Stock Core -Some important Details about This Broker

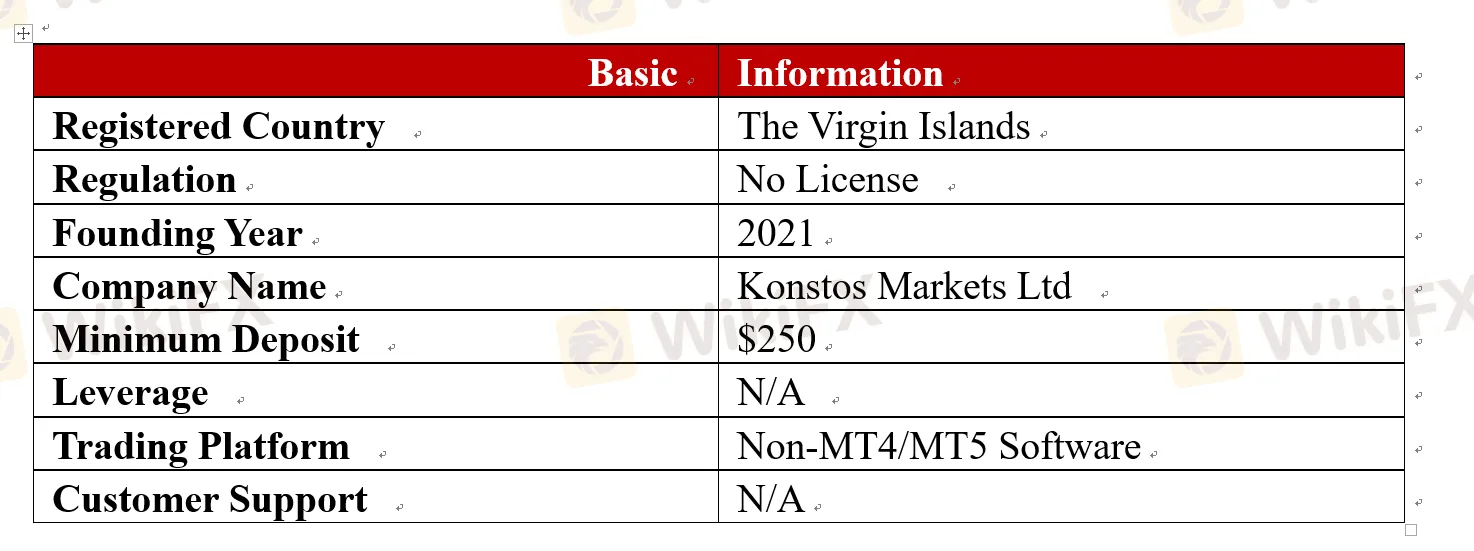

Abstract:Established in 2021, Stock Core is an offshore forex broker registered in the Virgin Islands, with the company behind it called Konstos Markets Ltd. Stock Core claims to offers tiered trading accounts designed for different types of clients, the minimum deposit to start with it from $250. Asides from these details mentioned, some other key information about its trading costs, leverage, withdrawal issues, customer support, and more is not disclosed, which makes this forex broker suspicious to trade with.

Since Stock Core official website (https://stockcore.co/) is now unavailable, we had to piece together as much information as possible on this brokerage house as a forex broker from other sources.

General Information

Established in 2021, Stock Core is an offshore forex broker registered in the Virgin Islands, with the company behind it called Konstos Markets Ltd.

Stock Core claims to offers tiered trading accounts designed for different types of clients, the minimum deposit to start with it from $250.

Asides from these details mentioned, some other key information about its trading costs, leverage, withdrawal issues, customer support, and more is not disclosed, which makes this forex broker suspicious to trade with.

When it comes to regulation, it has been verified that Stock Core is not governed by any regulatory authorities. Thats why its regulatory status on WikiFX is classified as “No License” and it only manages a score of 1.27 out of 10 overall.

Don't be oblivious to the potential danger, for trading with an offshore unregulated forex broker is a surefire way to lose your money.

Account Types

Stock Core offers three tiered trading accounts for both novices and professional traders, namely Newbie, Standard, and Premium accounts.

Let‘s disclose its account setting now, with the Newbie account, investors need to fund at least $250, acceptable yet much higher than their peers’ requirements. However, from the Standard account, the minimum deposit soars to $25, 00, with the Premium account as high as $10,000.

Obviously, as an offshore and unregulated forex broker, Stock Core is just trying to extract investors available funds at the very first by charging an absurdly high deposit, then disappears.

Trading Platform

Please note what Stock Core offers is not the industry-standard MT4 or MT5 trading platform.

Customer Support

Worryingly, no contact channel is available to get in touch with Stock Core, this is another red flag.

The absence of effective information means if you encounter something wrong during trading process, you would have no one to turn to.

Risk Warning

There is a considerable degree of risk involved with online trading of leveraged Forex and CFD instruments, and as a result, it may not be appropriate for all investors.

Please keep in mind that the data presented in this article is meant to serve as a guideline only.

Read more

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

FBS Forex Scam Alert: High Complaint Ratio

FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

Understanding how to add funds to your account and, more importantly, how to take them out is essential for safe trading. For any trader thinking about ACY Securities, making an ACY SECURITIES deposit is simple, but the ACY SECURITIES withdrawal process has many serious complaints and concerns. While ACY says it is an established, regulated broker, many users have complained specifically about withdrawal problems, creating a confusing and often contradictory picture. This guide provides a complete and critical analysis. We will first explain the official steps for deposits and withdrawals, including methods, fees, and stated timelines. We will then take a deep look at patterns found in over 180 real user complaints, examining the potential warning signs and risks. By combining official information with real-world user experiences and regulatory warnings, this article aims to give you the clarity needed to make an informed decision about the safety of your funds with ACY Securities.

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc