WikiFX report: Exclusive: Core Spreads revenues down 17% in 2019, launches Trade Nation

Abstract:Finsa Europe Ltd, which owns Core Spreads, reported revenues of £6.8 million (USD $9.1 million) for the year ending November 30, 2019, down from £8.2 million the year before. Despite the sales reduction, the company managed to cut costs, resulting in a net profit of £1.2 million in 2019, up from £0.8 million in 2018.

FNG Exclusive… FNG has learned via regulatory filings that FCA licensed FX, CFDs, and spreadbetting broker Core Spreads saw a significant decline in activity in 2019, although the company remained profitable.

Core Spreads parent company Finsa Europe Ltd reported revenues of £6.8 million (USD $9.1 million) for the 12 months ended November 30, 2019, down from £8.2 million the previous year. The company managed to cut costs alongside the revenue drop, such that net profit for 2019 was £1.2 million, up from £0.8 million in 2018.

Client deposits with Core Spreads dropped during the year, from £4.7 million as at year-end 2018 to £3.3 million in 2019.

Over the past few months Finsa Europe – while continuing to run the Core Spreads brand – has poured most of its efforts into launching a new online trading brand called Trade Nation, at tradenation.com. The company calls Trade Nation a much-improved service and user experience for retail and professional traders. Finsa stated that client service, product enhancement, client retention and improving the trading experience will be key differentiators for the new brand.

As with many other online brokers, Finsa reported that to date in 2020 (through to August) client trading activity is “exceeding expectation” at Core Spreads.

Finsa Europe and its various brands are controlled by UK entrepreneur Jasper White, who bought control of the company (then known as The Trader Management Company Limited) in 2014. Jasper White was previously CEO of sports betting concern Gambit Research. The company is run day-to-day by CEO Stuart Lane.

Read more

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

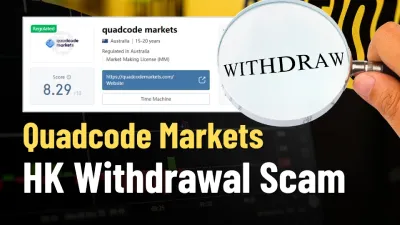

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

FBS Forex Scam Alert: High Complaint Ratio

FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc