Macau casino stocks: Can Sands and Wynn see further boost from Beijing?

Abstract:Macau casino stocks have jumped since early November. Beijing announcing existing licence will be renewed and hopes of an end/easing in covid restrictions are seen as key reasons for the stock rises.

Macau casino stocks have jumped since early November. Beijing announcing existing licences will be renewed and hopes of an end/easing in covid restrictions are seen as key reasons for the stock rises.

Sands China (Sands China) currently at HK$24 is up over 57% in the last month. Wynn Macau (WYNN)- currently at HK$7.74 is up 121% over the month.

MGM China (MGM China) - currently at HK$7.13 is up 98% over the month and Melco International Melco International (MLCO)- currently HK$7.88 is up 72% over the month.

Given the high percentage increase is there an argument that the positive noises on licensing and potential easing of Covid restriction are now priced into the stocks?

On closer inspection you could argue that the stock prices, historically speaking, are not inflated at current levels. Pre-pandemic, Sands China was priced at HK$44; Wynn Macau at HK$21;MGM China HK$17; and Melco International HK$22

All four stocks are still signficantly lower than these pre-Covid price levels. While the past month has shown positive momentum for these Macau names, it has been a pretty torrid year – so any bounce now is relative.

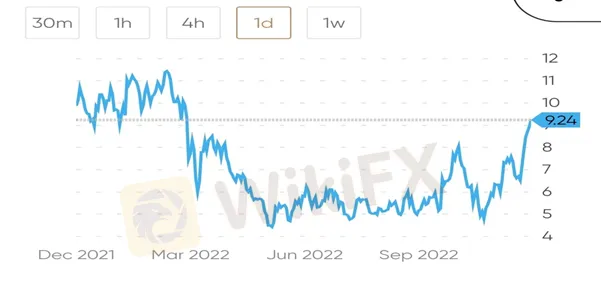

Melco International share price chart

Last year, the Macau government pledged to step up oversight of casinos. This hard-line stance wiped more than $20bn off the market value of listed gambling operators, as fears that tight regulations could squeeze margins already impacted by Covid-19.

Casino stocks took one hell of a tumble as investors feared that as licenses to operate in Macau expired and gaming laws were reviewed, casino groups were essentially a high-risk bet.

But the landscape has changed somewhat since then. Last month, Beijing confirmed that the casino licenses of many of the operators in Macau - including all four profiled here - would be renewed. Given the billions of dollars the casino groups have ploughed into the China-owned territory to make it a global gambling centre, there will have been a huge and collective sigh of relief.

Investment in Macau

There is though, a degree of compromise with Beijing‘s offer. Those awarded licenses will be obliged to increase the focus on overseas customers and develop non-gaming projects. It is believed casino groups may have to invest something in the region of $12.5bn (combined) and in so doing, diversify Macau’s tourist profile.

The attraction to families and non-gamblers is something that Las Vegas has pursued with theme/water parks, music events, shopping centres and art exhibitions included in the mix.

Lawrence Ho, chairman and chief executive of Melco, gave a clear indication that Beijings expectations for casino groups would be satisfied.

“We are committed to Macau and its development as Asia's premier tourist destination,” he said in a statement.

Brokers are largely bullish on these casino names right now. Marketbeat has a ‘strong buy’ recommendation for China Sands. And it has a ‘moderate buy’ rating for Melco International with a consensus price target of HK$11.51.

Read more

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Hong Kong Regulator Warns Against CoinCola

Hong Kong’s financial watchdog, the Securities and Futures Commission (SFC), has issued a public warning against CoinCola, adding the platform to its Alert List of suspicious virtual asset trading platforms (VATPs). According to the SFC, CoinCola operates through the website and is suspected of conducting unlicensed virtual asset activities while appearing to target or operate in Hong Kong.

Bridge Markets Review: Is It Safe to Trade Here?

Bridge Markets Review uncovers scam alerts, blocked withdrawals, and unregulated trading risks.

WikiFX Broker

Latest News

Ringgit hits five-year high against US dollar in holiday trade

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Commodities: Gold Targets $5,000 as Central Banks Buying Spree Meet Geopolitical Shocks

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Transatlantic Rift: Visa Wars and Tech Tariffs Threaten EUR/USD

JPY Alert: Bond Yields Hit 29-Year High as Market Challenges BOJ

US Banking Giants Add $600B in Value as Deregulation Widens Gap with Europe

Markets Wrap: Gold and Equities Surge to Records as Holiday Liquidity Thinness Rattles Speculative A

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Rate Calc