Gold Elephant Review: Safety, Regulation & Forex Trading Details

Abstract:Gold Elephant (GE Bullion) holds a regulatory status with the Hong Kong Gold & Silver Exchange Society and the Seychelles FSA, offering a score of 7.06. However, recent WikiFX data highlights significant user risks, including recurring complaints regarding withdrawal delays and platform login failures.

Gold Elephant (also known as GE Bullion) is a Hong Kong-based broker established in 2023. While it boasts a relatively high safety score on WikiFX, investors must look beyond the numbers to understand the operational reality. This Gold Elephant review analyzes its dual regulatory structure and addresses growing concerns regarding account access and fund security.

Key Takeaways

- Regulatory Status: Regulated by the Hong Kong Gold & Silver Exchange Society (HKGX/CGSE) and the Seychelles FSA.

- WikiFX Score: 7.06 (Good initial rating, but recent complaints require caution).

- Platform Issues: Multiple reports of Gold Elephant login failures and “white screen” technical errors.

- Client Risks: Recent data indicates struggles with withdrawals and forced position liquidations.

Gold Elephant Broker Summary

Gold Elephant operates primarily in the precious metals sector, utilizing both a self-developed platform and the widely used MT4 software. The broker serves a global audience but shows a strong focus on the Asian market. Despite being a young broker (founded in 2023), it has accumulated a significant number of user complaints in a short period. Factors like the lack of support for Windows or MacOS desktop apps (relying on mobile/MT4) and limited withdrawal channels contribute to its mixed reputation among traders.

Regulation: Is the License Real?

Regulation is the cornerstone of Forex and commodity trading safety. According to WikiFX records, Gold Elephant operates under two specific jurisdictions.

| Regulator | License Type | Status | License No. |

|---|---|---|---|

| Hong Kong Gold & Silver Exchange Society (HKGX) | General Registration | Regulated | 117 |

| Seychelles Financial Services Authority (FSA) | Offshore Financial License | Offshore Regulation | SD159 |

Regulatory Analysis

1. Hong Kong (HKGX/CGSE):

The broker is a member of the Hong Kong Gold & Silver Exchange Society. It is important to note that the CGSE is a self-regulatory organization for gold trading, distinct from the Securities and Futures Commission (SFC). While legitimate, it does not offer the same statutory protection level for Forex trading as an SFC license would.

2. Seychelles (FSA):

The entity Gold Elephant Markets Limited holds an offshore license. Offshore regulation allows for higher leverage and easier onboarding but generally provides less stringent client money protection compared to tier-1 regulators like the FCA or ASIC. Essential safety nets, such as compensation funds in case of insolvency, may differ or be absent in offshore jurisdictions.

