Bridge Markets Review: Is It Safe to Trade Here?

Abstract:Bridge Markets Review uncovers scam alerts, blocked withdrawals, and unregulated trading risks.

Introduction

Bridge Markets has positioned itself as a global brokerage offering access to forex, metals, stocks, and cryptocurrencies. Yet beneath the polished marketing lies a troubling reality: the firm operates without valid regulation, has a history of blocked withdrawals, and faces mounting complaints from traders. This Bridge Markets Review investigates the brokers background, regulatory standing, account offerings, and user experiences to determine whether it is safe to trade here.

Bridge Markets Regulatory Status

Bridge Markets is registered in the Marshall Islands, a jurisdiction notorious for hosting offshore brokers with minimal oversight. The broker once held a Common Business Registration with the National Futures Association (NFA) in the United States under license number 3732808, but that license has since expired.

- Current status: Unregulated

- WikiFX score: 2.08/10, flagged with warnings to “stay away”

- Regulatory alerts: Multiple warnings highlight that Bridge Markets has no valid forex regulation

This lack of oversight means traders have no legal recourse if disputes arise, a stark contrast to regulated competitors such as IG Group or CMC Markets, which operate under strict FCA and ASIC supervision.

Domain and Corporate Transparency

Bridge Markets operates through multiple domains, including bridgemarkets.global and bridgemarkets.eu, with servers located in the United States and the Netherlands. The company claims to have been founded in 2014, but its corporate transparency is limited.

Customer support is listed with two U.S. phone numbers and an email address (support@bridgemarkets.eu), yet numerous user reports suggest that communication is inconsistent, especially when withdrawal requests are made.

Trading Instruments and Platforms

Bridge Markets advertises a broad range of tradable instruments:

- Forex

- Metals

- Stocks

- Indices

- Cryptocurrency

- Shares and Mutual Funds

The broker supports MetaTrader 5 (MT5), available on desktop and mobile. Execution speed averages 164 ms, with two MT5 servers listed. While MT5 is a respected platform, the brokers infrastructure raises concerns due to reported disconnections and blocked accounts.

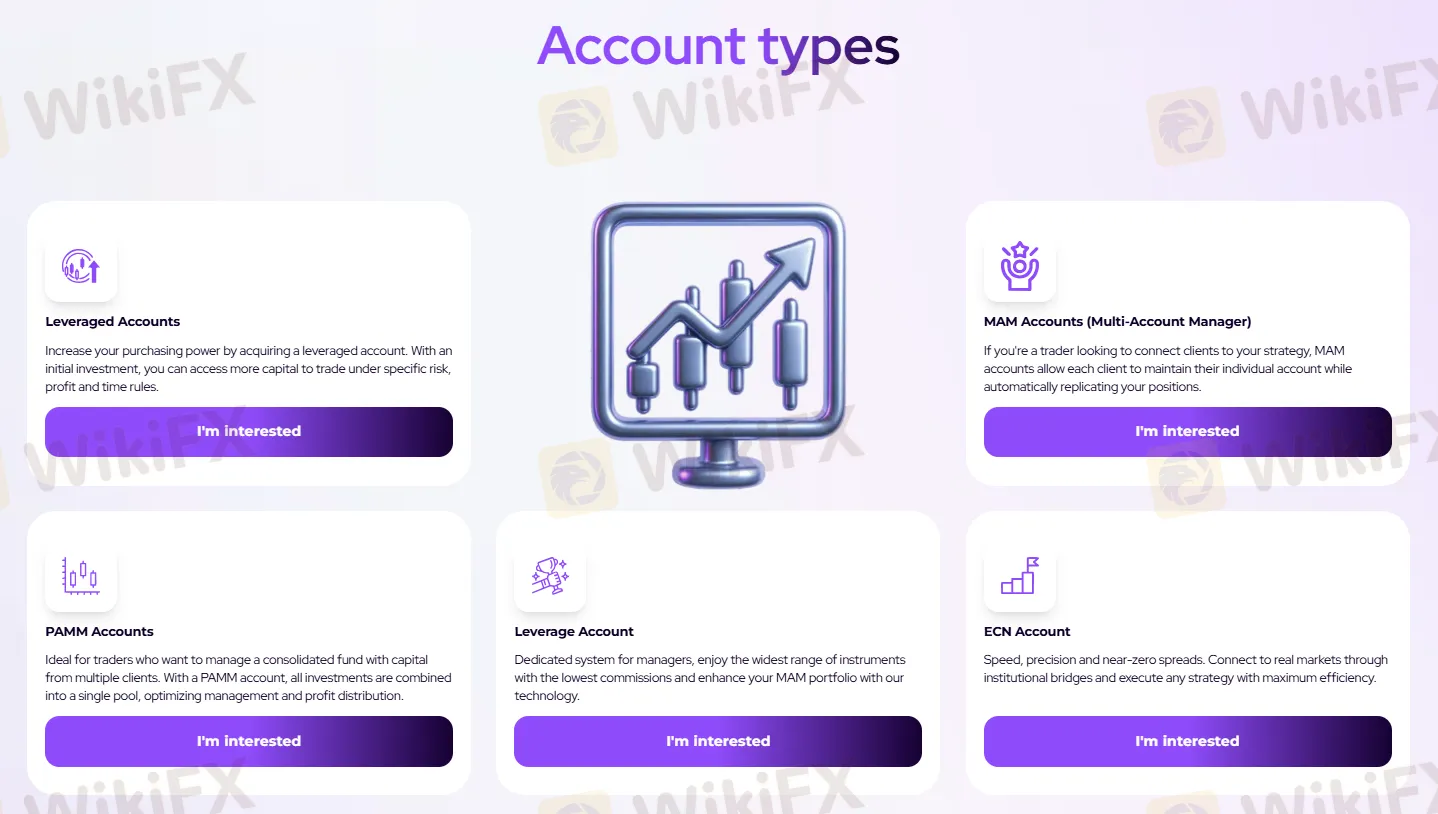

Account Types Offered

Bridge Markets promotes four account categories:

| Account Type | Key Features | Suitable For |

| Basic Account | Floating spreads, liquidity, clear trading conditions | Beginners |

| ECN Account | Raw spreads, direct market access, no requotes | Experienced traders, scalpers |

| MAM Account | Multi-account management, customizable allocations | Institutional investors, money managers |

| Prop Firm Accounts | Funded trading, performance-based payouts | Talented traders seeking capital |

While the variety appears attractive, the absence of transparent fee structures and the brokers regulatory shortcomings undermine the credibility of these offerings.

Reported Cases and User Complaints

The most alarming aspect of this Bridge Markets Review is the volume of user complaints. Based on the reported exposures, 78 user reviews, with recurring themes:

- Blocked withdrawals: Traders report deposits being accepted instantly, but withdrawals either delayed indefinitely or denied outright.

- Account freezes: Several accounts were disconnected from MT5 without explanation, leaving balances inaccessible.

- Altered records: Users claim withdrawal histories were manipulated, balances reset to zero, and profits erased.

- Accusations of HFT violations: Bridge Markets frequently responds to complaints by accusing clients of using high-frequency trading bots, a tactic often used to justify non-payment.

Examples include:

- A trader in Switzerland unable to withdraw $8,100 USD, with requests pending for weeks.

- Another user in Germany reporting execution delays exceeding one second and failure to process even the initial deposit withdrawal.

- Multiple cases in Colombia and Ecuador where accounts were deleted or balances frozen without resolution.

These reports paint a consistent picture of capital retention and systemic withdrawal issues, hallmarks of scam operations.

Pros and Cons

Pros:

- Supports MetaTrader 5

- Offers multiple account types

- Wide range of instruments

Cons:

- Unregulated, expired NFA registration

- Numerous withdrawal complaints

- Limited transparency on fees

- Offshore registration in Marshall Islands

Comparison with Competitors

Compared to regulated brokers such as Pepperstone or Saxo Bank, Bridge Markets falls short in every critical category:

- Regulation: Competitors are licensed under FCA, ASIC, or CySEC, offering investor protection.

- Transparency: Leading brokers disclose fee structures, spreads, and execution policies. Bridge Markets provides vague or missing details.

- Reputation: While competitors maintain strong trust scores, Bridge Markets is flagged with scam alerts and a WikiFX score of 2.08/10.

Bottom Line

This Bridge Markets Review concludes that the broker poses significant risks to traders. Despite offering MT5 access and multiple account types, the absence of valid regulation, offshore registration, and repeated reports of blocked withdrawals make Bridge Markets unsafe.

For traders seeking security and transparency, regulated alternatives such as IG Group, Pepperstone, or CMC Markets provide far stronger safeguards. Bridge Markets, by contrast, demonstrates the classic warning signs of an unreliable broker: unregulated status, opaque operations, and systemic withdrawal issues.

Final Verdict: Bridge Markets is not safe to trade with. Traders should avoid this broker and opt for regulated platforms that guarantee transparency, investor protection, and reliable withdrawal processes.

Read more

ZForex Review: Is It Safe for Traders?

ZForex Review highlights the lack of regulation, risky leverage, and withdrawal issues reported by traders worldwide.

Capitalix: The ‘Burn and Ransom’ Trap Hiding Behind a Seychelles Shell

It starts with a phone call—often aggressive, always persistent. A "personal manager" promises to guide you through the complexities of the market, asking for a modest $200 deposit. But according to sixteen separate reports from victims across Latin America, Europe, and the Middle East, that initial deposit is just the entry fee to a financial hostage situation.

WikiFX Deep Dive Review: Is dbinvesting Safe?

If you are thinking about trading with dbinvesting, you need to be very careful. At WikiFX, we analyze brokers based on facts, licenses, and trader feedback.

BitPania Review 2025: Safety, Features, and Reliability

BitPania is a relatively new brokerage established in 2024 and registered in Saint Lucia. The platform markets itself as a digital trading solution offering multiple account types and support for automated trading (EAs). However, potential investors should approach with significant caution. Currently, BitPania holds a WikiFX Score of 1.20, a very low rating that reflects its lack of regulatory oversight and recent user complaints regarding withdrawals.

WikiFX Broker

Latest News

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

JPY Forecast: Japan Raises Debt Cost Assumption to 30-Year High

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Brokers or Prop Firms, or both...

Trading.com Launches Zero-Commission Investment Account

Quotex Review 2025: Safety, Features, and Reliability

Government Officer Lost RM12,000 to Non-Existent Forex Scheme

Rate Calc