Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Abstract:Our detailed investigation into Solitaire PRIME, completed in 2025, answers the most important question every potential investor has: is this broker regulated? The answer is clearly no. When examining Solitaire PRIME Regulation, the answer is clearly no. Our research shows that Solitaire PRIME is not authorized or licensed by any major, trusted financial authority anywhere in the world. This serious lack of a valid Solitaire PRIME License is the biggest warning sign, showing extreme risk for any trader thinking about using their platform.

Our detailed investigation into Solitaire PRIME, completed in 2025, answers the most important question every potential investor has: is this broker regulated? The answer is clearly no. When examining Solitaire PRIME Regulation, the answer is clearly no. Our research shows that Solitaire PRIME is not authorized or licensed by any major, trusted financial authority anywhere in the world. This serious lack of a valid Solitaire PRIME License is the biggest warning sign, showing extreme risk for any trader thinking about using their platform.

The information we present here is a thorough analysis meant to reveal how this company really operates and protect investors from losing significant money. Without regulatory oversight, there are no protections for your money, no required operating standards, and no legal help through established financial channels—key elements that proper Solitaire PRIME Regulation should provide.

Checking Regulatory Records

A basic step in researching any broker is checking their regulatory claims against the official public records of financial authorities. We have carefully cross-checked the name “Solitaire PRIME” and its related companies with the databases of the world's leading financial regulators. The results are clear and consistent across all locations, reinforcing ongoing concerns about Solitaire PRIME Regulation. This process leaves no doubt about the broker's legal status and ability to legally offer financial services. The findings clearly show their lack of operational legitimacy.

Regulatory Compliance Check

To provide complete transparency, the results of our checks are detailed below. We searched for any current or past authorization for Solitaire PRIME and found no evidence of approval, registration, or enforcement under any recognized Solitaire PRIME Regulation framework.

| Regulatory Body | Jurisdiction | Authorization Status for Solitaire PRIME |

| FCA (Financial Conduct Authority) | United Kingdom | No Record of Authorization |

| ASIC (Australian Securities & Investments Commission) | Australia | No Record of Authorization |

| CySEC (Cyprus Securities and Exchange Commission) | European Union | No Record of Authorization |

| SEC / CFTC (U.S. Regulators) | United States | No Record of Authorization |

What This Means

This complete lack of Solitaire PRIME Regulation has serious, real consequences for you as a trader. Without oversight from organizations like the FCA or ASIC, Solitaire PRIME doesn't have to keep client funds separate from company operating funds, meaning your money can be used however they want. There is no access to a financial ombudsman service for resolving disputes, leaving you with no independent organization to appeal to if there's a conflict. Also, there are no investor compensation programs to protect your money if the broker goes out of business. Basically, putting money with an unregulated broker like Solitaire PRIME is taking a huge risk with no safety net.

How a Scam Works

Unregulated brokers like Solitaire PRIME often follow a predictable and harmful operating model. Based on our analysis of many user reports and industry patterns, we have mapped out the typical experience of a client's journey. This is not a legitimate business model; it is a structured process designed to take your money. Understanding these tactics is the first step in identifying and avoiding them, not just with Solitaire PRIME, but with any suspicious company you may encounter in the future. The process is designed to manipulate trust and exploit financial hope.

A Step-by-Step Breakdown

1. The Initial Contact: The process almost always begins with unwanted contact, often through aggressive cold calls, emails, or social media messages. These communications come with amazing promises of unrealistic returns. You will hear phrases like “guaranteed profits,” “double your deposit in a week,” or “make hundreds of dollars per day with no effort.” These are classic signs of a high-pressure sales environment designed to rush you into making an initial deposit without proper thought.

2. The “Smarter Scammer”: Once a minimum deposit is secured, the client is typically handed over to a more senior and persuasive agent, often called a “retention manager” or “senior account manager.” This person's only goal is to build a false relationship and convince you to deposit much larger amounts of money. They will use sophisticated psychological tactics, pretending to be experts and creating a sense of urgency or exclusivity to get more money.

3. Creating False Trust: To counter a potential client's research, these operations often invest in creating a fake appearance of legitimacy online. This includes paying for fake positive reviews on various websites and forums. These testimonials appear real but are part of the marketing deception. We warn all traders to be extremely skeptical of unverified online reviews and to rely on objective data from regulatory bodies instead.

4. The Withdrawal Block: The true nature of the operation is revealed when a client tries to make a withdrawal. The request is met with intentional delays, excuses, and endless requests for more documentation. This is a deliberate stalling tactic. The broker's goal is to delay the process beyond the six-month window that most credit card companies allow for a chargeback. Once this period expires, recovering funds through this method becomes nearly impossible.

5. The “Managed Account” Trap: A particularly harmful tool used is the Managed Account Agreement (MAA). Clients are often pressured into signing this document under the pretense that an “expert” will trade on their behalf for maximum profit. In reality, the MAA gives the broker full control over the account. This power is then used to create a series of losing trades, wiping out the client's balance. The broker can then claim the losses were due to market changes, leaving nothing to withdraw.

Step-by-Step Recovery Guide

If you have already put money with Solitaire PRIME, it is important to understand that you may have options, but you must act quickly and systematically. The following steps provide a guide for potential fund recovery. Stay calm about the situation and begin documenting every interaction immediately.

Method 1: The Chargeback

This is the most effective method for those who put money in using a credit or debit card.

• Act Immediately: Time is critical. The chargeback window is typically limited to 180 days (six months) from the date of the transaction. Do not wait.

• Contact Your Bank: Call the fraud or disputes department of your bank or credit card provider. Do not use the general customer service line.

