HCH-Overview of Minimum Deposit, Leverage, Spreads

Abstract:HCH Trading L.L.C is a forex brokerage firm registered in Dubai, UAE, allegedly offering its clients access to a series of trading instruments, such as Foreign Exchange, CFDs on the index, and shares, with the spread on the EUR/USD pair as low as 0.8 pips.

General Information

HCH Trading L.L.C is a forex brokerage firm registered in Dubai, UAE, allegedly offering its clients access to a series of trading instruments, such as Foreign Exchange, CFDs on the index, and shares, with the spread on the EUR/USD pair as low as 0.8 pips.

Regulatory Details

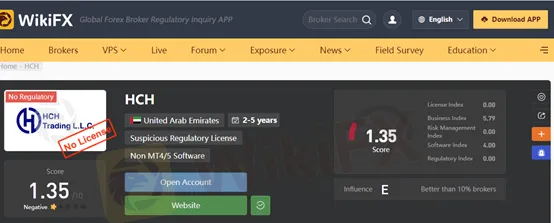

In terms of regulatory information, it has been verified that HCH Trading is not subject to any valid regulation, and it got a pretty low score of 1.35/10 on the WikiFX website.

Please be aware of the risk.

Market Instruments

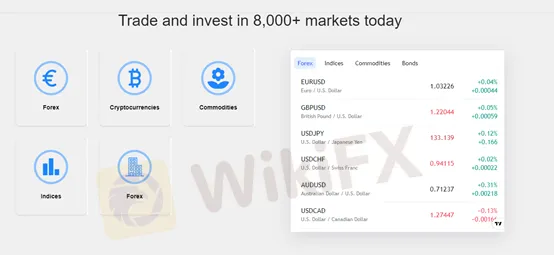

HCH Trading hypes that it offers clients access to trading and investing in more than 300 financial markets. Different classes of trading assets, including Foreign Exchange, Indices, Commodities, Indices, and Bonds, are all available through this brokerage platform.

Account Types

Three trading accounts are available with this brokerage platform, namely the Standard account, the VIP account, and the Active Account. Unfortunately, additional account details are not disclosed, even the minimum initial deposit for each account.

How to open an account with HCH?

Opening an account with HCH is an easy and simple process, with a few straightforward steps to follow:

Click the “CREATE AN ACCOUNT” link on the homepage of the HCH website.

Fill in the required details on the popping-up form.

Upload your relevant documents, such as an identification card, or passport, for this brokers verification.

After approval, fund your account and start to trade with this broker.

Leverage

The maximum trading leverage offered by HCH is up to 1:100, which could even satisfy the most aggressive trading strategy. Since leverage can amplify gains as well as losses, inexperienced traders are advised to use a lower lever that they feel most at ease.

Spreads & Commissions

Spread is determined by trading accounts. HCH says it offers competitive spreads, with the spreads on the EUR/USD pair as low as 0.8 pips. However, more instruments spread details are not disclosed.

Trading Platform

Please note that what HCH trading offers is not the MT4 or MT5 trading platform.

Customer Support

HCH Trading can be contacted through the following channels:

Telephone: +447572884741

Email: info@hchbroker.com

Online Communication

Or you can also follow this brokerage platform through some popular social media platforms, such as Facebook, Instagram, Youtube, and Linkedin.

Risk Warning

Online trading in leveraged Forex and CFD instruments contains a high level of risk and may not be suitable for all investors.

Please note that the information contained in this article is for general information purposes only.

Read more

AssetsFX Review – What Traders Are Saying & Red Flags to Watch

Has AssetsFX stolen your deposits when seeking withdrawals from the trading platform? Did the broker fail to give any reason for initiating this? Did you notice fake trades in your forex trading account? Does the Mauritius-based forex broker deny you withdrawals by claiming trading abuse on your part? Did you also receive assistance from the AssetsFX customer support team? Firstly, these are not unusual here. Many traders have shared negative AssetsFX reviews online. In this article, we have highlighted such reviews so that you can make the right investment call. Take a look!

ROCK-WEST Complete Review: A Simple Guide to Its Trading Platforms, Costs, and Dangers

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.

LTI Review 2026: Safe Broker or a High-Risk Scam? User Complaints Analyzed

When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

LTI Regulatory Status: Understanding Its Licenses and Company Registration Details

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Trade deal: India and EU to announce FTA amid Trump tariff tensions

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Rate Calc