggests that complaints directed at “Dhan” might be deflected, forcing the client to navigate a corporate structure just to have their grievance heard by the correct legal entity and its regulator. This additional layer of complexity can be a significant deterrent for traders seeking a speedy and effective resolution to their problems. An ideal brokerage relationship is one where the line of accountability is direct and unambiguous.

Risk 4: Disparities in Operating Standards

A shared brand name does not guarantee shared operating standards. The parent company and its subsidiary can have different management teams, internal policies, risk control measures, and overall financial stability. The parent may adhere to the highest standards of conduct as mandated by its regulator, while the subsidiary operates with more lax internal controls.

This can manifest in various ways, from the quality of customer service to the reliability of the trading platform and the robustness of its cybersecurity. The source analysis gives Dhan's software a moderate score of 4.86, but its risk control has a score of 0.00, which is a major red flag. It suggests that while the front-end user experience might be appealing, the back-end systems for managing financial risk may be critically deficient. For a trader, this increases counterparty risk—the risk that the broker will be unable to fulfill its financial obligations, potentially leading to losses that have nothing to do with one's trading decisions.

A Closer Look at Dhan's Offerings

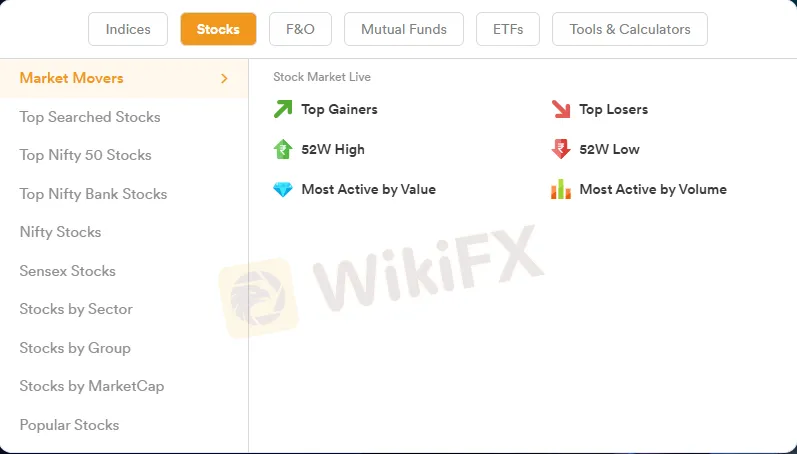

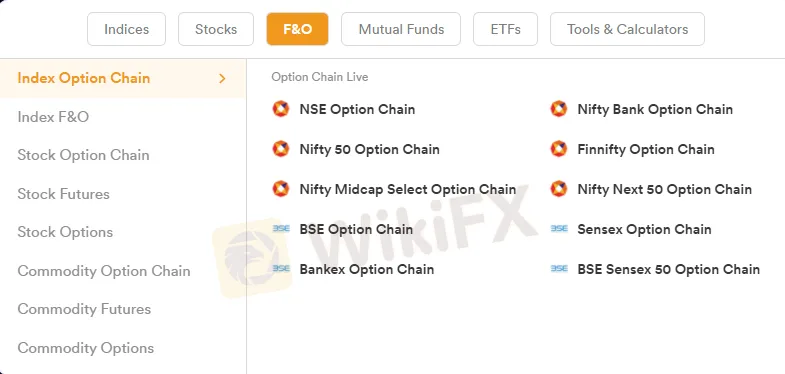

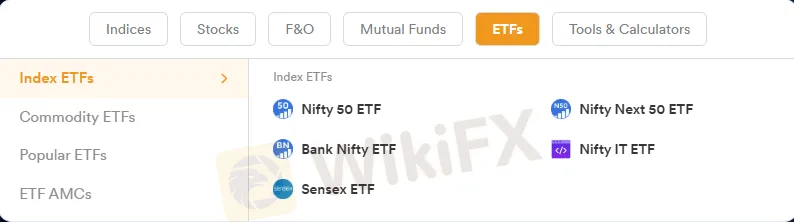

Despite the regulatory concerns, Dhan's platform is designed to be attractive to modern traders. The website advertises a wide array of products, including Stocks, Options, Futures, Commodities, ETFs, and Mutual Funds. It boasts features built for “Super Traders” and “Long Term Investors,” such as Strategy Builders, Flash Trades, and Margin Trading Facilities (MTF). The company highlights its “1 Mn+ Active Users” and a “4.5 Play Store Rating” as markers of its success and user satisfaction.

However, these features and metrics must be viewed through the lens of the underlying risks. A sophisticated trading platform is of little value if the broker's regulatory foundation is questionable. The extensive product list, from Nifty 50 options to various equity funds, is offered through a platform that has been flagged for having “no valid regulatory information” of its own. The slick user interface and promises of an “incredible experience” can inadvertently distract users from conducting the necessary due diligence on the broker's legal and financial integrity.

