WikiFX report: Core Spreads Review

Abstract:Clients of Core Spreads get access to thousands of markets using two trading platforms: CoreTrader 2 and MetaTrader 4. Traders can trade forex in more than 30 of the most popular currency pairs, as well as gold, silver, and Brent crude oil, using Core Spreads' commodities choices, whether they want to trade CFDs or spread betting. Users can also trade shares from the United Kingdom, Europe, and the United States, as well as a variety of prominent indices.

Core Spreads provide its clients with access to 1,000's of markets via two trading platforms, CoreTrader 2 and MetaTrader 4. Whether traders are interested in trading CFDs or spread betting, with Core Spreads they are able to trade forex in more than 30 of the most popular currency pairs, as well as gold, silver and brent crude oil with Core Spreads commodities options. Users can also trade across UK, European and US Shares and a host of popular indices.

Core Spreads is authorised and regulated by the Financial Conduct Authority (FCA) and is fully compliant with the European Securities and Markets Authority (ESMA). Core Spreads hold their client‘s money in ring-fenced, segregated bank accounts with Barclays. These accounts are fully separate from Core Spreads’ own funds, and they can never be used for operational expenses, hedging, or any purpose not directly related to your account. By default, Core Spreads classifies all clients as Retail Clients.

In addition, Core Spreads‘ clients are also covered by the UK’s Financial Services Compensation Scheme (FSCS), which guarantees a return of your funds up to £50,000.

Pros

Segregates client funds

Established in 2014

Regulated by Financial Conduct Authority

Min. deposit from $1

Cons

Doesnt allow EAs (See alternatives)

Limited range of instruments

Not ASIC Regulated (See alternatives)

To open a live account, youll need a minimum deposit of at least $1. Alternatively, Core Spreads offers a demo account that you can use to practice and familiarise yourself with their platform.

Regulated by the Financial Conduct Authority, UK (FRN: 525164). Core Spreads puts all client funds in a segregated bank account and uses tier-1 banks for this. Core Spreads has been established since 2014, and have a head office in .

Before we dive into some of the more detailed aspects of Core Spreads‘s spreads, fees, platforms and trading features, you may want to open Core Spreads’s website in a new tab by clicking the button below in order to see the latest information directly from Core Spreads.

What are Core Spreads's spreads & fees?

Like most brokers, Core Spreads takes a fee from the spread, which is the difference between the buy and sell price of an instrument.

The commisions and spreads displayed below are based on the minimum spreads listed on Core Spreadss website. The colour bars show how competitive Core Spreads's spreads are in comparison to other popular brokers featured on BrokerNotes.

As you can see, Core Spreadss minimum spread for trading EUR/USD is 0.6 pips - which is relatively low compared to average EUR/USD spread of 0.70 pips. Below is a breakdown of how much it would cost you to trade one lot of EUR/USD with Core Spreads vs. similar brokers.

What can you trade with Core Spreads?

Core Spreads offers over 1,605 different instruments to trade, including over 30 currency pairs. Weve summarised all of the different types of instruments offered by Core Spreads below, along with the instruments offered by IG and XTB for comparison.

Whats the Core Spreads trading experience like?

1) Platforms and apps

Core Spreads offers the popular MT4 forex trading platform. To see a list of the top MT4 brokers, see our comparison of MT4 brokers. Core Spreads also offer their custom CoreTrader platform.

2) Executing Trades

Core Spreads allows you to execute a minimum trade of £0.50. This may vary depending on the account you open. The maximum trade requirements vary depending on the trader and the instrument.

As a market maker, Core Spreads may have lower entry requirements compared to an ECN broker who benefits from a higher volume of trades and typically has larger capital and minimum trade requirements. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades.

As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. You can see the latest margin requirements on their website.

Finally, weve listed some of the popular funding methods that Core Spreads offers its traders below.

Trading Features:

Allows scalping

Allows hedging

Low min deposit

Guaranteed stop loss

Accounts offered:

Demo account

Micro account

Standard account

Funding methods:

Credit cards

Bank Transfer

Skrill

Payoneer

3) Client support

Core Spreads support a limited number including English.

Core Spreads has a BrokerNotes double AA support rating because Core Spreads offer live chat, phone, email support and less than three languages.

4) What you‘ll need to open an account with Core Spreads

As Core Spreads is regulated by Financial Conduct Authority , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. When you open an account, you’ll likely be asked for the following, so its good to have these handy:

A scanned colour copy of your passport, driving license or national ID

A utility bill or bank statement from the past three months showing your address

You‘ll also need to answer a few basic compliance questions to confirm how much trading experience you have, so it’s best to put aside at least 10 minutes or so to complete the account opening process.

While you might be able to explore Core Spreads‘s platform straight away, it’s important to note that you wont be able to make any trades until you pass compliance, which can take up to several days, depending on your situation.

Read more

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

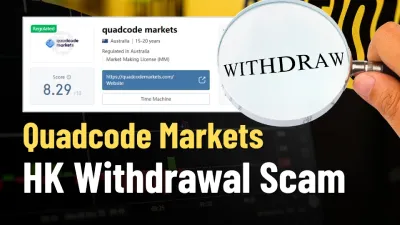

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

FBS Forex Scam Alert: High Complaint Ratio

FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc