GLEX-Overview of Minimum Deposit, Leverage, Spreads

Abstract:Registered in Mauritius, GLEX is an online forex broker offering a series of trading instruments, including currency pairs, commodities, index, stocks, as well as digital pairs. With GLEX, investors have the flexibility to choose from three trading accounts, and the maximum leverage that can be used is up to 1:300.

General Information

Registered in Mauritius, GLEX is an online forex broker offering a series of trading instruments, including currency pairs, commodities, index, stocks, as well as digital pairs. With GLEX, investors have the flexibility to choose from three trading accounts, and the maximum leverage that can be used is up to 1:300.

Market Instruments

GLEX boasts that it provides easy access to a massive financial markets. Different types of trading assets, including Foreign Exchange, Commodities, Equity, Cryptocurrency are all available through this brokerage platform.

Account Types

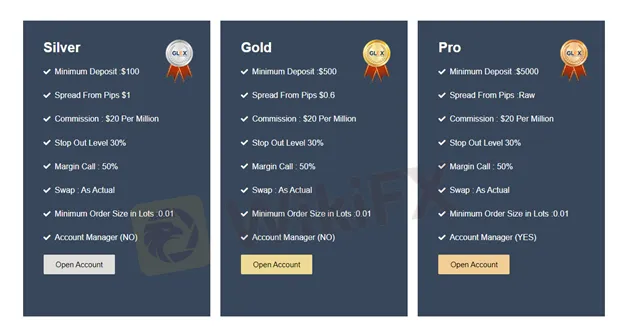

Three types of trading accounts are offered on the GLEX platform: Silver Gold and Pro, to accommodate both retail and professional traders trading needs. The Silver account is more suitable for beginners or inexperienced traders, asking for an initial deposit of $100, which is acceptable. The Gold account is suitable for moderate traders, with the minimum deposit required starting at $500, and traders who want to try out the Pro account need to fund at least $5,000.

Aside from live trading accounts, demo accounts are also available for you to get a feel of this platform and then practice your trading skills.

How to open an account with GLEX?

Opening an account with GLEX is not troublesome, with a few steps to follow:

1. Click the “Register” link, and fill up some required details on the following page, including your valid email, password, preferable trading account.

2. Upload relevant personal data for this company to verify your details.

3. Fund your account and begin to trade.

Leverage

When it comes to leverage, GLEX permits traders to use leverage of up to 1:300, which is significantly higher than the levels regarded appropriate by many regulators.

As leverage can also cause serious fund losses, it is important for inexperienced traders to choose the proper amount that they feel most at ease.

Spreads

All three trading accounts charge the same commission, with spreads varying from each account. The spreads offered by these three accounts from 1 pips, 0.6 pips, and 0.0 pips, respectively, with a commission of $20 per million.

Trading Platform

What GLEX offers is not the industry-leading MT4 or MT5 trading platform, and it offers trading app that can be downloaded from MacOS, Google Play and Android APK.

Payment Methods

GLEX says it offers multiple payment methods including Credit Cards, Online Wallets, including Neteller and Skrill, online banking and bank wire transfer. To view the full list of depositing methods and fund your account-login to your client area and click on “Deposit” on the right side menu. Choose “Deposit”, select the trading account to which you wish to deposit and click “submit”.

Customer Support

If a trader has any inquiries or issues regarding his or her account or trading activity on GLEX he or she can only use the following channel to contact the broker:

Telephone: +1 551-225-8492

Email: support@glex24.com

Online Communication

Registered Company Address: 235, Camp Fouquereaux, Phoenix Mauritius, 73609

Or you can keep up with this brokerage on some popular social media platforms, such as Facebook, Twitter, Instagram, Youtube, Linkedin and Pinterest.

Service Hour: Monday-Friday Time Zone GMT 04:00-13:00.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

Read more

Vonway Review: A Series of Unfair Account Suspension & Withdrawal Denial Complaints

Have made substantial profits through Vonway, but could not withdraw? Initiated the Vonway withdrawal request, but the same was denied on the grounds of hedging violation? Were your trade orders executed at an unfair price? Have you faced a trading account suspension by the broker without any explanation? These have allegedly become regular for many traders here. In this Vonway review article, we have shared a list of the top complaints against the forex broker.

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Attracted to Advanced Markets for the expert-led copy trading experience? Did you earn profits from the copy trade executed by the expert hired by the forex broker? But did the broker question some trades even though you paid the performance fee to the expert? Is the trade order execution time too slow at Advanced Markets? Do you witness high slippage issues? You are not alone! Many traders have shared these concerns online. In this Advanced Markets review article, we have described some complaints. Take a look!

Is WisunoFX Safe? An Unbiased 2025 Assessment of Platform Risks and Red Flags

Is WisunoFX a safe broker for your money? The answer is not simple. After looking at everything carefully, the platform gets a score of 7.21 out of 10. This means it has both good points and serious risks. For traders who want to research before investing, WisunoFX has two sides: it offers good trading conditions, but it also has some structural and regulatory issues that need careful thought. The broker has been operating for 5-10 years and has built up a presence in the market. However, it's officially labeled as a "Medium potential risk" platform, which cannot be ignored. Before investing, it's important to compare its good points with its bad ones.

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

When evaluating any trading company, it is essential to conduct a thorough WisunoFX regulation check first. This broker operates under two distinct sets of rules, which you must understand carefully. First, it has a license from the Cyprus Securities and Exchange Commission (CySEC), which is a trusted European regulator. Second, it has another license from the Financial Services Authority (FSA) in Seychelles, which is located offshore. These two licenses don't give traders the same level of protection. The CySEC license means the broker must follow strict European Union financial rules, while the FSA license has much less supervision. This guide will explain what each license means to traders, look at the company structure behind the brand, and examine the safety factors every potential client should think about.

WikiFX Broker

Latest News

The "VIP" Trap: Inside the Algo-Trading Nightmare at Zenstox

A Simple Guide to WisunoFX Rules: Understanding Safety and Risks When Trading

Advanced Markets Exposed: Faulty Copy Trading & Execution Failures Cost Traders Dearly

Coinlocally Broker Review: Coinlocally Regulation & Real User Complaints Exposed

RM783,000 Gone: Restaurant Owner Fell Victim to an 85%-Return Investment Scheme

Complete Breakdown: MARKET-HUB Regulation & All Negative Reviews Exposed

Exposure: NAGA’s "Phantom Bonus" Trap and the $80,000 Silent Treatment

ATFX Partners with KX to Enhance Real-Time Trading Solutions

ThinkMarkets Hit By Chaos Ransomware In Major Data Breach

Interactive Brokers Opens Access to Brazil’s B3 Exchange

Rate Calc