How Traders Can Protect Themselves

The issues raised in this review are not unique to Dhan but are prevalent in the online brokerage industry. Therefore, it is crucial for every trader to develop a rigorous checklist for vetting any potential broker. Based on the expert advice provided in the source document, here are the essential steps to protect yourself:

- Verify the Specific Regulation: Do not simply trust a broker's marketing claims of being “regulated.” Find the specific legal name of the entity that will hold your account and your funds. Then, visit the official website of the relevant regulatory body (e.g., SEBI in India, FCA in the UK, ASIC in Australia) and use their public register to confirm the entity's license and its permitted activities. If the name doesn't appear, it's a major red flag.

- Check the Jurisdiction: Identify the country where the broker entity is registered and regulated. Be extremely wary if the subsidiary that holds your account is based in a known offshore financial center or a lightly regulated jurisdiction. The level of protection you receive is directly tied to the strength and reputation of that jurisdiction's regulatory framework.

- Understand Investor Protections: Investigate the specifics of the investor protection schemes in the subsidiary's jurisdiction. Is there a compensation fund? How much does it cover per client? What are the conditions for a payout? A broker that is unable to provide clear and direct answers to these questions should be avoided.

- Review the Client Agreement: Before funding an account, carefully read the entire client agreement or terms of service. This legal document is your contract with the broker. Confirm that the entity named in the contract is the same regulated entity you intended to trade with. Pay close attention to clauses related to dispute resolution, liability, and the governing law of the contract.

Conclusion

The case of Dhan and its parent company, Raise Securities Private Limited, serves as a powerful illustration of a critical issue in the modern trading landscape. While the platform offers an extensive range of products and a seemingly advanced user experience, its regulatory structure presents risks that cannot be overlooked. The reliance on a parent company's license, while the brand itself remains unregulated, creates a potential gap in investor protection, legal recourse, and operational oversight. The low score and explicit warnings found in the source analysis highlight the severity of these concerns.

For traders, the primary lesson is the paramount importance of due diligence. The allure of a technologically sophisticated platform or attractive marketing should never overshadow the fundamental need for clear, direct, and robust regulation. Always ensure you are contracting directly with a licensed entity in a strong jurisdiction and that you fully understand the protections afforded to you. In an industry where risk is inherent, adding unnecessary counterparty and regulatory risk by choosing a broker with an ambiguous structure is a gamble that is simply not worth taking.

Read more

City Index Exposed: Users Report Login Failures, Deposit Discrepancies & Poor Customer Service

Does your forex trading experience with City Index face issues like repeated login failures, preventing you from trading in a dynamic market? Do you face deposit credit issues with the United Kingdom-based forex broker? Does the broker’s customer service team fail to respond to your queries? You are not alone! In this article, we have shared the trading complaints made by the traders. Take a look!

Checkout the FCA Warning List of Unauthorised Firms Now!!

The Financial Conduct Authority (FCA) in the UK has published the FCA Warning List- October 2025, alerting forex traders and investors about unauthorized brokers. To safeguard your funds and avoid scam. Checkout the Full warning list below

Traders Expose Major Flaws in Moomoo’s Operations: Payout Issues, Poor Support & More

Is receiving payouts from Moomoo, a Malaysia-based forex broker, becoming virtually impossible? Have you faced account lockups while raising payout queries with the broker? Does the customer service team fail to understand your queries and give you general replies? Have you witnessed the forced liquidation of your Moomoo forex trading account? These indicate a potential forex investment scam. In this article, we have exposed the broker through various trader reviews. Take a look!

Zacks Trade Review: Is Zacks trade Legit or Scam?

Zacks Trade is a forex broker operating in Forex market, but its customer support has received negative feedback. Many users have reported that the support team is totally unprofessional & Slow. If you are considering using Zacks Trade, it's important to be aware of these concerns.

WikiFX Broker

Latest News

RM8.7 Million Lost to Scam Promising US$3 Million Returns Abstract: 57 Malaysians have collectively

Top Forex Regulatory Bodies You Need to Know

Fidelity Global Innovators to High Risk in Jan 2026

BotBro Chief Lavish Chaudhary to be Behind Bars Soon? Here’s the Inside Story!

Malaysia Investor Alert List is Out! Check the list to Avoid Scam

Think Your Broker is Safe? 5 Secrets Only WikiFX Can Uncover

Why Forex Trading? Top 10 Reasons to Start Now

WTO hikes global trade forecast for 2025 — but next year doesn't look so good

Kazakhstan Cracks Down Unlicensed Crypto Exchanges

Spot Forex Trading Explained: Definition, How It Works and Key Factors to Know

Rate Calc