Fake FXTM-Overview of Minimum Deposit, Leverage, Spreads

Abstract:Fake FXTM is allegedly a Mauritius-based forex broker regulated by the Cyprus Securities and Exchange Commission that provides its clients with supreme trading platforms, up to 1:2000 leverage, variable spreads on various tradable assets, as well as a choice of seven different account types.

General Information

Fake FXTM is allegedly a Mauritius-based forex broker regulated by the Cyprus Securities and Exchange Commission that provides its clients with supreme trading platforms, up to 1:2000 leverage, variable spreads on various tradable assets, as well as a choice of seven different account types.

Market Instruments

Fake FXTM advertises that it mainly offers six different classes of trading instruments in financial markets, including forex, precious metals, stock CFDs, commodities, CFD indices and cryptocurrencies.

Account Types

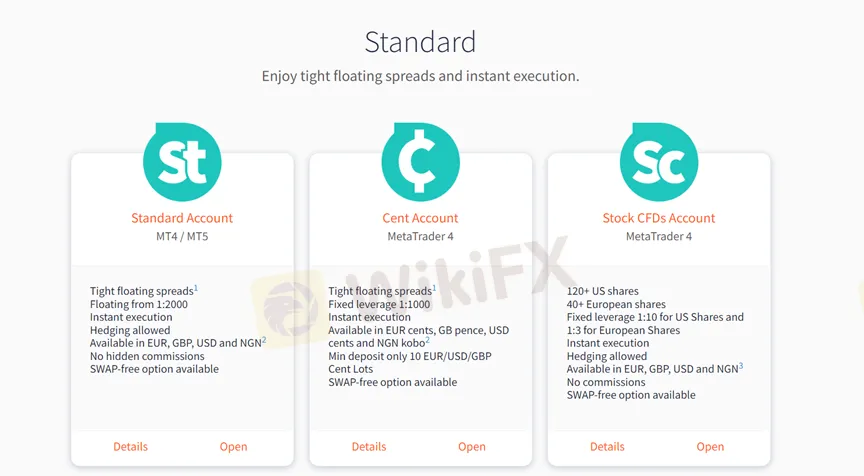

There are seven different Standard and ECN trading accounts offered by Fake FXTM, apart from demo accounts, namely Cent, Standard, Stock CFDs, Stocks, ECN Zero, ECN and FXTM Pro. Opening a Cent account requires the minimum deposit of $/€/£ 10 /₦2,000, while the other six account types with the minimum initial capital requirements of $/€/£ 100, ₦40,000, $/€/£ 100, ₦40,000, $/€/£ 100, ₦200,000, $/€/£ 200, ₦80,000, $/€/£ 500, ₦80,000 and $/€/£ 25,000, ₦5,000,000 respectively.

Leverage

Traders holding different account types are equipped with different maximum leverage ratios. Clients on the Cent account can experience the fixed leverage from 1:1000, while the Standard or ECN Zero or ECN account can enjoy floating leverage from 1:2000, the Stock CFDs account with fixed leverage of 1:10 for US shares and 1:3 for European shares, the FXTM Pro account with floating leverage up to 1:200. Keep in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spreads & Commissions

Spreads and commissions are significantly influenced by what type of accounts traders are holding. The spread in the Cent or ECN Zero account starts from 1.5 pips, the Standard account from 1.3 pips with 0 commission, the Stock CFDs from 0.1 pips, the Stocks account is tight, the ECN account from 0.1 pips with the commission of $2 per lot, and the FXTM Pro account from 0 pips.

Trading Platform Available

When it comes to trading platforms available,Fake FXTM gives traders three choices: MetaTrader4, MetaTrader5 on PC, Mac, mobile or tabletand FXTM Trader. MT4 is equipped with interactive charts, monitoring and analyzing the real-time markets, access to 30+ technical indicators and more. Compared to MT4, MT5 has more balance transaction types, analytical objects, unlimited number of charts, an integrated economic calendar and more. FXTM Trader is available on both iOS and Android devices, The broker claims that it offers open, close and modify positions on a wide range of forex and CFD instruments, user-friendly trading dashboard, state-of-the-art charting tools and etc.

Deposit & Withdrawal

There are a wide selection of payment methods provided by Fake FXTM. It accepts deposit via VISA, Skrill, VISA, MASTER and more, and withdrawal with MASTER, PerfectMoney, Skrill, VISA and etc. More specific information about the fees or processing time can be found on this brokers official website.

Customer Support

Fake FXTM‘s customer support can be reached through live chat. Besides, you can also follow this broker on some popular social media platforms such as Facebook, Twitter, LinkedIn, Instagram, YouTube and Telegram. Company address: Exinity Limited, 5th Floor, 355 NEX Tower, Rue du Savoir, Cybercity, Ebene 72201, Mauritius. However, this broker doesn’t disclose other more direct contact information like telephone number or email while most brokers offer.

Read more

Capital.com Review: Is This Broker Safe or a Scam?

Capital.com is a well-known brokerage established in 2017 with a significant global presence. Headquartered in the Bahamas, the broker has expanded its influence across regions such as the UAE, Australia, and parts of Europe, achieving an "AA" Influence Rank. On the surface, Capital.com presents a robust regulatory framework and a high WikiFX Score of 7.84.

SDstar FX Exposed: Withdrawal Delays and Questionable Deposit Demands

Have you been witnessing long fund withdrawal delays by SDstar FX, a Comoros-based forex broker? Does the broker disallow you from withdrawing either principal or profit? Are you made to deposit every time you demand a withdrawal? Does the SDstar FX customer support team fail to address your queries? This has reportedly become the case of many traders here. In this SDstar FX review article, we have highlighted these complaints. Read on!

Is WisunoFX Trustworthy? A Complete 2025 Review for Traders

Picking a reliable forex broker is the most important decision any trader will make. It's like choosing the foundation for your house - everything else depends on it. With so many brokers out there, WisunoFX often catches traders' attention, making them wonder: "Is WisunoFX trustworthy?" and "Is WisunoFX reliable?" To answer these questions properly, you need more than just a quick look at its website - you need a complete, fact-based review. This detailed 2025 review will provide you with the clarity you need. We'll take an honest look at WisunoFX by examining the key factors that make a broker reliable. We'll verify its licenses and regulations, examine its actual trading conditions, compare its various account types, assess its platform performance, and review what other traders are saying. Our goal is to give you all the information you need to make a smart decision.

FINRA Imposes $150,000 Fine on Kingswood Capital Partners Over Supervisory Failures

The Financial Industry Regulatory Authority (FINRA) has imposed a $150,000 fine on Kingswood Capital Partners, LLC, after finding supervisory and compliance failures related to the sale of illiquid alternative investments to senior clients.

WikiFX Broker

Latest News

Libertex Investigation: When "Expert Advice" Leads to Total Ruin

EZINVEST Exposure: When a "Personal Advisor" Becomes Your Portfolio’s Worst Enemy

Deriv Review: Is This Popular Broker Legit or Risky?

Is CICC Broker Safe? CICC Regulation Check & In-Depth Review

A Collapse In Germany's Chemical Sector Is A Bad Omen

Change Review: The Broker Faces Massive Complaints on KYC Goof-ups and Fund Blocks

FINRA Imposes $150,000 Fine on Kingswood Capital Partners Over Supervisory Failures

Why Smart People Still Get Scammed | The Danger of Hope and Greed

IQ Option Review: Regulated Global Broker or Withdrawal Trap?

Inside the Elite Committee: Talk with Ayu Nur Permana

Rate Calc