Santander Spreads, leverage, minimum deposit Revealed

Abstract:Santander UK is a large retail and commercial bank based in the UK and a wholly-owned subsidiary of the major global bank Banco Santander. It is registered in England and Wales, authorised by the Prudential Regulation Authority, and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

| Santander Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

| Regulation | Exceeded |

| Products and Services | Mortgages, Credit Cards, Savings and ISAs, Investments, Insurance, Personal Loans, Current Accounts |

| Trading Platform | Online Banking, Mobile Banking app |

| Min Deposit | Not mentioned |

| Customer Support | 24/7 Live chat |

Santander Information

Santander, founded in 2003 and registered in the UK, is an online trading platform that offers many financial services accessible through online and mobile banking. While the Investment Advisory License is now exceeded, this platform provides diverse products including mortgages, credit cards, savings, ISAs, investments, insurance, and personal loans, alongside various current account options.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is Santander Legit?

Santander once had an Investment Advisory License regulated by the Financial Conduct Authority (FCA) in the United Kingdom with a license number of 106054, but now it is exceeded. The WHOIS search shows the domain santander.co.uk was registered on August 14, 2003.

Products and Services

- Mortgages: Santander offers mortgage services for first-time buyers, home movers, and remortgagers, including options for switching lenders, borrowing more, and managing existing mortgages.

- Credit Cards: Santander offers credit cards to suit different needs, including the All in One, Long Term Balance Transfer, Everyday No Balance Transfer Fee, and Santander World Elite™ Mastercard®.

- Savings and ISAs: Santander provides various savings and ISA options for different financial goals, such as the Easy Access Saver, Regular Saver, Santander Edge Saver, Easy Access ISA, Fixed Rate ISAs, Fixed Term Bonds, Junior ISA, and Inheritance ISA.

- Investments: Santander offers investment options with cashback, an online Investment Hub for advice and fund selection, and readily available investment advice and resources.

- Insurance: Santander offers a comprehensive range of insurance products, including home, life (with critical illness), health, mortgage life, family/lifestyle, over 50s life, car (including EV), travel, business, and landlord insurance.

- Personal loan: Santander offers personal loans with fixed interest rates, ranging from £1,000 to £25,000, with flexible repayment terms, subject to eligibility.

Current Accounts

Adult current accounts:

Account Name Benefits Monthly Fee Key Requirements Everyday Current Account Simple bank account, optional overdraft, no fees at Santander ATMs abroad. No fee None explicitly stated. Santander Edge current account Up to £10 cashback on bills & essential spend, optional savings account with exclusive rates, no card usage fees abroad from Santander. £3 Pay in £500/month and have 2 active Direct Debits. Santander Edge Up current account Up to £15 cashback on bills & essential spend, earn interest on balances up to £25,000, no card usage fees abroad from Santander. £5 Pay in £1,500/month and have 2 active Direct Debits.

Student & child current accounts

Other current accounts

- Basic Current Account: Suitable for those with poor credit history or new to the UK for work/study, no monthly fee.

- Carer's Card account: Allows giving debit cards to up to 2 carers, money transferred from your other accounts, carers can withdraw cash or shop for you, no monthly fee.

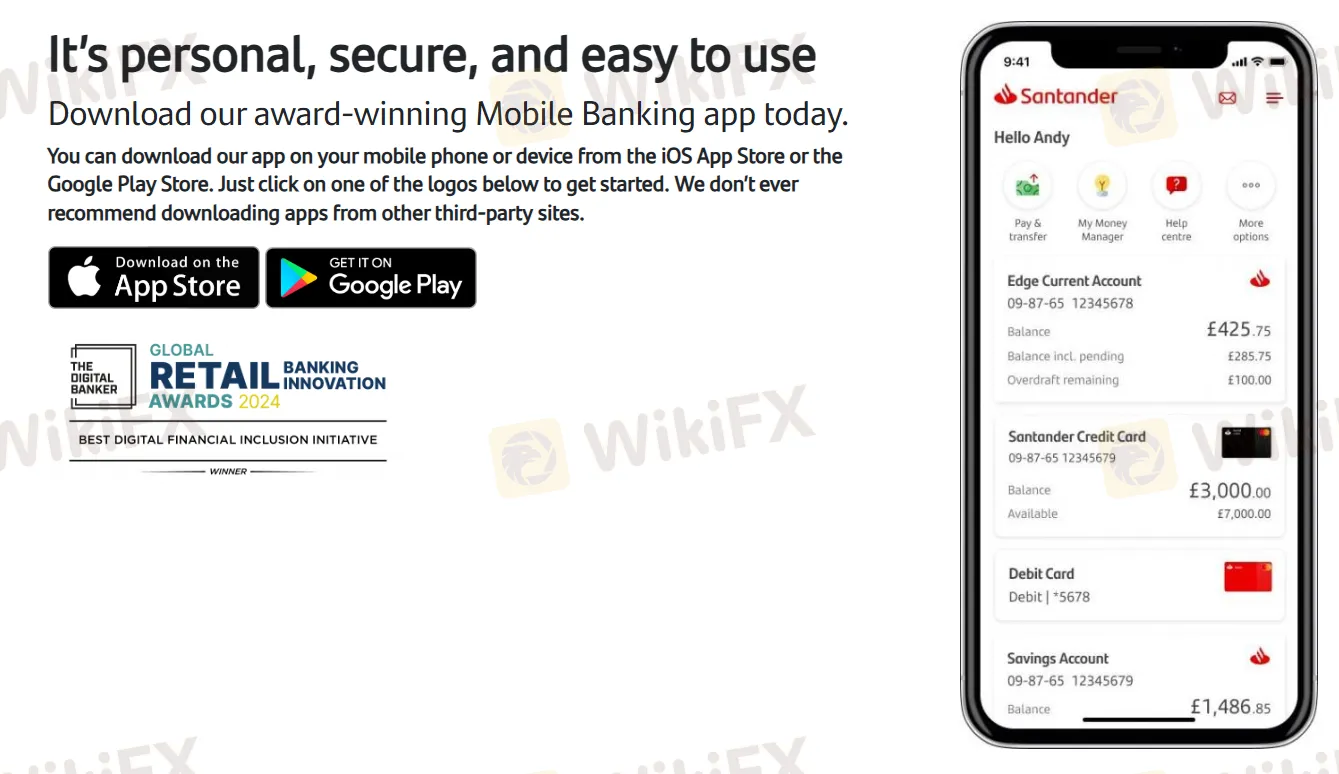

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Online Banking | ✔ | PC and Mobile | Investors of all experience levels |

| Mobile Banking app | ✔ | IOS and Android | Investors of all experience levels |

Payments and Transfers

Deposit/Withdrawal Fees and Minimum Deposit are not mentioned on the website. But you should pay attention to:

- Free Transfers: Up to £25,000 per transaction online/mobile (daily limit £100,000).

- Adjustable Limits: Easily manage your payment limits in the app.

- Large Payments: Use CHAPS for amounts over £100,000.

- High-Risk Limits: Transactions to risky accounts capped at £300 (single) and £1,000 (30-day total).

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc