Introduction of PNB

Abstract:Philippine National Bank (PNB) is one of the oldest and biggest private commercial banks in Philippines, which opened in 1916. It is currently not regulated by any financial authorities, either in the US or abroad, but it does offer a full range of traditional and digital financial services to customers in the US and abroad through its large network of branches and ATMs.

| PNB Review Summary | |

| Founded | 1916 |

| Registered Country/Region | Philippines |

| Regulation | No regulation |

| Products and Services | Retail & Corporate Banking, Loans & Mortgages, Remittance, Insurance, Investments, Stock Brokerage, Mobile & Online Banking |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | PNB Digital App |

| Minimum Deposit | PHP 3,000 (for basic savings account) |

| Customer Support | Trunkline: (+632) 8526 3131 |

| Bank Hotline: (+632) 8573-8888 | |

| Email: customercare@pnb.com.ph | |

| Social Media: Facebook, X, Instagram, YouTube, LinkedIn | |

PNB Information

Philippine National Bank (PNB) is one of the oldest and biggest private commercial banks in Philippines, which opened in 1916. It is currently not regulated by any financial authorities, either in the US or abroad, but it does offer a full range of traditional and digital financial services to customers in the US and abroad through its large network of branches and ATMs.

Pros and Cons

| Pros | Cons |

| Long-standing banking history since 1916 | Not regulated |

| Extensive local and international branch network | Complex fee structure |

| Offers a wide range of banking services | |

| Various contact channels |

Is PNB Legit?

PNB is not regulated by any Philippine financial institution, including the Securities and Exchange Commission (SEC) and the Bangko Sentral ng Pilipinas (BSP). Furthermore, it is not overseen by any internationally recognized financial regulators, like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Products and Services

PNB provides a wide range of traditional and innovative financial services, including retail banking, corporate banking, remittance, asset management, lending, insurance, and investment options. It has one of the largest domestic and foreign branch networks of any Philippine bank, serving both local and worldwide Filipino clients.

| Products / Services | Supported |

| Retail & Corporate Banking | ✔ |

| Loans & Mortgages (e.g. OPHL) | ✔ |

| Remittance Services | ✔ |

| Insurance (Life & Non-life) | ✔ |

| Investment & Trust Services | ✔ |

| Stock Brokerage | ✔ |

| Mobile & Online Banking | ✔ |

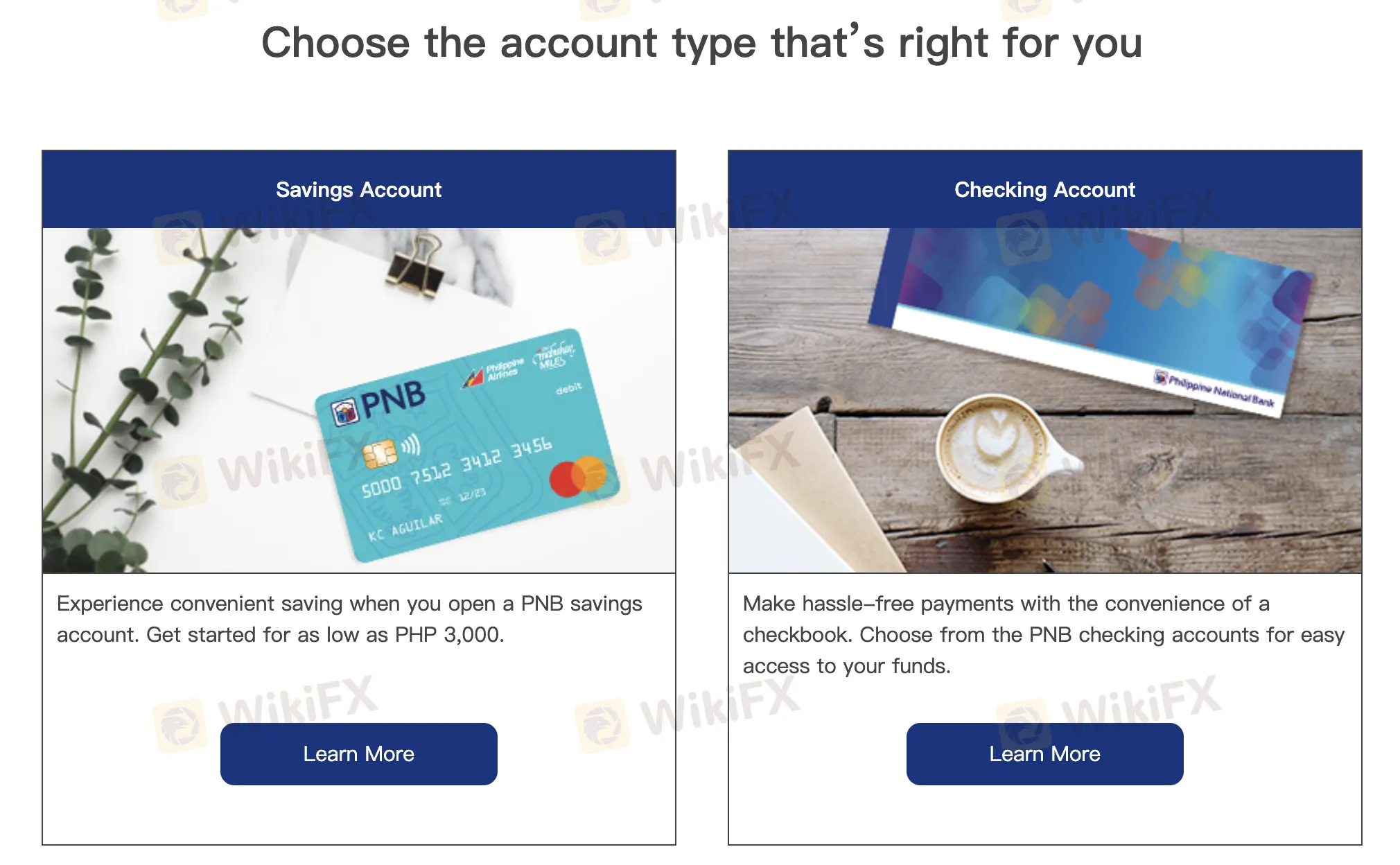

Account Types

| Account Type | Purpose / Features | Suitable For |

| Savings Account | Basic deposit account; initial deposit starts from PHP 3,000 | Everyday savers |

| Checking Account | Comes with checkbook; for easy payments and fund access | Individuals/businesses needing payment flexibility |

| Time Deposit | Fixed-term savings with interest | Those seeking secure savings growth |

| Foreign Currency | For holding foreign currencies securely | Individuals with forex needs or overseas transactions |

PNB Fees

Compared to other banks, PNB charges moderate to high fees, notably for transactions between branches and with people from other countries. Within its network, some services, like checking your balance and using an ATM, are free. However, many others, notably those that involve branches in different regions, on other islands, or with different currencies, have different fees.

| Fee Category | Description | Fee |

| Interbranch Cash Deposit | Same region: FreeDifferent region: ₱50/₱100K or more | ₱50 minimum, ₱50 per ₱100K |

| Interbranch Check Deposit | Regular ↔ Island Branch | ₱100 |

| USD Cash/Check Deposit | All branches | ₱100 |

| Interbranch Withdrawal (PHP) | Regular ↔ Island Branch | ₱200 |

| USD Withdrawal/Encashment | All branches | ₱200 |

| ATM (Local) | PNB ATM: FreeOther banks: ₱15 withdrawal, ₱2 balance inquiry | ₱2–₱15 |

| ATM (International) | Withdrawal: ₱150–₱250Balance Inquiry: ₱75 | ₱75–₱250 |

| Digital Transfers (Retail) | InstaPay / PESONet | ₱20 per transaction |

| Digital PNB to PNB Transfer | First 3 per week free; next ₱10 each | ₱0–₱10 |

| Over-the-Counter Services | Withdrawal slip: ₱50Checkbook reorder: ₱250–₱500Bank cert: ₱200 | Varies |

| Inward USD Remittance | Service fee + DST | $5–$8 |

| Dormancy Fee | After 5 years inactive | ₱30 / $0.50 (selected accounts) |

| Early Closure (≤30 days) | PHP accounts: ₱500USD accounts: $10 | ₱500 / $10+ |

| Maintaining Balance Penalty | Peso: ₱350–₱500USD: $10–$20Other currencies vary | ₱350+ / $10+ |

| Other Fees | SOA requests, remittances, demand drafts, safety box rental, etc. | Varies by service |

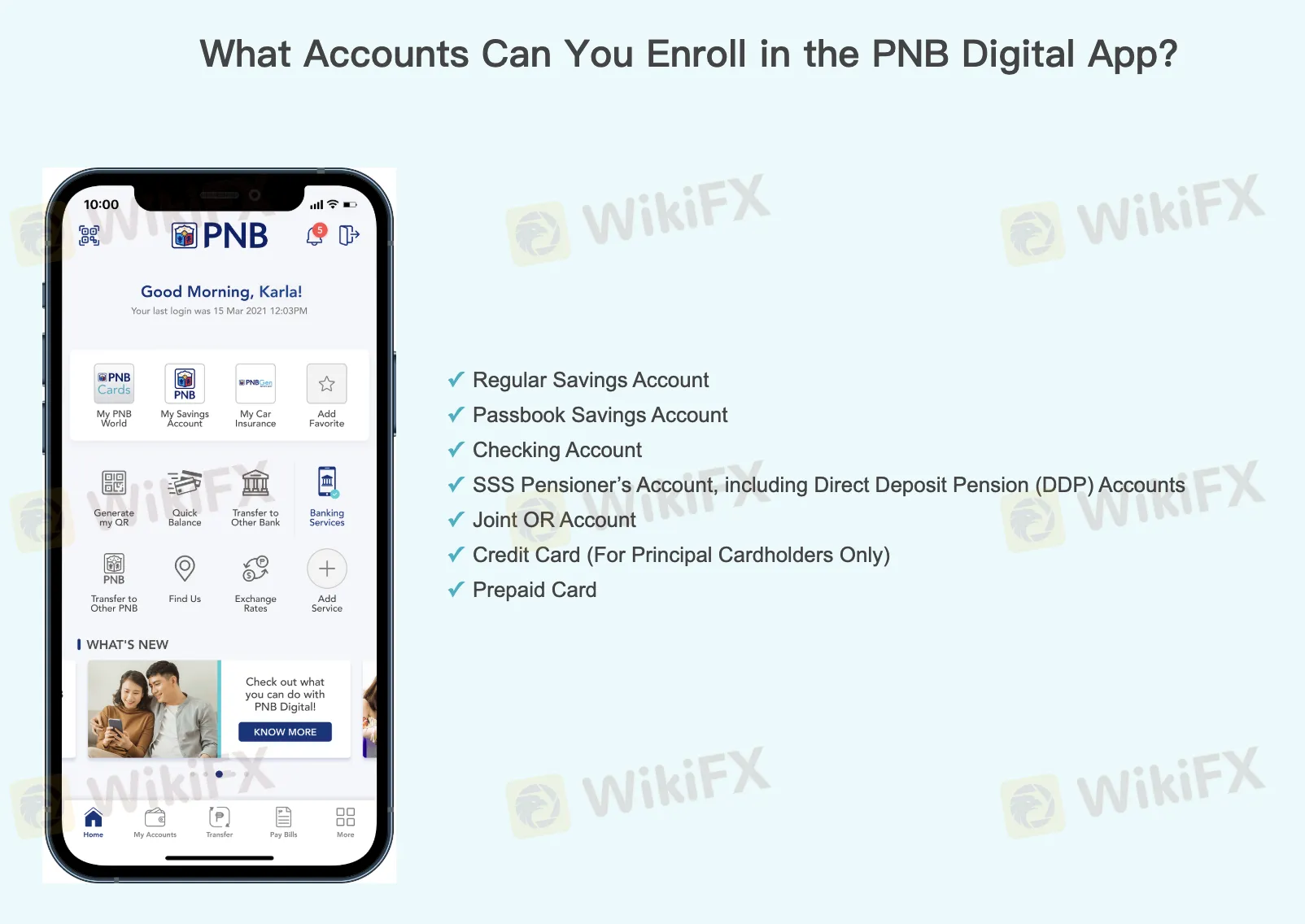

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| PNB Digital App | ✔ | Android, iOS | / |

Read more

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

WikiFX Broker

Latest News

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Rate Calc