• Prepare Your Case: Clearly state that you were deceived by an unregulated online trading company that is refusing to process your refund request. Explain that the service provided was not as described and that the company does not comply with financial laws.

• Gather Evidence: Compile all evidence you have. This includes emails, chat logs, and screenshots of your withdrawal requests and any refusal or delay tactics from Solitaire PRIME. This documentation is critical for building a strong case with your bank.

Method 2: Escalation

For deposits made through wire transfer, a chargeback is not possible. The strategy here shifts to applying pressure.

• State Your Intentions: Write a formal email to Solitaire PRIME. State clearly and professionally that if your withdrawal request is not processed within a specified, short timeframe (e.g., 48-72 hours), you will be filing official complaints with financial authorities and cybercrime divisions in your country of residence and theirs.

• Identify the Right Authorities: Search online for the primary financial regulatory agency and the national cybercrime reporting agency in your country. Mentioning these specific agencies by name in your communication with the broker adds weight to your threat.

• Draft a Complaint Letter: Prepare a detailed letter or email outlining the entire timeline of your interaction, the deception involved, and their refusal to refund your funds. Attach your supporting evidence. Show a copy of this draft to the broker. The prospect of having a formal complaint filed can sometimes be enough to motivate a fraudulent entity to issue a refund, as it creates a paper trail they would rather avoid.

Prevention is Key

The issues highlighted with Solitaire PRIME are not unique; they are characteristic of the entire unregulated broker ecosystem. The most powerful tool an investor has is not fund recovery, but prevention. Before engaging with any online broker, you must adopt a non-negotiable habit: independent verification of their regulatory status. This simple step is your best defense against financial fraud.

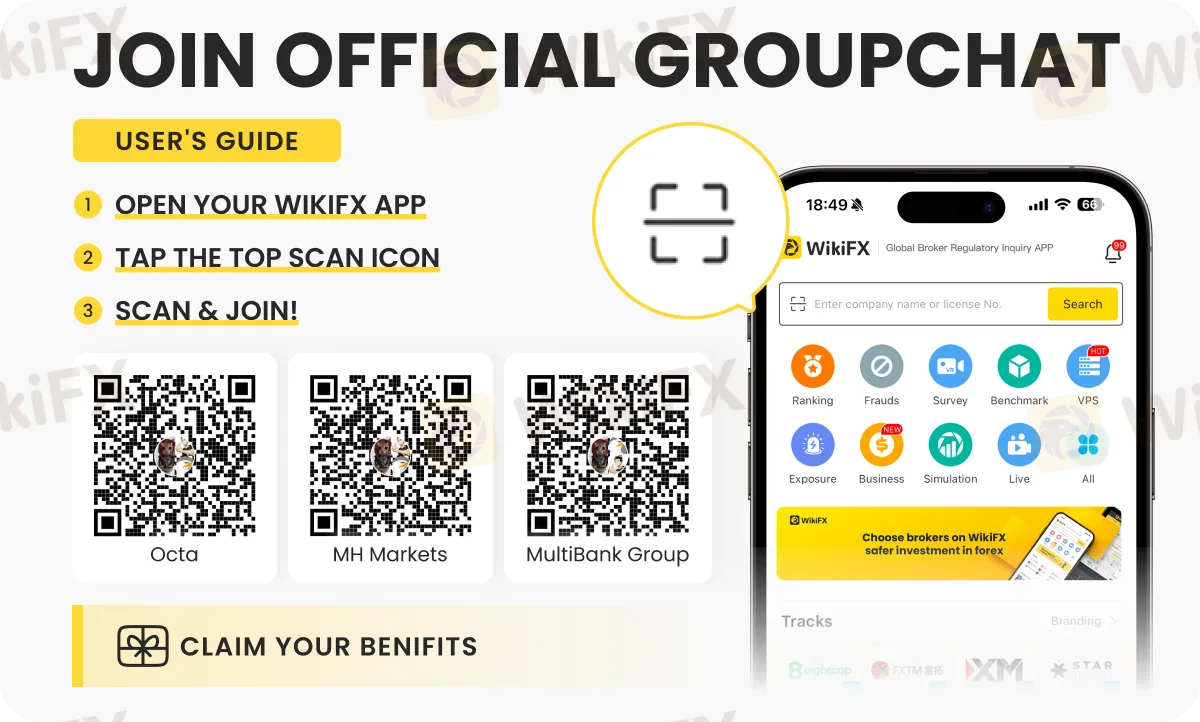

Platforms like WikiFX are an invaluable resource for this purpose. They serve as comprehensive databases that bring together regulatory information, license details, user reviews, and expert evaluations in one place. Before you deposit a single dollar with any broker, perform a quick search on WikiFX. A broker's profile will clearly show if they hold a valid license from a reputable regulator. A lack of a valid license or a low score on the platform is a clear signal to stay away and protect your money.

Final Verdict on Solitaire PRIME Regulation

To conclude, our investigation confirms a complete and total absence of any credible Solitaire PRIME Regulation. The company operates outside the legal framework established to protect investors, making it an extremely high-risk choice. The operating tactics observed are consistent with those of fraudulent schemes, not legitimate financial service providers. To protect your money and financial future, you must only engage with brokers that are transparently and verifiably regulated by top-tier authorities. Always perform your research, and always verify a broker's license using an independent tool like WikiFX before you invest.

WikiFX Broker

Latest News

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

Market Perception: 'SA Inc' Under Review

Energy Markets: Chevron and NNPCL Add 146,000 b/d to Global Supply

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Dollar Index Falters Near 97.00 as Washington Dysfunction Overshadows Economic Data

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

Emerging Markets: West Africa Projected for 4.4% Growth Amid Reforms

Rate Calc