User Reviews: Gold Elephant Login & Withdrawal Complaints

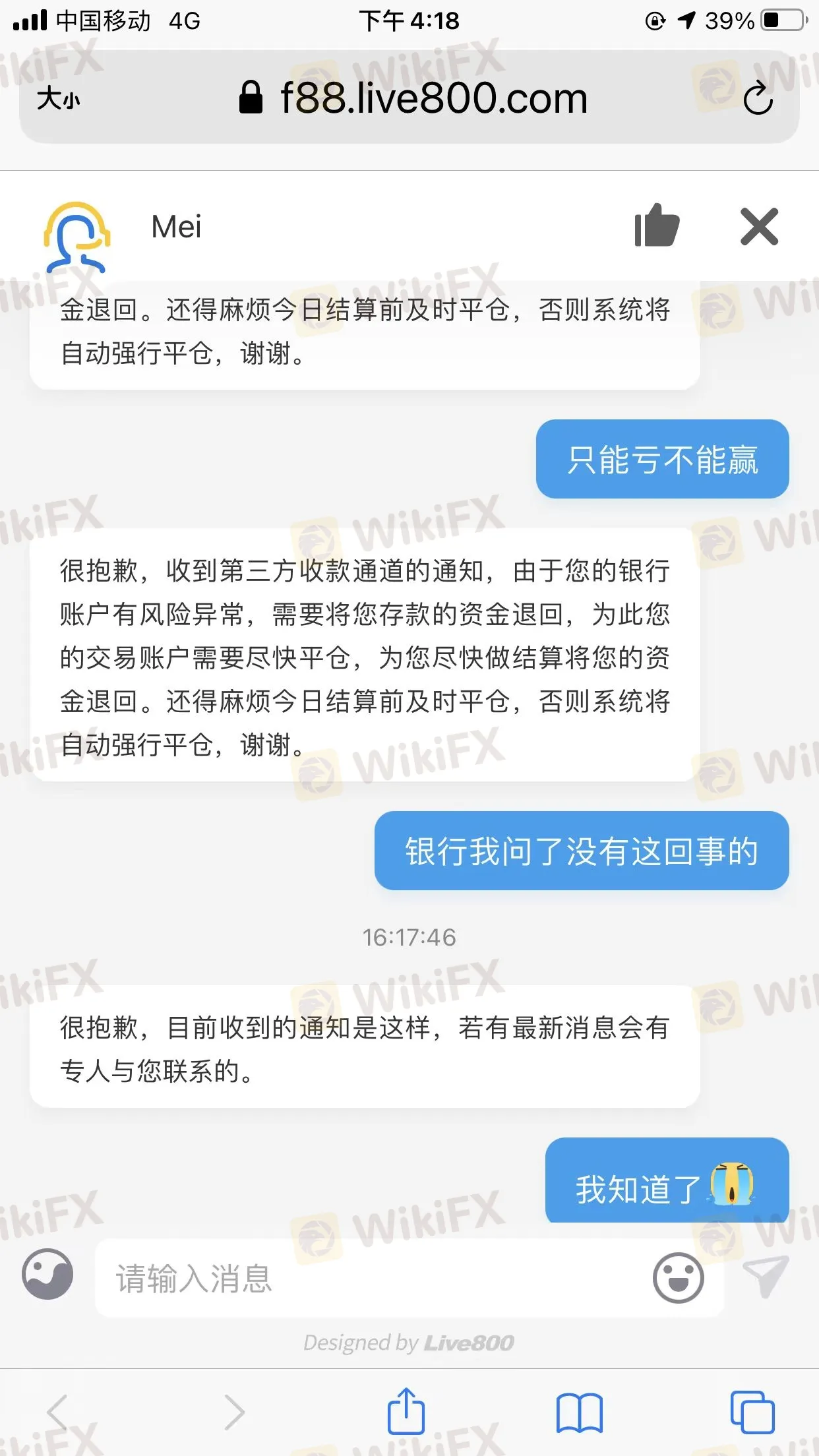

While the regulatory paperwork appears in order, recent user feedback paints a concerning picture of the operational experience. WikiFX records show over 10 serious complaints in recent months, focusing on two main areas: Gold Elephant login stability and fund withdrawals.

1. Login and Platform Stability

Reliable access to your trading account is non-negotiable. However, data indicates frequent technical failures:

- Login Failures: Users have reported being unable to access the personal center on both computer and mobile endpoints. One specific report noted that after an app update, the Gold Elephant login function ceased to work entirely.

- “White Screen” Errors: Multiple traders detailed opening the app only to face a blank “white screen,” preventing them from managing open positions during volatile market moments. This technical instability poses a high risk of unintended losses.

2. Withdrawal Delays and Deductions

Capital mobility is a key indicator of a broker's health. Recent cases highlight:

- Delayed Funds: Traders have reported waiting months for principal withdrawals. One user mentioned a three-month waiting period for capital return.

- Unclear Deductions: There are reports of withdrawals being approved in the system but funds never arriving, or funds being deducted under the guise of “bonus” reclamations without clear communication.

3. Trade Execution Issues

Complaints also mention severe slippage and forced liquidations. Some users claim their positions were closed by the system without reaching stop-loss levels, which the customer service attributed to market gaps or “jumping” prices.

Conclusion

Gold Elephant presents a complex profile for investors. On paper, it holds valid registrations in Hong Kong and Seychelles and offers the robust MT4 platform, resulting in a respectable WikiFX score of 7.06.

However, the operational reality involves significant friction. The detailed reports of Gold Elephant login failures and prolonged withdrawal processes suggest internal instability or technical immaturity. For African and global investors, the combination of offshore regulation and technical blocking creates an elevated risk profile.

Recommendation: Traders should exercise caution. If you choose to trade with this broker, test with small amounts first to verify withdrawal speeds and platform stability before committing significant capital.

WikiFX Broker

Latest News

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc